Curtains Down On The Unprecedented Central Banks Action!

The last two weeks were one of the busiest as prominent Central Banks worldwide announced their monetary policies. There were some nasty surprises, and the markets across assets (FX and Bonds) were roiled.

Along with the CB decisions, a host of vital data was released demonstrating that there are emerging signs of bottoming out and inflationary pressures building, leading to market participants calling out for a stagflationary outcome.

Since January, there have been flip-flops around data due to varied reasons. While January had a tremendous seasonal effect, March was an outlier due to pessimism among consumers post the SVB fiasco.

Furthermore, early in the year, a consensus call was the bottoming out of the commodities due to optimism about the Chinese reopening. Nevertheless, commodities have been in a tight range, and the early rally in January and February might have influenced the April numbers (rise in input prices).

Comprehending the variable lags across the data is crucial to get the macro around the business cycles correct.

Let us dig in and understand what the CBs have in their minds.

The Bank Of Japan (BoJ)!

“In light of this, the Bank has decided to conduct a broad-perspective review of monetary policy, with a planned time frame of around one to one and a half years.”- Bank Of Japan.

The market was split before the policy, as some people (including me) believed that the BoJ would likely announce the normalization of the policy. Instead, the BoJ stunned the markets and guided for a 12–18 month period for the normalization of policy which will involve abandoning the Yield Curve Control (YCC).

Some of the snippets from the policy and “Outlook” are really intriguing.

“On the price front, the year-on-year rate of increase in the CPI (all items less fresh food) is slower than a while ago, mainly due to the effects of pushing down energy prices from the government’s economic measures, but it has been at around 3 % recently owing to the effects of a pass-through to consumer prices of cost increases led by a rise in import prices. Inflation expectations have been more or less unchanged recently after rising.”

One needs to appreciate that the Japanese government has been massively subsidising fuel and electricity prices to shield consumers from the enormous rise in energy prices post-war.

Nevertheless, the most significant source of inflation in Japan has been the “imported inflation”, as BoJ mentions in its outlook, thanks to more than 25% depreciation of JPY in the last year.

The BoJ projects the core inflation to remain stable around the 2.5% mark till 2025 before falling to their long-term target of 2%.

However, the biggest impediment to lower inflation is the structural change in the labor market, rising inflation expectations and the elevated wage pressures which we are witnessing in Japan.

As per BoJ:

“In addition, wage growth is expected to increase, reflecting tightening labor market conditions and price rises. Due to these factors, employee income is projected to continue increasing.”

“Labor market conditions are expected to tighten, partly due to a deceleration in the pace of increase in labor force participation of women and seniors, and upward pressure on wages is projected to intensify. This is likely to put upward pressure on personnel expenses on the cost side and contribute to an increase in households’ purchasing power.”

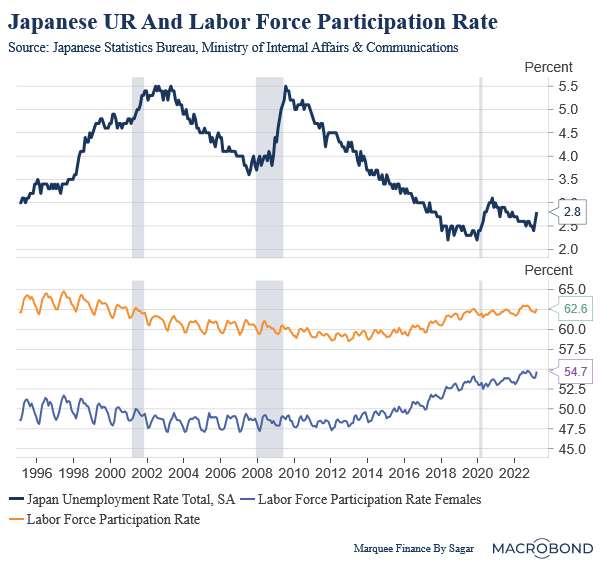

Japan’s Unemployment Rate (UR) has been trending downward and is one of the lowest in the world thanks to the worsening demographics.

