Now Is The Time To Act!

“Lithium and rare earths will soon be more important than oil and gas. Our demand for rare earths alone will increase fivefold by 2030. […] We must avoid becoming dependent again, as we did with oil and gas. […] We will identify strategic projects all along the supply chain, from extraction to refining, from processing to recycling. And we will build up strategic reserves where supply is at risk. This is why today I am announcing a European Critical Raw Materials Act.”- Ursula von der Leyen.

Historians describe the period 1500 AD-1945 AD as “Modern History”. Modern history witnessed significant human inventions and rapid advancements in industrial development. The resource-rich “empires” flourished in the modern era, and the quest for minerals and precious metals led Europe to colonise the whole world, making Europe the powerhouse of modern history. As the modern era ended (1945 AD), Europe lost its sheen and the world’s new superpower, the “USA”, took centre stage.

As oil became the new gold, the world’s superpower, the USA, pumped the largest amount of oil from its shores till the 1960s. The 1970s saw the rise of the Middle East and the Soviet Union as energy giants.

Thus, the power dynamics shifted, and the Middle East became the №1 concern for the West. Undoubtedly, the Middle East has been marred in geopolitical conflicts for the last 30 years, and the Soviet Union broke in 1990.

While OPEC+ is still the de facto leader in oil production, the shale boom ensured that the US became self-sufficient in energy consumption.

Now, as the world gears up for its most significant transition ever, the focus has once again turned to the raw materials and metals that will power this transition.

Let us dig deep and understand why the urgency from the EU!

Rare Earth Metals!

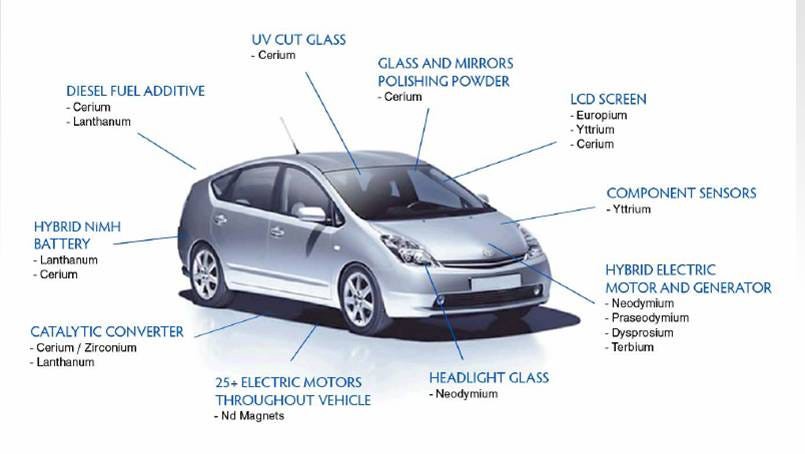

Rare Earth Metals (REM) are the crucial elements for producing high-tech hardware used in military and space, clean energy tech, electronic gadgets and Electric Vehicles (EVs).

