A surge in bond yields, fears about rising inflation and a jump-forward in interest rate expectations will be top of mind for investors at this week’s Federal Reserve policy meeting.

The policy-setting Federal Open Market Committee (FOMC) led by Chair Jerome Powell convenes on March 16-17, with a policy statement and fresh economic projections due to be released at the end of the meeting.

Investors will be looking for signs of whether the U.S. central bank’s outlook for the economy has changed due to the ongoing COVID-19 vaccination program and other developments.

Here are some questions investors may have:

How worried is the Fed about inflation?

The recent passage of President Joe Biden’s $1.9 trillion coronavirus relief package has some investors worried that America’s expansionary fiscal policy will stoke inflation.

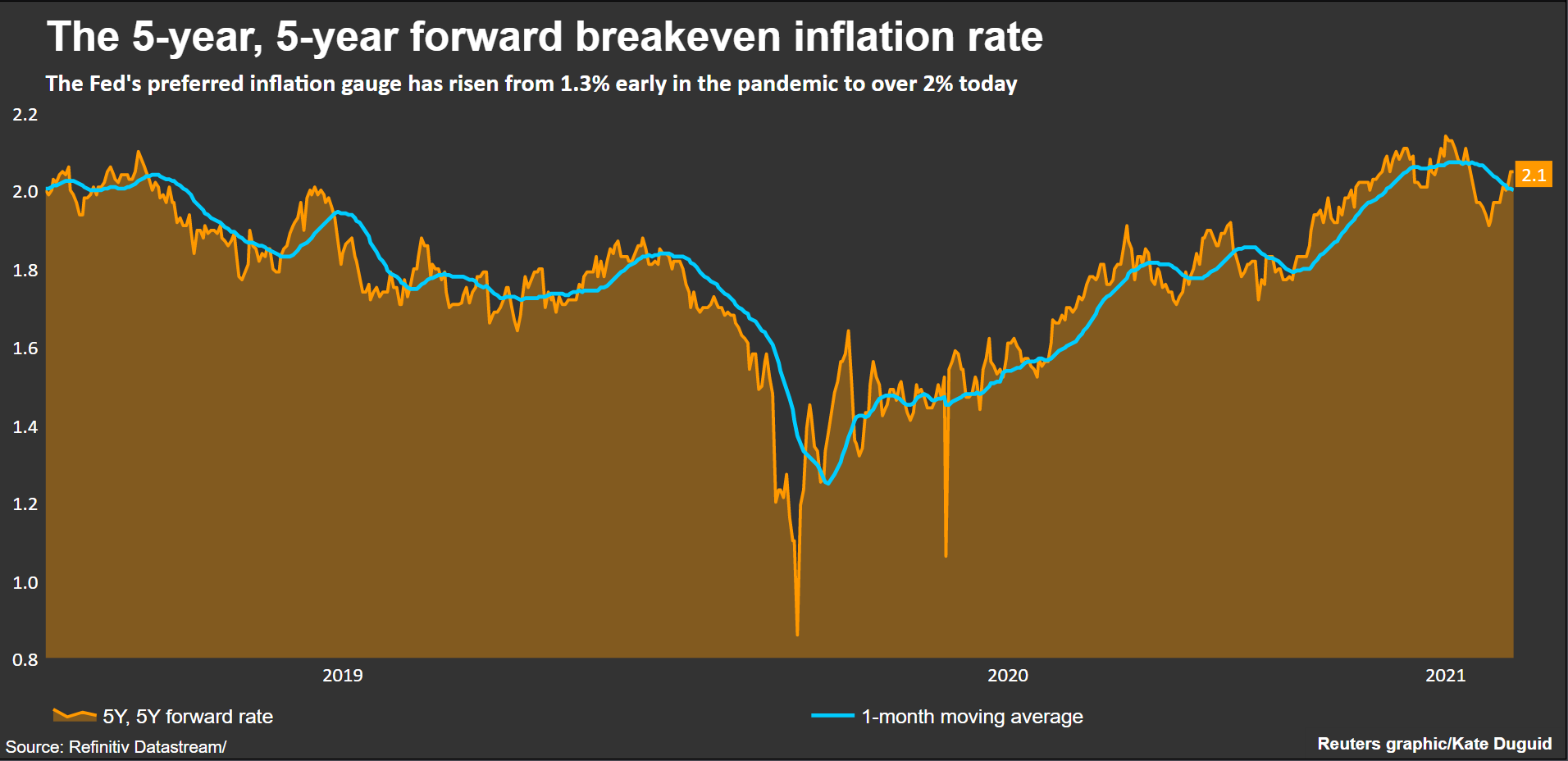

Though recent inflation data showed that core consumer prices haven’t moved significantly in recent months, inflation expectations have risen. The five-year, five-year forward breakeven inflation rate, which tracks the expected rate of inflation over five years in five years’ time, was recently at 2.1%, above the Fed’s target rate of 2%.

