Why the S&P 500 can be expected to bottom in April or May and post a double-digit gain by March 2024.

Plunge followed by quick recovery is the stock market’s typical pattern in economic crises.

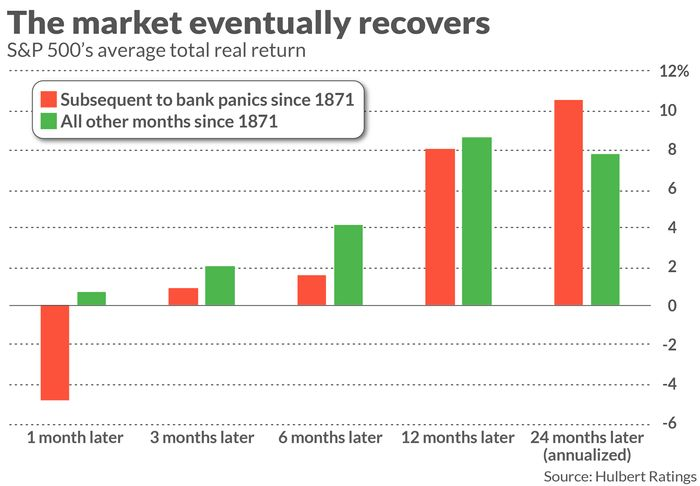

The S&P 500 could beat inflation by 8% over the next 12 months. That cheery prospect emerges from an analysis of the U.S. stock market's reaction to past banking panics. Though stocks not surprisingly declined in the immediate wake of those past crises, they almost always recovered quickly. On average a year later, the market was well above where it stood before the crisis erupted.

To conduct this analysis, I focused on banking panics in the U.S. since 1870, according to a database compiled by Matthew Baron of Cornell University, Emil Verner of MIT, and Wei Ziong of Princeton. On average, the stock market's post-panic low was hit within two months of the panic's onset. Furthermore, in an average of just five months the S&P 500's total real return index was higher than where it was prior to the panic's onset. At the panics' one-year anniversary, the index was 8.0% higher, on average.

If the stock market follows a similar script in the wake of the current banking crisis, the S&P 500 will hit a low sometime this April or May and then rally strongly -- eclipsing its early-March level by the end of the summer and, by March 2024, sitting on a double-digit gain in nominal terms over where it stood recently. (This nominal gain reflects the average one-year post panic return of 8% real, plus inflation; see accompanying chart.)

These averages gloss over considerable variation from panic to panic. The longest recovery time for any panic since 1870 was for the one that occurred most recently, in September 2008. It took the S&P 500 six months to finally hit its low, and more than an additional year for the S&P 500 to be higher than where it stood prior to the panic's onset.

You shouldn't be particularly surprised by the overall averages. The "plunge followed by quick recovery" pattern is the stock market's typical reaction to geopolitical and economic crises, not just bank panics -- as I've written before.

Probably the worst thing you can do, from an investment point of view, is to sell into a panic. Odds are good that, by doing that, you'll get highly unfavorable outcomes.

Unless you were lucky enough to get out of stocks before the SVB- $(SIVB)$ and Credit Suisse (CSGN.EB)-triggered panic, the best course of action is to hold on for the anticipated recovery. History suggests that, in not too many months, you will be glad you did.

Comments