The FX market is in turmoil!

“The US Dollar is our currency but your problem”- John Connolly.

Fed Chair Paul Volcker created history when he tightened the monetary policy by epic proportions in the 80s. The Fed Funds Rate (FFR) was raised to a record 20% in 1980–81. The domino effect was the enormous appreciation of the USD as the precious capital rushed back to the US.

The global currency markets went for a toss, and the finance ministers and Central Bankers of France, West Germany, Japan, the UK and the US met at Plaza Hotel in 1985 to finalize the Plaza Accord. The Plaza Accord was a signal to the forex markets that the G5 was ready to intervene in the currency markets when required to halt the march of King USD.

Fast forward to 2022, and we are witnessing unease in the forex markets again due to the Fed’s aggressive tightening of monetary policy.

When I wrote in late June about a brewing currency crisis in Asia similar to the Asian Financial Crisis of 1997, I never reckoned that the crisis would be global and more pronounced in Europe than in Asia.

Let us understand what’s happening in the forex markets and what can be the “Endgame” here.

Overview Of The Forex Market!

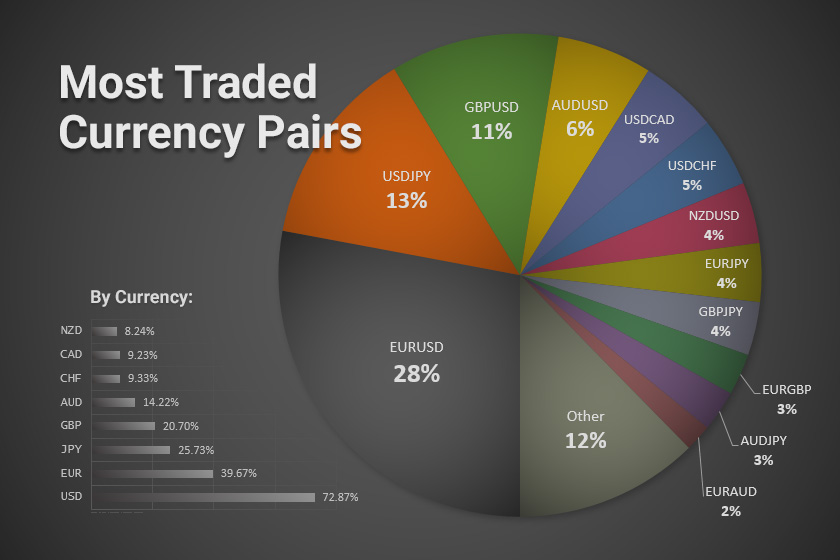

A mind-boggling $6.6 trillion of currency is traded daily globally across the forex markets. The most intriguing fact is that more than 88% of the trade is dominated by the greenback, which indicates how the shortage of dollars can roil the forex markets.

As we can see, some currency pairs are the most traded and highly liquid in the FX market.

DXY was developed in 1973 with a base of 100, post the end of the gold standard. It measures the value of USD against the basket of six foreign currencies with weights as the following:

- EUR: 57.6%

- JPY: 13.6%

- GBP: 11.9%

- CAD: 9.1%

- SEK: 4.2%

- CHF: 3.6%

The DXY is the most closely tracked dollar index among the many because it includes the currencies that have the highest volume of trade in the FX markets.

Thus, high volatility in DXY signals that the FX market is in turmoil globally!

Forex markets have also seen a dramatic transformation over the last decade. The spot volumes in the forex market have steadily declined, whereas the FX swap volumes have taken the lion’s share in recent years.

A FX swap is an agreement between the two parties to buy(sell) currencies at an initial date and then sell (buy) the same amount of currency upon maturity at the agreed-on (later) date.

Both parties continue to pay interest on the swapped principal amounts until maturity in the “currency” swap.

The demand for FX swaps has skyrocketed as the world has globalized and international trade has risen multifold. As a result, businesses and institutions use FX swaps to hedge exchange-rate risk and borrow at favourable terms in the international markets.

The Central Banks also use FX swaps to provide liquidity in times of stress. For example, Federal Reserve used the swap lines during the heights of GFC and covid to provide dollar liquidity to Central Banks across Emerging Markets and even in the Eurodollar market.

Now let us move to Asia, where after 25 years, the BoJ intervened in the forex markets.

The Asian FX Situation!

As predicted in June, the events in the FX markets are turning horrendous with each passing day. The Bank Of Japan (BoJ) has raged a war against the currency speculators by announcing a historical intervention in the FX markets after nearly 25 years.

So what does the BoJ intend to accomplish?