But a new framework adopted by the central bank last year means it will allow inflation to rise above its target for a period in order for inflation to average 2% over time. And many economists, including Powell, do not expect the strength in inflation will persist beyond the so-called base effects.

GRAPHIC: The 5-year, 5-year forward breakeven inflation rate -

How worried is the Fed about the rise in bond yields?

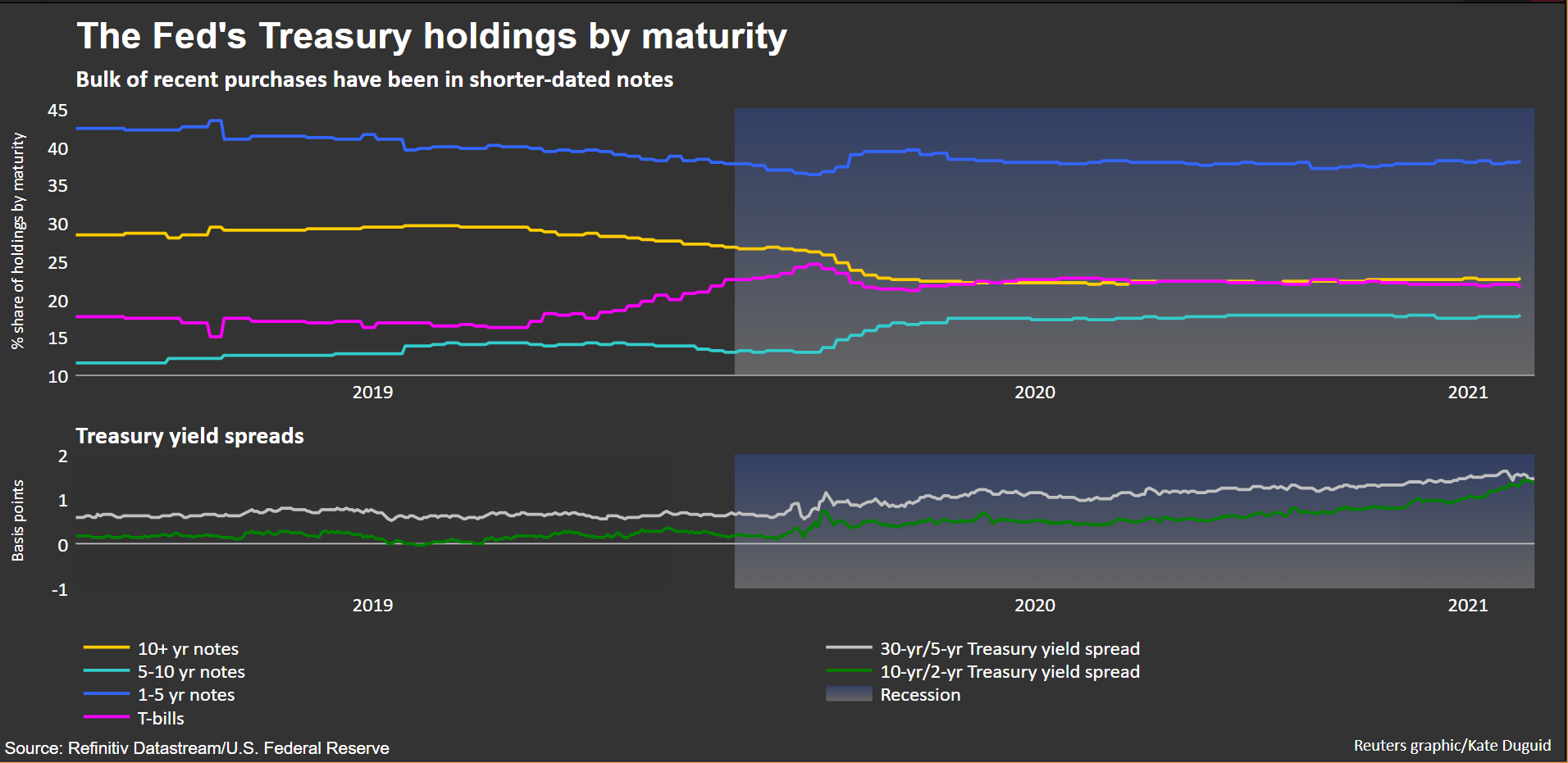

Investors still hoping for action from the Fed to cap rising yields on longer-dated Treasury bonds may be disappointed. Following the rise in yields to their highest since the start of the coronavirus pandemic, investors and analysts have raised the possibility the Fed could purchase more longer-dated debt to bolster prices.

