Rice stays pricy // European Gas Price Update // Yuan & Commodity Correlation // & more

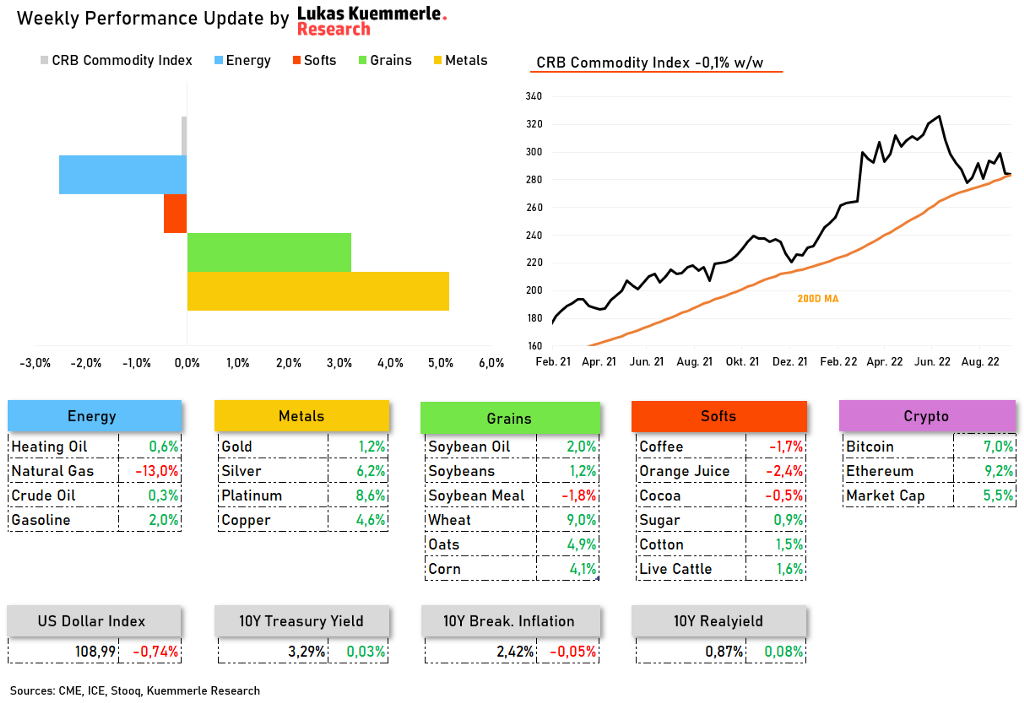

The benchmark, CRB Commodity Index, ended the week -0,1% lower

Rice prices stay near highs

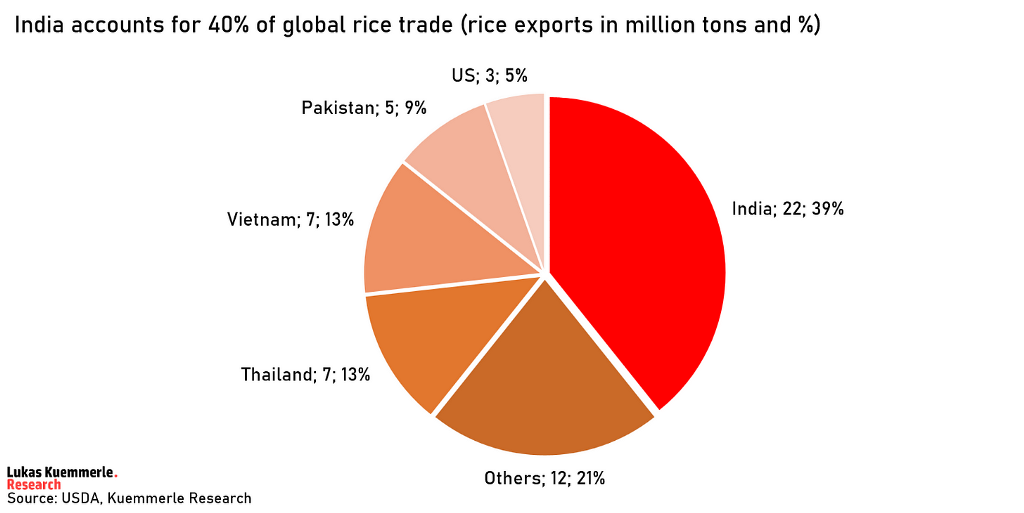

India, the world’s biggest rice shipper, restricted exports of key varieties that mainly go toward feeding Asia and Africa. India imposed a 20% duty on a variety of rice varieties. Keep in mind that Asia is producing and consuming about 90% of the global supply. India alone is the world’s most important exporter with a share of 40%.

