The Data From West to East Is Concerning!

“Liquidity is like a cab in New York on a rainy night. It disappears when you need it the most” — J.P. Morgan.

The adage in the financial markets is that credit markets always lead the equity markets. The beauty of credit markets is that it’s all about the availability of liquidity at the desired cost, which is the function of “trust”.

A minor crisis gets morphed into bigger one if the trust vaporises from the credit and financial markets.

It always starts with the build-up of pessimism in the economy, and as the sentiment turns sour, the credit to the economy dries.

We are witnessing early signs of credit tightening in the economy, and as the transmission of tighter monetary policy happens, the growth has begun to crumble in the West.

In the East, Chinese growth and inflation have been disappointing of late.

Let us dig in and understand what’s transpiring in the global economy.

The “Tightening” Lending Standards And Its Implications!

Jerome Powell has repeatedly mentioned in his last 2–3 policies about the “tightening” financial conditions.

While the markets were perplexed as the financial conditions (measured by GS Financial Conditions Index or the Chicago Financial Conditions Index) remained considerably loose. So, JayPo clarified that it was the tightening lending standards that he was referring to.

The Senior Loan Officer Opinion Survey (SLOOP) is conducted by the Fed every quarter and is timed so that the results are available before the FOMC meeting.This helps the members to assess the bank lending standards and demand for credit from households and corporates.

The latest SLOOP was of paramount importance as the survey was conducted post the demise of SVB on March 27th, and the responses were received from 65 domestic banks and 19 U.S. branches.

Interestingly, the results were mixed and not as horrific as the markets were anticipating.

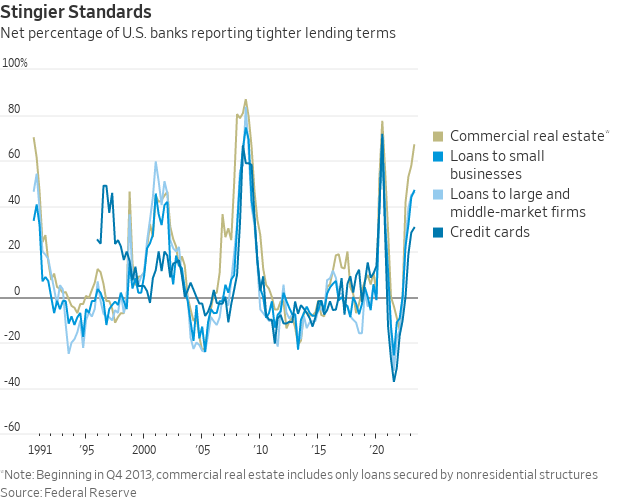

As expected, the CRE witnessed considerable tightening as banks became wary of lending to the sector due to mounting concerns. The CRE prices continue to plunge unabated, especially in areas such as NYC and San Fransisco.

This is a double whammy for CRE developers (already facing high vacancy rates) as tighter lending standards will mean the sector will be liquidity parched when they require it the most as maturities begin to approach later this year. As much as $500 billion of CRE loans are expected to mature in the next 15–18 months.

Loans to small, middle and large businesses also tightened.

Nevertheless, small businesses are a lifeline to the US economy as they constitute 99% of all the companies in the US, 65% of the job growth in the US, 50% of all jobs & 44% of all economic activity.

As the credit tightens significantly for small businesses, we might see bankruptcies rise and thus the unemployment rate inching up later this year.

Overall, 46% of the surveyed institutions responded in the affirmative about tightening lending standards.

Some market participants get this grossly wrong as they argue that it’s a slight change from the previous quarter. However, one needs to appreciate that for correct interpretation; the SLOOP should be read as :

“A net 46% of banks further tightened lending standards against the first quarter’s already tight levels.”

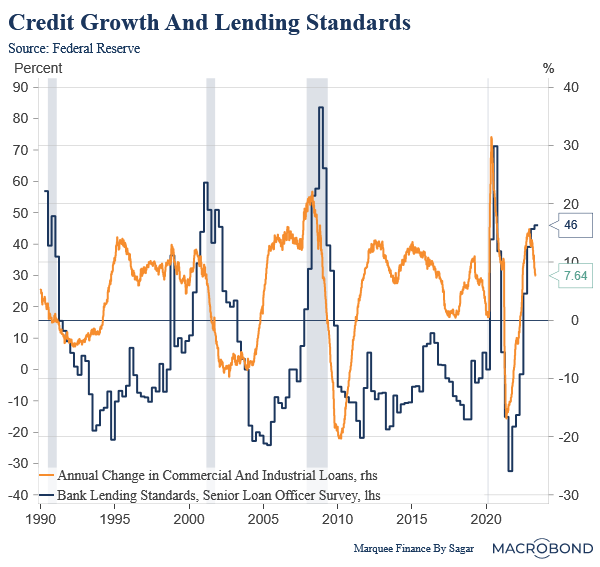

Furthermore, if history indeed rhymes, we may see a collapse in the credit demand and offtake in the coming 3–4Qs.

