Buy the rumor, sell the news? Here is how Apple stock tends to perform around earnings day, and what potential investors should think about before pushing the “buy” button.

Apple will report its fiscal Q1 results on Thursday, January 27. The Apple Maven has already started to preview the event, and we will cover the results and earnings call in real time.

Today, I turn the focus to Apple stock’s performance around the company’s earnings day. Is now a good time to buy shares ahead of the results? How does the stock tend to perform before and after earnings?

Buy AAPL on earnings day

Have you heard the phrase “buy the rumor, sell the news”? It turns out that, historically, Apple stock has not traded in line with the mantra during earnings seasons.

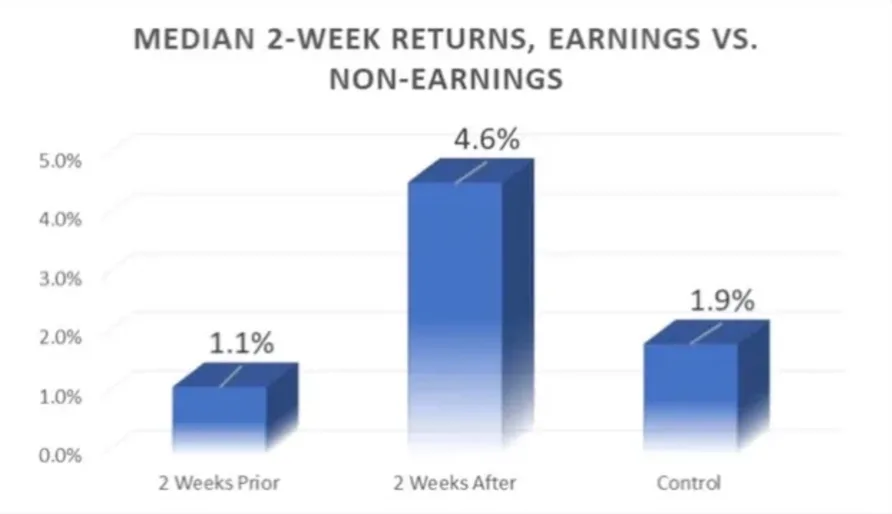

A few months ago, I ran an analysis on AAPL’s performance before and after earnings day. A bit of a surprise to me, the stock tends to underperform its own two-week average ahead of the earnings release; but then the price tends to spike shortly after the results are published.

Since publishing the chart above for the first time, Apple released earnings twice: in fiscal Q3 and Q4 of last year.

After July 27, AAPL stock moved generally sideways for two weeks, but eventually started to climb through early September. After October 28, something similar happened: sideways through early November, then viciously higher in the following four weeks.

The narrative that seems to fit the observations is the following: traders and investors position themselves ahead of earnings. When the results come out, bulls and bears engage in a tug of war to determine if the results and outlook seem good enough. Eventually, after digesting the numbers and commentary, the market settles largely with the bulls.

Consider seasonality

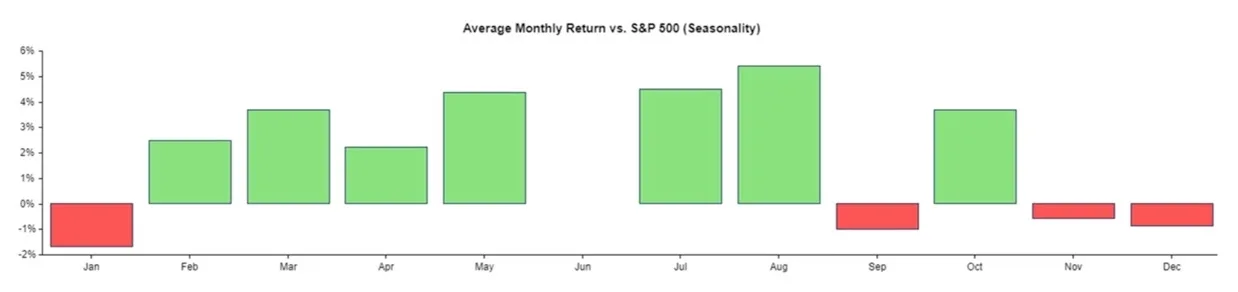

Looking not much more than a couple of months past fiscal Q1 earnings day may further encourage investors to buy AAPL soon. The chart below shows that, from a seasonality perspective, December and January tend to be the worst months to own AAPL.

While AAPL managed to climb through the end of December 2021, January has, in fact, been a challenging month for the stock so far.

The better news is that February tends to mark a long, four-month period of outperformance over the S&P 500. This is probably the case because investors finally leave behind concerns over the performance of the new iPhone in the holiday quarter and start to think longer term.

Don’t forget fundamentals and value

Of course, earnings trends and seasonality are only two factors to consider when deciding whether to buy Apple stock. More important is to assess Apple’s business fundamentals, and how much an investor might be willing to pay for them.

I believe that the Cupertno company continues to be one of the best (if not the best) consumer product and service companies in the world. My concern until recently was whether valuations were a bit too rich, following the dizzying Q4 rally.

Here, I am slightly encouraged by the fact that AAPL price has dipped 8% from the January 3 peak. While $167 per share still does not sound like a once-in-a-lifetime bargain, the figure is easier on the eyes of a buyer than $180-plus.

Comments