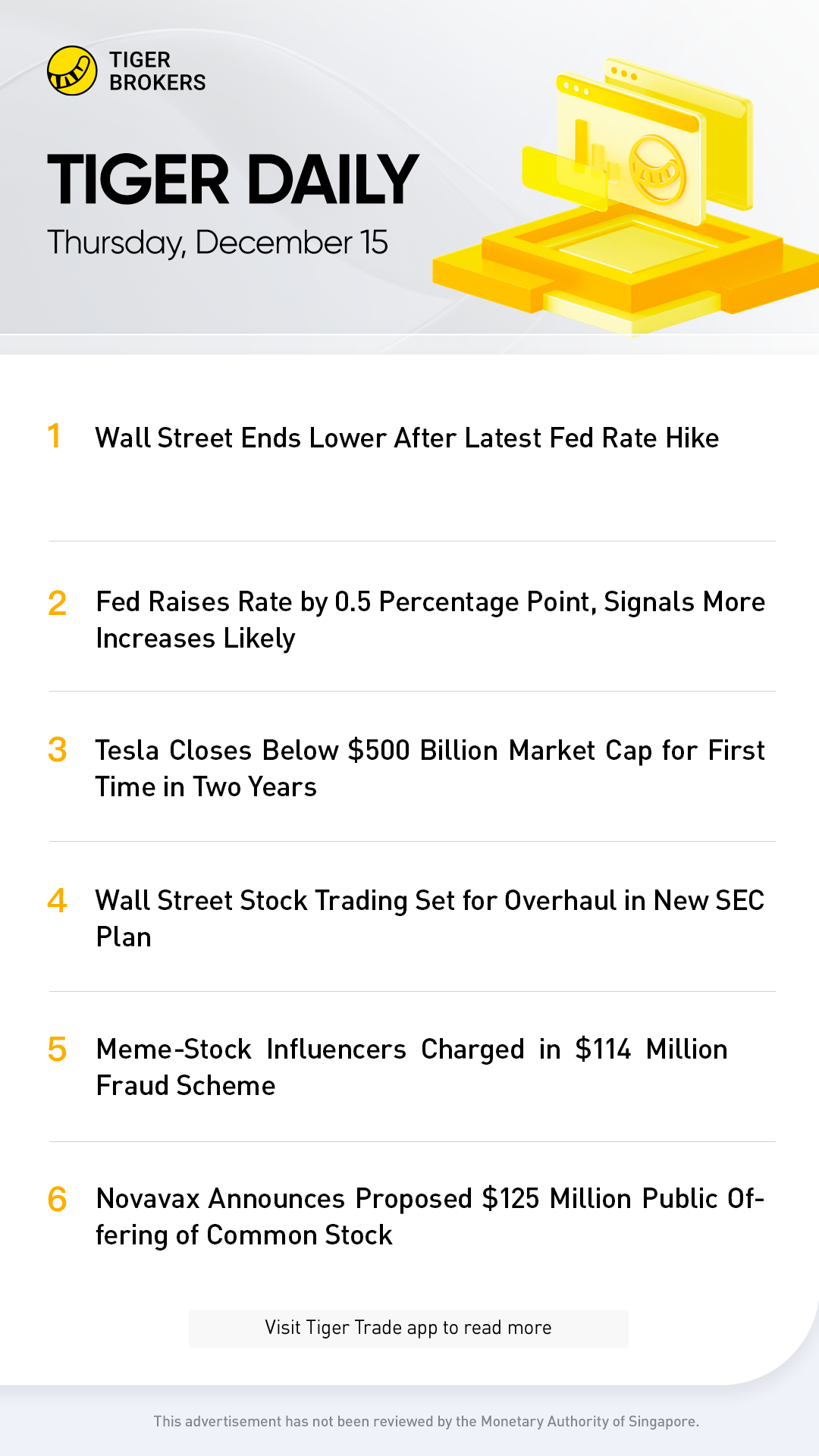

* Fed raises interest rates by 50 basis points

* Summary of economic projections sees higher policy rate

* Tesla falls after Goldman cuts price target

* Dow down 0.42%, S&P 500 down 0.61%, Nasdaq down 0.76%

NEW YORK, Dec 14 (Reuters) - U.S. stocks closed lower in volatile trading on Wednesday following a policy announcement by the Federal Reserve that raised interest rates by an expected 50 basis points, but its economic projections see higher rates for a longer period.

The central bank raised interest rates by half a percentage point on Wednesday and projected at least an additional 75 basis points of increases in borrowing costs by the end of 2023, as well as a rise in unemployment and a near-stalling of economic growth.

The Fed's latest quarterly summary of economic projections shows U.S. central bankers see the policy rate - now in the 4.25%-to-4.5% range - at 5.1% by the end of next year, according to the median estimate of all 19 Fed policymakers, up from the 4.6% view at the end of September.

In comments after the statement, Fed Chair Jerome Powell said it was too soon to talk about cutting rates as the focus is on making the central bank's policy stance restrictive enough to push inflation down to its 2% goal.

Economic data on Tuesday, which showed cooling consumer inflation for November, had heightened expectations a move by the Fed to halt rate hikes might be on the horizon next year.

“They may be using these sort of very aggressive dot plot forecasts to take any steam out of the easing that has gone on in the last couple of months," said Rhys Williams, chief strategist at Spouting Rock Asset Management in Bryn Mawr, Pennsylvania, said of Feb policymakers.

"Conditions have eased, and that is their way of jawboning they are not going to let any easing really happen until they see unemployment go up."

The Dow Jones Industrial Average fell 142.29 points, or 0.42%, to 33,966.35, the S&P 500 lost 24.33 points, or 0.61%, to 3,995.32 and the Nasdaq Composite dropped 85.93 points, or 0.76%, to 11,170.89.

Nearly all of the 11 major S&P sectors ended the session in negative territory, with healthcare the sole advancer. Financials, down 1.29%, were the worst performing sector.

Despite the Fed statement, U.S. Treasury yields were slightly lower after initially jumping in the wake of the announcement.

The strategy of aggressive interest rate increases by major central banks around the world this year has increased worries the global economy could be pushed into a recession and weighed heavily on riskier assets such as equities this year.

Each of the three major averages on Wall Street are on track for their first yearly decline since 2018, and their biggest yearly percentage decline since the financial crisis of 2008.

Tesla Inc slipped 2.58% after a Goldman Sachs analyst trimmed the price target for the electric-vehicle maker's stock.

Charter Communications Inc tumbled 16.38% as brokerages cut their price targets following the telecom services firm's mega-spending plans for a higher-speed internet upgrade.

Volume on U.S. exchanges was 12.15 billion shares, compared with the 10.55 billion-share average for the full session over the last 20 trading days.

Declining issues outnumbered advancing ones on the NYSE by a 1.39-to-1 ratio; on Nasdaq, a 1.42-to-1 ratio favored decliners.

The S&P 500 posted eight new 52-week highs and two new lows; the Nasdaq Composite recorded 82 new highs and 223 new lows.

Comments