Bond Markets have nowhere to escape after the Fed’s checkmate!

“While higher interest rates, slower growth, and softer labour market conditions will bring down inflation, they will also bring some pain to households and businesses. These are the unfortunate costs of reducing inflation. But a failure to restore price stability would mean far greater pain.”- Jerome Powell, Fed Chair, Jackson Hole 2022.

In the game of Chess, the player’s utmost aim is to propel checkmate on their opponent. Checkmate is the ultimate move where the player’s king is in check, and there is no escape or defence possible.

At Jackson Hole 2022, we witnessed a checkmate by the Fed, and the bond markets were dumbstruck to listen to Jerome Powell’s eight minutes of super hawkishness.

Powell’s Jackson Hole speech was a stunner in all aspects. Quoting Paul Volcker and his lessons from the 1980s, Powell seems to be worried and determined at the same time. I would like to draw your attention to the third lesson that Powell spoke about in his speech:

(emphasis added throughout by the author)

“That brings me to the third lesson, which is that we must keep at it until the job is done. History shows that the employment costs of bringing down inflation are likely to increase with delay, as high inflation becomes more entrenched in wage and price setting. The successful Volcker disinflation in the early 1980s followed multiple failed attempts to lower inflation over the previous 15 years. A lengthy period of very restrictive monetary policy was ultimately needed to stem the high inflation and start the process of getting inflation down to the low and stable levels that were the norm until the spring of last year. Our aim is to avoid that outcome by acting with resolve now.”

The jury is out, and it doesn’t look good for the bond and stock markets. A “super-hawkish” Fed is committed to bringing down inflation and, in the process, inducing pain in the economy. The most likely result will be the spike in the unemployment rate, which will slowly creep up to 5–6%, further ensuring that the demand destruction takes place and the inflation returns to the comfort level of 2%.

After losing his credibility over the “transitory” inflation rhetoric, Powell now has the finest opportunity to restore the credibility of the world’s largest central bank.

Today, we will talk about the bond markets, which are undoubtedly jittery after the Jackson Hole speech. Let us understand what’s transpiring in the world of bonds.

The Bond Rout!

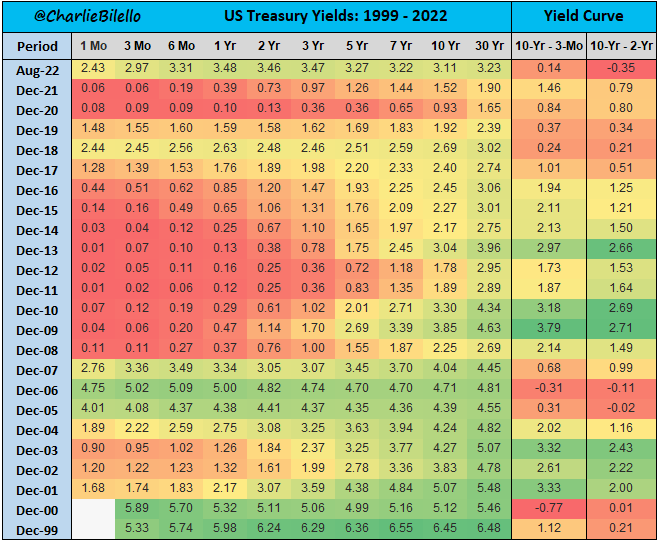

Bonds have been the hardest hit post the unleashing of the “Volcker Avatar” of Jerome Powell at the Jackson Hole. While the short end of the curve is seen massive steepening, the longer end is still 30 bps away from the highs reached in June.

