Investors Have Burnt Their Fingers Investing In This Asset Class!

“An emerging market is a country where politics matters at least as much as economics to the market.”- Ian Bremmer.

The phrase “Emerging Market” was coined in 1981 by Antoine van Agtmael, the then Deputy director of the capital markets department of the World Bank’s International Finance Corp. (IFC), as a euphemism for third-world countries. According to Antoine:

“People looked down upon the ‘Third World.’ It sounded so distasteful. I thought people with that feeling would never invest,”

According to Wharton Faculty, the emerging economy is characterized by the evolution of its economic and political institutions, such as the rule of law, regulatory controls and enforcement of contracts.

The emerging economy is poised for growth as it transforms into an economy that is more transparent and fosters the ease of doing business, welcoming foreign capital. As a result, emerging economies undergo stupendous growth and are marked by a burgeoning middle-class population as millions move out from the clutches of poverty.

Initially applied to a handful of countries from Asia and East Europe after the fall of the Berlin Wall, the phrase is now extensively used across the globe for countries like Indonesia, Thailand, China, India, Brazil, South Africa and Russia.

As the central bank’s rates plunged to negative territory across the developed world, and the global financial system was flush with liquidity post the GFC, the liquidity started to chase these fast-growing “emerging markets”.

However, the last decade has disappointed “yield-hungry” investors as emerging markets bonds, stocks, and currencies failed to deliver on their promises.

Let us find out the underperformance and decode the reasons for the same!

EM Currencies!

The EM Currencies have been facing turbulent times as the dollar wrecking ball creates havoc across the EMs. This year has been horrendous for the EM Currencies as multiple factors, such as the energy crisis, the Fed’s tightening of monetary policy at the fastest pace ever and economic war, create havoc across the EMs.

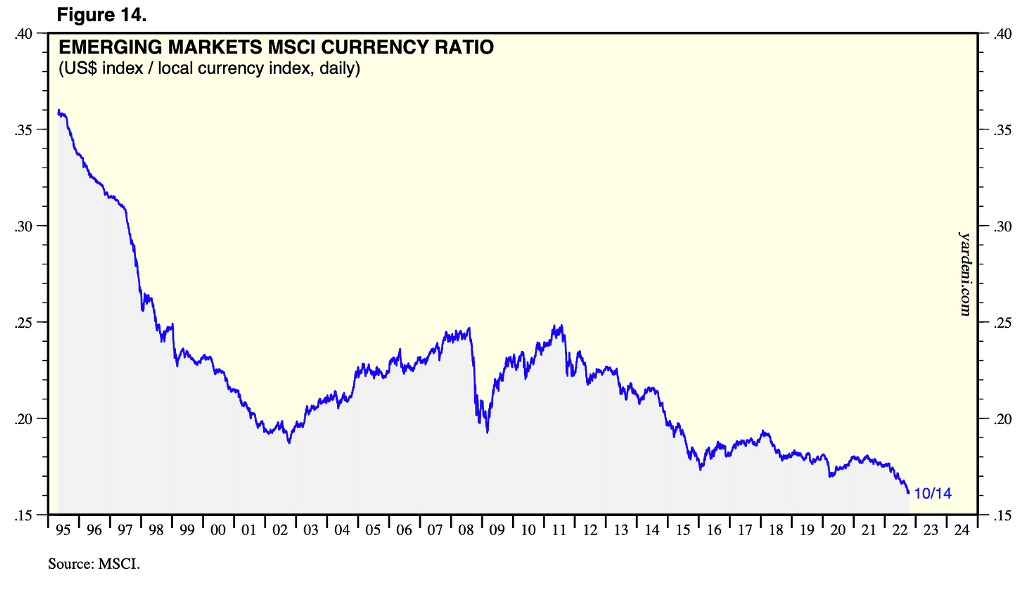

The EM MSCI Currency ratio has been falling since 2010 and has reached an all-time low, depicting extreme local currency weakness across the board.

This is a matter of grave concern for global investors as the continued depreciation of local currency erodes the USD returns for foreign investors.

Many countries like Egypt, Lebanon, Pakistan, Srilanka, Ghana, El Salvador and Turkey have seen their currencies lose almost 70–95% of their values in the last decade as the political climate in these countries has deteriorated, leading to a BoP (balance of Payments) problem and concerns about a wave of debt defaults across EMs.