We can see from the chart that post-2012, the female participation rate has risen significantly from 47.5% to 55%. However, as BoJ notes, the rate of increase of female participation is decelerating, thus putting upward pressure on wages and further tightening the labor market.

Furthermore, the just concluded “Shunto Talks” in March had seen the negotiation power of the unions increase significantly. In fact, it’s a no-brainer that the BoJ is very closely monitoring the wages to determine the stickiness of core inflation.

BoJ further mentions:

“The vulnerability of the financial system could increase, mainly due to the search for yield behaviour. Although these risks are judged as not significant at this point, it is necessary to pay close attention to future developments.”

One of the biggest challenges that BoJ faces is the move to higher-yielding assets,most likely JGBs (Japanese Government Bonds), once the policy normalizes.

BoJ mentions it as a risk, specifically after the events in the US (money moving from deposits to MMFs in search of higher yields).

Japan is a unique proposition because more than 50% of the Household savings are locked in bank deposits making the banking system extremely vulnerable to any movement of deposits.

The BoJ is trapped, but the normalization of policy is inevitable as wage pressure builds and fears mount of sticky inflation.

The Federal Reserve And The ECB!

“Continue to think that this time is really different”- Jerome Powell: 3rd May 2023.

The world’s most powerful Central Banker uttered the most “dangerous” words in the world of finance. These words by Jerome Powell indicate the fear among the markets and within the Fed, considering the past outcomes of the tighter monetary policy.

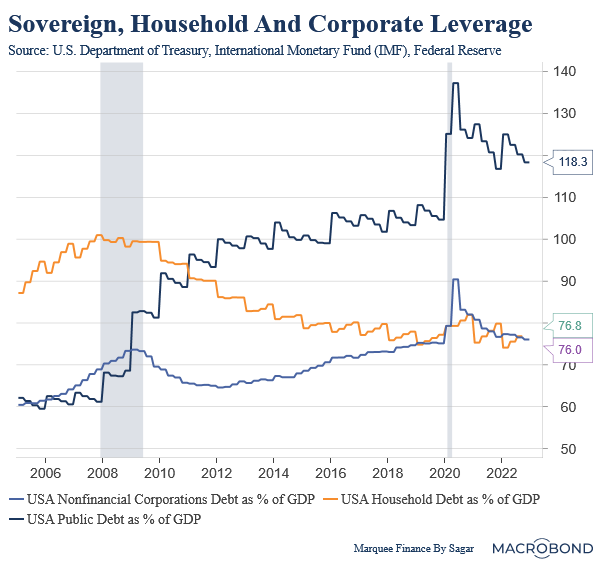

This time the high sovereign Debt/GDP and the spread between the bank deposit rates and the Money Market Funds (MMFs) call for the worst-case scenario.

Nonetheless, the Household (HH) and corporate leverage remain well below historical levels, and the real risk, as you are well aware, lies in regional banks, office CRE, opaque private markets, leveraged loans and multifamily housing.

There are some crucial snippets which I would like to share from the JayPo presser and the monetary policy statement.

We will make that determination meeting by meeting, based on the totality of incoming data and their implications for the outlook for economic activity and inflation. And we are prepared to do more if greater monetary policy restraint is warranted.

Leaving aside the financial stability constraints, JayPo left one more hike in June open as he clearly mentioned that they would do more if the incoming data (there will be two more inflation prints before the next policy announcement) surprises on the upside (labor and inflation)

However, he also said that “We feel like we are close, or maybe even there”.

