Fertilizer & Gas crisis // Decarbonization in the Shipping Industry // Dollar weakness ahead & more

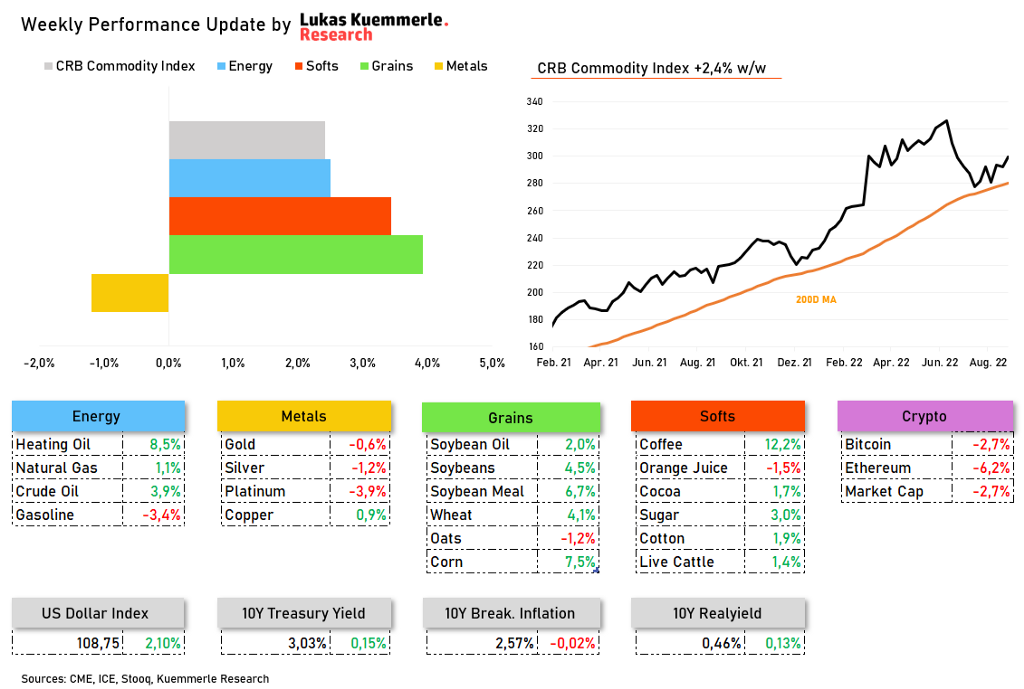

The benchmark, CRB Commodity Index, ended the week 2,4% higher

Fertilizer & Gas crisis

While natural gas made a higher high, the fertilizer complex remained in a sideways market for some time. Last week fertilizer prices saw an awakening, as especially European natgas prices rallied further. US Gulf Urea futures jumped 20% while Middle East Urea futures jumped 18% w/w.

In The Kuemmerle Report, I explain how these developments influence commodity prices and where the best setups are.

