Do you want to know who is winning?

“Restoring price stability is essential to set the stage for achieving maximum employment and stable prices in the longer run. The historical record cautions strongly against prematurely loosening policy. We will stay the course until the job is done.”- Jerome Powell, November 2nd, 2022.

On June 10th this year, the US CPI data came out at 8.6%, the highest since 1981, sending shockwaves across the markets worldwide.

Thanks for reading Marquee Finance by Sagar! Subscribe for free to receive new posts and support my work.

Within a span of a few hours, the bond markets spooked by the hot numbers forced the terminal rate higher, and the probability of the first ever 75 bps hike crossed more than 85%.

On June 15th, the Fed obliged the markets and raised the rates by 75 bps. Since then, the markets have dictated to the Fed what to do and compelled the Fed to frontload the enormous rate hikes.

Nonetheless, the tug-of-war between the Fed and markets reached a climax this Wednesday when the Fed desired more from the markets.

Let us understand how the Fed dashed the “false hopes” of a pivot!

Higher Levels For A Longer Time?

“Data suggests we may ultimately move to higher levels that we thought at September Meeting”-Jerome Powell.

Powell astounded the markets when he came out and said that markets should reprice the terminal rate higher. Clearly, markets went into the FOMC meet with a “false longing” for a Fed Pivot, and as Powell repeated his ultra-hawk avatar of the Jackson Hole meet, the equity and stock markets sold off sharply.

The statement also makes the pace of tightening irrelevant, and Powell’s focus is entirely shifted to forcing the markets to move the terminal rates higher.

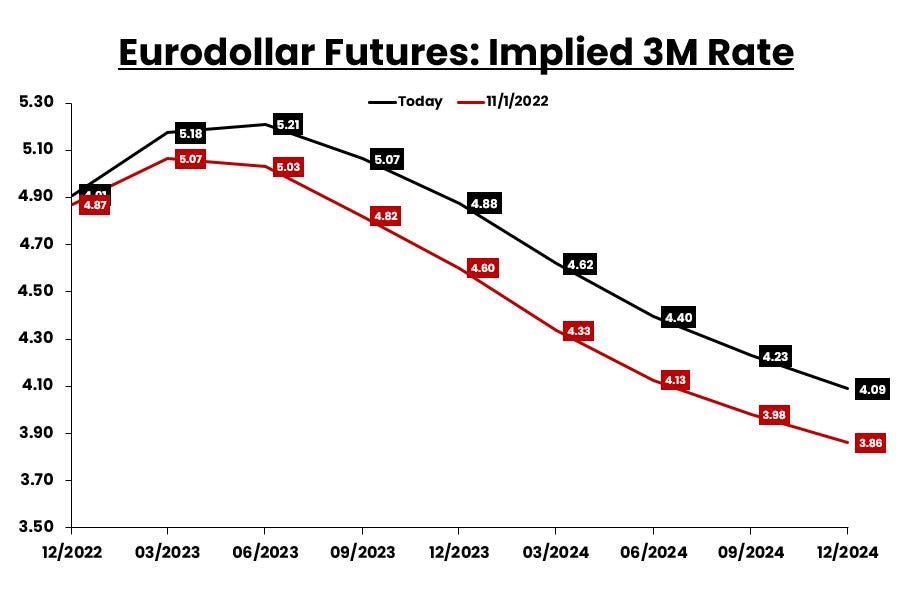

The immediate reaction was visible in the terminal rate as the next day, the terminal rates increased by 20 bps, nearly pricing in another rate hike.

The other “stunner” for markets was Powell’s statement that he expects rates to remain higher for longer than expected.

The statement is significant as the markets were pricing in rate cuts of nearly 50 bps next year. This was reduced to just 30 bps post the FOMC meet and may decline further if the inflation keeps surprising on the upside.

Powell mentioned that we would stay the course until the job was done. The Fed comprehends the road to lower inflation is softening of the labor market, which is showing no signs of cooling off as of now.

As the US labor market is presently in the wage spiral, the Fed will not back off until it breaks the bone of the labor market. I covered this in my newsletter: “Long Road Ahead” that an unemployment rate of 5% is needed for the price pressures to ease, which will require a “recession”.

So, the biggest question is, when does it happen?

Nobody knows the answer to this, but one can be sure that by the end of H1 next year, we might see a substantial softening of labor market as the monetary policy acts with a lag. Even the FOMC statement conceded this fact:

“In determining the pace of future increases in the target range, the Committee will take into account the cumulative tightening of monetary policy, the lags with which monetary policy affects economic activity and inflation, and economic and financial developments.”

