A big change in CPI, which could change the whole market

China's assets declined last week, $HSTECH(HSTECH)$'s pulling back 5.9%, while $KraneShares CSI China Internet ETF(KWEB)$ down 4.1%. However, the entire recovery momentum since the end of last year has not been over.

Several factors continue to support the recovery and rebound

1. The southbound capital of Hong Kong stocks continues to resume the inflow momentum, At the same time, overseas active funds also maintained a net inflow. According to EPFR data, there is a net inflow of over 200 million US dollars (Hong Kong stocks and China stocks) from overseas active funds, and the inflow momentum has been maintained for five weeks. Hong Kong Stock Connect also bought more than HK $800 million in Hong Kong stocks.

2. In the semi-annual adjustment of MSCI China, 12 stocks new added and 6 stocks out. New in include $AKESO-B(09926)$,$MINISO Group Holding Limited(MNSO)$,$RLX Technology(RLX)$ and the $Shanghai Aiko Solar Energy Co., Ltd.(600732)$, Shi Ying Co., Ltd., SDIC Capital, Antu Bio, Zhonggong Education, Long-term Lithium, Meihua Bio, Wanda Film and Oriental Risheng. Out include $HAICHANG HLDG(02255)$,$GOLDWIND(02208)$, Huagong Technology, GCL Integration, Bishuiyuan and Oufeiguang.

3. Cost reduction and efficiency increase will gradually help earnings growth. Most Chinese big techs have taken actions to reduce costs and increase efficiency in 2022, and the companys' profit are expected to be stronger. At the same time, there will be more favorable policy support in the future.

4. Economic data shows signal of recovery, there is still room for further policy support. In January, RMB loans increased by 4.9 trillion yuan, an increase of 922.7 billion yuan year-on-year, and the monthly scale reached a record high. The expansion of credit scale pushed the year-on-year growth rate of M to 12.6% in January. Due to the influence of festivals, CPI increased by 2.1% year-on-year in January.

In addition, international investors are vital to further cash flow in, while the monetary policy of Feds also decides the risk appitite.

Jan CPI would be the most important indicator.

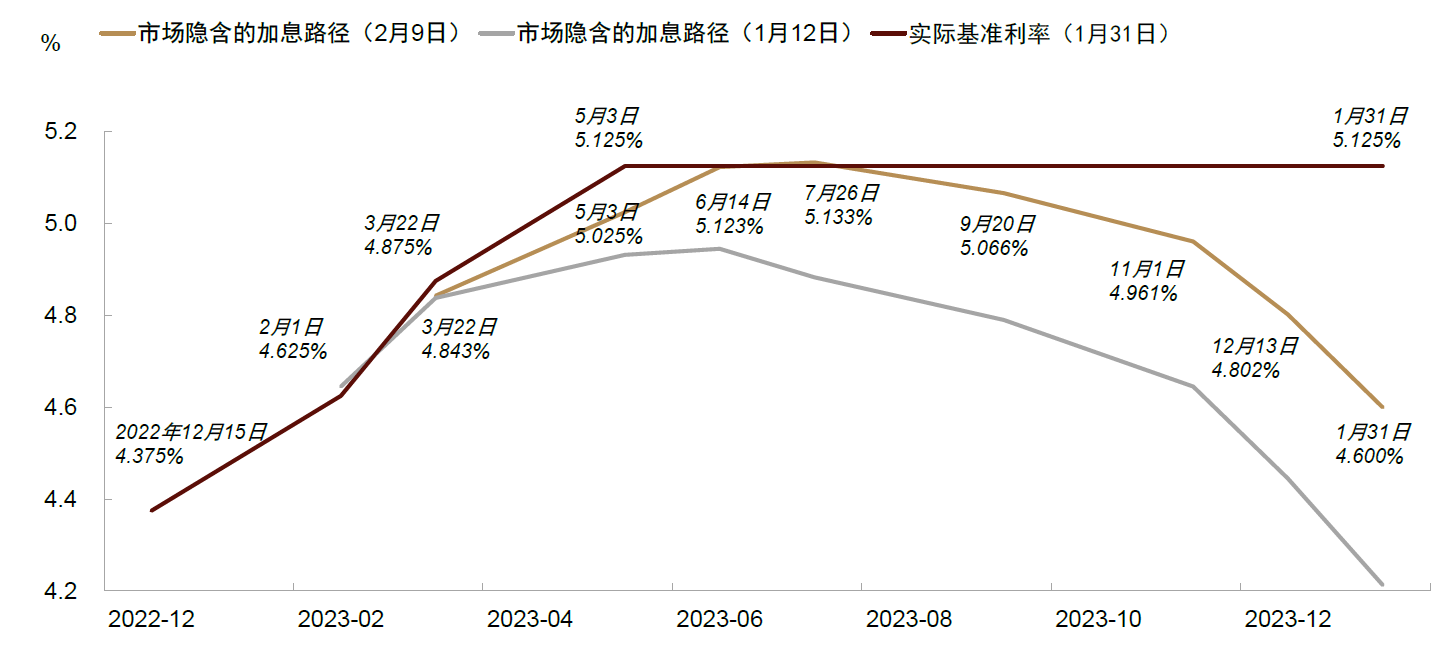

As the NFP enrolls exceeded expectations, some important officials of the Fed delivered hawkish speeches, the market's expectation for the high point of interest rate hike rose, the yield of US bonds rose, and US stocks were under pressure.

