Wall Street's main indexes ended Wednesday (November 23) with solid gains after the Federal Reserve's November meeting minutes showed interest rate hikes may slow soon.

Regarding the options market, a total volume of 35,616,231 contracts was traded, down 3% from the previous trading day.

Tesla shows the highest volume of bullish activity by option delta volume. Tesla stock surged 7.82% to $183.2 on Wednesday as Citi analyst Itay Michaeli upgraded TSLA stock from a“sell” rating to a “neutral” rating. The company’s shares are down 55.7% year to date. However, Michaeli believes the pullback has gone far enough.

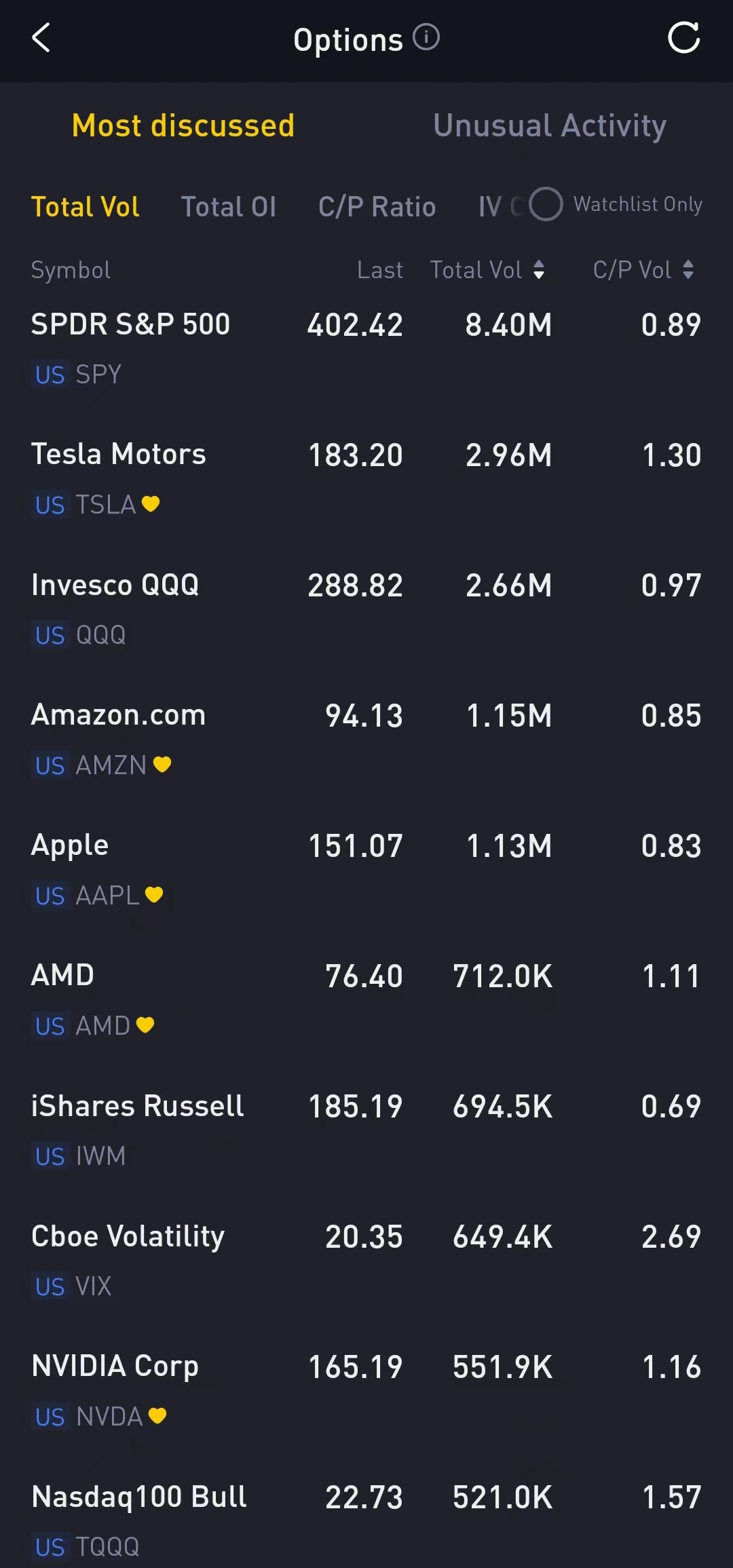

Top 10 Option Volumes

Top 10: SPY, TSLA, QQQ, AMZN, AAPL, AMD, IWM, VIX, NVDA, TQQQ

Options related to equity index ETFs are popular with investors, with 8.4 million SPDR S&P500 ETF Trust and 2.66 million Invest QQQ Trust ETF options contracts trading on Wednesday.

Tesla saw an increase in options trading volume. There were 2.96 million options trading on Wednesday. Call options account for 56% of overall option trades. Particularly high volume was seen for the $180 strike call option expiring this Friday, with 230,991 contracts trading on Wednesday.

Tesla stock surges 7.82% to $183.2 on Wednesday after Citi analyst Itay Michaeli upgraded the shares in a recent research note. Citi boosts TSLA stock from a“sell” rating to a “neutral” rating. The company’s shares are down 55.7% year to date. However, Michaeli believes the pullback has gone far enough. According to him, this has “balanced out the near-term risk/reward,” for the electric vehicle (EV) company’s shares.

