If you think that inflation has peaked, then you are gravely mistaken!

“Ignorance is not bliss. Ignorance is poverty. Ignorance is devastation. Ignorance is tragedy. And ignorance is illness. It all stems from ignorance.”- Jim Rohn.

Covid-19 caught every country in the world by surprise. Nobody, even in the developed world, was prepared for a pandemic; thus, the response was contentious and chaotic. The lockdowns across the globe had a catastrophic impact on the economic output.

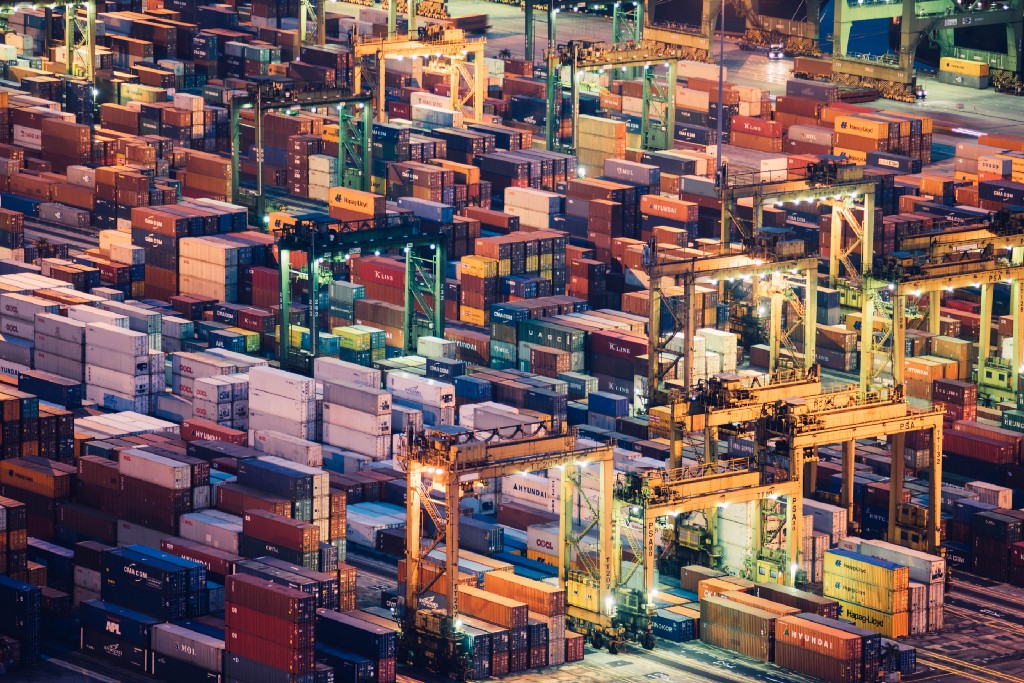

The world witnessed an unprecedented supply shock and recognised the dominance of China in the world’s supply chain ranging from APIs to semiconductors.

Fast forward to 2022, and humanity saw the most significant inflationary event since the 1970s as Russia attacked Ukraine.

Initially, most people believed that the Russian sanctions would reduce the supply of oil, natural gas, food, metals and fertilisers globally, as Russia is one of the largest suppliers. However, nobody in their wildest dreams thought that the Russian retaliation of reducing natural gas supplies coupled with one of the worst ever droughts in China would lead to “Supply Shock 2.0”.

Let us dig deep and understand the upcoming inflationary shock 2.0!

Fertilisers and Food Shock!

