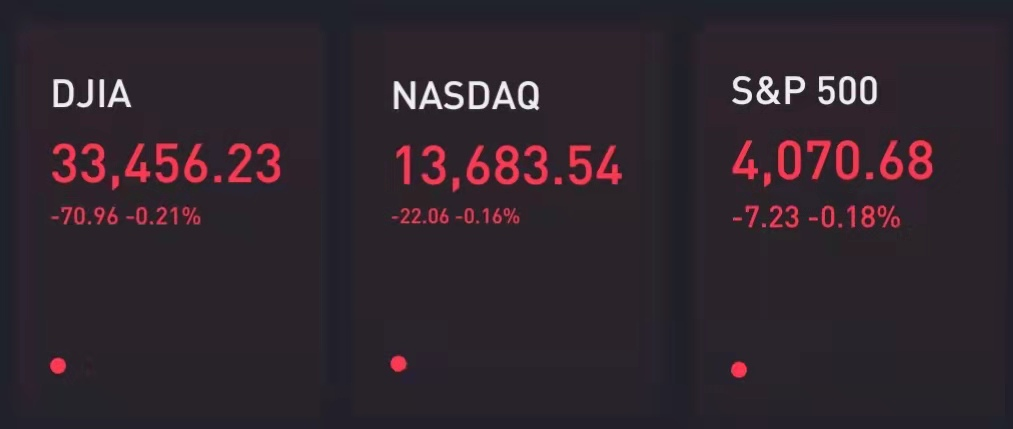

U.S. stock dipped on Tuesday after the Dow Jones Industrial Average and the S&P 500 both closed at record highs in the prior session as strong economic data boosted hopes of a smooth recovery.

The blue-chip Dow fell 80 points, while the S&P 500 lost 0.2%. The tech-heavy Nasdaq Composite dipped 0.2%.

Wall Street rallied to record levels on Monday after Friday's blowout jobs report and a surge in the gauge of services industry activity showed the economic rebound gained momentum amid accelerated vaccine rollout.

"Vaccinations are rolling out at a record clip, and historic stimulus efforts from Congress have all paved the way for continued positive market momentum," said Chris Larkin, managing director of trading and investing product at E-Trade Financial.

Bond yields had another quiet session with the 10-year Treasury yield held steady at 1.71%, easing fears of rising inflation. The 10-year rate was down slightly Tuesday morning to 1.70%.

Cleveland Federal Reserve President Loretta Mester told CNBC Monday that she is largely unconcerned by this year's run-up in government bond yields.

"I think the higher bond yields are quite understandable in the context of the improvement in the economic outlook. The increase has been an orderly increase," Mester said. "So I'm not concerned at this point with the rise in yields. I don't think there's anything for the Fed to react to."

Investors continue to assess President Joe Biden’s $2 trillion infrastructure proposal announced last week and its chance to become reality. While politicians on both sides of the aisle support funding to rebuild American roads and bridges, disagreements over the ultimate size of the bill and how to pay for it remain, including Biden’s plan to raise the corporate tax to 28%.

Biden said Monday he is not worried that a corporate tax hike would hurt the economy. Conservative Democrat Sen. Joe Manchin of West Virginia reportedly said he opposes the proposed tax hike to a level that high.

Comments