First-quarter earnings season begins in earnest during the second full week of April, led by banking giants JPMorgan Chase, Wells Fargo and Citigroup. The market is closely watching the impact of the failure of Silicon Valley Bank and Signature Bank on U.S. financial institutions.

Now that the banking crisis is over, the impact of the credit crunch remains to be seen. Data released on April 5 showed that the Fed's total assets fell by $73.6 billion month-on-month, a widening decline; Total lending at the Fed's discount window fell $18.45 billion from the previous month, contracting for the third straight week. Bank term financing plan (BTFP) balance rose $14.62 billion month on month, significantly lower than the outbreak of the crisis; Money market mutual fund assets rose $49.07 billion month-on-month, narrowing gains.

The U.S. regional bank turmoil has eased, but the alarm does not appear to be all clear, and the extent of the credit crunch on the economy remains to be seen.

The most theoretically advantageous options strategies can be found using historical data on bank stock prices before and after earnings reports.

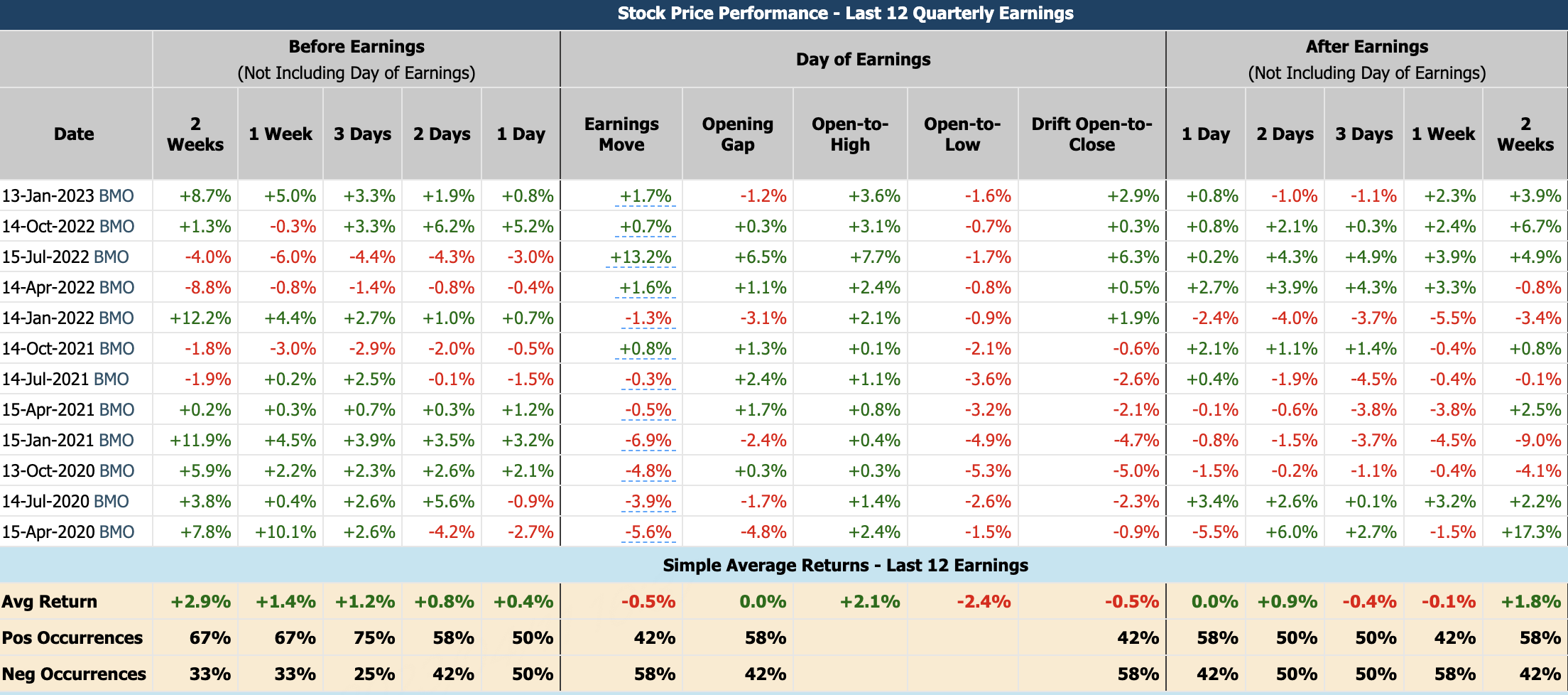

$Citigroup(C)$

Citigroup is scheduled to report earnings on 14-Apr-2023. The last time Citigroup reported earnings on Jan 13, 2023, the stock increased by 1.7% to close at $49.43.