The chaos in the EM FX market has led to a massive capital exodus from these markets, which has led to a sharp fall in the EM bond and equity markets.

Let’s have a look!

EM Bonds!

One of the biggest reasons investors allocate money to the EM sovereign and corporate bonds is the diversification benefits it brings to the table.

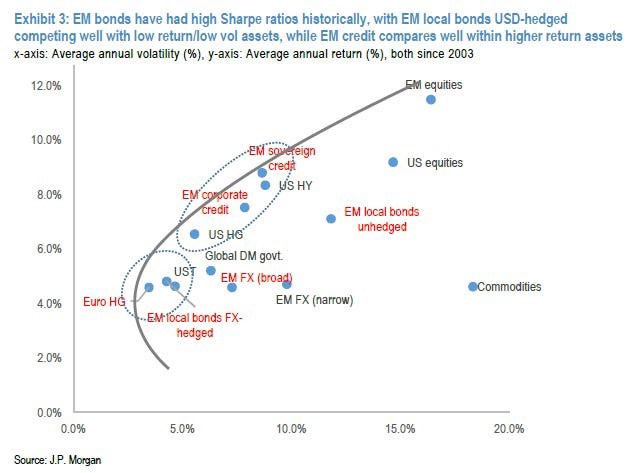

Historical data shows that EM debt has a higher Sharpe Ratio as compared to similar debt in the DM (Developed Market). The comparable yields in the DMs can be discovered in the below-investment-grade corporate debt such as HY (High Yield) / Junk bonds. For those who are not aware of the term Sharp Ratio:

Sharpe ratio is a measure to calculate risk-adjusted relative returns.

Global investors have exposure to EM bonds in the following ways:

- EM Sovereign USD Debt: This includes USD-denominated government debt and government-guaranteed debt.

- EM Local Sovereign Debt: This includes government debt and government-guaranteed debt, denominated in the issuer’s local currency.

- EM Corporate USD Debt: This includes USD-denominated corporate debt.

As we can see from the graph, the EM local bonds (unhedged) have the highest volatility of all the debt securities. This is due to the FX implications and wild moves in the EM currencies, as discussed earlier.

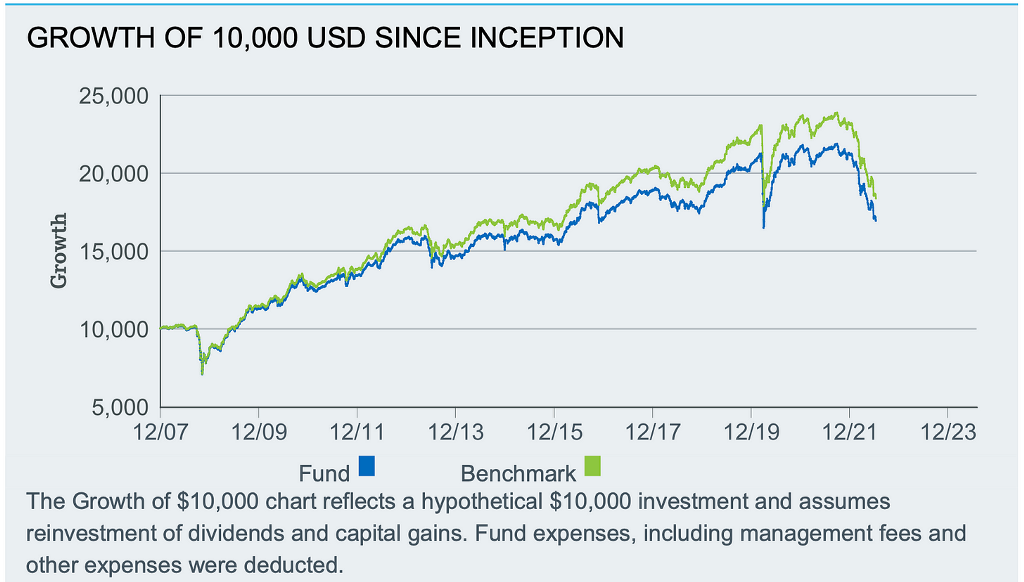

Global investors most preferred instrument to invest in the basket of EM debt is via iShares J.P. Morgan USD Emerging Markets Bond ETF, which has exposure to the sovereign debt of more than 30 EM countries. The ETF tracks the JPMorgan EMBI Global Core Index.

More than three-quarters of the EMBI Global Core is EM sovereign debt, with most of the rest focused on high-yielding corporate bonds.

