What do we learn from ServiceNow's earnings report ?

ServiceNow's financial report rose by 10%. For the recent general decline, I just want to say that there are more such financial reports.$ServiceNow(NOW)$

To put it simply, the company's financial report exceeded expectations, and the guidance was good.

Specific highlights are as follows:

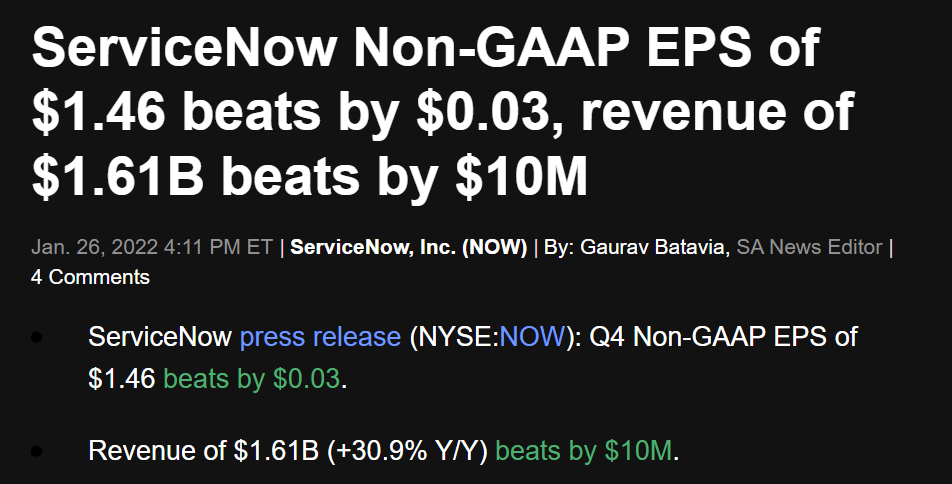

4Q Sales Rose 30% to $1.6 Billion on Strong Subscription Sales, Expanding Deal Sizes

Adjusted EPS Up 25% to $1.46 on Solid Sales; Operating-Margin Expansion Offset by Higher Tax Expense

CRPO Up 32% as Enterprises Accelerate Shift to Digital; Renewals Remain Strong at 99%

Total Billings Jumped 33%, Topping Consensus of 24%, on Large Deals and Enterprise IT Resurgence