The curbs apply to roughly 60% of India’s overall rice exports, according to Bloomberg. Therefore it’s no surprise that the forward contract of rice is still trading near all-time highs, as this step should also keep US prices for rice on elevated levels.

It would mean the world to me if you leave a like or share The Commodity Report if it brings you any value. It helps the community to grow further and to provide more people with practical commodity research.

German Gas prices continue to decline — latest update

Even JP Morgan came out on Friday and told clients that they expect that Europe will be able to fill their storage levels to 94% by November, as long as the situation stays like it is right now. (80% was initially planned)

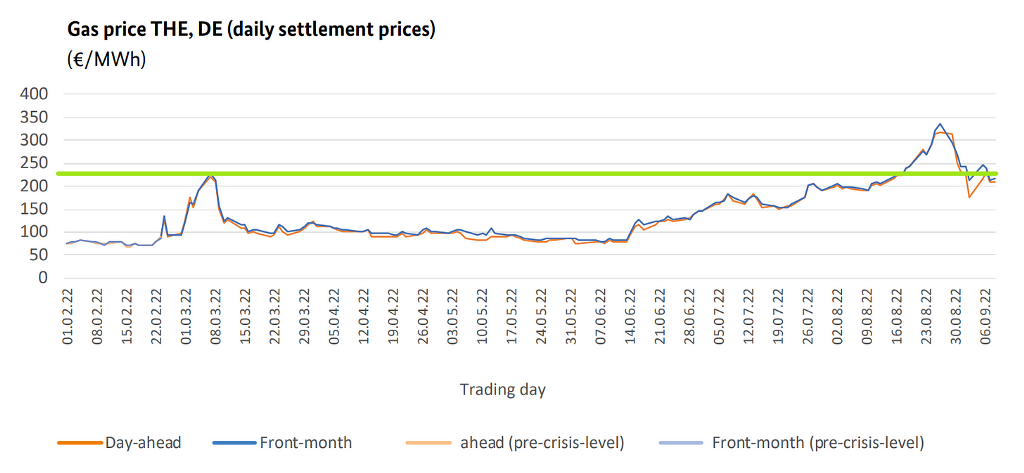

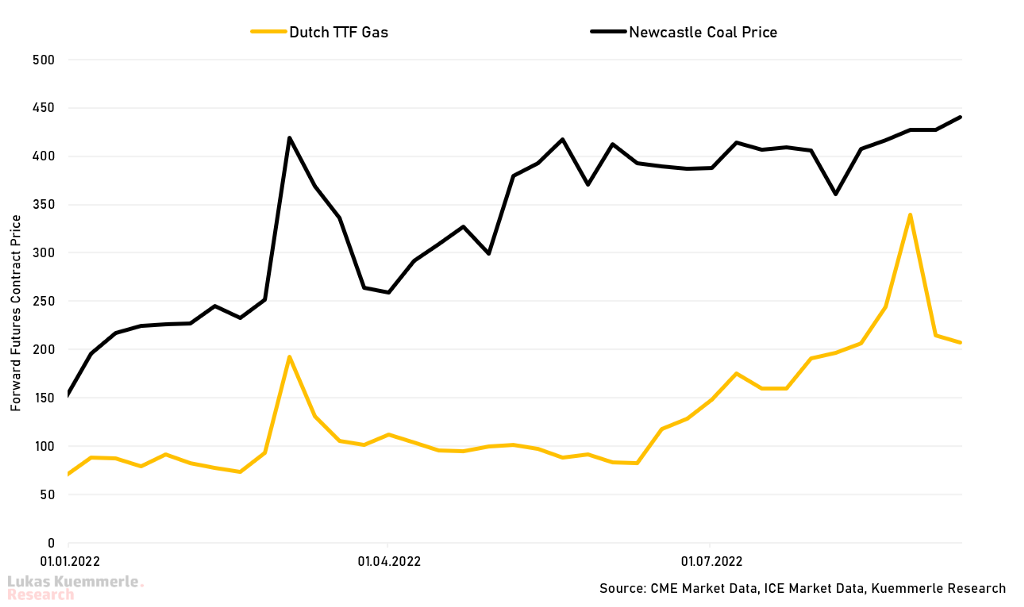

Isn’t it stunning that daily gas prices in Germany are now already back below the highs from March at the beginning of the year? This is good news for Germany and Europe in terms of energy security. We’re back down to €225 per MWh. Fingers crossed this trend continues.

