Big Rail Strike Averted // Inflation stays sticky after all — markets panic // & more

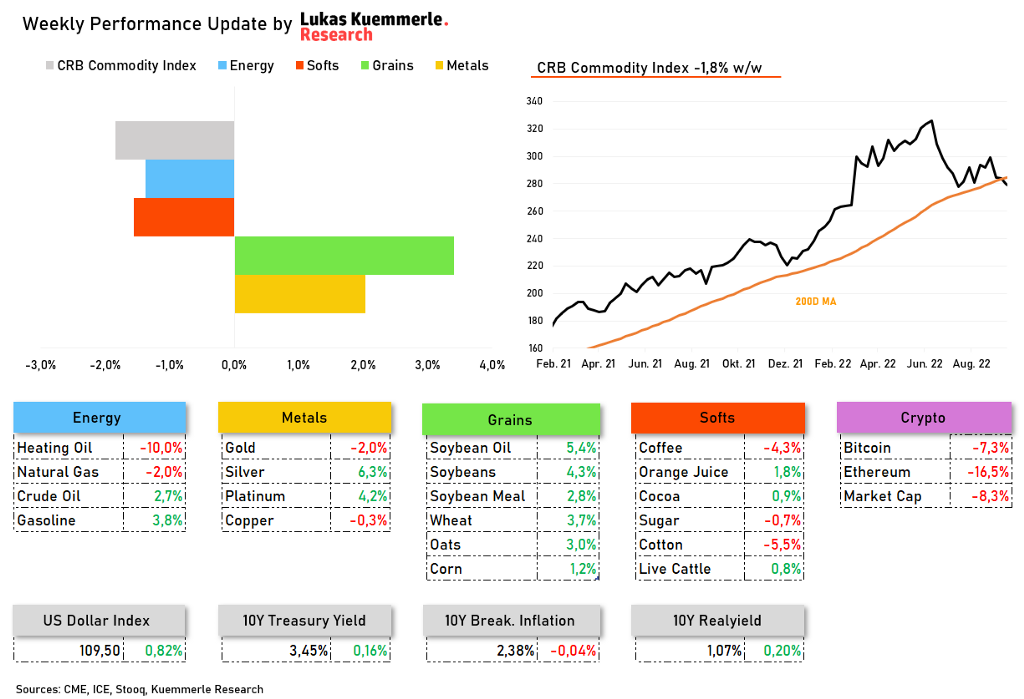

The benchmark, CRB Commodity Index, ended the week 1,8% lower

Welcome to another 115 people that subscribed to the Commodity Report during the last week, bringing the total subscriber count up to 2.182 people!

Big rail strike averted

Probably the best news of the week was that a rail strike in the US was averted after both parties agreed on a deal including higher wages and benefits for rail workers. The deal includes a 24% wage increase over five years, including 14,1 % effective immediately as well as five annual $1.000 payments, according to the National Carriers’ Conference Committee. According to the Bureau of Labor Statistics, there are currently 150.000 people working in the US railway sector.