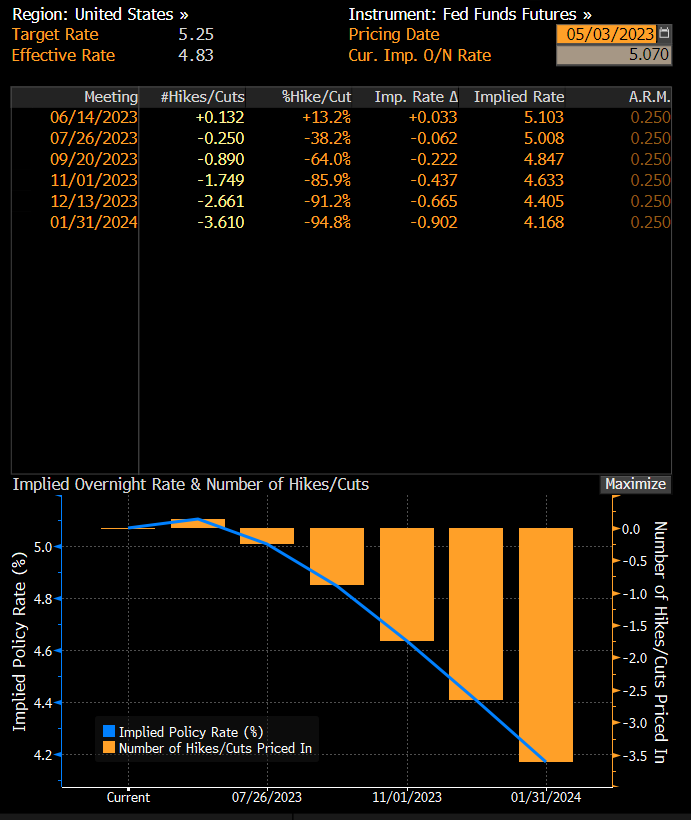

The bond markets are giving a very low probability (just 15%) of a hike in the June meeting.

The most significant disconnect remains the Fed’s guidance of no cuts this year(remember rates were on hold for 18 months in 2006–7), whereas markets are screaming significant rate cuts beginning from June/July.

Powell further mentioned in the presser:

“In turn, these tighter credit conditions are likely to weigh on economic activity, hiring, and inflation. The extent of these effects remains uncertain.”

“Nonetheless, inflation pressures continue to run high, and the process of getting inflation back down to 2 % has a long way to go.”

Undoubtedly, the Fed is “uncertain” about the consequences of the tighter credit conditions on the economy and inflation.

This should really scare the market participants as past experiences indicate that economic activity comes to a grinding halt due to tightening credit conditions.Remember, credit is the lifeline for any economy in a fractional banking system.

Furthermore, JayPo mentioned that 2% has a long way to go; thus giving a hawkish tilt (higher for longer) to what may be his last hike in this unprecedented monetary policy cycle.

ECB raised the rates by 25 bps in Europe despite elevated inflationary pressures.

The highlight of the ECB meeting was the doubling down of the QT as the ECB will increase the pace of reducing its bond holdings by EUR 30 Billion/ month from the current EUR 15 billion from July.