BoJ plans to utilise its foreign reserves to intervene in the currency markets to stabilize the Yen (JPY), which has significantly depreciated (around 20%) this year due to BoJ’s loose monetary policy.

The BoJ will sell dollars in the spot, futures and (offshore) derivatives markets to keep the JPY in check.

BoJ has a ruthless history as speculators betting against the Central Bank by shorting the Japanese Government Bonds (JGBs) for decades have been encountering the “Widow Maker” trade.

The BoJ is ferociously defending the JPY as it has been doing with the JGBs. A fortnight ago, the BoJ spent roughly $25 billion in a single day to defend the key psychological level of 145.

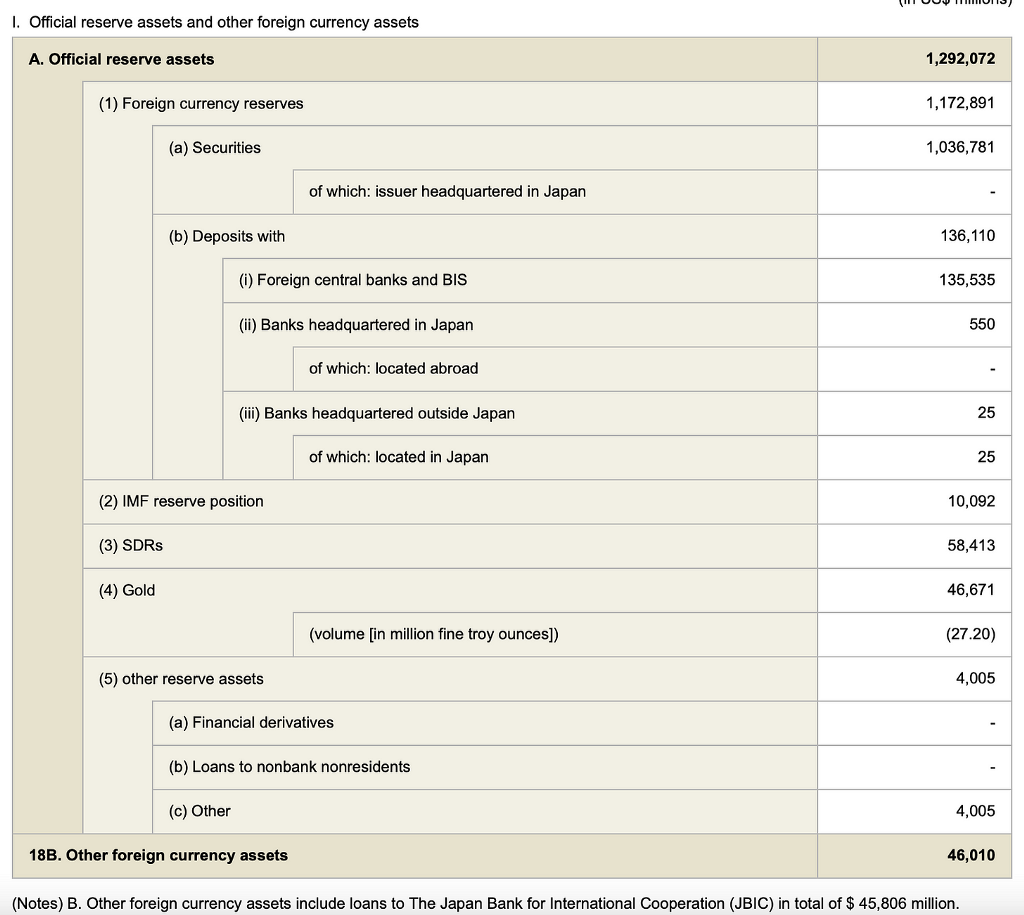

Let us look at the foreign reserves of Japan to ascertain where the precious USDs are parked!

BoJ has around $135 billion of deposits with Foreign Central Banks and BIS as of August 31st 2022, which it can utilize immediately to quell the depreciation fire of the JPY.

However, with the Fed in no mood to buckle up, the BoJ will have to use enormous firepower to stop JPY from sinking further. The $25 billion was barely enough to stop the king USD march for only a week, and now the JPY is “again” flirting around the 25-year low.

There is a very high probability that BoJ will most likely sell the US Treasuries (USTs) [$1.03 trillion as on August 31st 2022] at these depressed levels to protect the JPY from free fall.

The BoJ has an arduous task on its hands, and a lot hinges on the trajectory of US monetary policy.

