Shares ofGameStop$GameStop(GME)$ are trading higher again in June, helped by catalysts such as the launch of the company's NFT marketplace and a stock split.

In fact, GameStop shares have managed too utperform the S&P 500$S&P 500(.SPX)$ so far this year. And they've also managed to cause big losses for short sellers who insist on betting against the stock.

GME Is Among the Top 10 Most Unprofitable Shorts in July (So Far)

GME Is Among the Top 10 Most Unprofitable Shorts in July (So Far)

According to a report published by S3 Partnerson July 21, GameStop has been among the top 10 most unprofitable stocks for short sellers during July 2022. So far this month, short sellers have already lost $443.4 million on GME.

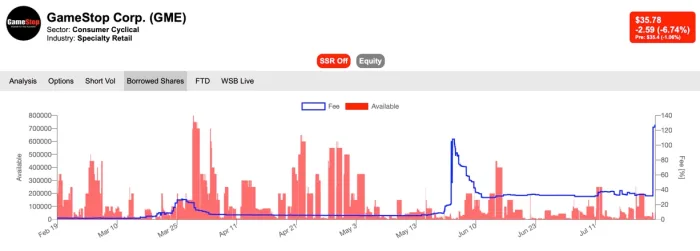

It's worth noting that, compared to the many large-cap companies on the list, GameStop's average borrow fee is incredibly elevated — 32%.

Borrow fees are the amount that short sellers must pay to "borrow" shares of the stock and open a short position.

However, following the report and GameStop's 4-for-1 stock split,feesreached a sky-high 126%:

Why Short Sellers Are Losing

Why Short Sellers Are Losing

GameStop's stock is up 15% so far in July – at last check. The recentlaunch of GameStop's NFT marketplaceand the implementation of a 4-for-1 stock split have reinforced GME investors' bullish sentiment.

GameStop's NFT marketplace has made a good first impression. Even in its beta version, the platform managed to beat the trading volume of competitor Coinbase$Coinbase Global, Inc.(COIN)$ in its first 48 hours.

In its first week alone, GameStop's marketplace averaged $1.1 million in total daily trading, accounting for over 5,254 ETH.

As expected, the stock split also influenced a short-term rally in GameStop shares. Each shareholder gained three additional GME shares for each share they already owned.

Bronte Capital, a hedge fund thatreportedlyhas short positions in GameStop and other meme stocks, issued a letter to its clients highlighting that it was aware of what effects a GameStop stock split could have, considering the unique nature of GME stock.

"Not accepting that stock splits add value is a recipe for losing money," the firm wrote.

A Step Back for Short Sellers

Due to the catalysts that were already expected for July, short interest in GameStop naturally took a step back, as the latest official data points out.

With the readjusted stock split, data from May 30 showed that 62.15 million shares were being shorted. As of June 29, the number of shorted shares stood at 53.21 million, which is roughly 20% of the stock's float.

But there's another reason why short sellers are backing off: GameStop is improving its business fundamentals.

ValueWorks portfolio manager Charles Lemonides recently toldReutersthat hedge fund managers should be more cautious about betting against meme stocks. "There's been too much confidence among the shorts that these businesses are completely failed," he said.

The businesses underlying meme stocks like GameStop and AMC Entertainment$AMC Entertainment(AMC)$ are far from having completely failed.

While there are still concerns about these companies' cash balances and profitability, both have healthy liquidity for the time being. That is providing them with the opportunity to go on the offense and consider ways to improve and diversify their core businesses.

GameStop CEO Ryan Cohen did not miss the opportunity to pin down the skeptics who considered GameStop a "left-for-dead retailer" after the launch of the company's NFT marketplace:

Comments