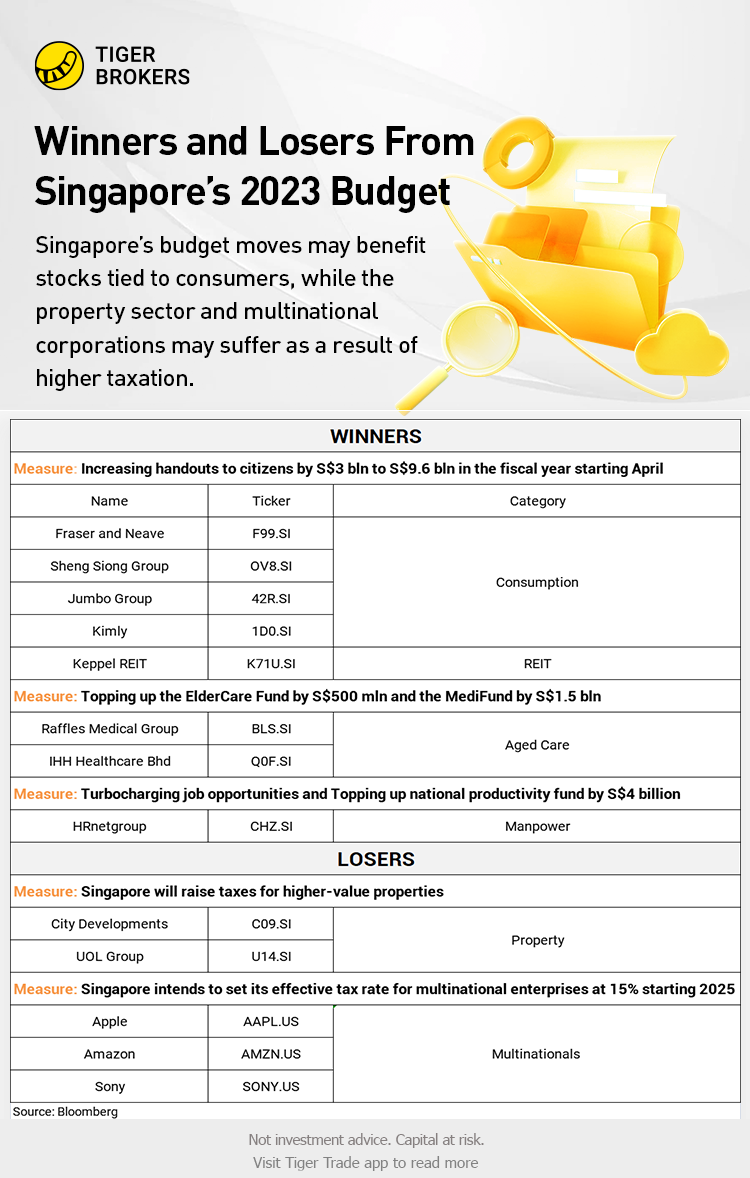

Singapore’s budget moves to address the city-state’s high cost of living may benefit stocks tied to consumers, while the property sector and multinational corporations may suffer as a result of higher taxation.

According to Bloomberg, Here are details of what analysts see as the main winners and losers from the budget:

WINNERS

Consumer Stocks

Singapore’s plan toincreaseits handouts to citizens by S$3 billion to S$9.6 billion in the fiscal year starting April, to help offset higher price pressures, will be positive for stocks tied to local consumption.

Food and beverage manufacturer Fraser and Neave Ltd., grocer Sheng Siong Group Ltd. and restaurants and food caterers such as Jumbo Group Ltd. and Kimly Ltd. could all benefit. Keppel REIT and other consumption-focused real estate investment trusts may also gain.

Aged Care

Singapore’s move to add more resources for lower-income seniors can aid hospital operators such as Raffles Medical Group Ltd. and IHH Healthcare Bhd.

Wong plans to top up the ElderCare Fund by S$500 million and the MediFund by S$1.5 billion.

Manpower

Wong’s plans aimed at turbocharging job opportunities for Singaporeans implies more business for staffing-solutions providers such as HRnetgroup Ltd.

The city-state will top up national productivity fund by S$4 billion, develop labor-market intermediaries who can go through industry training and employment facilitation, and extend the Senior Employment Credit and the Part-time Re-employment Grant.

LOSERS

Property

Singapore will raise taxes for higher-value properties in an attempt to boost revenue and help fund an array of spending programs.

The residential properties in excess of S$1.5 million and up to S$3 million will be taxed one percentage point higher at 5%. Properties in excess of S$3 million will be taxed two percentage points higher at 6%.

Stocks to watch include property firms such as City Developments Ltd. and UOL Group Ltd.

Multinationals

Singapore intends to set its effective tax rate for multinational enterprises at 15% starting 2025, in line with a global agreement to increase the floor rate. Some world-renowned multinationals with presence in Singapore include Apple Inc., Sony Group Corp. and Amazon.com Inc.

Such a move may also weigh on multiple members of the Straits Times Index, if they qualify as multinational corporations under local laws.

Comments