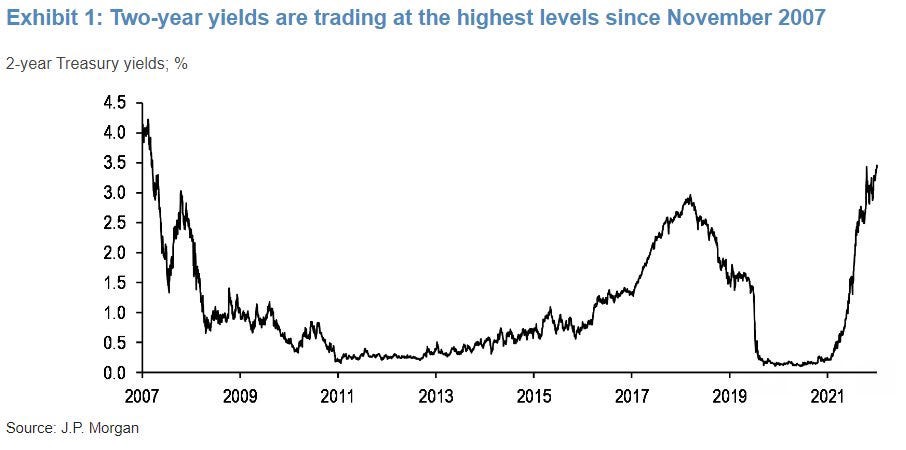

The 2-year yield has spiked to the highest levels since the GFC and is now quoting at 3.8%. The significant hardening continues as other Fed officials continue to make ultra-hawkish statements.

