About soybeans, pork meat and wheat

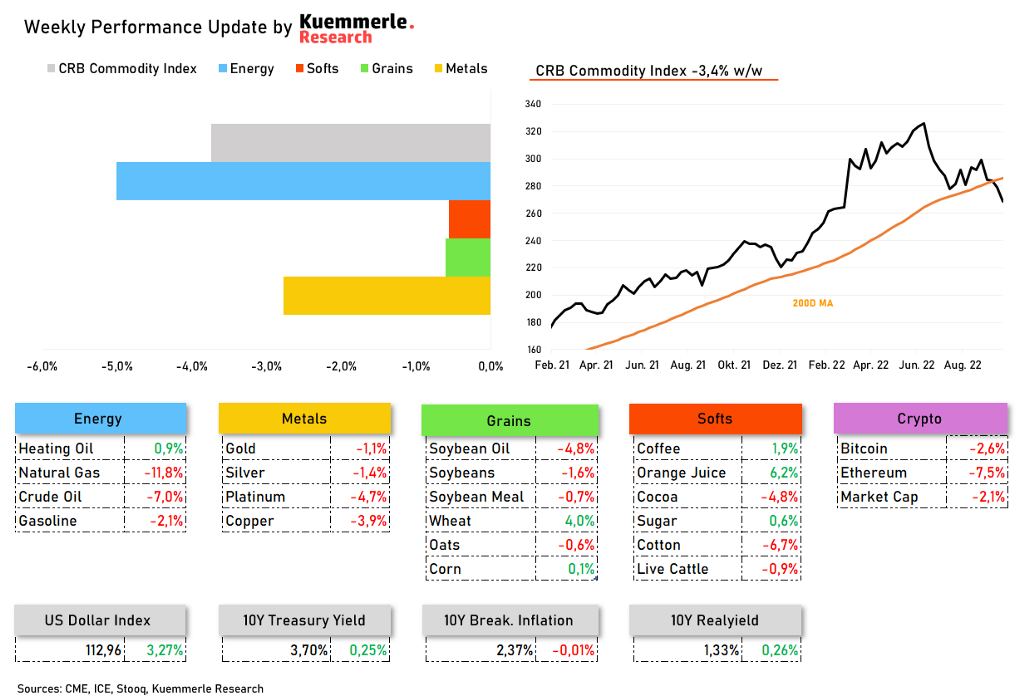

The benchmark, CRB Commodity Index, ended the week 3,7% lower

Welcome to another 44 people that subscribed to the Commodity Report during the last week, bringing the total subscriber count up to 2.226 people!

China’s soybean shortage

At the beginning of the week, China was redoubling its efforts to bolster food security by trying to cut the amount of soybeans that get turned into animal feed. China is by far the world’s biggest importer of soybeans, which account for the bulk of its consumption. A lower ratio would of course mean fewer soybean imports needed as demand would somehow decline a bit.

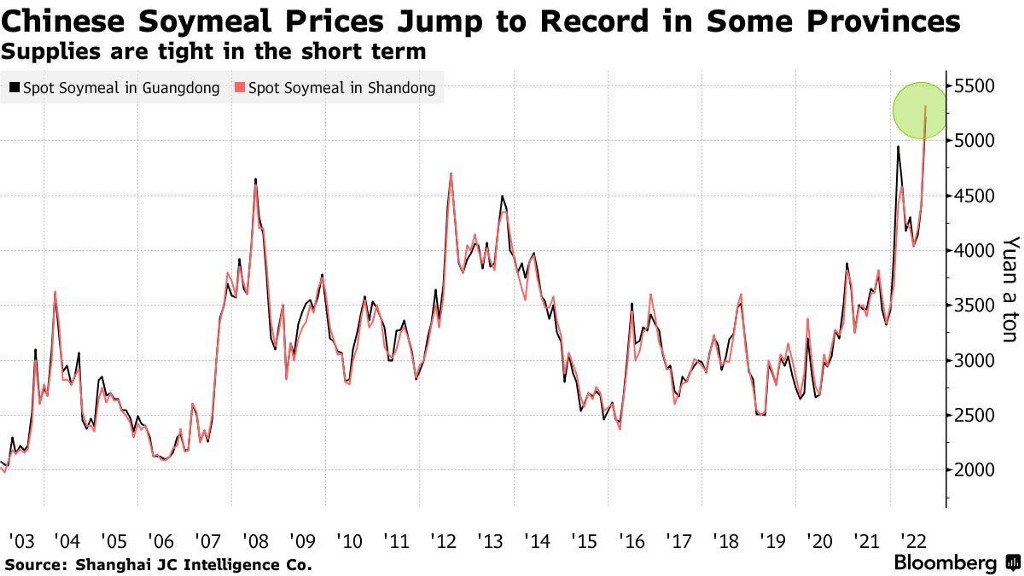

On Friday Bloomberg reported that China is facing a soybean meal shortage, at least in the short term, with prices of the feed ingredient soaring to a record in some provinces.