As we can see, the ETF has diversified exposure from Asia, the Middle East and LatAm. Now let us look at the return of the ETF since its inception.

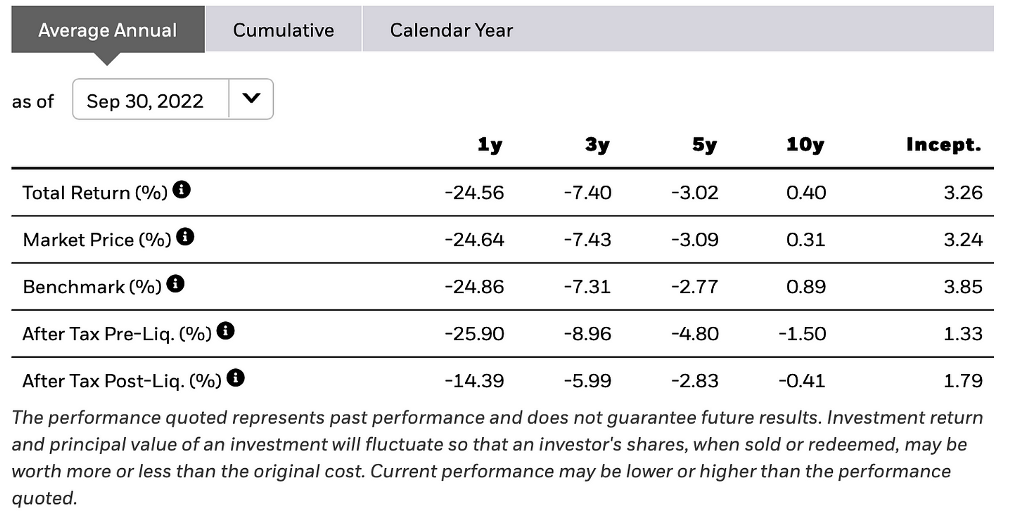

The USD-denominated EM ETF has given a CAGR of just 0.40% in the last ten years. Furthermore, the Post-Tax returns have been negative in the previous decade and a minuscule 1.33% since inception.

This is significant underperformance compared to the TLT (iShares 20+ Year Treasury Bond ETF) as even after the current bond market rout, the 10-year returns for TLT is 0.45%, greater than the EM USD Bond ETFs.

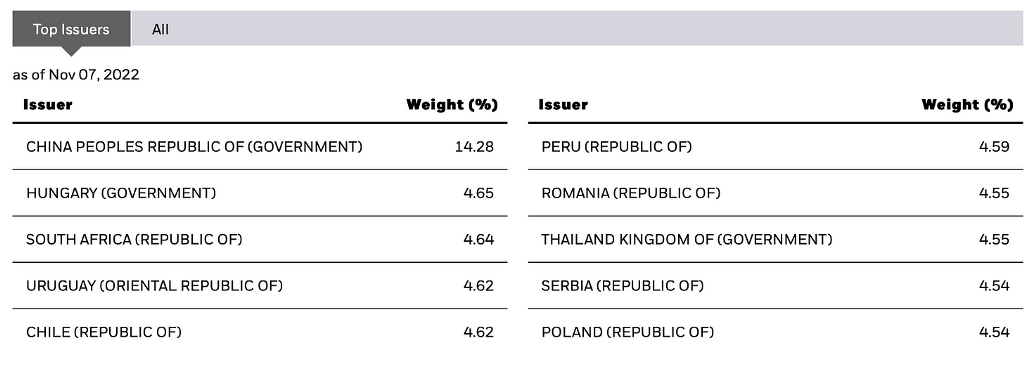

Well, the USD Denominated EM Debt still had positive pre-tax returns, the iShares J.P. Morgan EM Local Currency Bond ETF, which tracks the index comprised of local currency-denominated EM sovereign debt, has been a disaster. So let us first look at the composition of the ETF.

As we can see, the major issuer is the Chinese government, and then a significant chunk of the debt securities are from “resource” rich LatAm.

