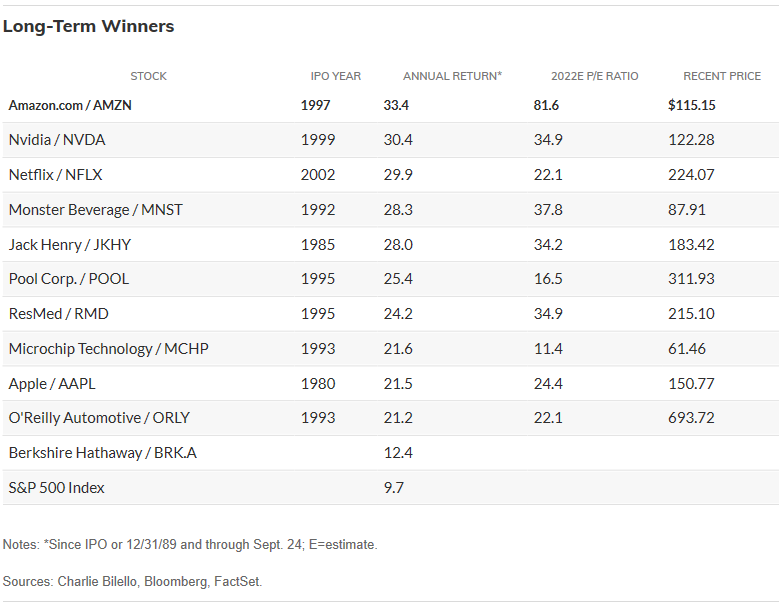

Despite tumbles this year, Amazon.com, Nvidia, and Netflix are the top-performing stocks over the past three decades, highlighting the value of holding top-quality names regardless of the short-term challenges companies face.

The tally is based on analysis by Charlie Bilello, the founder of Compound Capital Advisors, who posted his figures on Twitter. Barron's updated the figures through Sept. 23 using Bloomberg data.

The results are based on stock performance since the beginning of 1990, or the company's initial public offering date, if the IPO was more recent. It includes companies public for at least 20 years.

In addition to Amazon.com (ticker: AMZN), the best performer, both household names and some less well-known stocks made the ranking of the 10 hottest stocks. The list features Apple $(AAPL)$, Nvidia $(NVDA)$, Netflix $(NFLX)$, Monster Beverage $(MNST)$, Jack Henry $(JKHY)$, Pool Corp. $(POOL)$, ResMed $(RMD)$, Microchip Technology $(MCHP)$, and O'Reilly Automotive $(ORLY)$.

Amazon.com achieved a 33.4% annualized return since its 1997 IPO, as its stock price has risen to $116 from a split-adjusted price of 7.5 cents, marking a roughly 1,500-fold gain. Amazon earlier this year split its stock 20 for one, its fourth such move since going public. Its stock is down 31% this year, compared with a loss of 23% for the S&P 500.

Nvidia is second with a 30.4% annualized return since its 1999 IPO despite dropping 58% this year to near $124. It is one of the 10 worst-performing stocks in the S&P 500 in 2022. Netflix is down even more this year, falling 63% to near $224, but it still has gained 29.9% annually since its 2002 IPO.

By comparison, the S&P 500 is up 9.7% a year since the end of 1989 and just 6% annually since the start of 2000, when the tech bubble was peaking.

The showings for Netflix and Nvidia illustrate that big winners over the long term can experience swoons along the way.

Another great long-term performer, Berkshire Hathaway, has returned 12.4% annually since Dec. 31, 1989, and 9% a year since the beginning of 2000, a strong result but not good enough to make the list. Berkshire has risen 20.1% annually since CEO Warren Buffett took control of the company in 1965, but most of that outperformance came in the first four decades of Buffett's tenure, when his superior stock picking led to enormous gains.

Apple has matched Berkshire's long-term record since 1990 with a 21.5% annualized return. Its stock has risen to $150 from a split-adjusted price of 31 cents. The iPhone maker went public in 1980 and has compounded at nearly 20% annually since then.

Many of the long-term winners are outside the technology sector, which has been the biggest wealth creator in the stock market in the past 20 years.

Pool Corp., the subject of a recent favorable Barron's article, has expanded steadily through acquisitions to become the dominant national provider of swimming-pool supplies. It also does repair and maintenance work.

Monster Beverage, a leading maker of energy drinks, went public when its predecessor company, Hansen Foods, did a reverse merger with a public shell company in 1992.

O'Reilly Automotive, an auto-parts retailer, has scored since its 1993 IPO. Its chief rivals, AutoZone $(AZO)$ and Advance Auto Parts $(AAP)$, also have been big long-term gainers. They dominate the sector.

Jack Henry has scored by providing technology and other services to financial companies, while ResMed produces medical devices for conditions like sleep apnea and offers software services to the healthcare industry. Microchip Technology is a producer of a range of analog semiconductors and other chips.

Comments