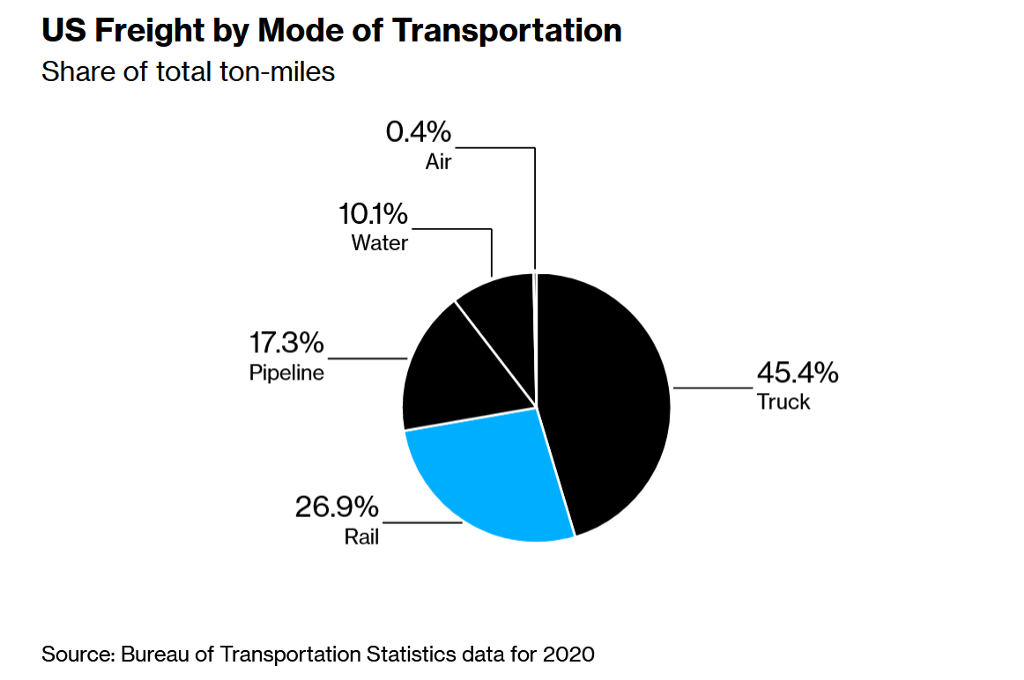

The impact of a strike would have been big, as rail moves about 40% of the U.S.’s long-distance trade. Approximately $2 billion of freight is shipped by rail in the US per day.

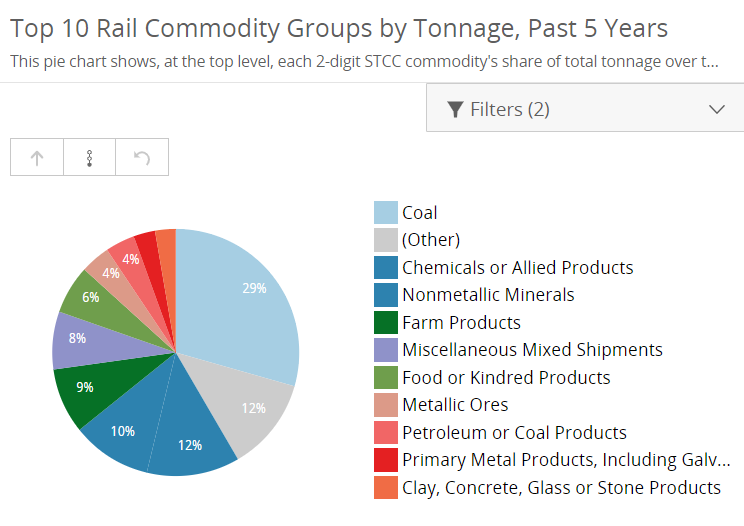

By the way, those are the percentage numbers of commodities that are shipped by rail, the USDA is providing us here with some great charts.

It would mean the world to me if you leave a like or share The Commodity Report if it brings you any value. It helps the community to grow further and to provide more people with practical commodity research.

Inflation stays sticky after all — markets panic

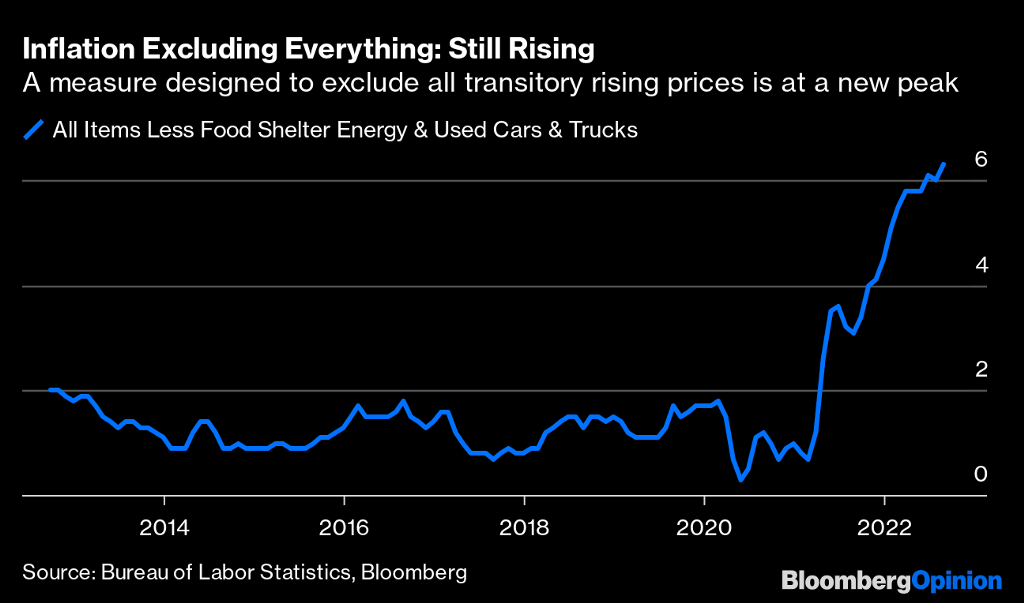

Seems like inflation is sticky after all, which shouldn’t be a surprise to anyone as upside surprises in inflation data were basically THE story of 2022 so far.