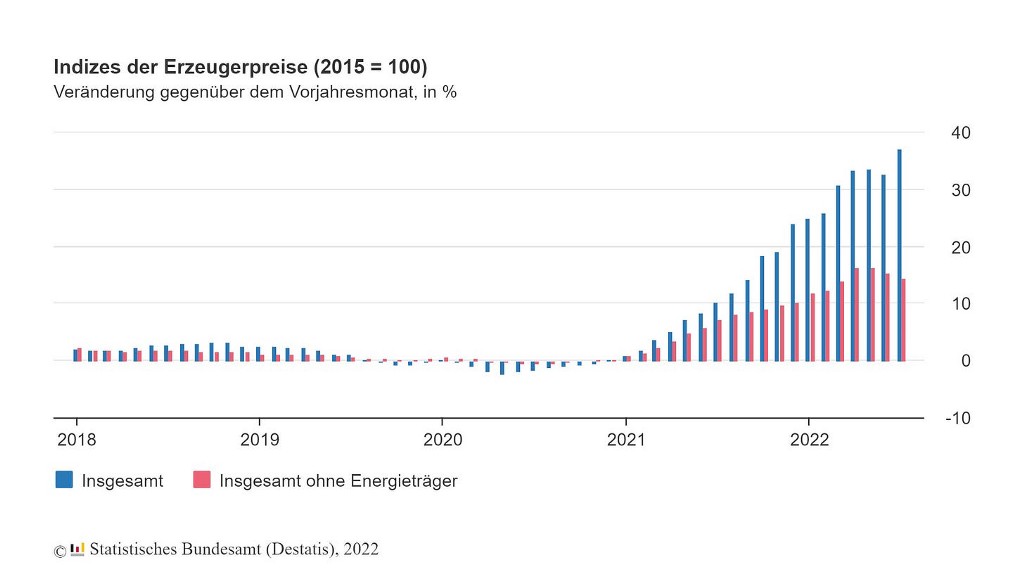

While European Energy prices seem to have peaked, the pain for businesses and households stays. There’s a lag of up to 6 months between financial markets and felt effects by the consumer. Businesses decrease production capacity which will most likely make inflation even stickier.

Gas flows continue to flow on a stable basis from Norway, Belgium and the Netherlands towards Germany, helping to hike the storage levels further and further.

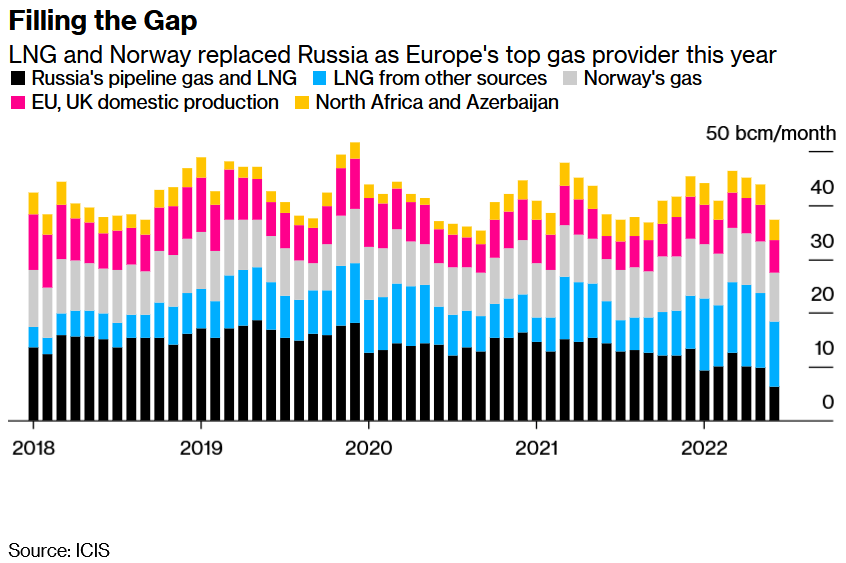

Looking forward the next challenge for the EU will be to find new gas suppliers perhaps from North Africa or increase imports from the US even further to become completely unreliable of Russian gas.