Having said that, the most significant upside risk to inflation is China’s Zero-Covid policy.

What happens if China abruptly abandons its zero policy at the exact time when inflation starts to taper down in the US to around 5%, and we get massive pent-up demand from Chinese consumers?

Undoubtedly, the result will be a big rally in energy and commodity prices, and the Fed will be in a tough spot. As a result, in that scenario, we might see Fed holding the rates higher for much longer. Probably well into 2024!

Well, as the consensus builds for higher rates for a prolonged period, let us now understand what happens to the various asset classes in that scenario.

Higher Rates: A Shakeout And A Hard Landing?

The result of terminal rate repricing and higher rates will mean more misery for bonds and equities.

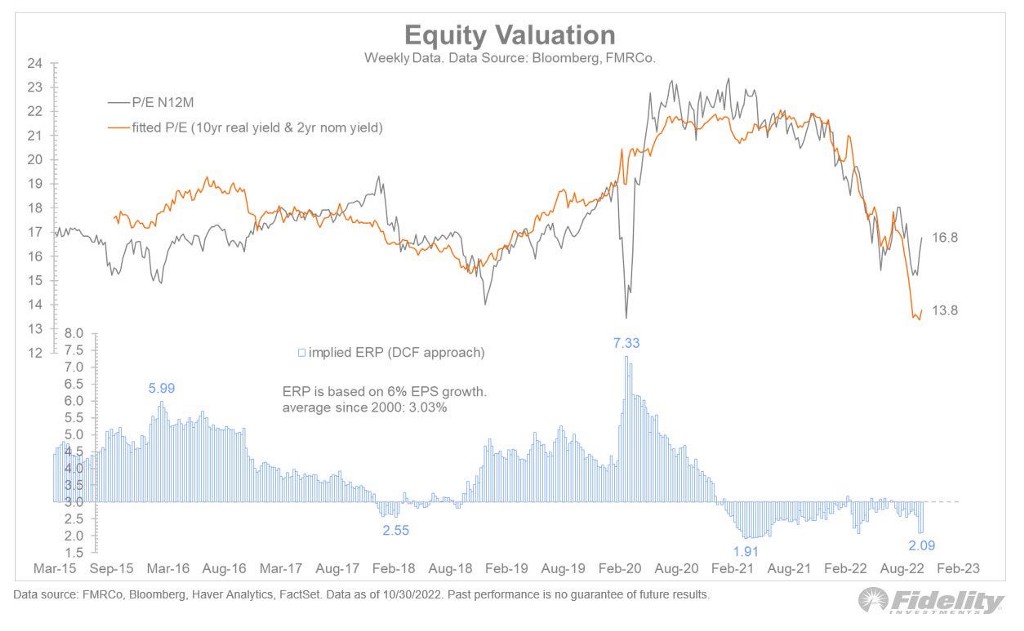

Higher terminal rates will lead to a further increase in the Equity Risk Premium, which has already undergone a tremendous rise this year.

As per Investopedia, Equity Risk Premium (ERP) is defined as:

An equity risk premium is an excess return earned by an investor when they invest in the stock market over a risk-free rate.

The “Valuation Guru”, Ashwath Damodaran, beautifully illustrates the working behind the equity risk premium. The equity guys reading this newsletter should read the thread multiple times (a gold mine).

As we all look outside domestic markets for returns, understanding why risk varies across countries and how to measure it becomes a key. My 2022 mid-year update for country risk is up. Paper:bit.ly/3yCWGRL Post: bit.ly/3c7IDvY, Data: bit.ly/3Od3o6Y

As per the latest data as on October 30th, 2022, the P/E that comes out for the S&P 500 is 13.8, and the markets are still trading at 16.8.

The data will be revised post the terminal rate repricing and the astronomical rise in bond yields we have seen post the policy announcement. IMO we may see the 2-year at 5% in the next one month, and thus the fitted P/E below 13.

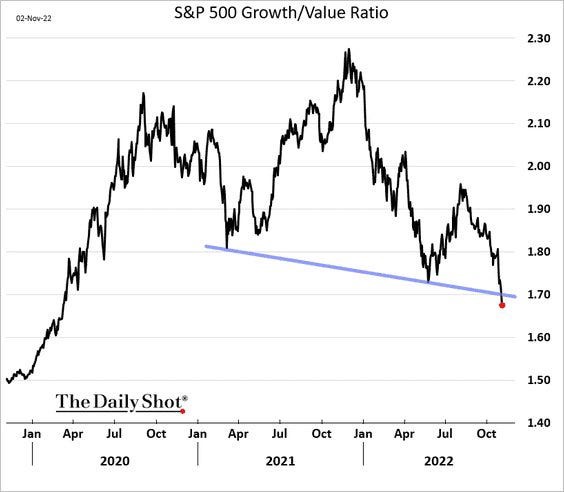

The other casualty of persistent higher rates is the growth stocks. Since the Fed commenced the tightening cycle earlier this year, the Growth stocks have massively underperformed the value stocks.

