Macro Edge #53

Originally posted on thepensivenugget.com

The USD continues to strengthen broadly, and macro markets remain stuck in their negativity, warning of worse to come for risk assets.

USD Keeps Strengthening, Warning Of Worse To Come

- The USD continues to rally, except against the EUR. Given how macro conditions and markets remain weak, renewed Dollar strength is signaling further sell offs

- CNY has broken out vs the Dollar in a bad way, and continues to make new lows for the year. If CNY continues to weaken vs the USD, expect more selling in global risk assets

- Although UST yields are rallying, the US yield curve remains deeply inverted at multiple points, base metals are still weak, and breakevens remain low

- Given how macro markets have aligned over the past few months, we are looking at further, and possibly steeper, sell offs - USD strength remains broad based

- Stress levels in USD funding markets are obviously high, and still increasing. Global USD funding conditions are critical to how far financial contagion spreads, and how deep the recession is

- USDCNY is very weak and looking bearish. CNY’s shift, and it being one of the last to weaken vs the USD, heralds a shift in the global cycle, which does not bode well for economic growth and risk assets - Commodity markets are aligned with the USD and the US yield curve, signaling serious deterioration in global conditions

- WTI remains off its Russian war highs, Aluminum remains very weak, Copper has broken below major support, and Iron Ore looks set to break below its recent range - US 10y and 30y yields have bounced strongly after breaking below key support in early August, and could retest their current cycle highs. However, UST yields can fall sharply given global conditions, and how other markets have been trending

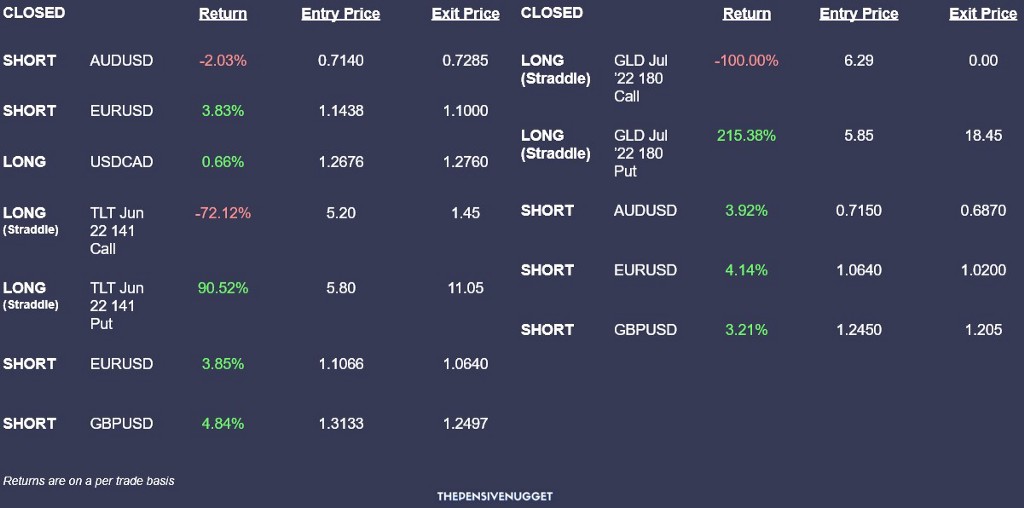

Trading Ideas — Performance

Trading Ideas — Commentary

- Re-entered Dollar longs against EUR, GBP, AUD, and CAD, as broad USD strength continues

- Entered a short position in Copper’s December 2022 contract in anticipation of further weakness given deteriorating global economic conditions, and bearish indications from other macro markets

- US long yields have turned, although it remains to be seen if a top has been made. Our long TLT call position is still in the red, but we purchased a year long expiry for this reason, to give the market time to make a top (if it does!)

- Went long TLT calls with 1 year expiry, as strong bids for USTs look to be on the horizon as the global cycle shifts

- Stronger USD, with significantly weaker CNY, is a huge warning signal

- Re-inverting yield curve, plummeting breakevens, base metals breaking lower, and now even tumbling oil prices, are all ominous signs - Closed the straddle on GLD for a net profit of 115%

- Decision to straddle gold using GLD options, instead of putting on an outright long position, has paid off handsomely, with gold tumbling down to ~$1700 after failing its retest of 2000

Trading Ideas

Long USD

- Well established trend, in place for >11 months in most major currency pairs

- Recent sharp increases in the Dollar’s value signals that global economic growth is going to take a turn for the worse. Global USD funding markets will tighten even more, driving the USD even higher