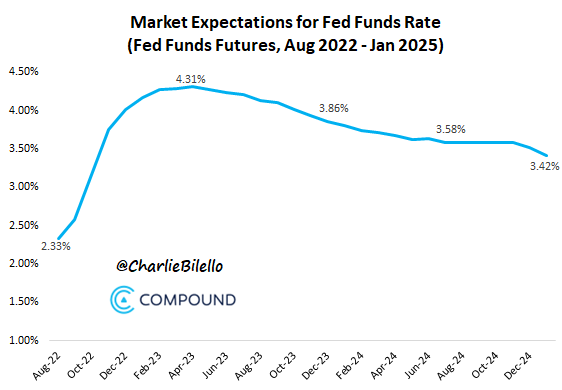

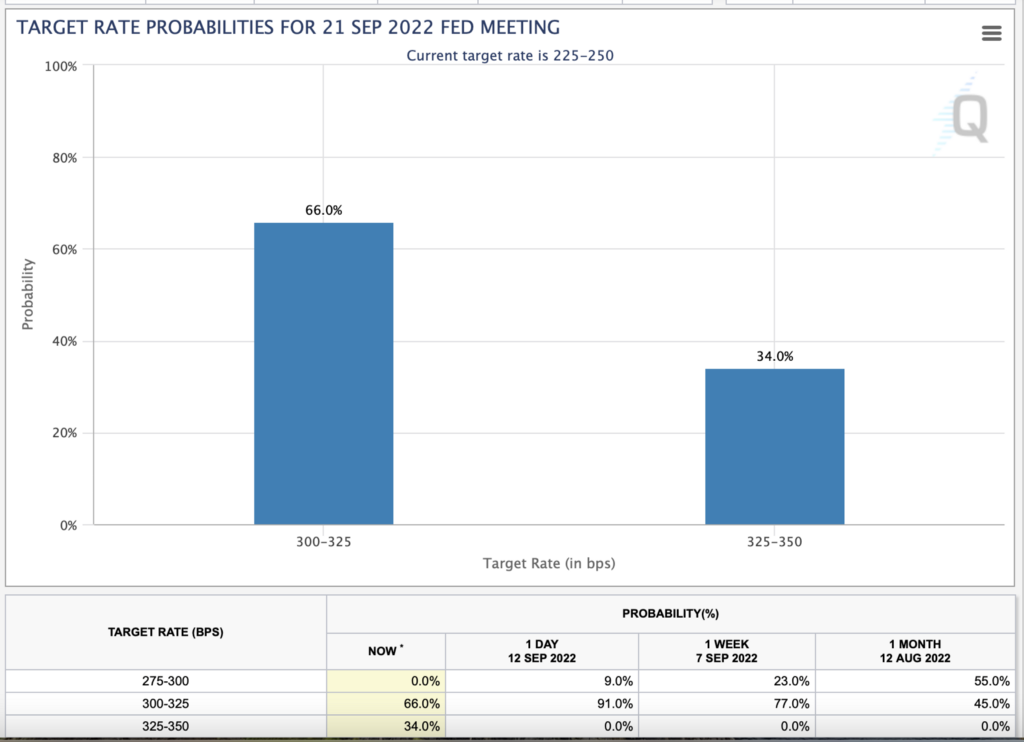

Cleveland Federal Reserve President Loretta Mester said that she sees the benchmark rate above 4% and no cuts at least through 2023! This is a slap on the face of bond markets that are anticipating cuts starting from the middle of 2023.

The bond markets are also forecasting a recession in the next 12–18 months as yield curves are inverted across the curve in the US.

The 10Yr-2Yr has been inverted for the last two months and is the most inverted since the dot com bubble, which also suggests that the market expects the future growth trajectory to be weak. Currently, it’s hovering around -35 bps.

As the probability of 75 bps rises to more than 85% in the next FOMC meeting, it is expected that the 10-year might scale new highs and breach the earlier highs of 3.5% reached in June.

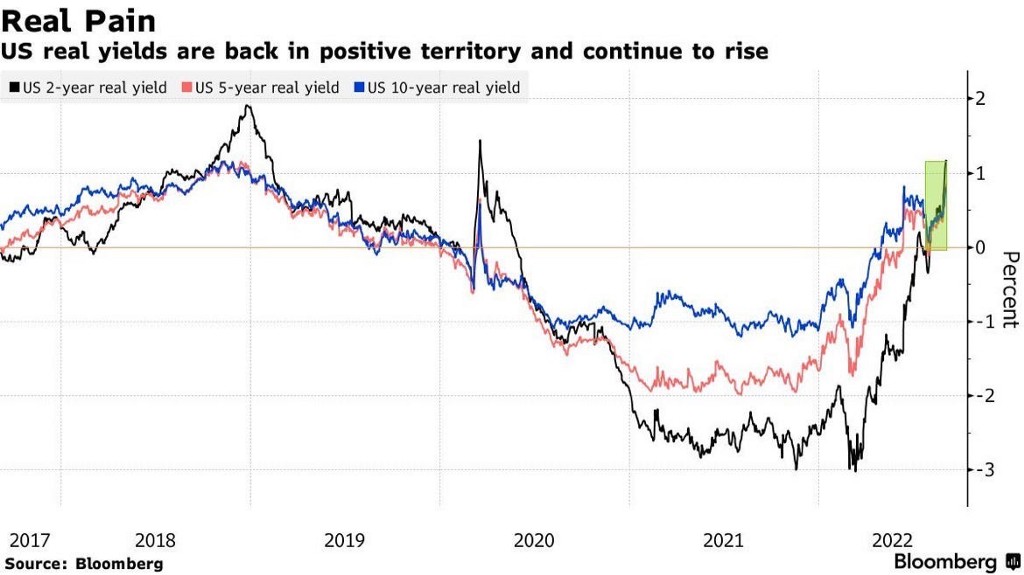

Powell has, on multiple occasions, also reiterated that he desires to see the real yields positive across the yield curve. Finally, the markets obliged him after his 8-minute of inflation-pounding speech at Jackson Hole.

Though today’s newsletter is all about bonds, do remember that positive real yields are a bad omen for risk assets.

The equity markets and gold prices tend to underperform when the real yields are positive.

Global Bond Bear Market!