A credit contraction in a highly financialized economy will most likely lead to plummeting growth.

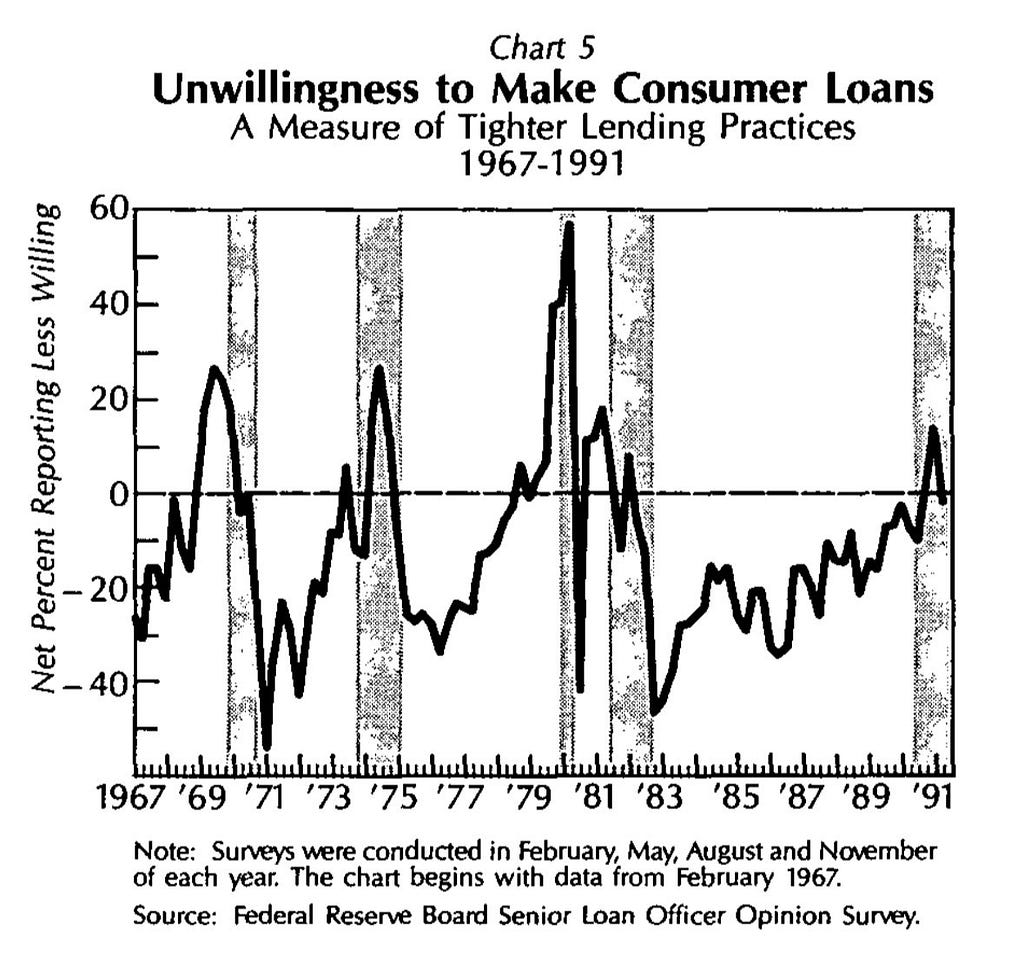

When we look at the historical perspective, Kantro shared this great chart from the archive on Twitter!

Ironically, even in the 70s, as the Fed pursued uber-tight monetary policies to quell monstrous inflation, the recessions were marked by tightening lending standards.