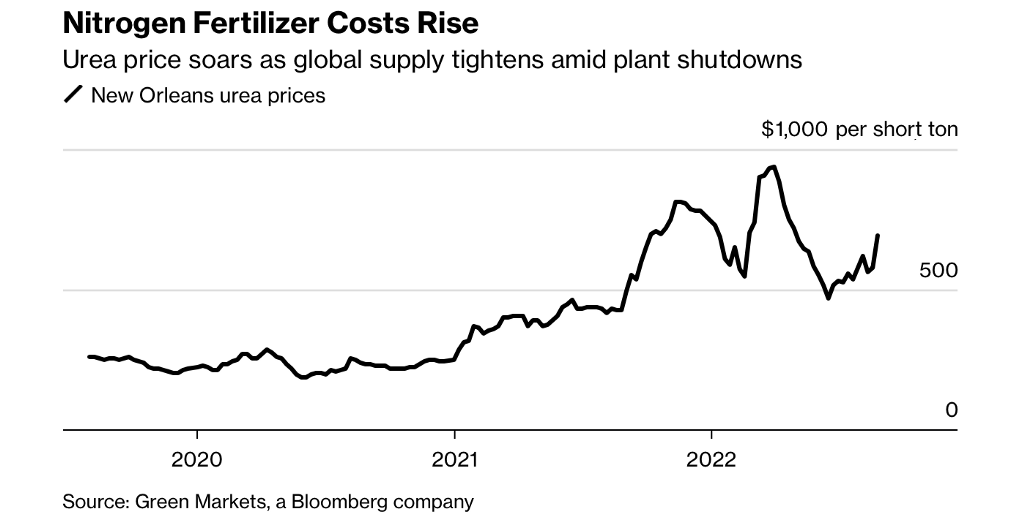

Fertiliser plants use natural gas as an essential feedstock. Thus, the unavailability of gas has led to the shutdown of nearly two-thirds of Europe’s fertiliser production capacity.

As a result, Europe is scouting for fertiliser supplies worldwide, leading to soaring urea and ammonia prices globally.

Post-war and sanctions, Urea prices reached record highs as Russia and Ukraine contributes around 15% of the total exports of Nitrogen, Phosphate and potassium (which are key ingredients for fertiliser production).

We might see fresh all-time highs for urea and ammonia in the coming months as Europe goes on a mad scramble to secure the supplies. In the process, poor countries in Africa and Asia that import fertilisers will either pay astronomical costs to import or will be unable to import, resulting in lower harvests.

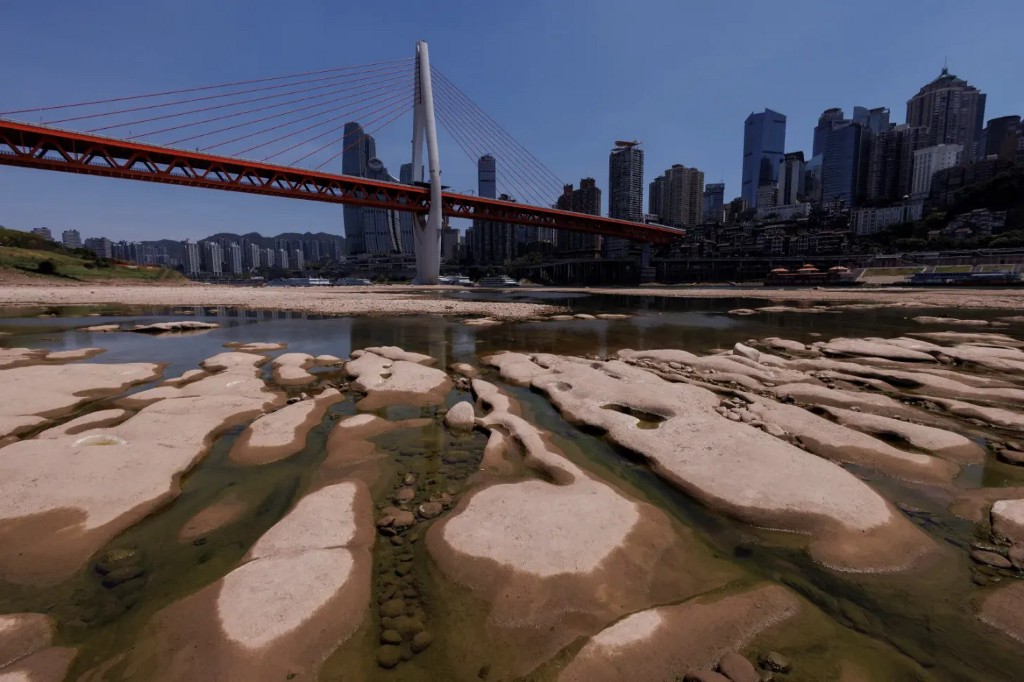

On the other hand, China is self-sufficient in many agro commodities and has also built colossal grain reserves. However, a severe drought which has engulfed half of the Chinese provinces, accompanied by one of the lengthiest heatwaves, has dried the rivers across China. The drought coupled with flooding in the northeast region will create havoc on agricultural production in China(primarily corn and rice).

If the North China Plain suffers a 33% crop loss due to water insufficiency, China would need to import roughly 20% of the world’s internationally traded corn and 13% of the world’s wheat.

Though such sharp crop loss looks improbable today, there is a serious concern about the drought hampering crop production.