But while Powell has said he is watching recent Treasury market volatility, he brushed off concerns that the move up in yields might spell trouble for the Fed.

Demand at the 10- and 30-year Treasury auctions last week initially seemed sufficient to allay some fears that investors would struggle to soak up the flood of supply hitting the market. But although yields fell at the long end of the curve on Wednesday and Thursday, those moves reversed and the 10- and 30-year yields hit fresh 13- and 14-month highs respectively on Friday.

GRAPHIC: The Fed's Treasury holdings by maturity -

Where is the market pricing rates?

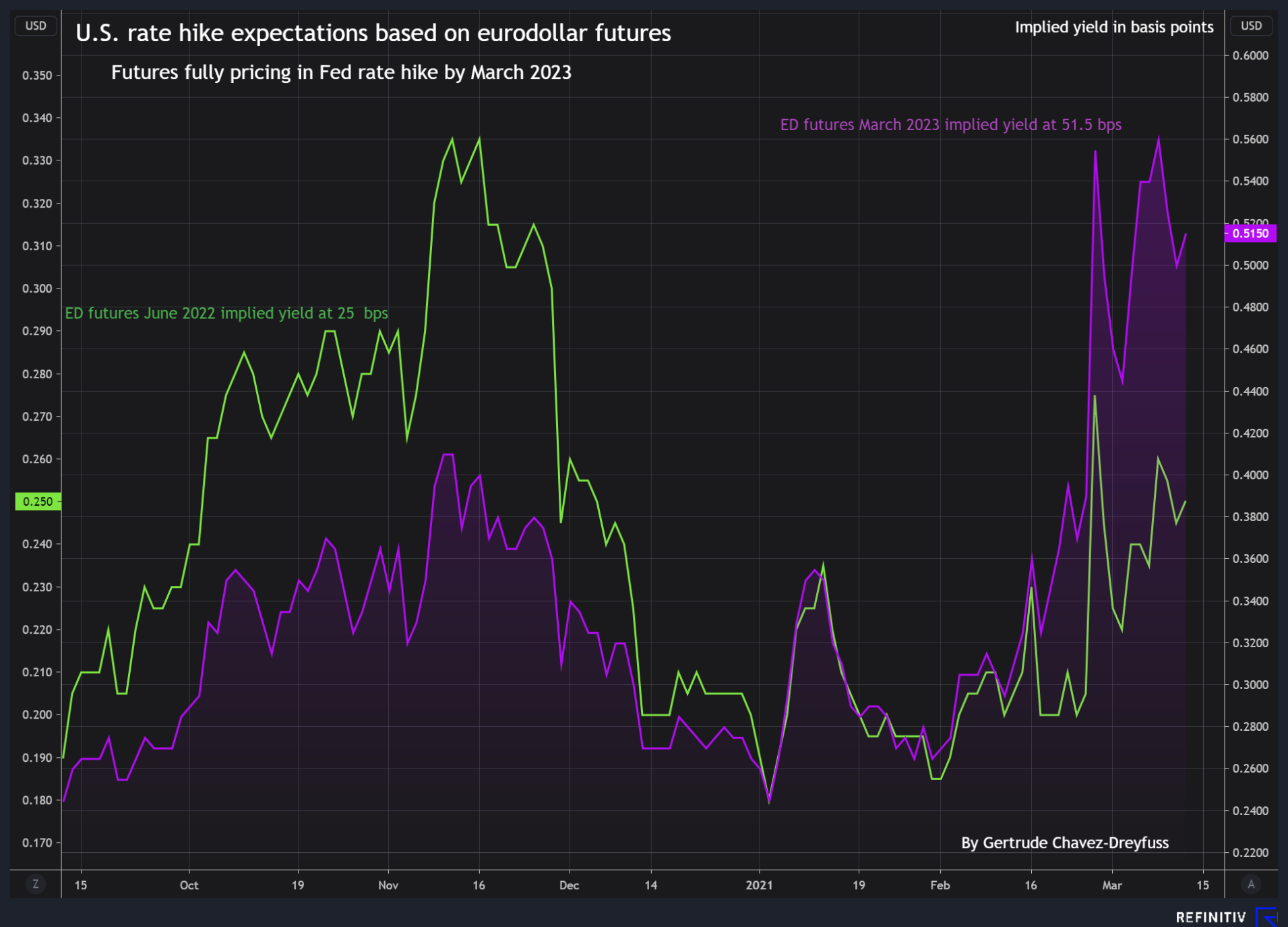

Eurodollar futures, which track short-term U.S. interest rate expectations over the next few years, are fully pricing in a U.S. rate hike by March 2023, with an implied yield of more than 50 basis points.

The March 2023 rate hike pricing has been pulled forward from late-2023 in the past few weeks, and going back to last August, as late as mid-2024.

Pricing in the futures market, however, does not guarantee the outcome it predicts. The Fed was on hold for seven years after the 2008 global financial crisis. Throughout that period, market participants had expected a rate increase within 12-18 months after the crisis, yet the Fed only resumed hiking rates in 2015.

GRAPHIC: Eurodollar futures and Fed rate hike -

Will the Fed raise IOER?

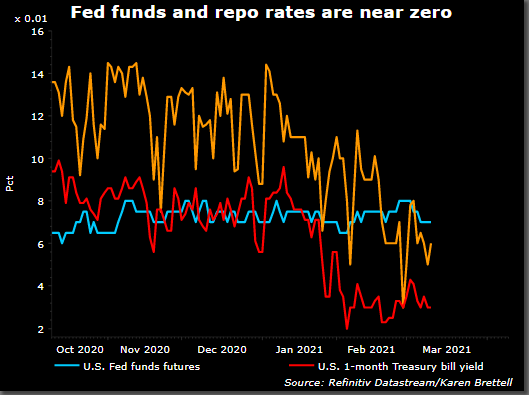

The Fed is expected to raise the interest it pays on excess reserves (IOER) if the federal funds rate, its benchmark overnight interest rate, falls below around 5 basis points, a level that would likely curb investor participation in the market and leave it vulnerable to large price swings.

So far, however, the fed funds rate has held steady at around 7 basis points. Analysts say that means that any hike may not be urgent and could be delayed until the Fed’s April 27-28 policy meeting, if it is needed at all.