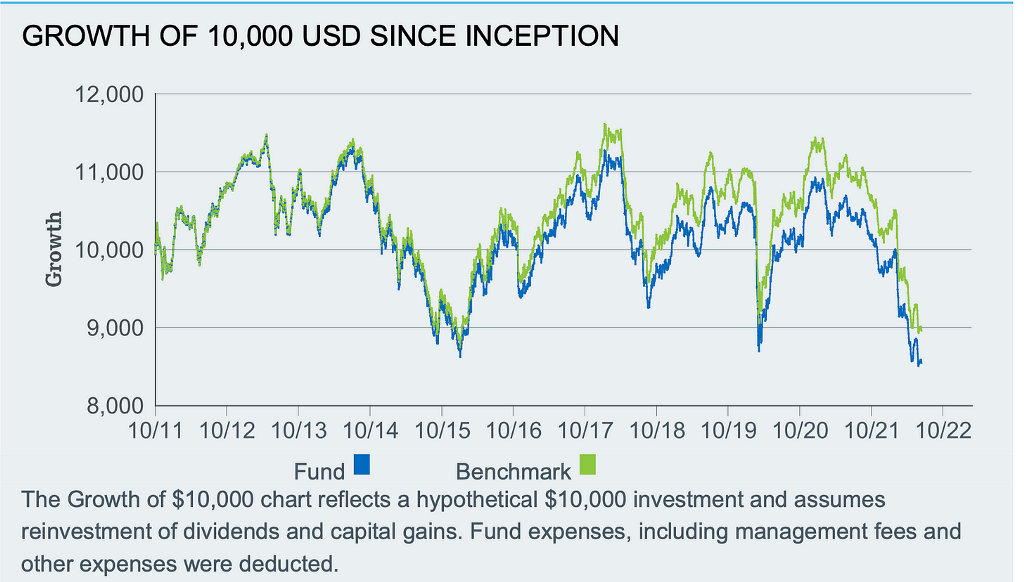

Now let us look at the performance.

Unfortunately, the benchmark has given a catastrophic -2.75% CAGR in the last decade.

The three major dips that we see in the above chart are due to the Fed tightening or ending the QE policy, which led to a massive exodus of capital from EM stocks and bonds.

Clearly, investors have burnt their fingers betting on the EM Local currency debt in the name of diversification.

EM Stocks!

The EM equities are considered the riskiest investments as measured by Sharpe Ratio in the whole investment universe.

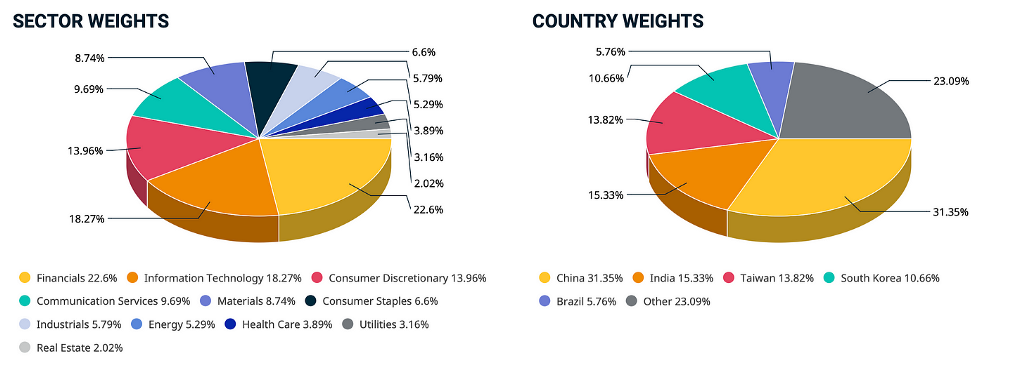

The preferred index for global equity investors who invest in equities is the MSCI Emerging Markets Index. MSCI EM Index is a diversified index with investments primarily in large Asian economies, which is in contrast to the EM bond indexes, which had a large chunk in the Middle East and LatAm countries.

Financials dominate the MSCI EM index, while IT and Consumer Discretionary are the second and third largest holdings. When we look at the country-wise exposure, we find that Chinese equities constitute the bulk of the exposure, while India and Taiwan have the second and third largest weightage.

Compared to the MSCI World and MSCI ACWI (a global index comprising equities from both developed and emerging markets), the MSCI EM index has been a stark underperformer.

In fact, MSCI EM has just given a 1.05% CAGR over the last 10 years whereas MSCI World has given a 8.11% CAGR!

The subdued performance can be explained by the massive underperformance of the Chinese and South Korean equities over the last decade. Once the darling of investors, lately, Chinese equities have faced significant headwinds. Regulatory concerns like tech crackdowns and a Chinese-US Trade war since the Trump era have rocked the Chinese market, which is trading at half its 2008 peak (Shanghai Composite).