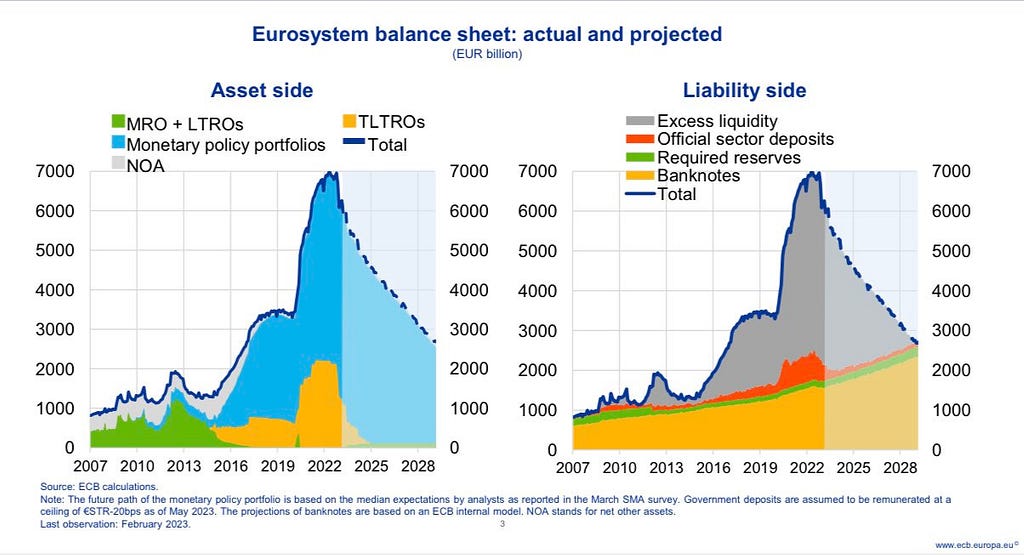

Even today, there is enormous excess liquidity in the Euro Area as the ECB increased its balance sheet by a whopping EUR 4 trillion post covid.

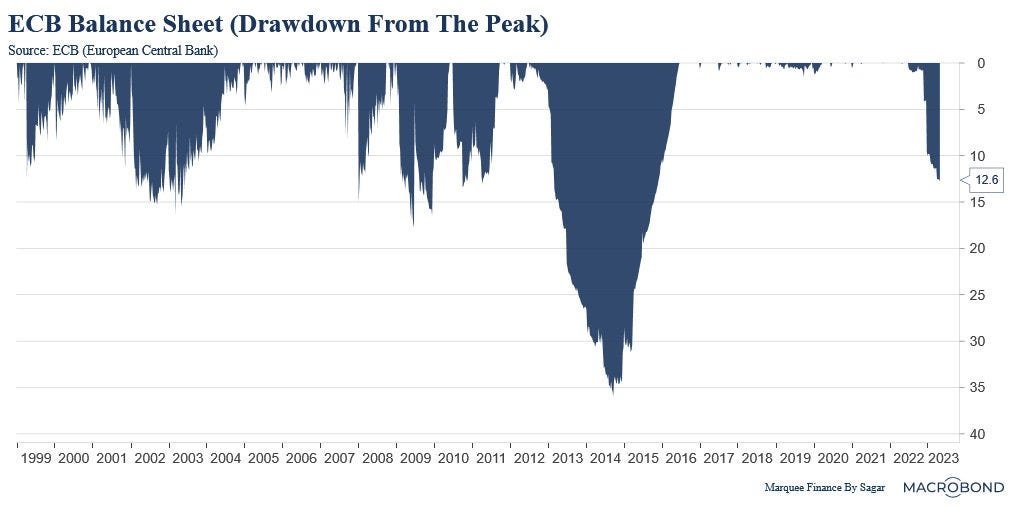

As we can see, the ECB Balance sheet is down by 12% from the peak, mainly as banks repaid the TLTRO borrowings. However, it’s a long road to normalization of liquidity as ECB’s projections estimate that draining out excess liquidity will take more than five years, raising concerns that inflation will be sticky for longer than what market participants anticipate.

The Economic Data!