As you can see from the table below, the data displays the percentage moves had for the last 12 quarters around earnings. The 3 day run up into earnings is notable as it shows that the stock increased 75% of the time for an average gain of 1.2%. That was actually a better bullish play than holding C through earnings that saw a -0.5% decline.

Bull Put Spread:

Bull Call Spread:

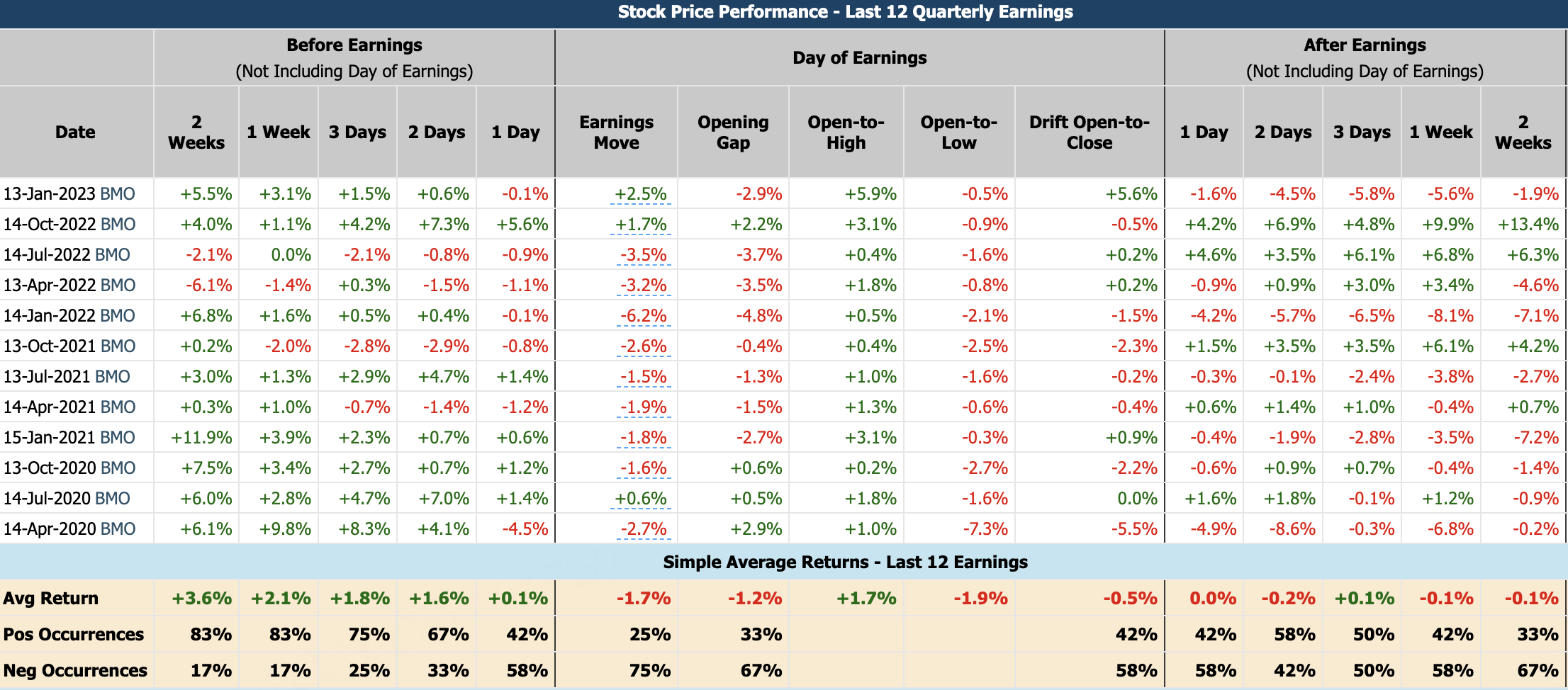

$JPMorgan Chase(JPM)$

JPM is scheduled to report earnings on 14-Apr-2023. The last time JPMorgan Chase reported earnings on Jan 13, 2023, the stock increased by 2.5% to close at $141.90.