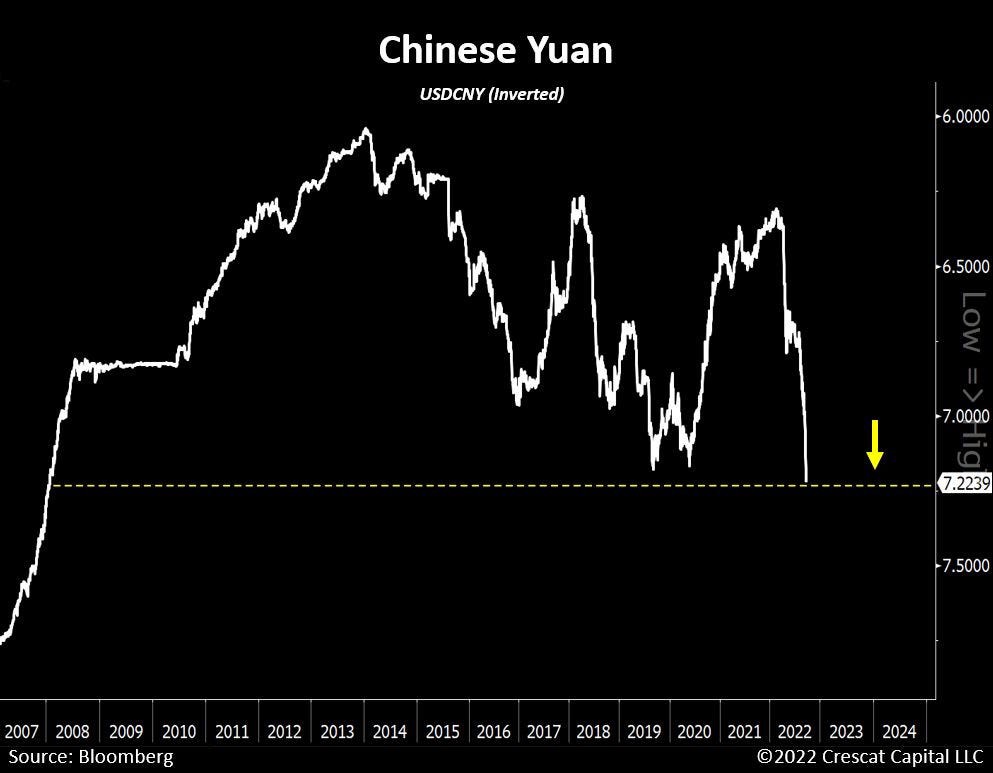

China is the other country in Asia that has seen swift moves in its currency. The Chinese Yuan (CNY) has now approached levels last seen in 2008.

The People’s Bank Of China (PBoC) has taken decisive steps in the past month to slow down the depreciation of the CNY.

The PBoC, in early September, cut the foreign exchange reserve requirement ratio (RRR) to 6% from 8%, which freed up $19 billion for the Chinese Banks.

Furthermore, in late September, the PBoC raised the FX risk reserve ratio for foreign exchange forwards trading from 0 to 20 percent to increase the cost of foreign exchange forwards trading by banks.

India lost more than $80 billion or 15% of FX reserves as the Reserve Bank of India (RBI) used its mighty firepower to stop the INR from depreciating wildly against the USD.

The South Korean Won has been under tremendous pressure and is down 19% YTD against the USD. As a result, the South Korean Central Bank enlisted its pension fund NPS and entered into a currency swap agreement worth $10 billion to defend the Won.

The Asian economies continue to drain their precious FX reserves to stop the USD march; however, every Central Bank has its limitation.

Eventually, if the Fed raises the FFR to more than 4%, we will see the Central Banks across Asia giving up one by one.

The UK and European Mess!

The troubles keep mounting for Europe, which was already in a dire situation. Moreover, the Dollar wrecking ball has further exacerbated the problems for the continent.

As the dissent against the ruling parties grows, populist leaders have seen a rise in the recent elections. The loose fiscal policy: doling out sops to the battered consumers and businesses has led Europe to a vicious circle.

The heart of the crisis in Europe is the UK, where the incoming Liz Truss government doled out enormous “unfunded” tax cuts worth £80 billion and provided subsidies to industries and consumers worth £180 billion.

Shocked by the development, the bond markets crashed, and yields spiked to record highs. Furthermore, the Sterling took a massive hit and crashed to all-time lows. And the results were:

In a dramatic sequence of events last week, the BoE intervened in the long end of the curve in the bond markets (maturity greater than 20 years) and averted the collapse of pension funds, which would have been a probable “Lehman Moment” for the UK.

Those who want to understand in detail the pension funds fiasco in the UK can read the below twitter thread:

https://twitter.com/Peston/status/1575160338248761344

In a stark warning, even the IMF criticized the UK government for fiscal mismanagement, and as a result, markets have lost confidence in the British economy.