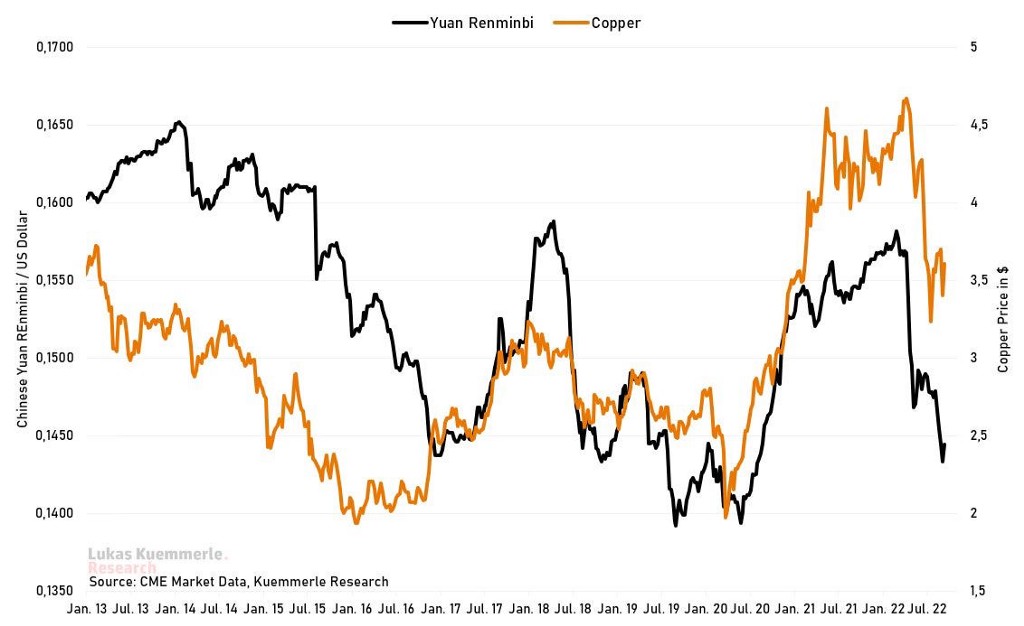

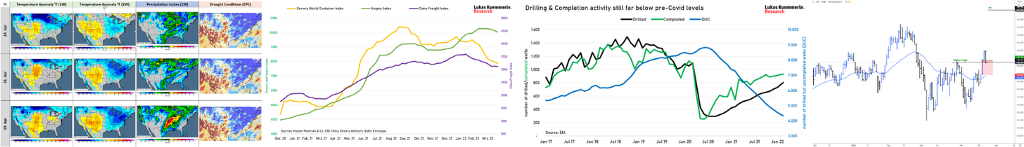

Industrial Metals and the Chinese Yuan usually go hand in hand

Like the rest of the planet, China typically buys commodities in USD. So the weakening in the yuan to 7 or more to the greenback piles on the costs for importers, depressing demand and forcing prices lower, as China is the largest commodity importer. The falling yuan could be a problem for financing, in cases where Chinese traders have borrowed commodities in dollars to make their purchases and will now be left with elevated funding costs. So a dollar reversal would be significant and a big relief for worldwide commodity demand.

Subscribe to The Commodity Report for free and receive these updates every Monday morning!

Bitcoin is leading the stock market?

If you want to know over the weekend how the general sentiment is and how the stock market will most likely open just track the movements of bitcoin. The high beta assets on steroids were a reliable indicator since the FED started their hawkish rate hike cycle.

BTW if you ask yourself why bitcoin rallied hard into the close on Friday, the filing of Microstrategy to sell shares in the amount of $500 million in order to buy more bitcoin was probably the leading argument for the price jump.

This week look out for:

- CPI data on Tuesday

- PPI data on Wednesday

- Empire State Manufacturing Index on Thursday

- Retail Sales data on Thursday as well

- Prelim UoM Consumer Sentiment on Friday

Check this out as well:

We see a coal/natgas price divergence in Europe. As Germany and other countries in the EU switch to the less pricy but even more polluting alternative, the demand for the energy component stays solid. TTF natgas is meanwhile continuing its price decline as maximum fear seems to be priced in for this year.

Subscribe to The Kuemmerle Report

Commodity Metrics, Futures Activity and Trading Opportunities

A subscription costs you 34$ a month and you will receive an additional in-depth report every Sunday evening at 6:00 PM CEST. That information will be only published to members and not to the general public.

Till next Monday, Lukas

If you have any questions in the meantime, please feel free to contact me via Twitter or Mail.

(The Commodity Report is not investment advice)

The Commodity Report #68 was originally published in InsiderFinance Wire on Medium, where people are continuing the conversation by highlighting and responding to this story.

Comments