The multiples have significantly contracted for the growth stocks, and the value stocks (generally the old economy stocks) have benefitted from the high “nominal growth/ high inflation” and higher energy prices.

Let us now jump to Powell’s view that the US economy will crash land, and the soft landing scenario is increasingly becoming a pipe dream.

“Window for soft landing has narrowed”- Jerome Powell.

The Housing market in the US is lately coming out with horrendous numbers. Since “Housing is the Economy”, a crash landing in the housing sector due to the skyrocketing mortgage rates can lead to a hard landing for the economy.

As Powell has reiterated multiple times, there will be more “pain” before we witness lower inflation.

Overtighten Till Something Breaks?

“If we were to overtighten, we could use our tools to support the economy later on; but if we failed to tighten enough, inflation would become entrenched, and that would be a much bigger problem.”

This statement ensures that Fed will only intervene in the markets and “pivot” when either “Something Breaks” or “Inflation comes down considerably.”

Let us move on to “Something Breaks”!

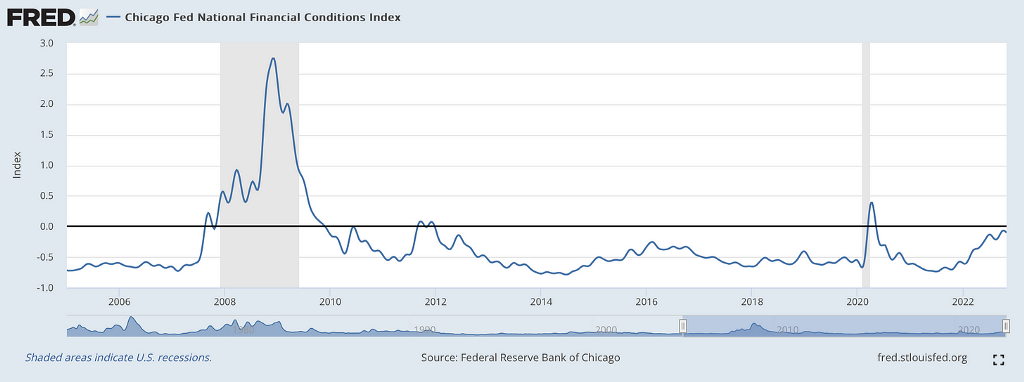

The Fed loves to see tighter financial conditions. We discussed the same in my June newsletter: “Bottom Fishing”.

Positive values of the NFCI indicate financial conditions that are tighter than average, while negative values indicate financial conditions that are looser than average.

In a shocker, the financial conditions are still looser than average even after the fastest pace of tightening since the Volcker era.