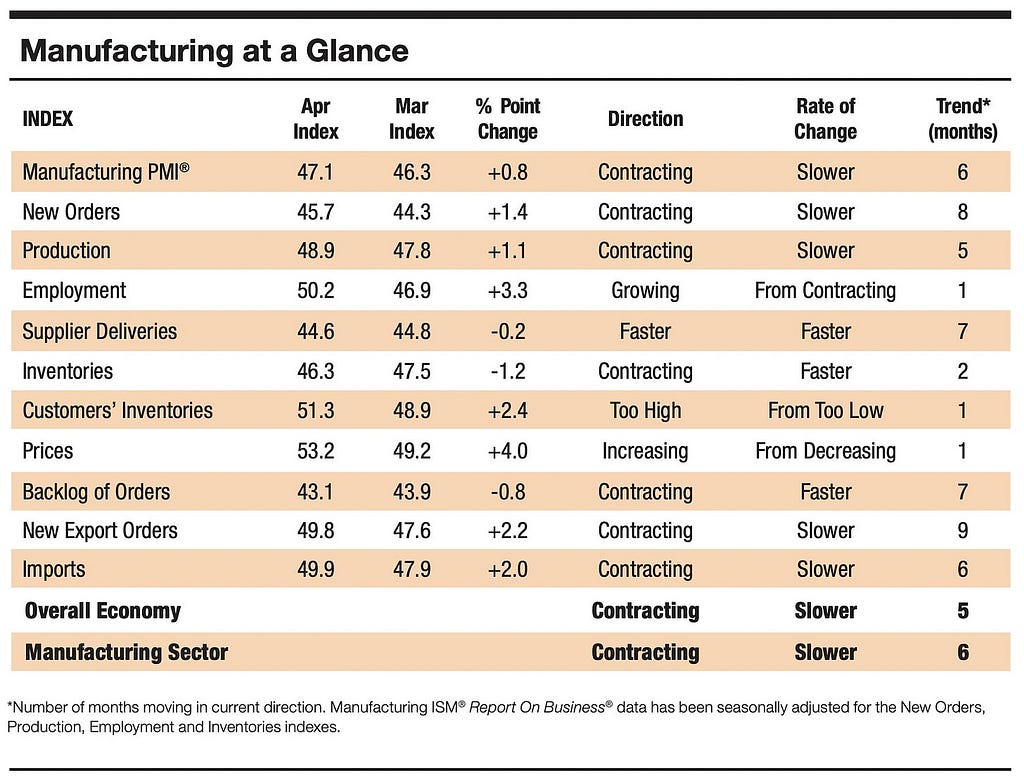

The ISM Manufacturing data revealed that pricing pressures are back (most likely the lagged effect of the commodities rally in Jan/Feb).

The headline number was also a beat indicating a broad-based recovery.

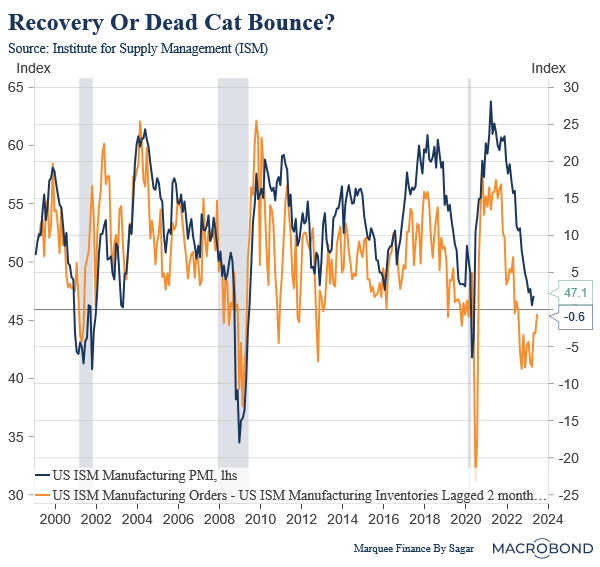

Long-term readers would know that I have constantly cited the New Orders Less Inventories indicator (ISM Manufacturing), one of the most robust indicators to determine where the business cycle is headed.

The move-up is encouraging here and is a potential signal of the economy bottoming out. Nevertheless, it can be a head-fake move (most probably is), as we saw in 2008 or the 1980s.

Since the March data was an outlier due to the SVB fiasco and the ensuing chaos, April had an element of that one-month delayed demand which revived/ normalized.

Dismissing all the biases, if the trend is real, we might see an upmove in the ISM data in the coming months, opening the floor up for one more 25 bps hike in June.