Thus, China will probably import critical Agri commodities in the latter part of the year and potentially squeeze the international markets.

Even India, which exports Wheat, has seen a massive decline in production due to deficient monsoon. As a result, wheat exports were banned by India in May this year. The low harvests of rice may also lead India to ban non-basmati rice in the next fortnight.

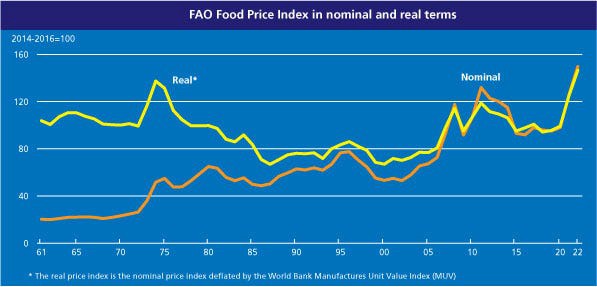

The FAO Food Price Index, a composite of cereals, meat, dairy, and vegetable oils, was at a record high in May and June this year. However, it cooled off considerably in July due to a massive fall in Wheat cost and Vegetable Oil Index.

Wheat prices fell 14% as Russia and Ukraine reached an agreement to unblock Ukraine’s main Black Sea ports.

However, with fertiliser prices skyrocketing, Europe facing the worst drought in 500 years and China increasing imports, it is expected that the FAO Food Price Index will see fresh highs in the coming months sending shockwaves across the world.

China and Metals!

The world’s manufacturing powerhouse is going through one of the most turbulent patches in history. A prolonged drought, a stalled property sector and covid lockdowns have paralysed the Chinese economy, with consumer confidence crashing to all-time lows.

Since China’s inclusion in the WTO in 2001, the world has long enjoyed the luxury of cheap Chinese goods due to the cheap and abundant Chinese labour pool. Thus, any disruption in the Chinese economy is inflationary for the global economy.

As a result of severe drought, hydro generation has plummeted, which has proved to be catastrophic for power generation.

The worsening power situation has led to blackouts and factory closures.

Companies like Toyota, Foxconn and CATL have suspended operations in Sichuan. Notably, Sichuan derives 80% of its electricity from hydropower.

Since Sichuan is the hub for auto supply chains, disruption in Sichuan has also led Tesla and SAIC Motor to curtail their operations in Shanghai.

Last year when coal shortages caused power outages in Shaanxi province, the global auto industry witnessed a gigantic supply shock. As a result, around 35 of the 50 magnesium smelters were ordered to close down, resulting in a 7X increase in the prices of magnesium.

Already, Europe is witnessing a string of closures from Aluminium smelters to Zinc smelters as energy costs now account for around 80% of the total production cost of Aluminium and Zinc.

Note that when a smelter’s operation is halted, it takes at least six months to restart the smelter.

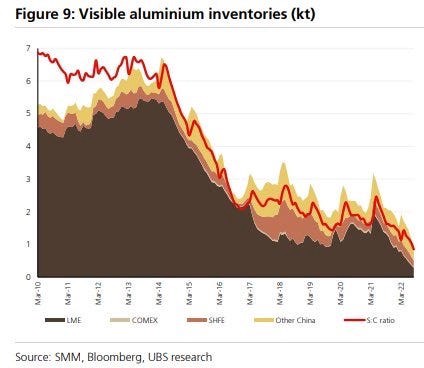

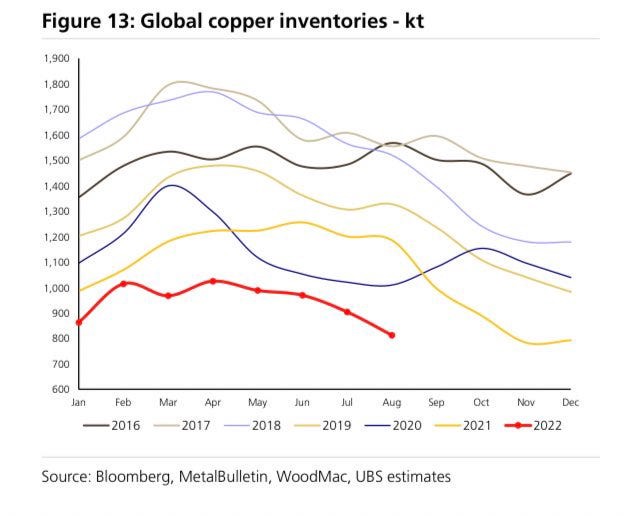

Low inventories will most probably exacerbate the supply shock.