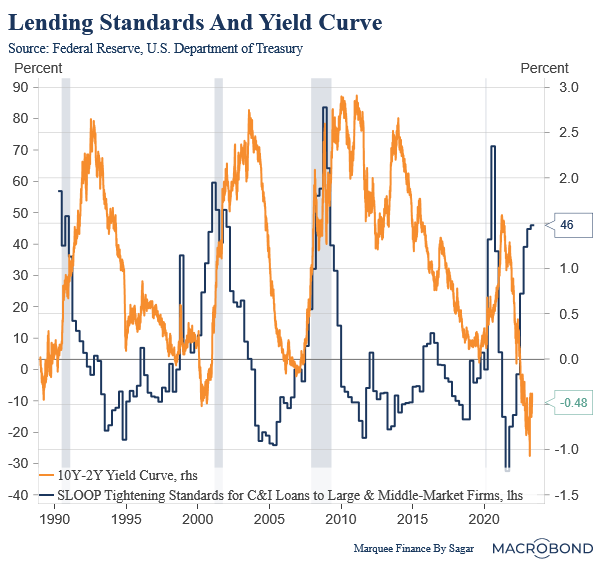

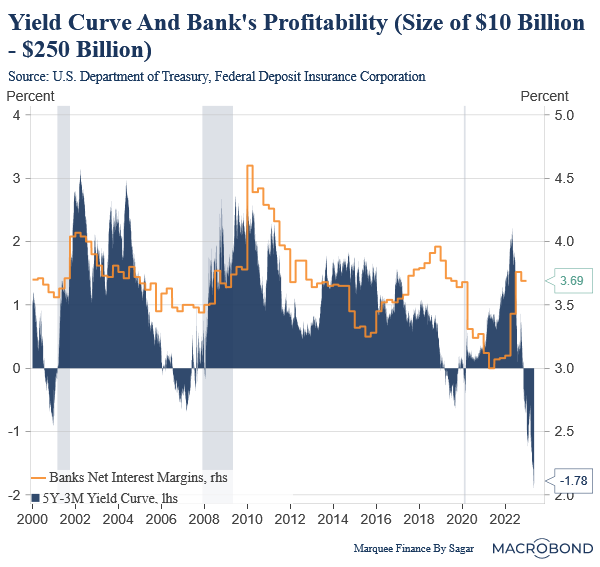

One of the reasons for banks opting for tighter lending standards is that banks are in the business of “Borrowing Short, Lending Long”.

As a result, an inverted yield curve where the short-term rates move significantly higher than long-term rates disincentivises lending operations.

As a result, the tightening starts as soon as the yield curve inverts and further elevates when the recession kicks in (though the yield curve steepens dramatically during a recession).

Since banks are highly leveraged entities, unprofitable operations hurt their profitability. Thus, an inverted yield curve is generally accompanied by a fall in the Net Interest Margins (NIMs).

Here, I took small banks because, lately, the majority of lending is accomplished by none other than the smaller banks.

Nonetheless, banks pulling away is a blessing in disguise for the shadow banks as they will likely jump in to plug the gap.

We all know that shadow banks charge much higher rates than banks, and as a result, ultimately, we are heading towards a much higher cost of capital which will be catastrophic for small and mid-size businesses.

Economic Data And Europe!