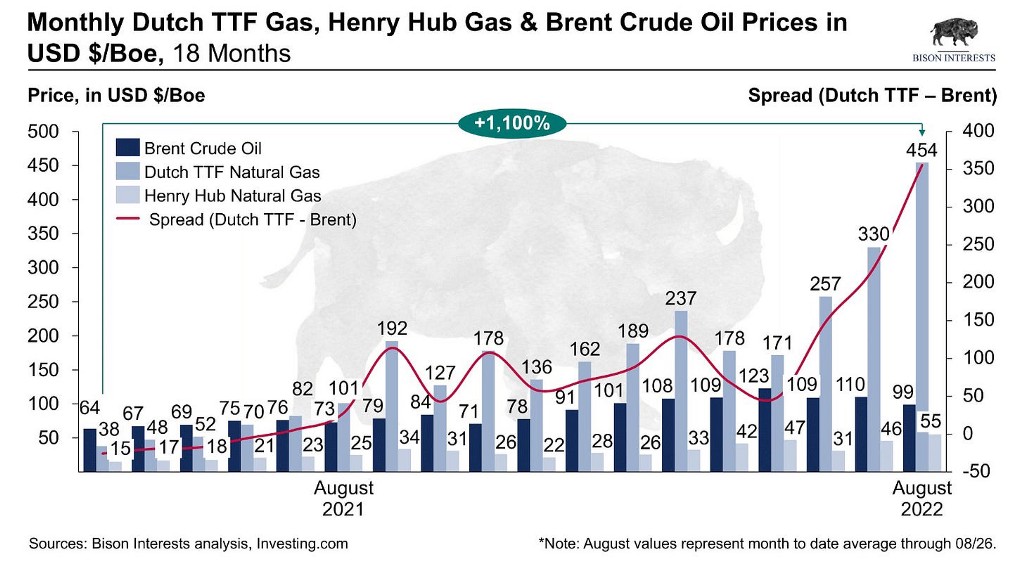

Meanwhile soaring gas prices have crippled Europe’s fertilizer industry massively, with output cuts leading to more than 70% of curtailed production, according to the region’s industry association. Companies including Yara and BASF have started to shut down facilities in Europe. As high energy bills over the winter will lead to lots of pain for the European consumer, sentiment could become even worse then. Natgas prices in the US are surging too but not nearly as much as in Europe, therefore the spread between both futures contracts is growing, as you can see in this great chart by Bison Interests.

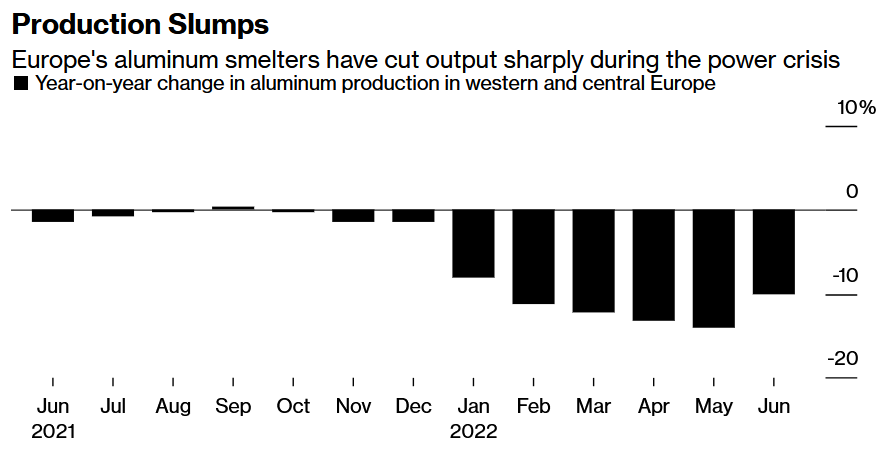

20 million people in the US — about 1 in 6 American homes have fallen behind on their utility bills. It is, according to @NEADAorg, the most severe crisis the group has ever documented. The problem though is that the effects will be even more severe in Europe going forward. More bad news comes from the manufacturing sector in Europe where aluminum production literally collapsed in 2022 as the sky-high costs of energy made it economically not doable anymore to produce at the current market price. If this trend continues the Manufacturing PMI data for the Eurozone should be revised further to the downside.

It really would mean the world to me if you leave a like or share The Commodity Report if it brings you any value at all. It helps the community to grow further and to provide more people with practical commodity research.

US Natgas from a technical perspective

How high can prices go; that’s the question traders and consumers these days ask. While no one knows the exact answer, the technical picture is looking quite interesting.