There were 649.4K options related to Cboe Volatility Index traded on Wednesday. The VIX extended its decline Wednesday to close at its lowest level in more than three months as stocks climbed after minutes from the Federal Reserve’s most recent meeting signaled that investors could soon see a slowing in the pace of interest rate hikes.

Wall Street’s fear gauge fell to 20.35. The last time it finished lower was Aug. 18, in the heat of the summer rally, when it was still trading under the key 20 threshold.

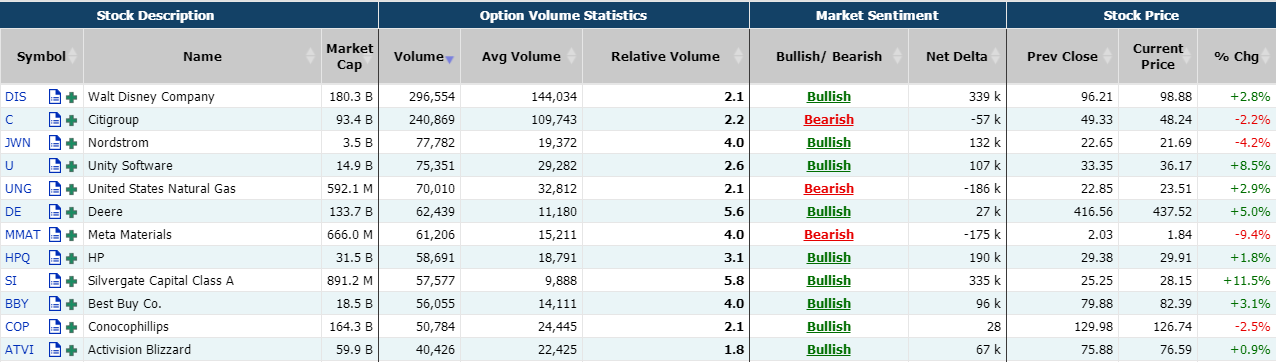

Unusual Options Activity

Source: Market Chameleon

Nordstrom Shares dropped more than 4% on Tuesday after the retailer swung to a surprise quarterly loss and joined other stores in reporting lower sales, saying it was "right-sizing" its inventory.

A total volume of 77,782 Nordstrom option contracts was traded, of which put options account for 58%. Particularly high volume was seen for the $20 strike put option expiring this Friday, with 8,137 contracts trading on Wednesday.

Best Buy reported third-quarter adjusted earnings of $1.38 a share, higher than forecasts. The stock jumped 3.1% to $82.39 on Wednesday and had rebounded 35% from its lowest position last month. Investors were also encouraged by Best Buy's guidance. Management now expects comp sales to decrease by roughly 10%, compared to a prior projection of an 11% decline.

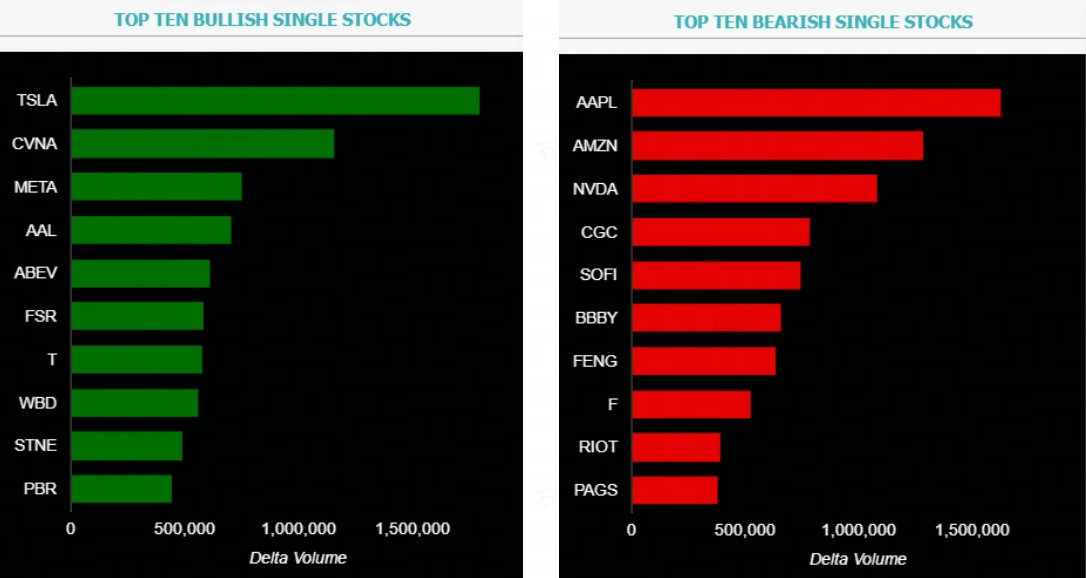

TOP Bullish & Bearish Single Stocks

This report shows stocks with the highest volume of bullish and bearish activity by option delta volume, which converts option volume to an equivalent stock volume (bought or sold).

If we take the total positive option delta volume and subtract the total negative option delta volume, we will get the net imbalance. If the net imbalance is positive, there is more bullish pressure. If the net is negative, there is more bearish pressure.

Top 10 bullish stocks: TSLA, CVNA, META, AAL, ABEV, FSR, T, WBD, STNE, PBR

Top 10 bearish stocks: AAPL, AMZN, NVDA, CGC, SOFI, BBBY, FENG, F, RIOT, PAGS

- Share experiences and ideas on options trading.

- Read options-related market updates/insights.

- Learn more about options trading if you are a beginner in this field.

Please click to join Tiger Options Club

Comments