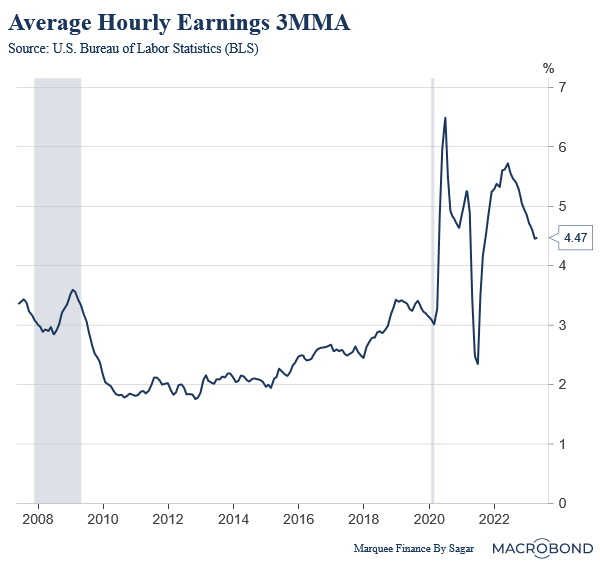

Furthermore, wages have also been resilient and seem to have bottomed out.

April wage growth was an upside surprise and logged the strongest MoM gain since March 2022.

Overall, the labor market, though is the most lagging indicator, remains exceptionally hot. Unless there is a credit event, a material easing in the labor market will take months.

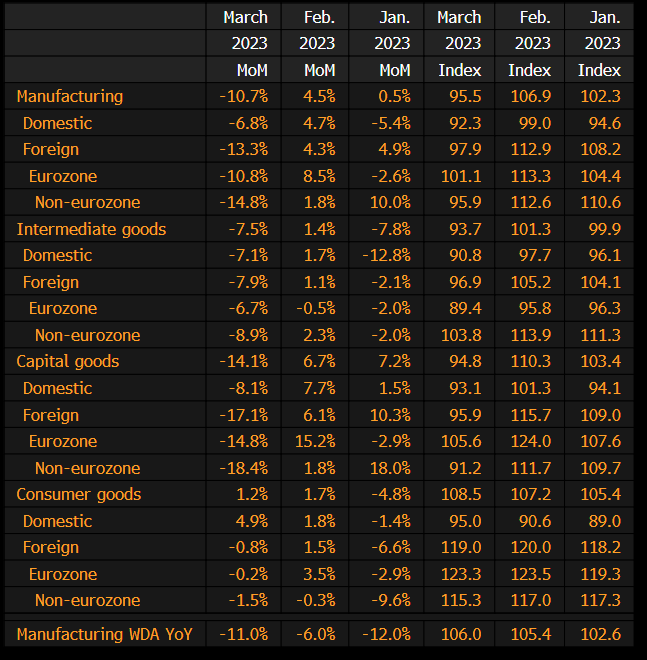

In Europe, stagflation fears are mounting as factory orders plunged in Germany and other parts of the Euro Area, whereas core inflation remains elevated at 5.5%+.

Conclusion!

As we reach the end of the unprecedented monetary tightening in the West, the aftershocks are being felt in the form of some of the largest bank failures in US history.

The transmission of monetary policy always transpires with a lag of 2–3Qs, and the entire impact of the tightening will be felt by the end of the year.

Nevertheless, the excess liquidity sloshing in the system might lead to a resurgence of inflation in H2.

As a result, stagflation will be the most likely outcome if we don’t get a hard landing.

While the West ends the tightening, BoJ readies itself for unwinding the most significant monetary policy experiment in finance history. The unintended consequences of the policy normalization in Japan can cause ripples across the global financial system.

The next 12 months will be a roller coaster ride.

It’s the beginning of the end!

Subscribe to DDIntel Here.

Visit our website here: https://www.datadriveninvestor.com

Join our network here: https://datadriveninvestor.com/collaborate

Beginning Of The End! was originally published in DataDrivenInvestor on Medium, where people are continuing the conversation by highlighting and responding to this story.

Comments

What you wrote was a bit deep and I didn't quite understand several parts of it