Decarbonization in the Shipping Industry

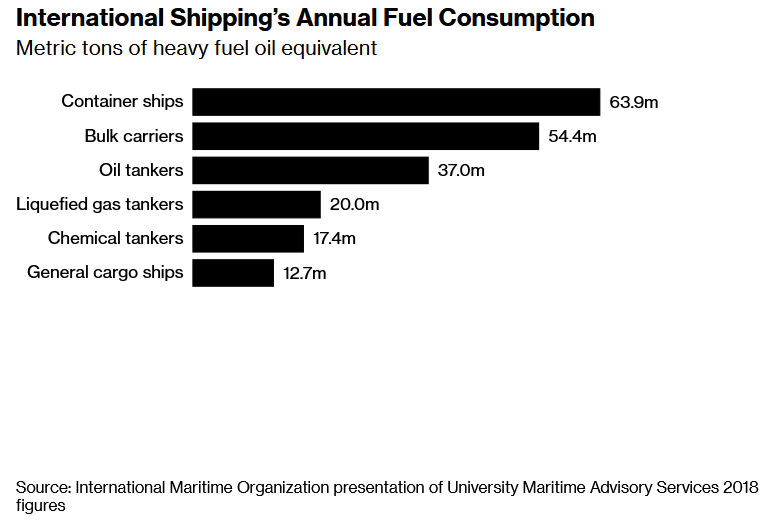

Shipping transports 90% of world trade and accounts for 3% of global greenhouse emissions, or about 1 billion metric tons of carbon dioxide a year.

With the focus on drastically cutting emissions, the shipping industry will likely face a transformation over the next several decades that’s as dramatic a disruption as the one it faced at the end of the 19th century when commercial ships propelled by wind and sails quickly lost favor as the Industrial Revolution ushered in the diesel engine.

Coffee goes wild

Coffee futures rallied hard over the past two weeks. I published the divergence between market fundamentals and price action way earlier in The Kuemmerle Report to all subscribers. (report from 24.07.2022)