- US yield curve’s inversion in early April, and mid June (even as the Fed turned hawkish) is a clear warning sign

- USDCNY has started to move higher rapidly, indicating high levels of stress in global USD funding markets - USD longs in general should do well, but of the G7 currencies, look to go long the USD vs:

- EUR

- CAD

- GBP

- AUD

- JPY

Long 10y or 30y US Treasuries

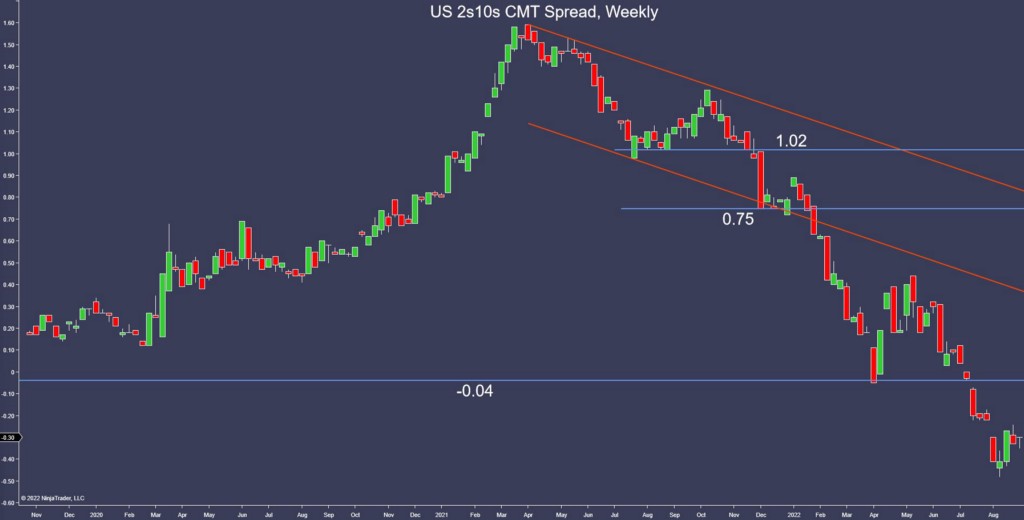

- Yield curve re-inversion (2s10s, 5s10s) signals the coming end of the current economic growth cycle, which means that nominal yields will start to turn down soon

- Monthly & yearly trends in yields are bearish, and looking for an opportunity to short yields is in alignment with long term trends

- 10y yields have broken below key 2.71% support — keep an eye on whether the breakout is sustained

- Trade can be expressed:

- Long TLT, or long TLT Calls

- Long US T Note/Bond Futures, or long Calls on Futures

Short Commodities

- Short oil, copper, aluminum, iron ore, given that so many macro markets are indicating more macro weakness to come

- Oil and copper are the most liquid and accessible markets to trade using futures, or E-mini futures

- Can express the short oil trade by shorting XLE, or purchasing puts on XLE (see ETF Edge)

USD consolidates vs the EUR

- EUR has taken a break from selling off

- It has moved slightly off its lows ~0.099 and is consolidating between 1–1.011

- Major support lies around 0.95

- Further weakness looks likely given the bearish trend and deteriorating global conditions

But strengthens against other currencies… GBP

- GBP has broken below its mid July low at 1.175 and looks to be headed for a test of 2020’s COVID low at 1.1440

- Further losses in GBP look likely at this point

But strengthens against other currencies… AUD

- AUD fell to retest intermediate support ~0.688, managing to break below this time

- A drop to major support at 0.64, and 2020’s low at 0.55, is possible given the bearish trend

- Major resistance lies at 0.7265

But strengthens against other currencies… CAD

- CAD rallied back to test resistance at 1.305, and managed to break out decisively

- A test of intermediate resistance at 1.323 looks likely in the near future, with major resistance at 1.339

- Major support lies at 1.287

But strengthens against other currencies… CNY

- CNY continues to sell off vs the USD, making new lows for 2022 ~6.90

- A move to test 7.02 is looking increasingly likely by the day, which does not bode well for risk assets

US long yields keep rallying… US 10y

- US 10y yields have broken above intermediate resistance ~3.1%, and look set to test major resistance at 3.25% soon

- A break above that level would open the door to a test of current cycle highs at 3.5%

US long yields keep rallying… US 30y

- US 30y yields are consolidating between 3.1–3.3%, with a retest of its current cycle high at 3.45% still looking likely