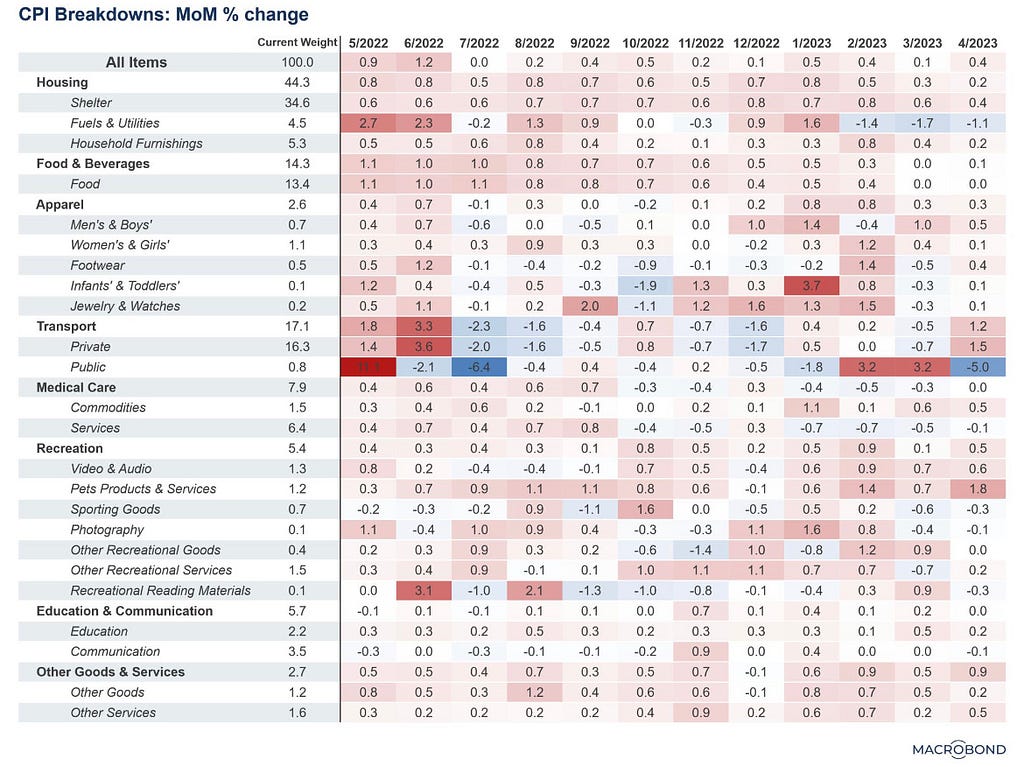

The other mega release of the week was the much-awaited CPI data which was a positive surprise.

I have been writing for months now that the headline number would fall to around 4–4.5% by June, but the real challenge remains the fall from 4% to 2%.

The headline number reached 4.9% as food and energy costs continued their downtrend due to the base effect.

Core goods saw a rebound thanks to the lagged effect of increased used car prices.

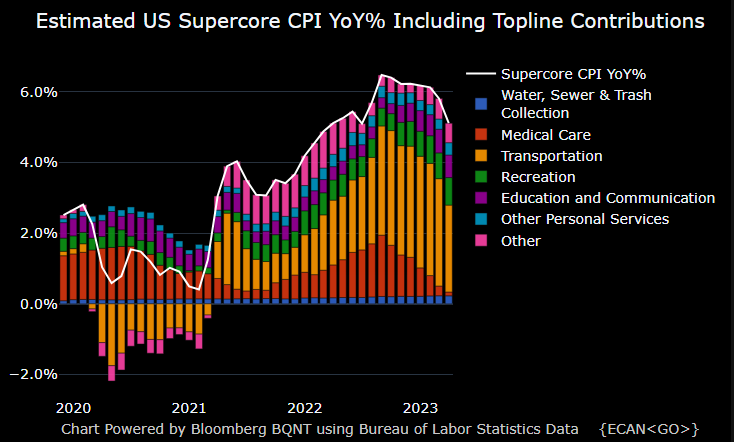

The “Supercore”, a.k.a Core Services Ex-Housing, which the Fed is tracking to measure the stickiness of core inflation, also moderated, which will give some comfort to JayPo.

The inflation story in H2 largely depends on how the wages evolve and how much the unemployment rate (UR) rises.

Any increase greater than 5% (more than 260 bps from the current 3.4%) will lead to Average Hourly Earnings (AHE) plunge to pre-covid levels.

However, if UR fails to cross 4.5%, we might see inflation settling around 3%.

The caveat here remains no more exogenous shocks and a credit event.