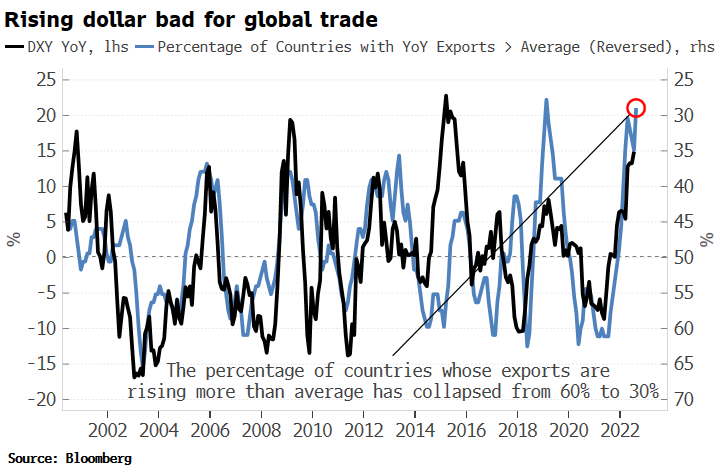

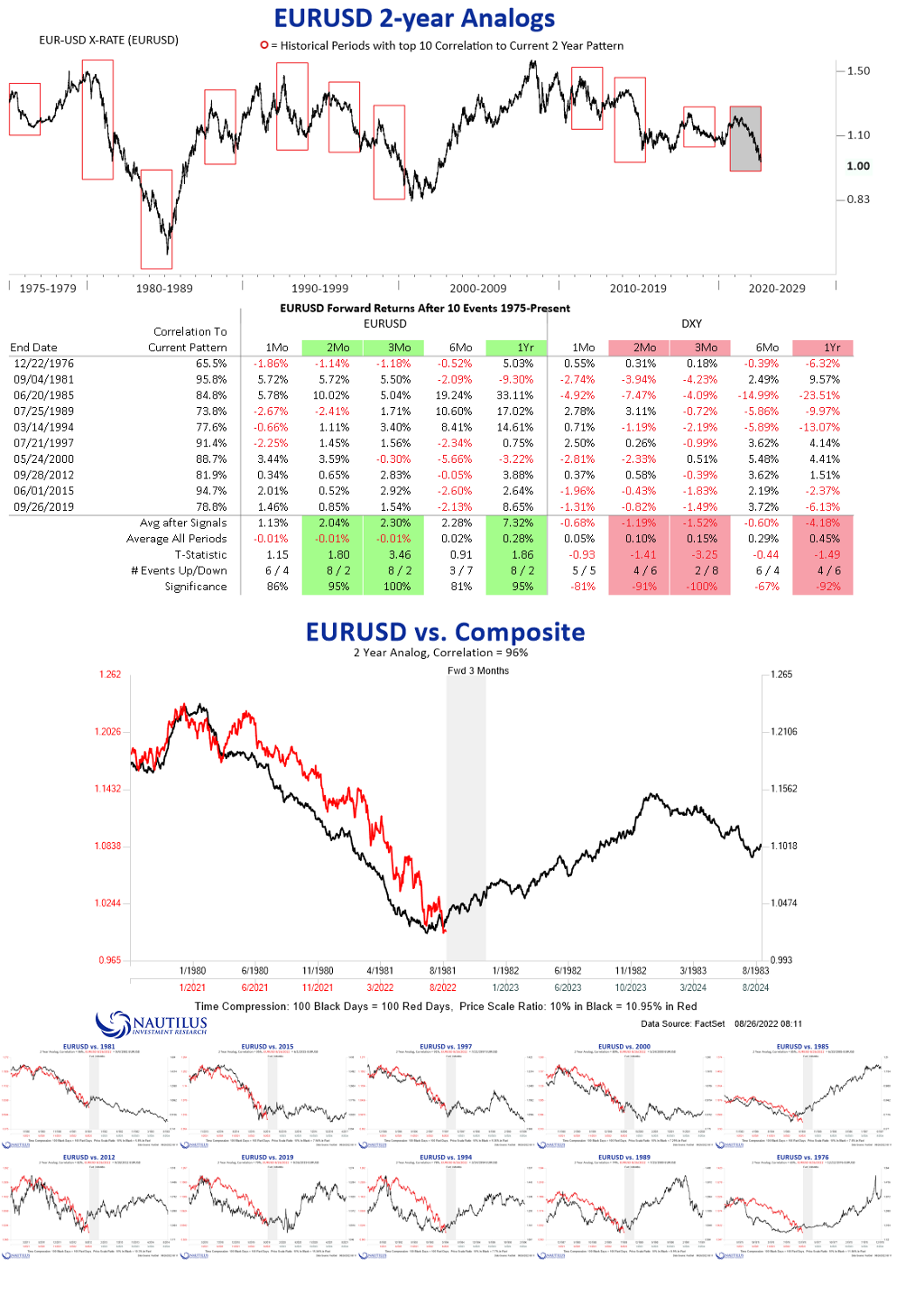

Dollar weakness ahead?

A weaker US Dollar would perhaps support commodity prices even more and there are a few long-term fundamental reasons that advocate some temporary dollar weakness going forward. For example, does a strong dollar hurt trade and therefore slow demand for USD-denominated assets.

While J. Powell made it very clear that the FED will stay ultra hawkish for some time, I don’t think that we’ll see a FED Funds Rate above 3,5%. Especially the ECB should have some more hikes to come to combat inflation and could surprise market participants. I know it’s a very unpopular view but IF the energy situation in Europe reaches maximum pain the Euro will most likely rebound again. Nevertheless, that could take some more months.

This week look out for:

- Consumer Confidence on Tuesday

- JOLTS on Tuesday

- Chinese Caixin Manufacturing PMI on Wednesday

- ISM Manufacturing PMI on Thursday

- Job Market Report on Friday

Check this out as well:

— @lukaskuemmerle

Subscribe to The Kuemmerle Report

Commodity Metrics, Futures Activity and Trading Opportunities

A subscription costs you 29$ a month and you will receive an additional in-depth report every Sunday evening at 6:00 PM CEST. That information will be only published to members and not to the general public.

Here you can subscribe to my research

Till next Monday, Lukas

If you have any questions in the meantime, please feel free to contact me via Twitter or Mail.

(The Commodity Report is not investment advice)

A Message from InsiderFinance

Thanks for being a part of our community! Before you go:

- 👏 Clap for the story and follow the author 👉

- 📰 View more content in the InsiderFinance Wire

- 📚 Take our FREE Masterclass

- 📈 Discover Powerful Trading Tools

The Commodity Report #66 was originally published in InsiderFinance Wire on Medium, where people are continuing the conversation by highlighting and responding to this story.

Comments