The latest surprise in CPI had less to do with CPI being extremely strong and more to do with consensus expecting excessively weak CPI. As we saw in the market reaction participants thought the inflation story was fading and markets sold off during the rest of the week accordingly. CPI Inflation increased 0.12% in August, surprising consensus expectations of -0.1%. Of particular now was the sustained pressures coming from core-inflation measures. Basically, the latest jump was less driven by commodity prices than by other goods like shelter and services.

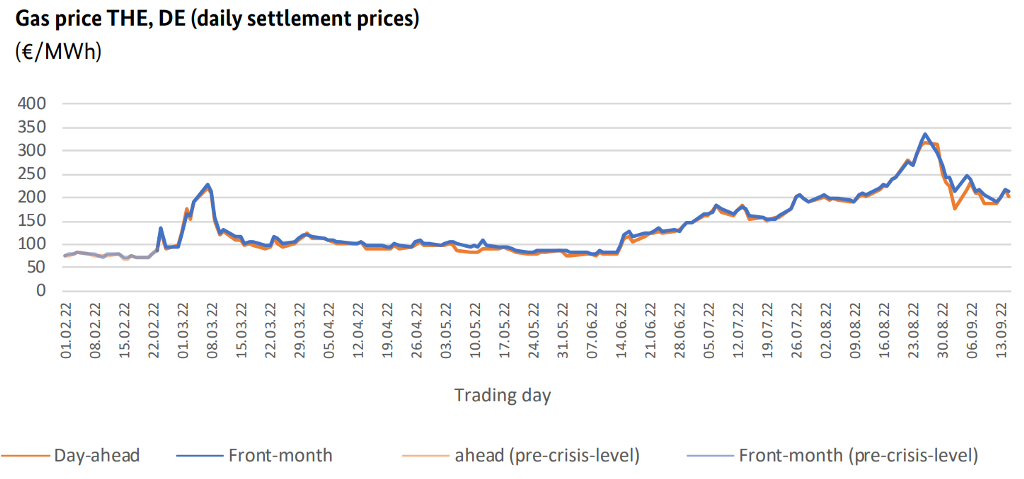

European gas price continues its downtrend

The December 22 contract closed last Friday at 205€. On August 28th the same contract traded at close to 350€. We already covered the topic weeks ago and called for the top in European energy prices on August 31st.

Meanwhile, it is getting colder in Germany and Europe in general. Therefore the heating season probably has started now. As I write this newsletter we have 9 degrees in Germany combined with a mix of rain and heavy winds. The weather forecast shows that going forward temperatures will sink. Let’s see how gas storage will develop from here, German chancellor Scholz said over the weekend that “energy security over the winter is already secured.” Gas prices in Germany continue to contract as well.

Subscribe to The Commodity Report for free and receive these updates every Monday morning!

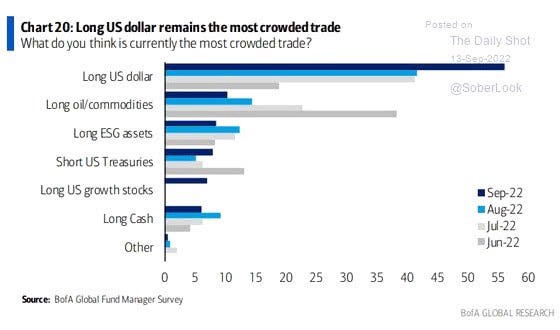

The long commodity trade became less crowded

The latest BofA survey showed that asset managers reduced their commodity exposure further. This makes sense as economic momentum continues to slow and we’re moving closer and closer to a recession. On the other hand, it’s crazy to see some positioning of commercial players in the industry at the moment. It seems like they’re basically just waiting for this weak growth phase to end before commodities can continue their bull market.

This week look out for:

- FOMC Meeting on Wednesday

- Flash Manufacturing data from Europe and the US

- Powell’s speech on Friday

Check this out as well:

Last week I also published a new piece about the problems we could face with agricultural products going into 2023. If you haven’t read it yet, check it out.

Subscribe to The Kuemmerle Report

Commodity Metrics, Futures Activity and Trading Opportunities

A subscription costs you 34$ a month and you will receive an additional in-depth report every Sunday evening at 6:00 PM CEST. That information will be only published to members and not to the general public.

Till next Monday, Lukas

If you have any questions in the meantime, please feel free to contact me via Twitter or Mail.

(The Commodity Report is not investment advice)

The Commodity Report #69 was originally published in InsiderFinance Wire on Medium, where people are continuing the conversation by highlighting and responding to this story.

Comments