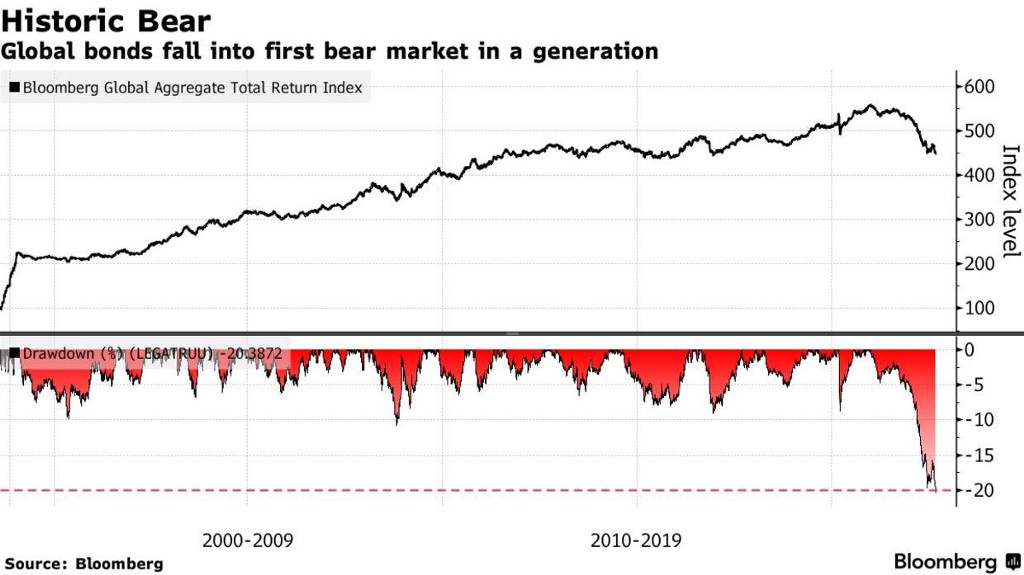

As I explore the history, the only time we have witnessed the bear market in the bond markets was in 1980–81, when Volcker unleashed his draconian avatar to control the monstrous inflation.

The drawdown was 21%, and there is “no” other instance of the bond bear market in the US, whether in investment grade or the treasuries.

Fast forward to 2022, and we are in the first bond bear market in generations. The Bloomberg Global Aggregate Index is down more than 20% since it advanced to record highs in January 2021.

The Bloomberg Global Aggregate Index is a flagship measure of global investment grade debt from twenty-four local currency markets.

It includes treasury, government-related, corporate and securitised fixed-rate bonds from both developed and emerging markets issuers.

The 20% fall in the LEGATRUU Index (Bloomberg Global Aggregate Total Return Index) shows that since the tightening is a globally coordinated activity by the central banks, the bond rout is widespread all over the world.

The gigantic rally that bonds worldwide witnessed post the GFC and the NIRP (negative Interest Rate Policy) by the CBs is unwinding, tormenting many portfolios.

Remember, Powell said more pain is coming!

The Demise Of The 60:40 Portfolios!

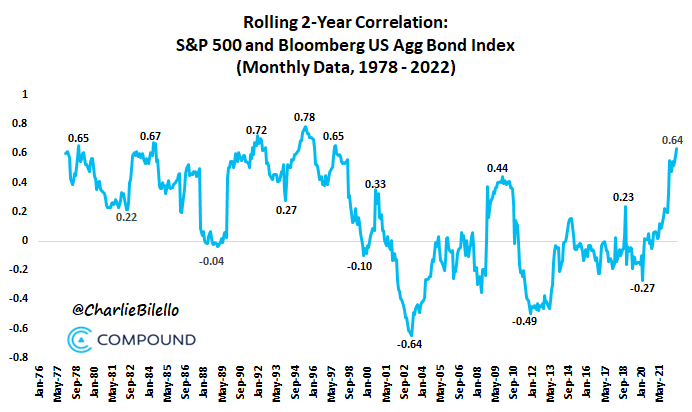

In the times of equity rout, the flight to safety typically happens in bonds. As a result, 60:40 portfolios were conceived [60% in equities and 40% in bonds] to cushion the impact of negative equity returns.

However, the correlation of bonds with equities this year is approaching all-time highs.

This has resulted in the poor performance of the 60:40 portfolios. The stagflation era in the 70s and 80s witnessed similar positive correlation episodes.

As the interest rates moved on a downward trajectory post the beginning of the 21st century, there were massive gains in the bond markets. The rolling 2-year correlation between S&P 500 and Bloomberg US Agg Bond Index was less than 0 for the better part of the 20 years, indicating that the bonds were a near-to-perfect hedge against equities.