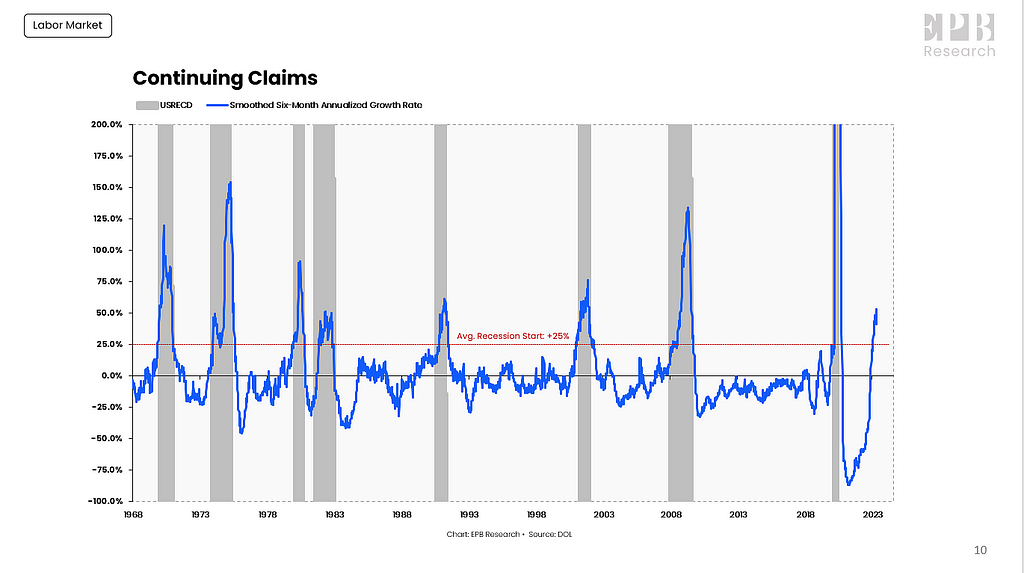

Early signs are emerging that employment is faltering.

The weekly claims data is the leading unemployment indicator and is well into recessionary territory.

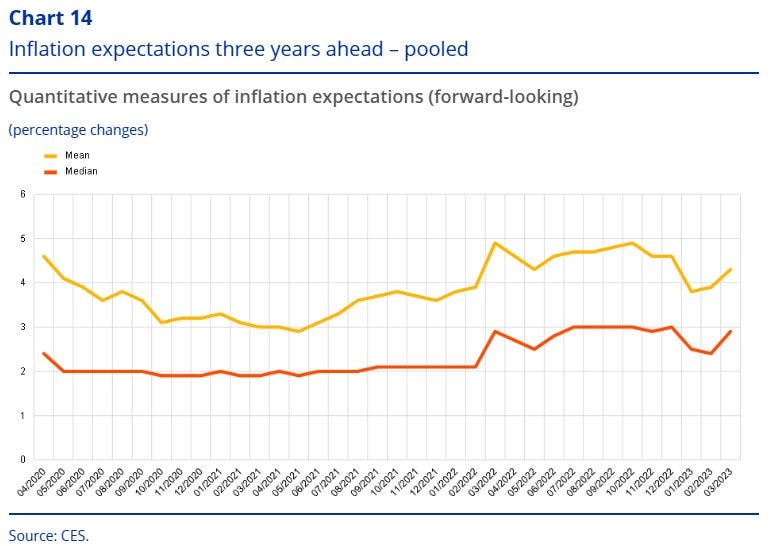

Moving to Europe, the situation is concerning as inflation expectations have started creeping up, and there is a risk de anchoring considering the rise in wages.

Furthermore, factory orders and industrial production have slumped in parts of the Euro Area (EA): Germany and Sweden.

The stagflation fears are rising each day as core inflation remains way higher than the ECB’s Deposit Rate.

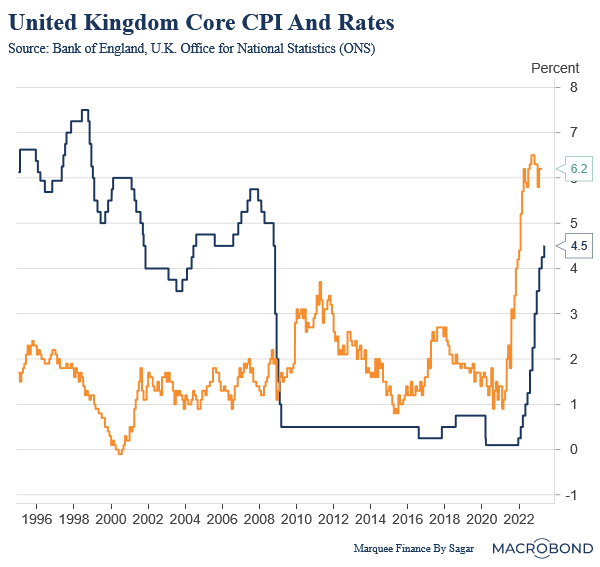

The surprise of the week was the Bank Of England (BoE) raising the growth guidance and indicating that the “loose fiscal policy” was a tailwind for the broad-based inflationary pressures in the economy.

The monetary policy around Europe, including the UK, is still accommodative as the core inflation is way above the policy rates.

We need a sustained restrictive policy to quench the inflationary fire.

Chinese Horror Show!

The Chinese reopening saga is not playing as the markets (and I) anticipated. I believed it would be the biggest story of the year; however, it looks like China is undoubtedly struggling.