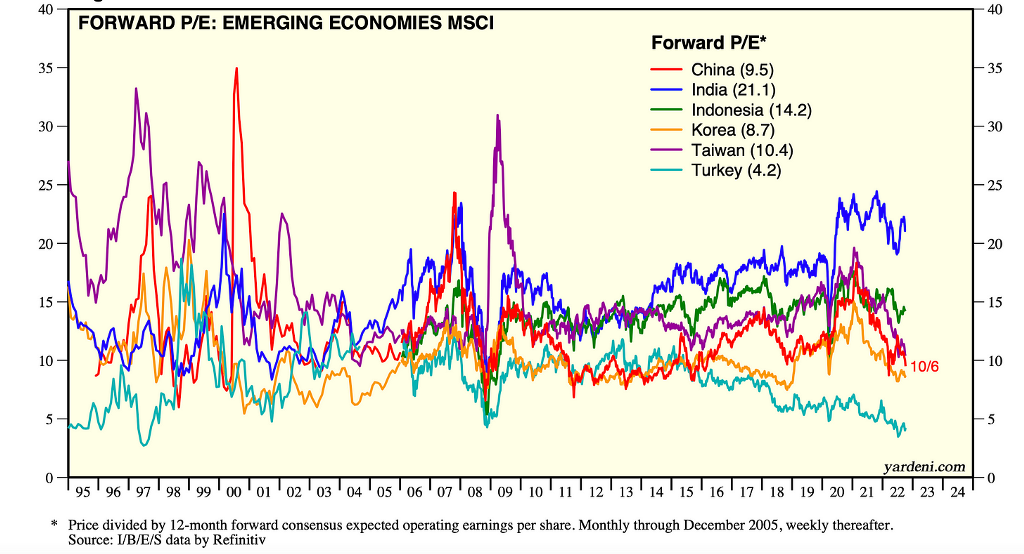

Even the valuations are at a significant discount to the MSCI DM. MSCI EM index trades at 11.48 PE as compared to 16.26 PE for MSCI DM index. (As of 09/30/2022)

The valuation compression can describe this substantial discount in the Chinese, Korean and Turkish equity markets. On the other hand, India has been one of the biggest outperformers, and the Indian market now trades at a significant premium to other EM markets.

Furthermore, the proponents of EM debt investors advocate that EM equities have underperformed the EM USD debt ETF.

We can infer from the above chart that from 2014–2021, the EM USD Debt outperformed the EM Equities for the majority of the time.

Thus, we can conclude that EM Equities have been an absolute catastrophe for global investors in the prior decade.

Conclusion!

The last decade has taught a grave lesson to investors across the globe that the EM universe is not as brilliant as it is portrayed. The massive risk investors take to invest and diversify via the EM universe has backfired. Investors investing across EM bonds and equities have faced horrific losses as the EM markets failed miserably compared to their DM peers.

The EM performance is closely linked with the liquidity Tsunami that the DM central banks generate. Any withdrawal of, especially, USD liquidity leads to massive capital outflows from these markets and makes them vulnerable to downgrades and tremendous underperformance compared to the DMs.

Furthermore, a $1 trillion debt default is looming large for the EMs, which may bring immense pain for global investors holding these papers.

Global Investors who still want exposure to the EM space can look at India via iShares MSCI India ETF, which tracks India MSCI Index. India is undergoing a credit boom led by cyclical sectors after a decade.

Investors can also look at Brazil. Brazil is trading at the cheapest valuation since the GFC (trades at 1 Yr Forward PE of just 6.8). Central Bank of Brazil was the first one to raise the rates, and as a result of tighter monetary policy and higher commodity prices, the Real has been one of the best-performing currencies YTDas it has given positive returns against the USD. The only concern is the political stability; any steps in the right direction can lead to a rerating for the Brazilian Markets.

iShares MSCI Brazil ETF tracks the MSCI Brazil Index.

The author is not a licensed investment professional. Nothing produced under Sagar Singh Setia should be construed as investment advice. Do your own research and contact your financial advisor before making investment decisions.

Subscribe to DDIntel Here.

Visit our website here: https://www.datadriveninvestor.com

Join our network here: https://datadriveninvestor.com/collaborate

The Lost Decade! was originally published in DataDrivenInvestor on Medium, where people are continuing the conversation by highlighting and responding to this story.

Comments