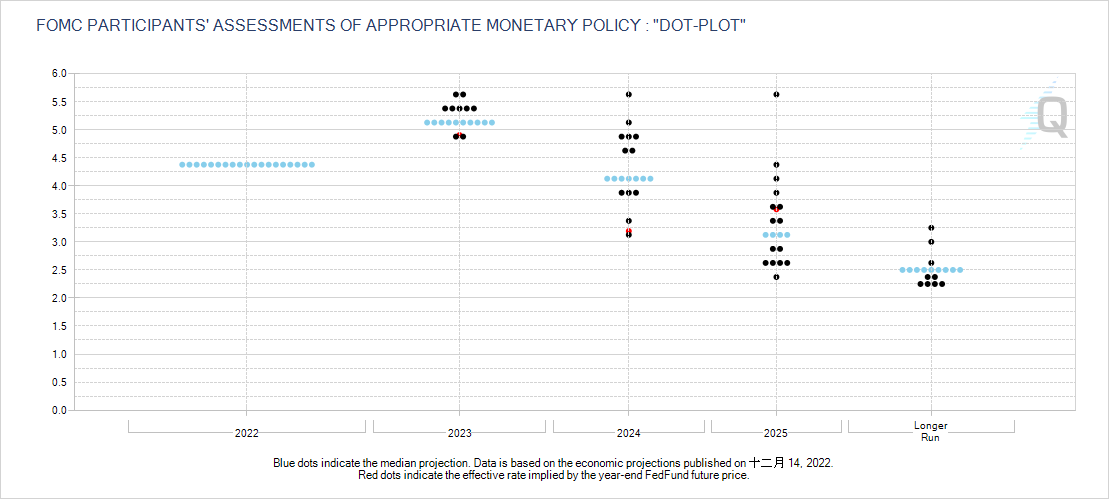

After the interest rate meeting on January 31st, the Dot Plot of the Federal Reserve shows that the end point of interest rate increase in 2023 is 5.25%.

And according to $CME Group Inc(CME)$ Federal Reserve's policy observation tool,Market expectations for the Fed to raise interest rates have risen compared with half a month ago, mainly the high point of interest rate hike and the extent of decline.

If energy prices rebound, or the rent market remains high, it may push up inflation again. Although the Fed doesn't admit that inflation is slowing down, it even shifts its focus from "core inflation" and "PCE inflation" to the core "service inflation" after excluding housing.

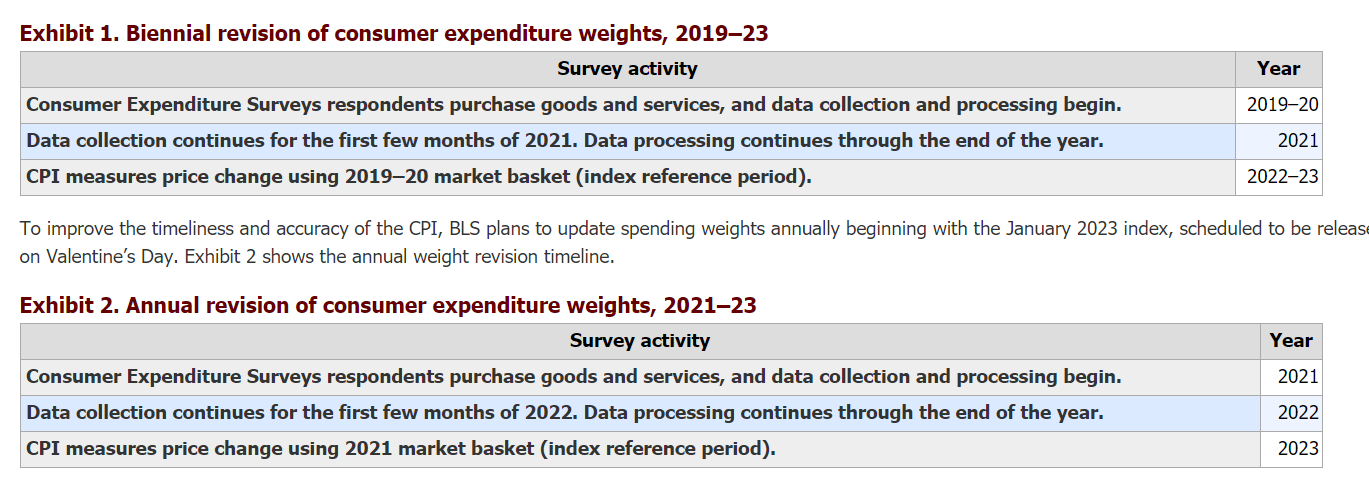

There is another point to pay attention to in Thursday's CPI data. That is, BLS will celebrate an improvement in the Consumer Price Index (CPI) weights. Click to view

The CPI weight is updated every two years, and will be updated once a year from this time. The CPI basket in 2023 will reflect the situation in 2021 instead of 2019-2020.

Compared with the weight in 2019-2020, the weight of used-cars is relatively lower and the weight of shelter is higher, which may also bring some disturbance to the development path of inflation this time and in the future.

According to the data of the past few quarters, CPI of the used-car market is relatively low, which is one of the biggest driving factors for inflation to fall in recent months, while the increment of shelter is relatively high. If the weight is increased, it will pull up inflation. This might pull up CPI.

At present, the market's expectation for the quarterly adjustment of CPI inflation in January is that it will increase by 0.4% month-on-month (the previous value is 0.1%) and increase by 6.2% year-on-year (the previous value is 6.5%); The core CPI increased by 0.4% month-on-month (the previous value of 0.4%) and 5.4% year-on-year (the previous value of 5.7%).

Disclaimer: Investing carries risk. This is not financial advice. The above content should not be regarded as an offer, recommendation, or solicitation on acquiring or disposing of any financial products, any associated discussions, comments, or posts by author or other users should not be considered as such either. It is solely for general information purpose only, which does not consider your own investment objectives, financial situations or needs. TTM assumes no responsibility or warranty for the accuracy and completeness of the information, investors should do their own research and may seek professional advice before investing.

Noted