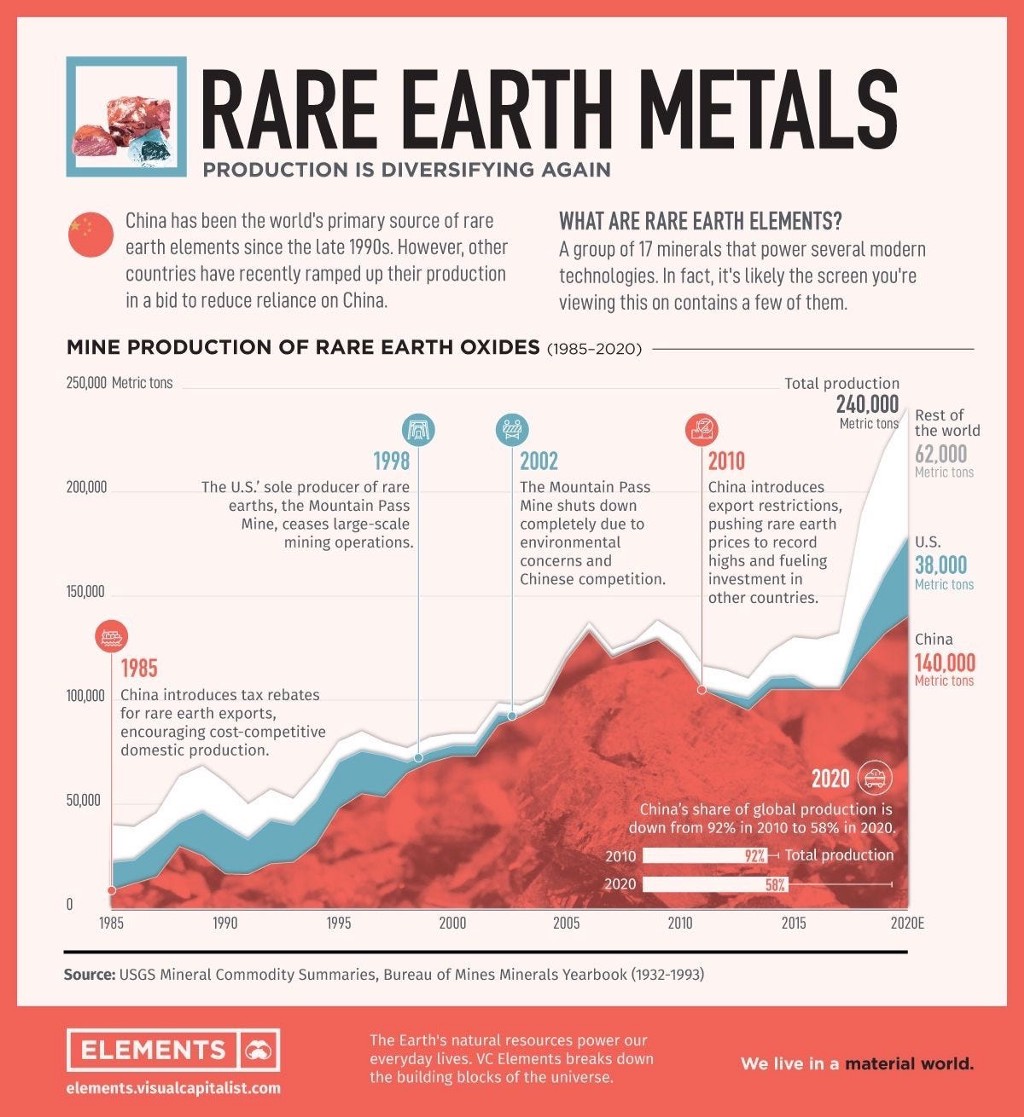

The 80s saw China playing a “tactical” move that helped them reap dividends in the first decade of the 21st century. The USA was the leader in the production of REMs in the 70s, which was still an extremely small industry.

However, in the 80s, China doled out huge subsidies and became the largest producer of REMs. Unable to match the low Chinese prices, competitive mines outside China closed. The exports of REMs were restricted by China, and as a result, the prices skyrocketed.

The USA looked at alternative substitutes to reduce the demand while the Chinese continued to increase their clout by monopolizing the industry.

However, the record prices and an astronomical rise in demand once again made the overseas mines profitable, and the Chinese share has reduced to 58% in 2020 from a high of 92% in 2010.