As you can see from the table below, the data displays the percentage moves had for the last 12 quarters around earnings. The 3 day run up into earnings is notable as it shows that the stock increased 75% of the time for an average gain of 1.8%. That was actually a better bullish play than holding JPM through earnings that saw a -1.7% decline.

Bull Call Spread:

Bull Put Spread:

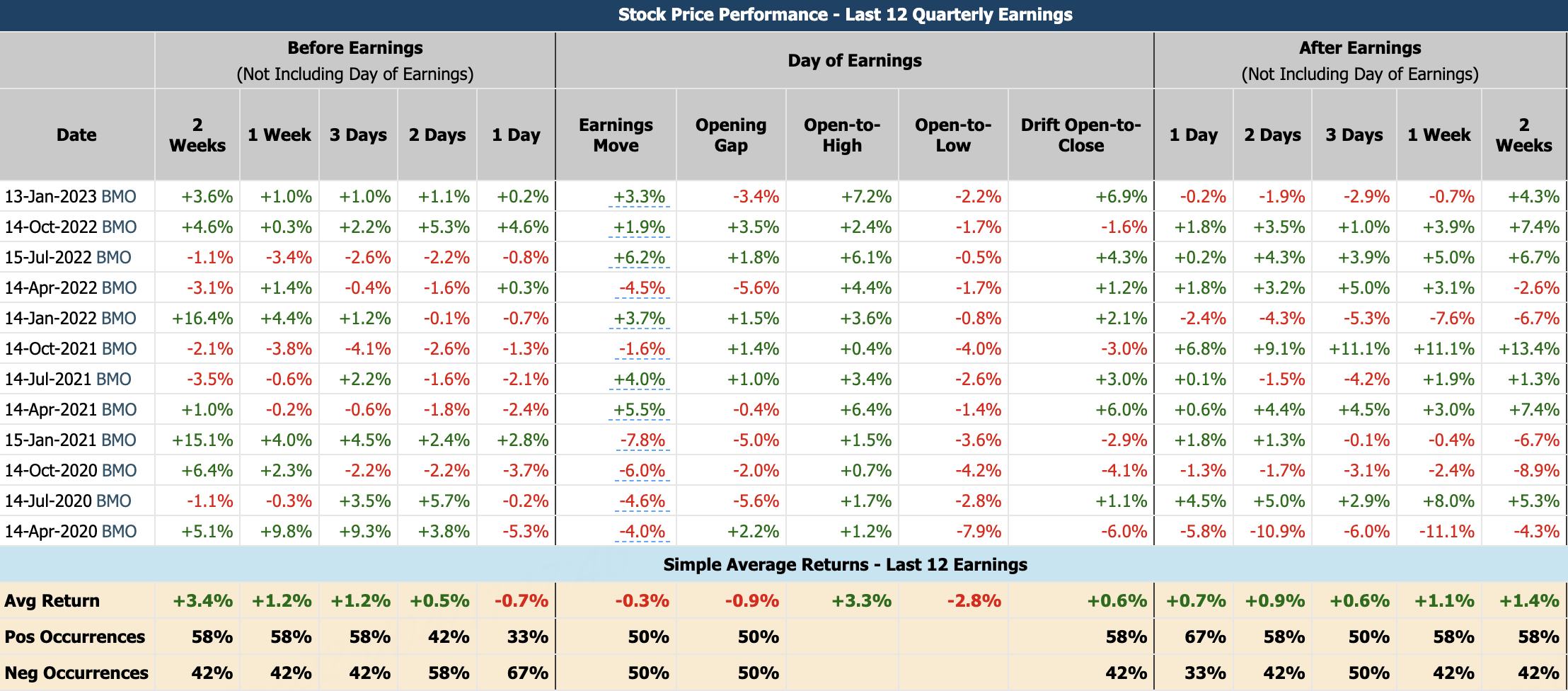

$Wells Fargo(WFC)$

WFC is scheduled to report earnings on 14-Apr-2023. The last time WFC Chase reported earnings on Jan 13, 2023, the stock increased by 3.3% to close at $44.22.

As you can see from the table below, the data displays the percentage moves had for the last 12 quarters around earnings. The 3 day run up into earnings is notable as it shows that the stock increased 58% of the time for an average gain of 1.2%. That was actually a better bullish play than holding WFC through earnings that saw a -0.3% decline.