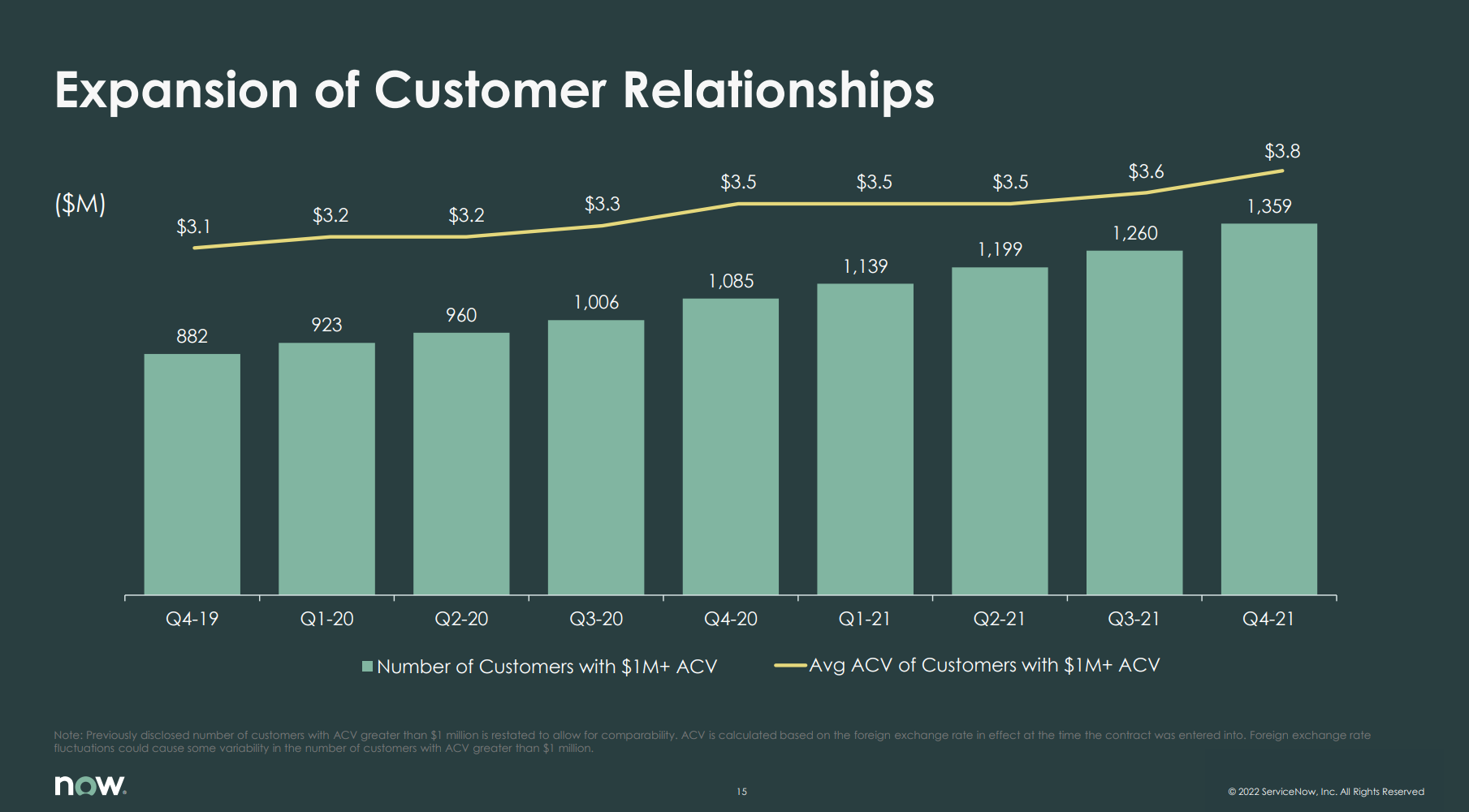

Customers With $1 Million-Plus in ACV Up 25%, Points to Acceleration in Enterprise Digital Shift

According to the analysis,A sharp increase in the number of clients spending over $1 million in annual contract value (ACV) could push ServiceNow to surpass consensus for 25% sales growth in fiscal 2022. In 4Q, ServiceNow added 99 clients to this key metric, 1.6x the average of 64 over the past four quarters. These results echo comments from Microsoft on Jan. 25 about increased cloud-based spending, and they give us confidence that 2022 may not see any substantial slowdown in growth, despite tough comparisons.

A rebound in spending from energy and utilities aided growth in new ACV, and we expect this to continue in 1Q. Strong organic sales growth could offset an increase in sales and marketing expenses as the year progresses, pushing up non-GAAP operating margin by 100-200 bps for the full year.This is the current optimism about ServiceNow.

Overall,ServiceNow is one of the key beneficiaries of increased demand for workflow automation, a critical piece of any digital transformation, which could help sustain its industry-leading organic-sales growth vs. most large cloud-software peers. Moving into new product categories, a high renewal rate (99%), a 125%-plus net-expansion pace and more partnerships with system integrators could be key growth drivers for the next 3-5 years. The potential for a large acquisition is the main uncertainty, given ServiceNow's strong balance sheet and elevated valuation vs. pre-pandemic levels.

Disclaimer: Investing carries risk. This is not financial advice. The above content should not be regarded as an offer, recommendation, or solicitation on acquiring or disposing of any financial products, any associated discussions, comments, or posts by author or other users should not be considered as such either. It is solely for general information purpose only, which does not consider your own investment objectives, financial situations or needs. TTM assumes no responsibility or warranty for the accuracy and completeness of the information, investors should do their own research and may seek professional advice before investing.

- wobee·2022-01-28ServiceNow CEO said that the company is on a "clear growth trajectory" to more than $15 billion in revenue by 2026.If this goal can come true, how much will the company's share price reach?8Report

- koolgal·2022-01-29Thanks for your excellent analysis of Service Now. It has produced an excellent earnings report and the share pricr rose in tandem. I will put on my watch list to monitor.6Report

- fuzzyx·2022-01-28Great!!!During the quarter, ServiceNow closed 135 transactions over $1 million in net new annual contract value, representing 52% year-over-year growth.6Report

- Eddywin·2022-01-30Almost every major MNC is using NOW!1Report

- zoomzi·2022-01-28Thanks for sharing. From the performance point of view, this company has performed quite well.3Report

- glintzi·2022-01-28I believe that ServiceNow is well-positioned to take advantage of the secular trends that have taken hold during the pandemic.2Report

- thuiminn·2022-01-29Good buy2Report

- wubbix·2022-01-28The stock price finally started to rebound. I’m So Happy2Report

- Yolofomo101·2022-02-02ServiceNow toooooo the Mooooon!2Report

- Slsebast·2022-02-02Nice thanks for sharing1Report

- AllOrNuttin·2022-02-01ServiceNow might be a good spot1Report

- Kimlet·2022-01-30thank you for info1Report

- Moolele·2022-01-30Such a powerful rebound 💪🏻1Report

- GoESg·2022-01-30Thanks for sharing1Report

- H_sn·2022-01-30Thanks fof sharing1Report

- AnnieReis·2022-01-30thanks for sharing 👍1Report

- SDG·2022-01-29好1Report

- 5ed1af03·2022-01-29Thanjs fir sharing1Report

- cwz·2022-01-29Thanks for sharing1Report

- Avg123·2022-01-29Thanks for the shar ing2Report