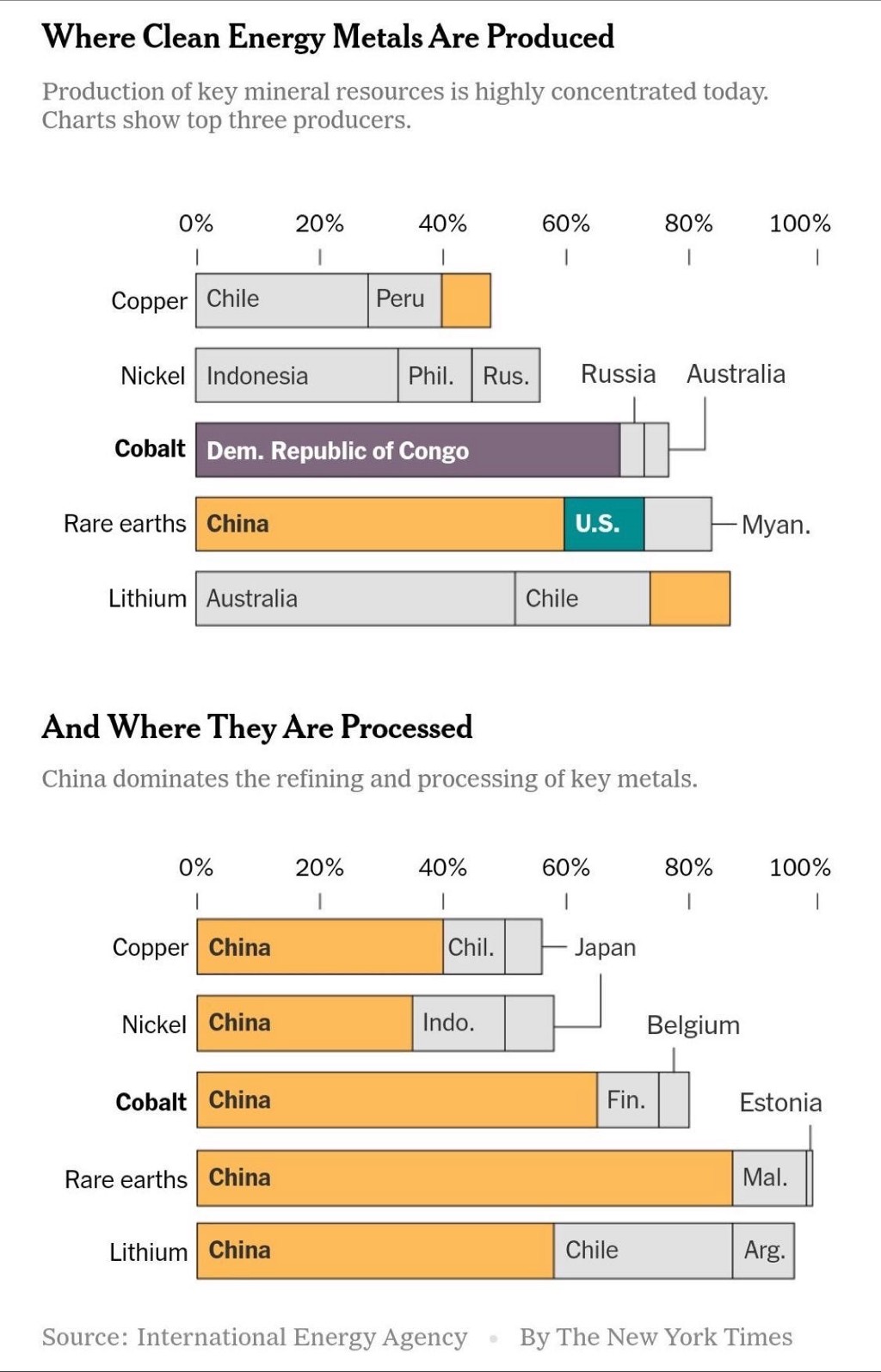

However, the processing of REMs is the biggest worry for the EU. Ursula von der Leyen states that 90% of REM processing occurs in China. Europe has ambitious plans and is designing a framework wherein they will reduce reliance on China for the processing of these critical minerals.

To mobilise the investment needed to up our game when it comes to critical raw materials, we will increase our financial participation to Important Projects of Common European Interest and create a new European Sovereignty Fund.

To frame the ambition, objectives could be introduced in the legislation. For example, a target could be set that at least 30% of the EU’s demand for refined lithium should originate from the EU by 2030, or to recover at least 20% of the rare earth elements present in relevant waste streams by 2030.

Lithium and EV Transition!

“Lithium Refining Business is the license to print money. Lithium-ion battery cell supply is the fundamental constraint for the global transition to sustainable energy.”- Elon Musk.

The next biggest challenge that our globe faces in the EV transition is the scarcity of Lithium. If we are indeed heading to EVs being at least 50% of total vehicles on the road in the next three decades, then we need to act “now”.

A large focus of the European Critical Raw Materials Act is on Lithium, as the EU recognizes the fact that the hunger for Lithium is leading to soaring Li prices.

Global EV sales have seen an astronomical rise post the pandemic. China accounts for 50% of global EV sales.

Lithium prices are up 80% YTD.

As EV sales expand globally, lithium prices’ stability becomes paramount. Any disruption or parabolic increase in Lithium prices can lead to delays in delivery and cost increases for the consumers, which could hamper the transition as consumers prefer ICE vehicles over EVs.

But can the world produce enough Lithium for a smooth transition?

This is a very fascinating chart and reveals the extent of the shortage of supply of critical raw materials for the EV transition. Remember, Tesla’s quarterly production is around 300k vehicles.

The “First Come, First Served” will perfectly fit for Lithium as the mad scramble goes on for this metal. Unsurprisingly, China dominates Lithium production and processing. In fact, other minerals required for the EV transition are processed “majorly” in China.

The biggest reason that the growth of REM, Lithium and other critical minerals has been lagging in the EU is due to “environmental concerns”.

Europe is finally headed in the right direction. Nevertheless, one should not forget that the production and processing of any type of heavy metals and minerals use a lot of water and involves the discharge of waste that is damaging to the environment.

It will be intriguing to see how Western leaders respond to opposition from “environmental groups, aka environmentalists”, as they take steps towards their goal of being independent of the shackles of Chinese dominance.

Solar!