- Major support lies in the 2.8% region

The US yield curve remains deeply inverted…

- The US yield curve continues to be inverted at multiple points

- 2s10s are deeply inverted ~ -30 bps

- 5s10s ~ -15 bps

- 2s5s ~ -15 bps

- 2s30s ~ -19 bps

- The yield curve is clearly signaling high levels of stress in the financial system

US breakevens nosedive…

- Breakevens have reversed their recent move higher, and look like they are headed back to their 2022 lows

- The market is flashing major warning signs about the lack of growth driven inflation, and has been since March

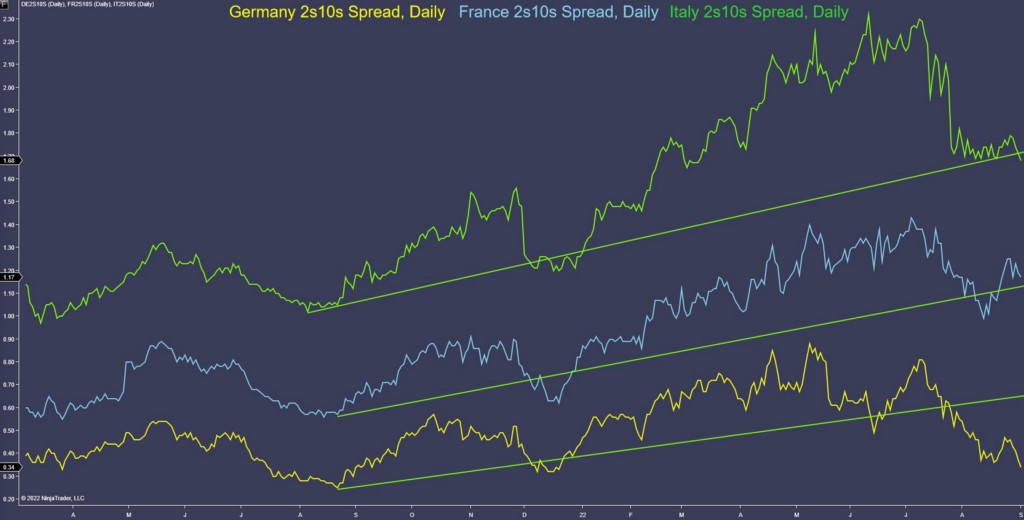

European yield curves flatten…

- DE, FR, and IT curves continued to flatten

- Italy’s curve has finally made a move below its trend, as Germany’s moves back to its lowest levels of the year

Oil continues to hover around its uptrend…

- Oil continues to fluctuate around its uptrend without making a decisive move in either direction, falling back to the high 80s

- A fall to ~72 remains possible, although range trading between 87–102 is also possible

Copper breaks below major support…

- Copper has fallen below 3.55 again, opening up the possibility of a move to test major support at 3.1

- Deteriorating macro conditions and the stronger USD indicate further weakness to come

Iron Ore remains in its range…

- Iron ore continues to trade in its range between 747–800, although it has fallen to test the bottom end

- A decisive break lower could lead to a return to recent lows at 620

- Further falls remain possible given macro weakness around the world

Aluminum consolidates at its lows for 2022…

- Aluminum remains stuck trading near its lows for the year, even as sky high power prices in Europe begin to affect production

- Trends in base metals as a whole are warning of a potentially painful global downturn

And Gold continues its slide…

- Gold is approaching major resistance, as well as its lows for the year ~1710

- It could end up in a wide range between 1690–2000, or fall back to test 1540

- A break above its bearish channel ~1810 is needed for it to have a chance at testing 1900

Do you want to make money trading a crisis? Check out our course on how to do so. And don’t forget to sign up for our FREE course on how to create a trading plan!

DISCLAIMER:

The information herein is for assistance and informational purposes only. It is not intended to be, and must not be taken alone as a basis for investment and/or trading decisions. Each recipient of this information should engage in their own due diligence process at the consult of their own legal, financial, accounting, regulatory, and tax advisors. You are solely responsible for any trading or investment decisions that you make.

A Message from InsiderFinance

Thanks for being a part of our community! Before you go:

- 👏 Clap for the story and follow the author 👉

- 📰 View more content in the InsiderFinance Wire

- 📚 Take our FREE Masterclass

- 📈 Discover Powerful Trading Tools

Heed The Dollar’s Warning. Macro Trading Opportunities was originally published in InsiderFinance Wire on Medium, where people are continuing the conversation by highlighting and responding to this story.

Comments