Let us understand the vicious circle that the Uk has entered:

Higher Fiscal deficits → Higher Yields and BoE printing — -> Currency Depreciation → Imports become costlier (energy and food) — -> Higher fiscal deficit, Higher Current Account Deficit and more pressure on the currency

Unfortunately, with inflation at 10%, the BoE behind the curve with the Bank Rate at just 2.25%, the Real yields negative across the curve, the Current account deficit (CAD) at 8%, fiscal deficit at 8% (expected to increase due to fiscal sops) and minimal FX reserves, the UK has limited options to prevent a catastrophe.

Furthermore, the most significant tragedy for the UK is that it has net FX reserves of just £ 80 billion, which are insufficient to defend the GBP in times of crisis. (just two months of import cover as compared to more than one year for Japan)

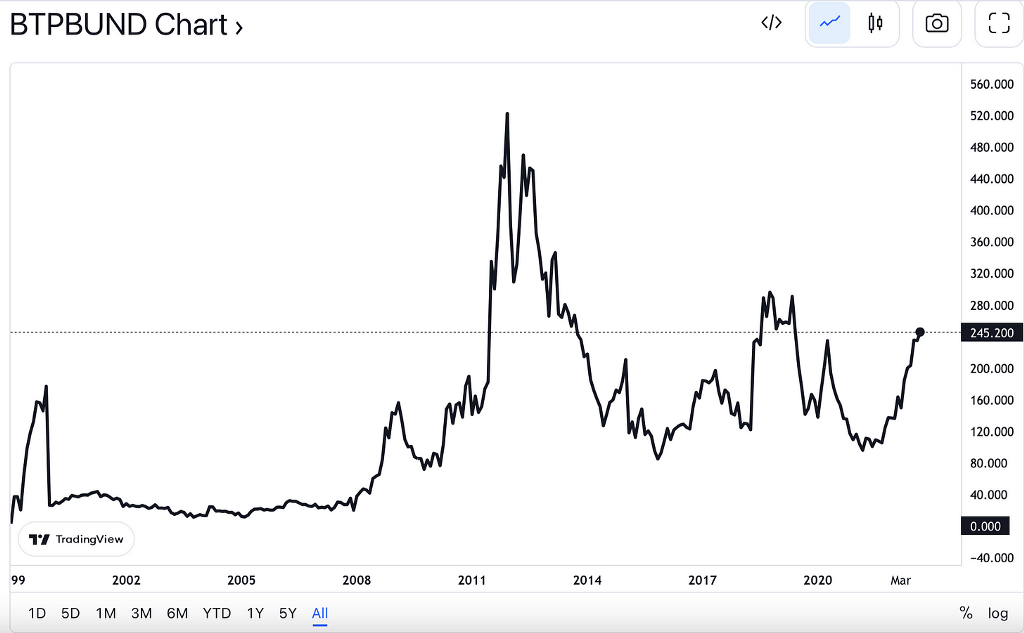

The Euro is also encountering pressure as it touches 0.95 against the USD. As the right-wing populist party takes over in Italy, there are concerns that Italy will witness similar fiscal sops as the UK’s.

The ECB has been way behind the curve in raising rates (rates at 0.75% while inflation at 9%), and with the launch of TPI, the markets will test the ECB’s resolve to weather the perfect storm in the EU’s bond markets.

The BTP-Bund spread (spread between Italian and German bonds: which is the measure of stress in the EU bond markets)has again started widening.

If the ECB goes on the same path as the BoE (buying bonds aggressively), the Euro will tank further to most probably below 0.90.

Conclusion!

Central Banks across Europe and Asia are facing a trilemma: Slowing growth, high inflation and deficit spending financing due to loose fiscal policy.

No way the CBs can manage all three issues simultaneously. While the prime focus remains on bringing down inflation at any cost, the fiscal policy is not helping. As a result, the Central Banks are/will sacrifice their currency to protect their bond markets and control inflation.

Therefore, it’s highly likely that we are heading to a Plaza Accord 2.0 when a further 8–10% appreciation in the DXY index to more than 120–125 will lead to utter chaos in the FX markets and major economies of the world.

Alternatively, if the Fed pivots (an improbable scenario as we are heading to mid-term elections in the US and the Fed’s sole focus remains to control inflation at home at any cost), then we may see the FX crisis getting averted.

Plaza Accord 2.0? was originally published in DataDrivenInvestor on Medium, where people are continuing the conversation by highlighting and responding to this story.

Comments