U.S. stock futures were slightly lower on Thursday morning following a big decline in the major averages as traders weighed another large rate hike from the Federal Reserve.

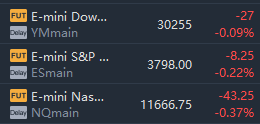

Market Snapshot

At 7:50 a.m. ET, Dow e-minis were down 27 points, or 0.09%, S&P 500 e-minis were down 8.25 points, or 0.22%, and Nasdaq 100 e-minis were down 43.25 points, or 0.37%.

Pre-Market Movers

Accenture PLC – The consulting firm reported a better-than-expected quarterly profit and revenue, but gave a weaker-than-expected revenue forecast for the current quarter. Accenture pointed to IT spending cuts by corporate customers and a negative impact from the stronger dollar. Nonetheless, Accenture gained 1% in premarket trading.

Darden Restaurants – The parent of Olive Garden and other restaurant chains fell 2.5% in the premarket after reporting in-line quarter results. Darden’s same-restaurant sales rose by 4.2%, short of the consensus FactSet estimate of 5.1%. Food and beverage costs also rose slightly more than expected.

KB Home, Lennar – KB Home and Lennar both reported better-than-expected quarterly earnings, but the home builders also posted lower-than-expected revenue as a housing market slowdown weighed on new home orders. KB Home fell 1.7% in premarket trading, while Lennar gained 1%.

Salesforce.com – Salesforce shares added 1.9% in the premarket after the business software giant unveiled a plan to operate more efficiently and increase profit margins. Salesforce is aiming for a 25% adjusted operating margin for fiscal 2026, compared with the 20% it had targeted for fiscal 2023.

Steelcase – Steelcase reported a better-than-expected profit for its latest quarter, but the office furniture company’s revenue came in below estimates. the company also cut its outlook on slower-than-expected return-to-office trends. Steelcase fell 1% in the premarket.

Novavax – The drug maker’s stock slipped 6.1% in premarket trading after J.P. Morgan Securities downgraded it to “underweight” from “neutral”. The firm said the company’s recent guidance cut may not have gone far enough, given reduced vaccine demand as well as other factors.

H.B. Fuller – H.B. Fuller rose 2.2% in premarket trading following a slight earnings beat and revenue that missed estimates. The industrial adhesives maker reported an increase in market share and raised the lower end of its fiscal 2022 earnings range.

Eli Lilly and – Eli Lilly rose 1.4% in premarket trading after the FDA approved its cancer drug Retevmo for new uses. Separately, UBS upgraded the drug maker’s stock to “buy” from “neutral” for several reasons, including a lowering of risks surrounding the Lilly weight loss drug tirzepatide.

FactSet Research – The financial information services provider fell 7 cents shy of estimates with adjusted quarterly earnings of $3.13 per share. However, revenue exceeded Wall Street forecasts as FactSet reported an increase in organic revenue and annual subscription value.

Market News

The Federal Reserve on Wednesday raised benchmark interest rates by another three-quarters of a percentage point and indicated it will keep hiking well above the current level.

The U.S. Federal Trade Commission on Wednesday rejected a bid by Amazon.com to quash demands that both Chief Executive Andy Jassy and Executive Chairman Jeff Bezos testify at investigative hearings.

Meta Platforms, Inc. is planning to cut expenses by at least 10% in the coming months, in part through staff reductions, as the social-media giant confronts stalling growth and increased competition, according to people familiar with the company’s plans.

Softbank Group Corp founder and CEO Masayoshi Son will discuss a "strategic alliance" between chip designer Arm and Samsung Electronics during the billionaire's first visit to South Korea in three years.

NVIDIA Corp Chief Executive Jensen Huang said Wednesday that he continues to see a large market for Nvidia's data center chips in China despite U.S. restrictions on exports of two of its top chips to the country.

Credit Suisse Group AG has drawn up plans to split its investment bank in three, the Financial Times reported on Thursday, as the Swiss lender attempts to emerge from three years of relentless scandals.

HSBC Holdings PLC raised its main lending rate in Hong Kong for the first time in four years, bumping up borrowing costs for property owners and businesses at a time when the economy is struggling with Covid restrictions and an exodus of talent.

Novartis AG unveiled a new strategy on Thursday based on eight big drug brands as the pharmaceuticals maker reshapes itself following the decision to spin off its underperforming generics business Sandoz.

Comments