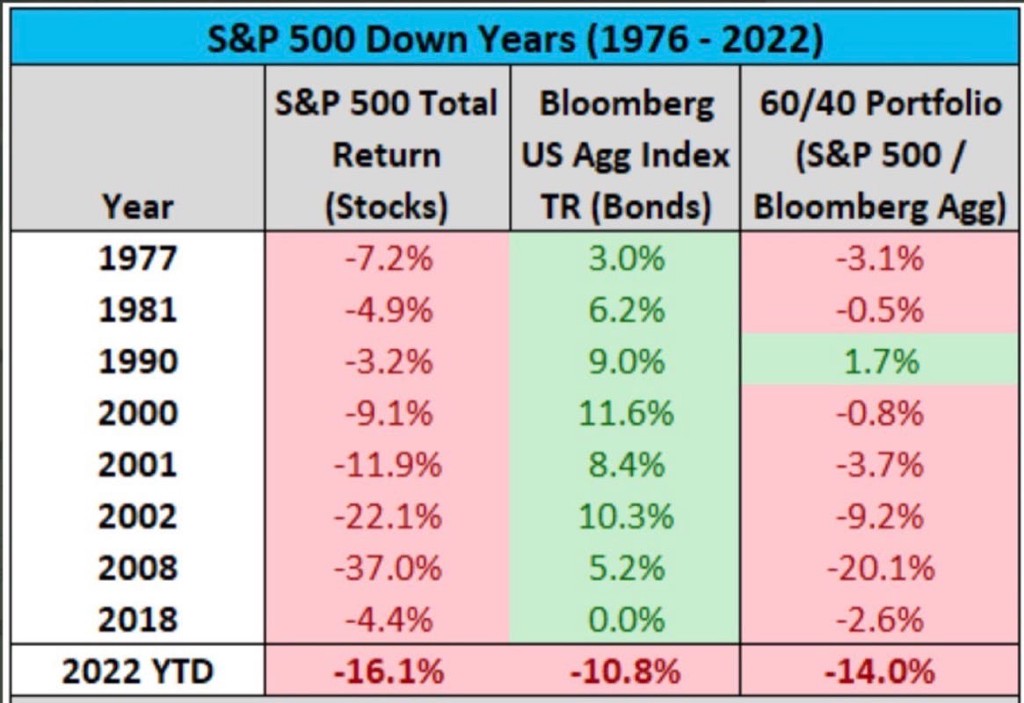

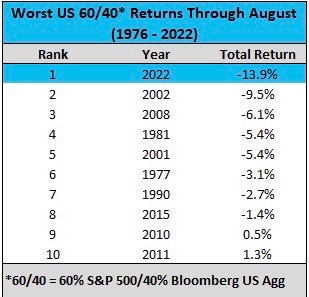

Let us look at the 60:40 portfolio returns over the years.

This is a remarkably intriguing chart. We can infer that when S&P was down considerably in the same year, bonds yielded positive returns. This helped investors to limit the downside in their equity portfolio by buying “adequate protection” in the form of bonds.

However, 2022 has been an unusual year. As a result, the 60:40 portfolio is on to one of the worst starts ever and most probably will end the year with one of the worst returns on the record.

Conclusion!

The US economy has been extremely resilient; however, lately, some cracks have started to develop (housing). However, the labour market continues to surprise on the upside.

Until we see a material slowdown in the US economy, a decline in inflation and cooling off in one of the hottest labour markets ever, Fed will continue to tighten its policy.

As the synchronised tightening gathers pace in the next two months, we might see the bond rout intensify in the next 2–3 months.

However, as the bond markets are forecasting, we might see some recovery in bond markets by H12023; if the Fed is successful in taming red hot inflation, which is now entrenched in the system.

Checkmate! was originally published in DataDrivenInvestor on Medium, where people are continuing the conversation by highlighting and responding to this story.

Comments