$YANGZIJIANG SHIPBLDG HLDGS LTD(BS6.SI)$

Evergrande debt implication on YZJ

YZJ has limited disclosure on its debt investments. So there is no information showing YZJ actually held Evergrande Debt

Analysis from public available information

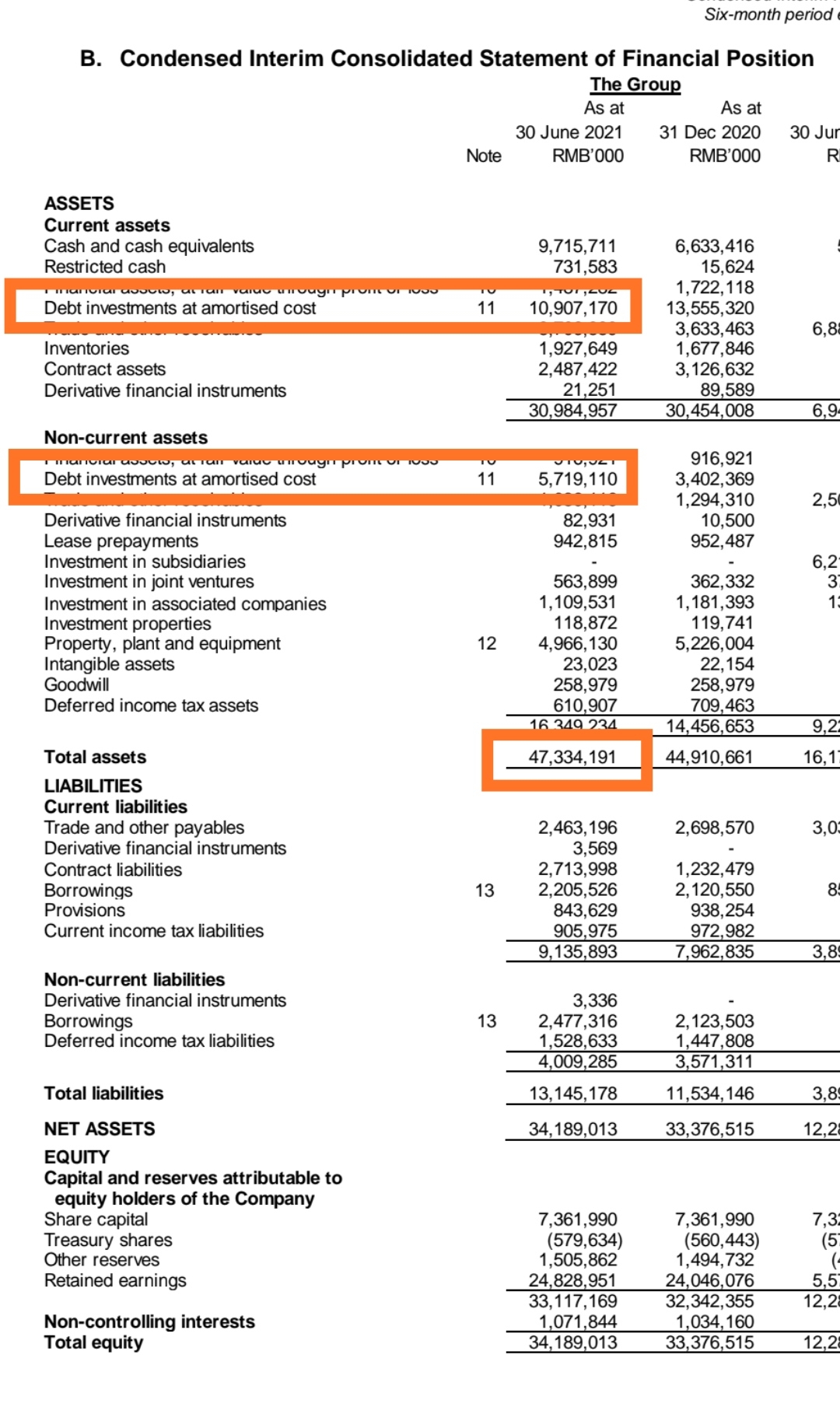

Source: YZJ 1H Financial Result

Total Debt amortised at cost:

10,907,170+5,719,110=16,626,280

Debt investment as a percentages of total asset:

16,626,280/47,334,191 = 35%

This means that if all YZJ debt investment get wipe out, 35% of its assets will be gone

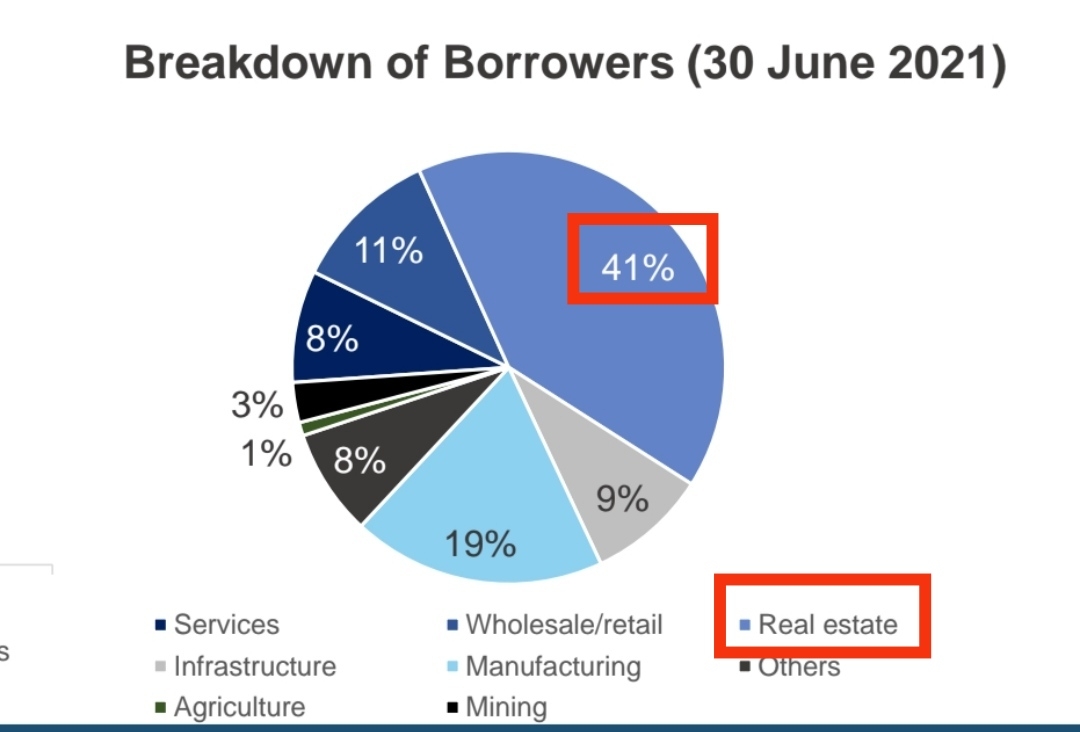

Concern about Real Estate debt default.

About 41% of its debt investments were from real estate sector.

0.41 x 16,626,280 = 6,816,774.8

Real estate debt investment as a percentage of total asset:

6,816,774.8/47,334,191 =14.4%

This means that if all YZJ real estate related debt investment get wipe out, 14.4%% of its assets will be gone.

Disclaimer: Investing carries risk. This is not financial advice. The above content should not be regarded as an offer, recommendation, or solicitation on acquiring or disposing of any financial products, any associated discussions, comments, or posts by author or other users should not be considered as such either. It is solely for general information purpose only, which does not consider your own investment objectives, financial situations or needs. TTM assumes no responsibility or warranty for the accuracy and completeness of the information, investors should do their own research and may seek professional advice before investing.

We verified with management that Yangzijiang has no direct exposure to Evergrande.