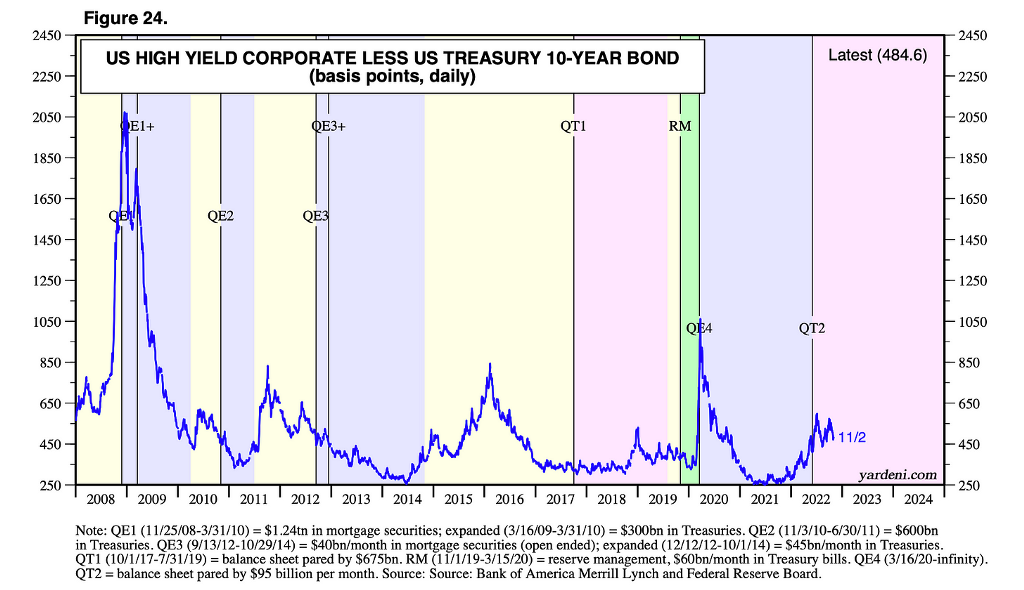

One of the primary reasons for the loose financial conditions is the US High Yield Spreads that are way lower than earlier episodes of “panic” and distress.

One of the reasons for the outperformance of the HY credit is the classification of the energy companies in the HY. This is because energy companies are cyclical, and the strong cash flows due to higher energy prices have led to outperformance.

So where can the accident happen?

The most vulnerable section of the financial markets is the most liquid market: The US Treasury Market. The sharp rise in yields has led to heightened volatility in the UST markets. This has raised concern about the illiquidity in the long end of the curve (20 Yr+), and some market participants have echoed about a Treasury Buyback to augment the liquidity in the market.

The other market that one should closely watch is the repo market, especially after what transpired in the 2019 repo market crisis.

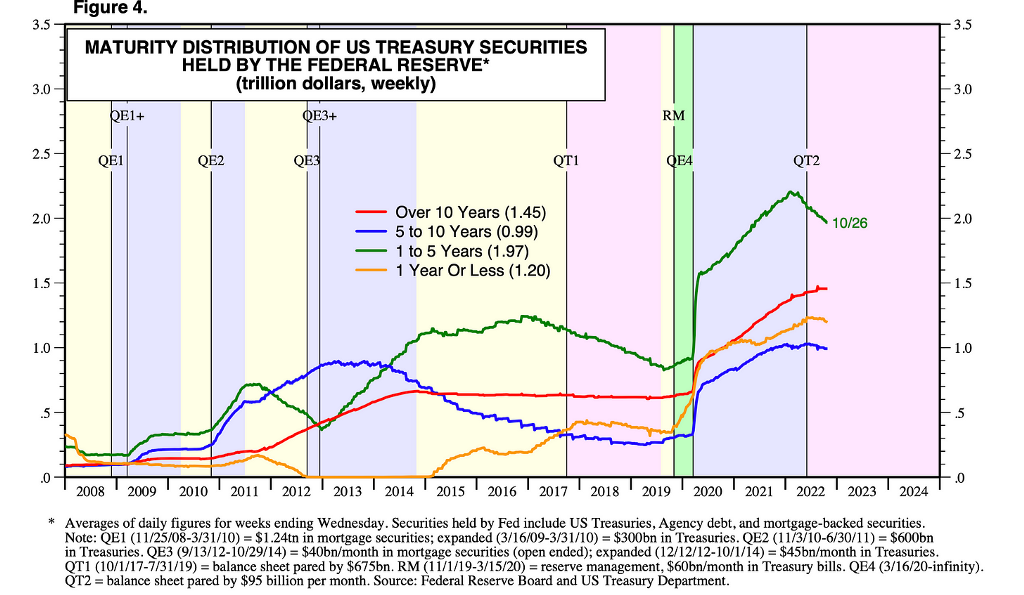

As we can see from the graph, since the beginning of the QT2, the 1–5 year bracket has seen the maximum paring by the Fed. This will reduce the collateral in the system used in the repo markets.

The repo markets work in a way such that the same short-term collateral is repledged multiple times. This works perfectly fine when the rates are low; however, as the bond prices have plunged more than 20% this year, there “can” be a blow-up of the repo market (leveraged entities can default).

In the worst-case scenario, if the 2-Year touches 6%, we might see enormous margin calls in the repo market across the board. This might lead to terrible circumstances, and the Fed might undertake emergency measures to halt the contagion.

Conclusion!

As I have mentioned before, Jerome Powell has taken the Volcker Avatar, and NOTHING but ONLY “lower inflation” will move the most powerful Central Banker in the world now (unless something breaks).

Considerable pain is yet to come for loss-making tech, zombie companies, growth stocks and other risk assets.

The wealth destruction across bonds and equities will cross $100 trillion soon,and we will most likely witness some vulnerable, weak points of the global financial system breaking in 2023.

Remember, Don’t fight the FED.

Tug-Of-War! was originally published in DataDrivenInvestor on Medium, where people are continuing the conversation by highlighting and responding to this story.

Comments