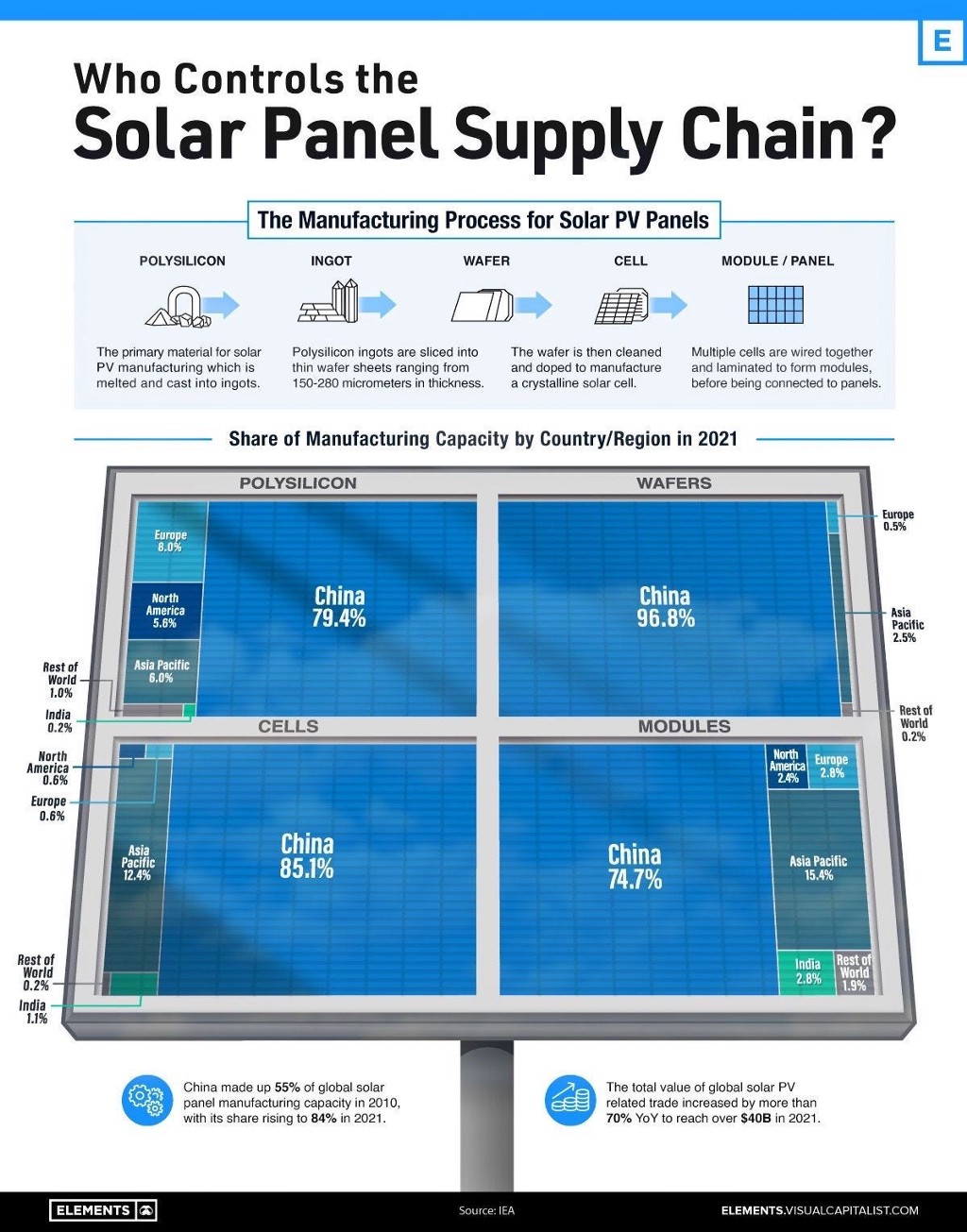

Climate Change targets are contingent on the successful implementation of solar and wind energy projects across the globe. Though we have seen a significant reduction in the cost of producing solar power in the past decade, however, this was primarily due to China.

The Chinese tightly control the manufacturing of various raw materials vital for producing solar panels.

The above chart is a vivid illustration of how China dominates the manufacturing of polysilicon, wafers, cells and modules.

The bewildering fact is that China made up just 55% of global solar panel manufacturing capacity in 2010, but now its share has risen to a whopping 84%!

Such a tremendous dominance can lead to spiralling prices of key raw materials if there is a disruption in China which can be catastrophic for the ambitious carbon-neutral dream.

As the Biden Administration announces a “100% clean electricity sector by 2035”, one can’t ignore solar power’s contribution to achieving the goal.

Conclusion!

The incompetence and short-sightedness of Western leaders have led China to dominate each and every supply chain related to the EV transition, Climate Change and Solar Panel manufacturing.

After a horrendous shock by Russia, it looks like Europe is finally taking the right steps by announcing the “European Critical Raw Materials Act”. Now, it’s time to act boldly against the people who oppose the construction of new smelters and the development of “critical” raw material mines.

If we are indeed headed into a “Green” future where the dependence on fossil fuels, which is still at 84%, reduces to less than 50%, then the West needs to act now before it’s too late.

Subscribe to DDIntel Here.

Visit our website here: https://www.datadriveninvestor.com

Join our network here: https://datadriveninvestor.com/collaborate

First Come, First Served! was originally published in DataDrivenInvestor on Medium, where people are continuing the conversation by highlighting and responding to this story.

Comments