The prices of base metals like Aluminium, Copper and Zinc have corrected 30–50% from all-time highs due to concerns about weaker demand induced by an “upcoming” recession and Chinese lockdowns.

However, with ultra-low inventories, smelter closures in Europe and Chinese stimulus, it is expected that we can see short-term gains in base metals unless we have enormous demand destruction.

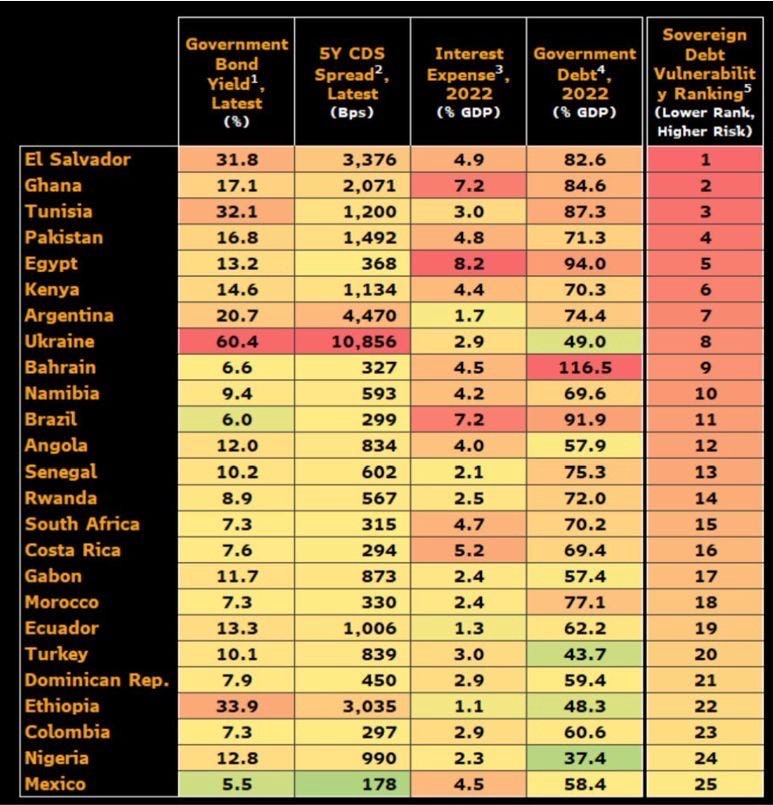

The Vulnerable Countries!

As Supply Shock 2.0 hits the world in the next few months, various vulnerable emerging markets will be the hardest hit. Already reeling from massive capital outflows due to Fed’s hawkish monetary policy, these countries have lately seen enormous pressure on their currencies.

Notably, the Emerging market's foreign reserves have shrunk by $379 billion this year through June, according to data from IMF.

So which are these countries? Let us have a look!

We can see from the above chart that most of the countries are in Africa and Latin America (few in Asia).

The bond yields in some of these countries indicate that their fiscal position is horrific, and they can’t remain solvent for long without bailouts from the IMF.

These countries have common problems, which include:

High fiscal deficits, low tax collection, high energy and food imports, high levels of corruption, a depreciating currency and low foreign reserves.

For example, Egypt is the largest importer of Wheat in the world, and more than 90% of Wheat is imported from Russia and Ukraine.

On the other hand, Pakistan shifted to natural gas for its energy needs seven years ago (2015) and became the world’s ninth largest importer. Now, with natural gas prices off the roof, Pakistan is facing blackouts of more than 10 hours daily, which has crippled their industry.

Conclusion!

Wars historically have been followed by bouts of high inflation. On top of it, the last two decades were a period of globalisation which had a disinflationary effect. Thus, a deglobalised world and a war will most probably lead to a multipolar world which is highly inflationary for the global economy.

When times are horrendous, every country in the world endeavours to safeguard its interests, including food and energy security, so that the people don’t starve to death and there is no social unrest in the country.

However, unfortunately, this time, the dollar wrecking ball coupled with enormous shortages of fertilisers, food and energy might create turbulence in vulnerable emerging markets economies. As a result, we might see scenes similar to Srilanka in many economies.

Remember, last time, a meteoric increase in global food prices in the early 2010s led to the Arab spring overthrowing governments in major African economies.

Supply Shock 2.0! was originally published in DataDrivenInvestor on Medium, where people are continuing the conversation by highlighting and responding to this story.

Comments