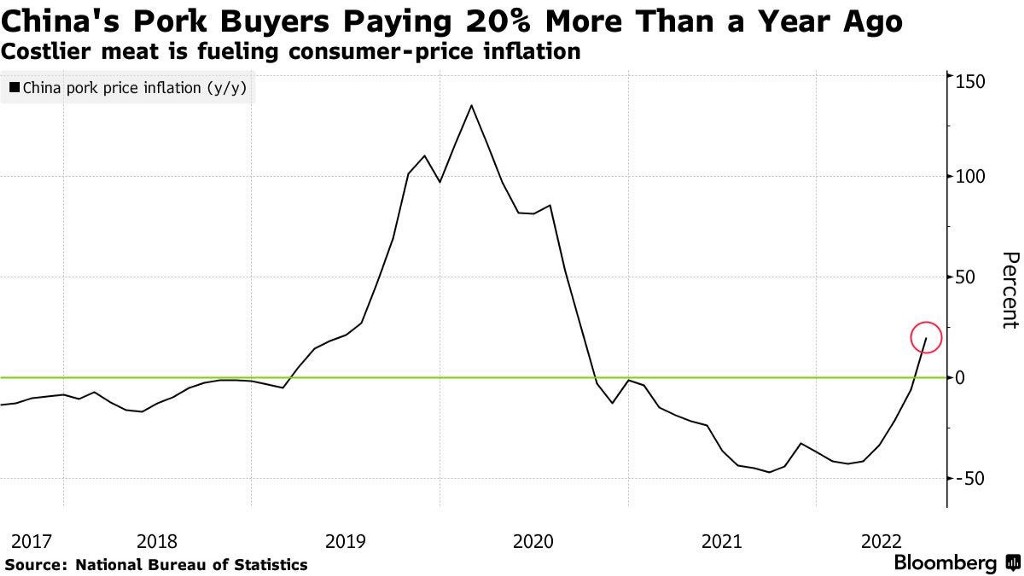

Soybean meal is the single most important component of animal feed, mainly pork, in China. As pork is the single most important protein component in China’s food chain, high soybean meal prices directly lead to higher pork prices as well.

Even more, there is a high correlation between pork prices and the headline inflation rate in China.

Nevertheless, more supplies are arriving but will take time. Chinese importers have stepped up soybean purchases in recent weeks, notably from Argentina. The US harvest is also just starting, which will ease supply tightness in the coming months. This should limit the upside for soybean meal prices going forward. Other grains remain far more attractive. All these market setups are highlighted in The Kuemmerle Report once tradeable opportunities emerge.

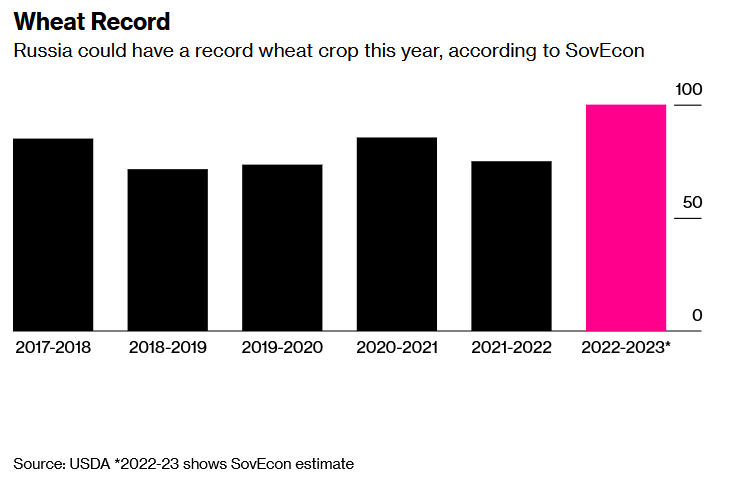

In other news, wheat prices have been increasingly at the mercy of remarks from Russian President Vladimir Putin in recent weeks, and this week they reached a two-month high amid an escalation of the country’s war efforts in Ukraine. Meanwhile, the grain is piling up in Russia as the nation struggles to export large volumes. Russia faces problems in exporting its record wheat harvest. Keep in mind that food exports out of Russia are not sanctioned. The problems have more to do with the war’s insurance coverage questions and logistical issues. Another reason why wheat is so volatile these days is.

Any further bad news about worsening conditions in Ukraine will also intensify the risk of exporting grain out of Ukraine and passing it through the grain corridor. Therefore the news that Putin announced that a partial mobilization of 300.000 reservists will happen was providing support for especially wheat and oat prices during the last week.

It would mean the world to me if you leave a like or share The Commodity Report if it brings you any value. It helps the community to grow further and to provide more people with practical commodity research.