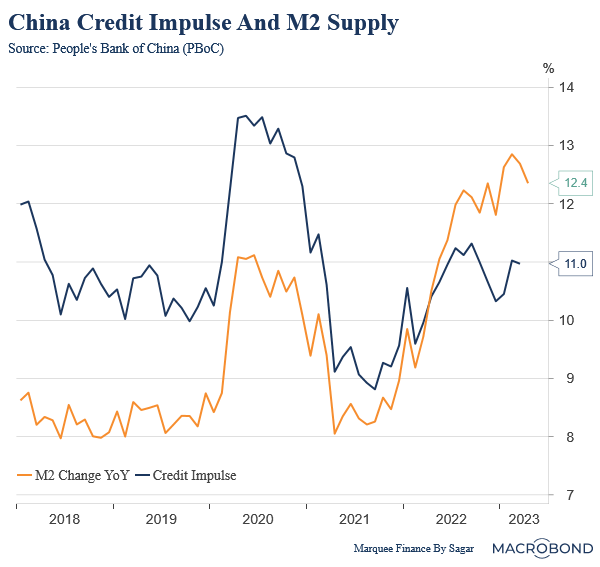

While the M2 supply and credit impulse initially jumped after reopening, it has now stalled.

The recent data suggests that M2 has contracted MoM, and credit impulse seems to have peaked.

Chinese Credit impulse is a well-known proxy for industrial commodities and crude oil, and a fall in credit impulse will not bode well for the commodities.

The new Yuan loans plunged drastically to 718.8bn from 3890bn last month. On the other hand, Households (HH) are focusing on deleveraging and splurging on services rather than goods.

As a result, Chinese imports plummeted further by 7.9%, indicating weak domestic demand for foreign goods.

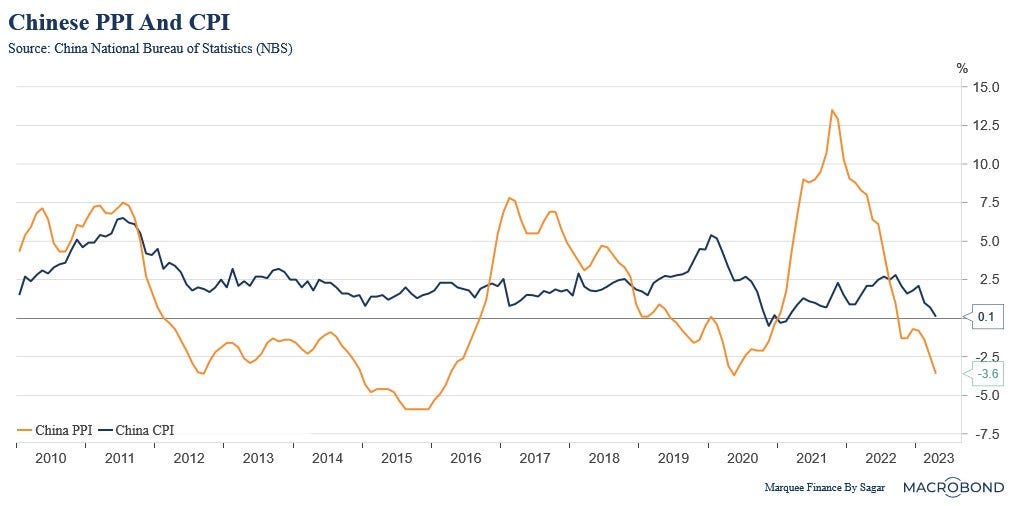

The final nail in the coffin was the inflation data which was horrific. China, even after a complete reopening for a quarter, is now on the verge of deflation as CPI plunged to 0.1% while PPI remains profoundly negative.

Deflationary conditions are a bane for manufacturers, and it would lead to stagnant corporate profitability as it would suppress the margins and erode pricing power.

As a result, the cyclical earnings will likely remain under pressure in China.

Furthermore, the last thing PBoC wants is deflation at a time when painful Real Estate deleveraging is underway.

Conclusion!

The foundation of global growth is faltering. As credit availability dries in the US and credit demand crashes due to the rising cost of capital, the growth will moderate and likely turn recessionary in the coming quarters.

In Europe, the slide in growth looks more imminent as industrial production has collapsed while inflation remains sticky as wages continue to rise above the trend.

The biggest worry for global growth lies in the East, as animal spirits have failed to revive in China as the sluggish property sector continues to drag the consumer sentiment.

All in all, while global growth will slow down considerably in H2, inflation going back below 3% in the US hinges on the developments in the labour market.

Crumbling Foundation! was originally published in DataDrivenInvestor on Medium, where people are continuing the conversation by highlighting and responding to this story.

Comments