Consider $Visa(V)$. Great company with ample free cash flow, no debt which is good at this high interest rate era, and still has rooms for double digits sales and earnings growth.

Visa Operating Performance

Visa Operating Performance

Visa is a great value compounder with economies of scale, durable moat, and high profit margins.

As you can see from the table above, Visa has an extraordinary operating performance. Super high ROIC and profit margins.

Visa Valuation

Visa Valuation

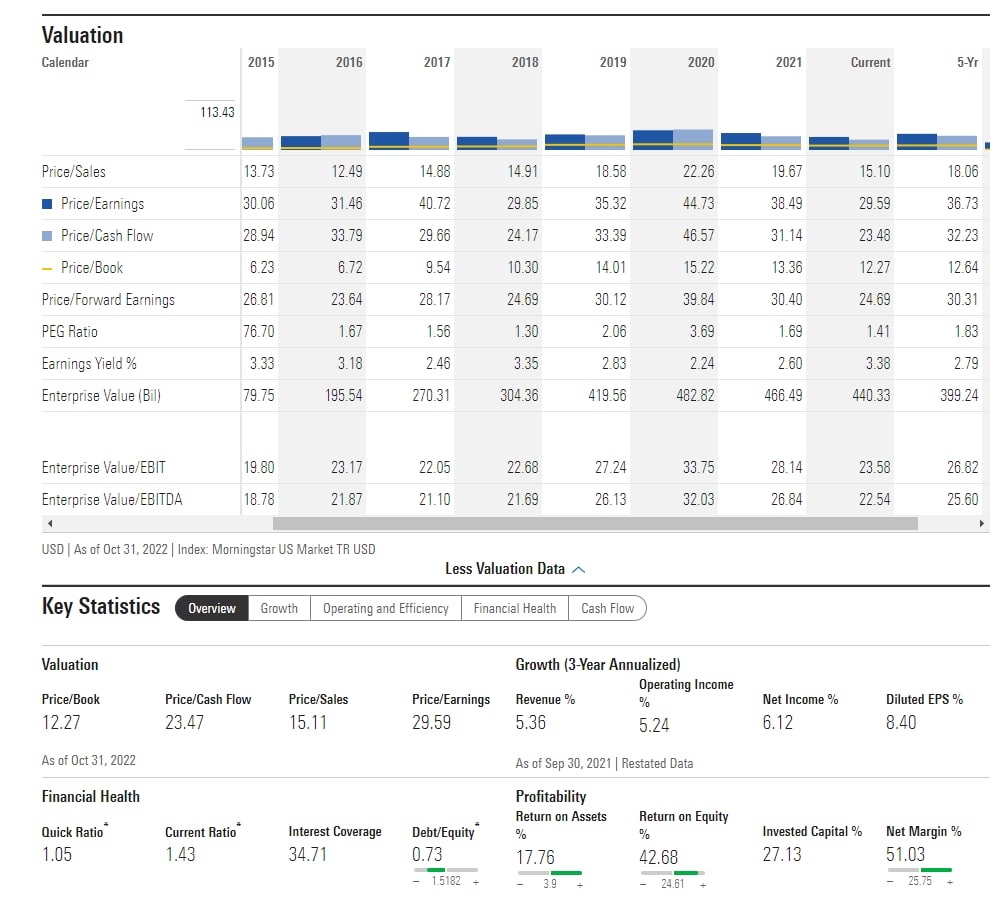

As for the valuation, V is now trading below its 5-year average valuation.

This is not a recommendation, just my opinion. Do your own research.

Data source : Morningstar.com

Disclaimer: Investing carries risk. This is not financial advice. The above content should not be regarded as an offer, recommendation, or solicitation on acquiring or disposing of any financial products, any associated discussions, comments, or posts by author or other users should not be considered as such either. It is solely for general information purpose only, which does not consider your own investment objectives, financial situations or needs. TTM assumes no responsibility or warranty for the accuracy and completeness of the information, investors should do their own research and may seek professional advice before investing.

Visa Operating Performance

Visa Valuation

Comments