Hiking or lowering the IOER - paid on bank reserve balances held on deposit with the Fed - influences other short-term rates and helps to keep the fed funds rate within its target range, which is currently zero to 25 basis points.

Tumbling yields on Treasury bills and recent disruptions in the repo market that have led some rates to trade in negative territory have increased speculation that a drop in the federal funds rate is also likely in the near-term.

GRAPHIC: Short-term rates -

Relief for banks?

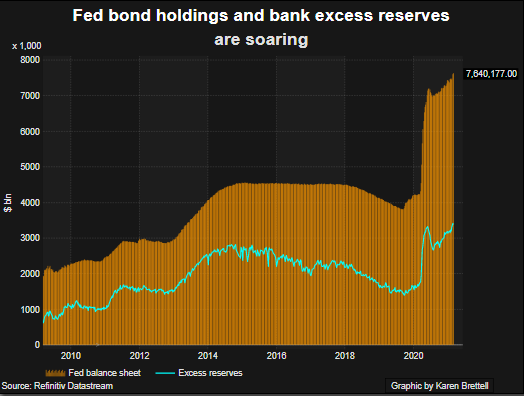

Treasury market participants will be keen to see if the Fed comments this week on whether a regulatory break that allows big banks to exclude reserve deposits and Treasuries from capital ratios will be extended.

The exemption to the supplemental leverage ratio, or SLR, is due to expire on March 31. That could mean that banks will need to sell and/or limit purchases of Treasuries, turn away deposits and reduce lending in the repurchase agreement market, which is used by investors to finance purchases of bonds.

Some big banks could struggle with the ratio as Fed bond purchases and plans by the U.S. Treasury to reduce its cash balance leave them flooded with excess reserves.

GRAPHIC: Fed balance sheet -

Investors have begun to price for the possibility that the exemption will not be extended. For the most part, however, the market expects the exemption will be continued, which could result in high volatility if it does not come through.

While the SLR may be a subject of discussion, it is not a matter for the central bank’s policy-setting Federal Open Market Committee.

Nonetheless, Powell is likely to be asked about it at a news conference shortly after the end of the meeting.

Comments