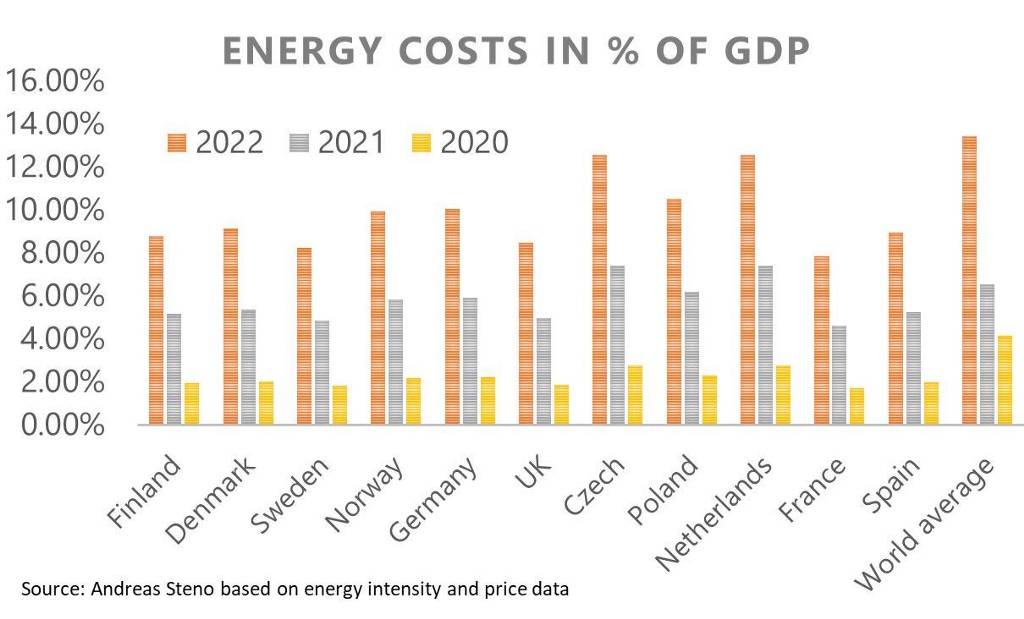

Inflation will become even worse in Europe

This winter could become one of the biggest challenges the EU has ever faced. The peak in futures prices of gas or electricity seems to be in. But the YoY differentials will be so high that inflation will easily top 11% during the winter months. (we saw 9.1% YoY in the whole Eurozone in August)

These high inflation rates will show how solitary the EU and its member countries really are when the first high energy bills for private households come in. I certainly hope they have the strength to go through these few months of pain and come back out of this energy crisis with the right solutions. But I doubt it.

Subscribe to The Commodity Report for free and receive these updates every Monday morning!

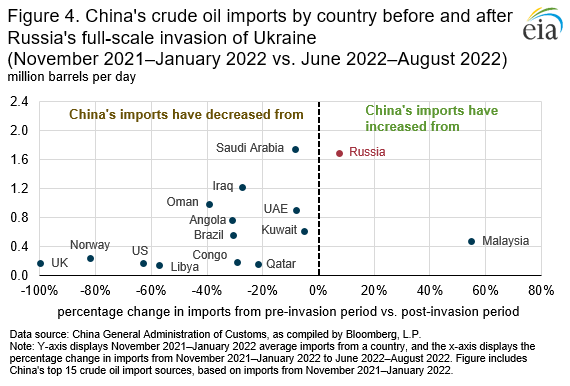

How China’s oil imports changed

During the June–August period, China also imported significantly less crude oil from its top sources in Europe and the United States. Imports from Norway decreased by 82% in this period, and imports from the United Kingdom decreased by 100% according to the EIA’s latest energy report.

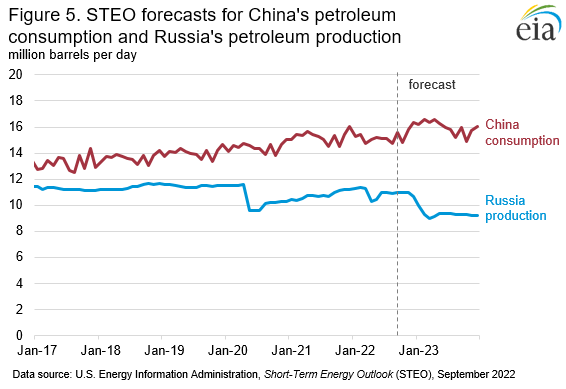

Nevertheless, there is a high chance that imports from China and demand for EU and US oil products will rebound as Russia’s production will only decrease going forward, as the EU economic sanctions are in full effect.

This week look out for:

- ECB President Lagarde Speaks on Monday

- Chair Powell speaks on Tuesday

- CB Consumer Confidence on Tuesday as well

- Core PCE Price Index on Thursday

Subscribe to The Kuemmerle Report

Commodity Metrics, Futures Activity and Trading Opportunities

A subscription costs you 34$ a month and you will receive an additional in-depth report every Sunday evening at 6:00 PM CEST. That information will be only published to members and not to the general public.

Till next Monday, Lukas

If you have any questions in the meantime, please feel free to contact me via Twitter or Mail.

(The Commodity Report is not investment advice)

The Commodity Report #70 was originally published in InsiderFinance Wire on Medium, where people are continuing the conversation by highlighting and responding to this story.

Comments

Unless China reduces soya import, otherwise they will import inflation into China itself now that prices for everything have gone up significantly due to chain reaction as a result of US continuous interest rate hike no?

Is the Kuemmerle Report Internationally recognizer? Tks for advise....