Bear Call Spread:

Bull Put Spread:

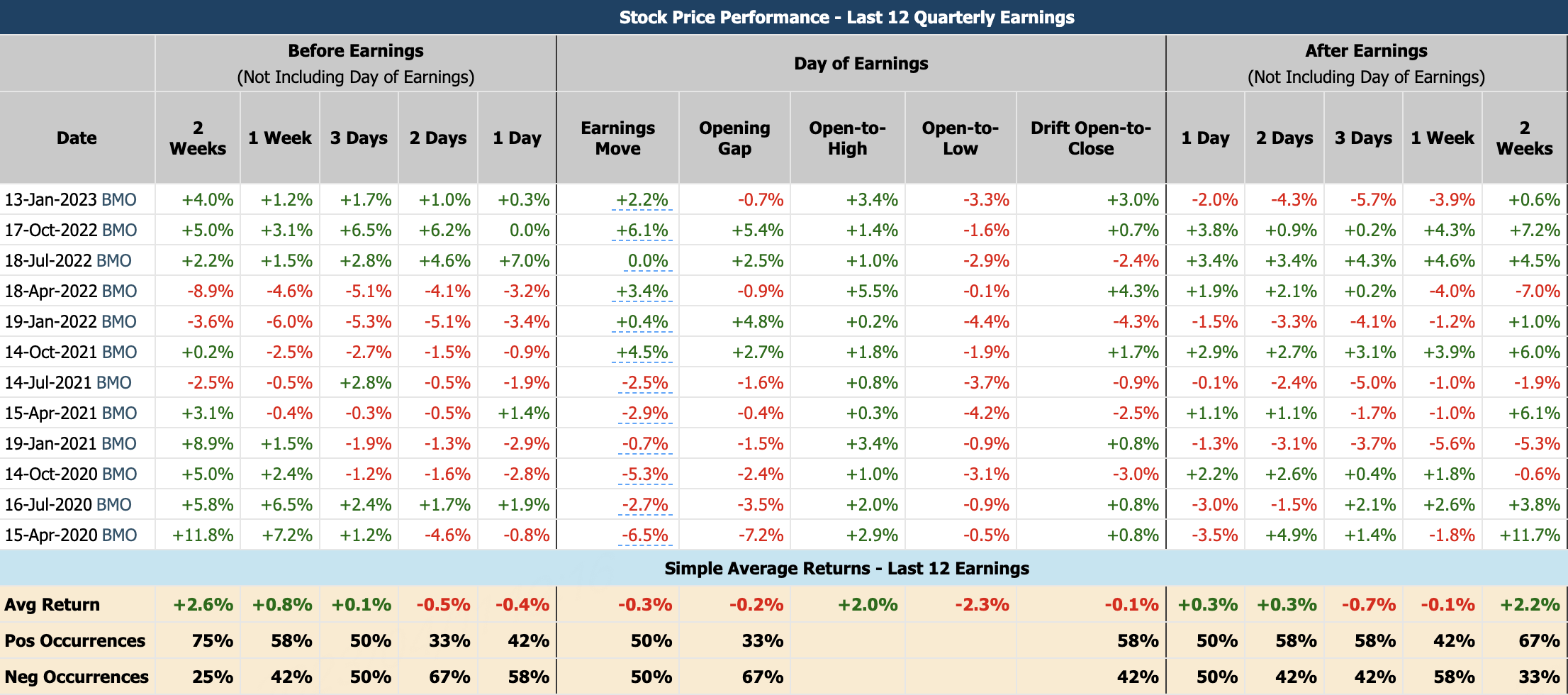

$Bank of America(BAC)$

BAC is scheduled to report earnings on 18-Apr-2023. The last time Bank Of America reported earnings on Jan 13, 2023, the stock increased by 2.2% to close at $35.00.

As you can see from the table below, the data displays the percentage moves BAC had for the last 12 quarters around earnings. The 2 week run up into earnings is notable as it shows that the stock increased 75% of the time for an average gain of 2.6%. That was actually a better bullish play than holding BAC through earnings that saw a -0.3% decline.

Bull Put Spread:

Bull Call Spread:

Comments

Great ariticle, would you like to share it?

Great ariticle, would you like to share it?

Great ariticle, would you like to share it?

Great ariticle, would you like to share it?

这篇文章不错,转发给大家看看