Netflix$Netflix(NFLX)$ 's financial report started the Q2 technology stock financial report season, and it was very exciting when it came up.

1.

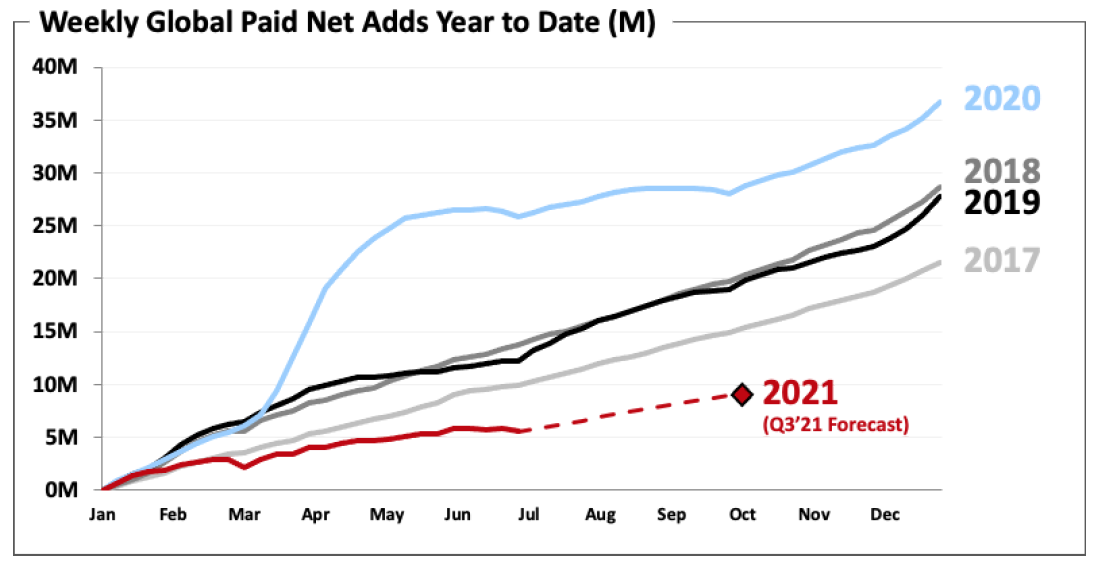

The market expectation is already very low. Before, the market consensus was to add 1.2 million users, but in fact it was 1.53 million. However, considering that it was 10 million users in the same period last year, it is difficult to compare. But look at the curve and combine 20 and 21 years, which is an average level.

But the problem is that North America has experienced the first decline, with a net loss of 430,000 users. This is a bad omen. Although Q2 is not a strong period for Netflix dramas, and the base has been pushed too high before, turning around for whatever reason means that the first wave of dividends is exhausted.

2.

Netflix started playing games. I'm not surprised at this, but it needs to do mobile games instead of more scene-based end games or console games, which shows that its purpose is very clear, that is, to make quick money. Then I'm still a little worried, because what mobile games need is channels. I can't think of other channels that Netflix has advantages except Netflix platform, and social communication is out of touch.

3.

Streaming media officially began to roll in. The volume is not necessarily from the traditional IP of Disney + or HBO +, or even YouTube and Tik Tok. From the user's point of view, UGC video is more realized and interactive, and it is easy to form a community (fan economy). However, the cost of OGC is too high, and it depends on the audience's taste. If a dish is screwed up, it will hurt. Disney has MCU at least, HBO can still feel the IP of DC in a big deal, and Netflix is pure and original, but it is not the kind of "indecision, quantum mechanics" that tells the story of the multiverse.

4.

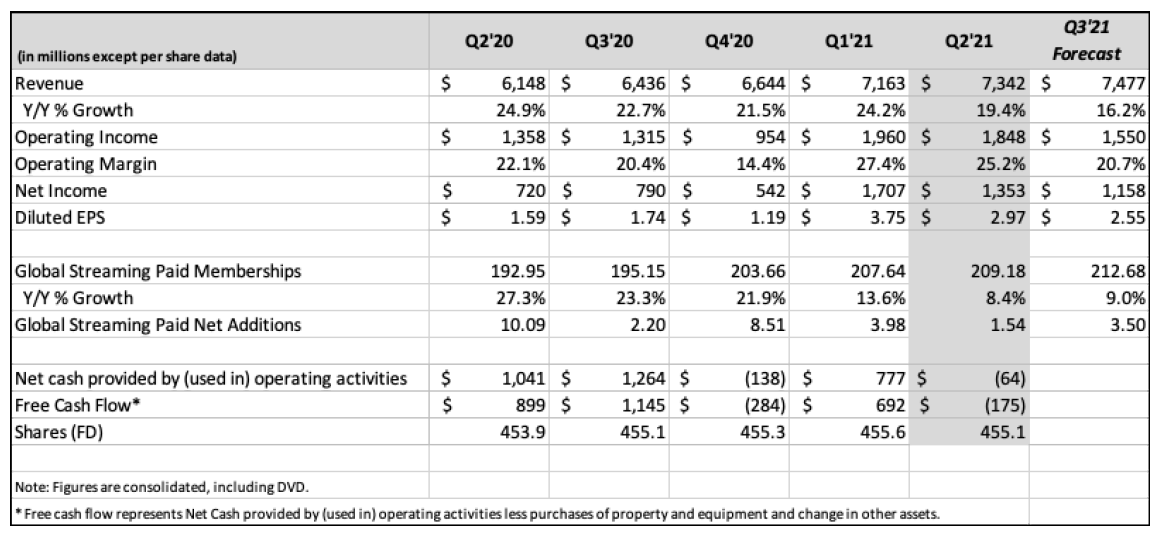

Netflix may not have much surprise in its share price in the next few quarters unless the epidemic worsens extremely again. If the market does not fall, Netflix's repeated ups and downs should be the main theme. Of course, it is also possible that the organization will start to abandon it and enter the downlink channel, but it is totally unnecessary for the organization. After all, the company's operational efficiency is improving, and it also buys back.

So shorting Netflix is not a good choice. Of course, if you have enough capital, it is ok to earn IV through option strategy, but with such a high price of Netflix, more individual investors may still not be able to play.

Therefore, if you want to seize this market opportunity, you may look at its competitors, such as$Disney (DIS) $$Comcast (CMCSA) $$Google (GOOG) $(YouTube) and$Amazon (AMZN) $. If Netflix's growth is not high, and the latter ones are growing well, it still shows that users are choosing content providers.

Of course,$Roku Inc (ROKU) $It is not the same logic as Netflix. ROKU is only a downstream distributor of Netflix. Hardware does not make money, but mainly relies on CTV advertising to make money. Unless NFLX performs extremely poorly and affects CTV business, it will not have much impact. After all, NFLX is not working, Prime or YouTube is on top. But ROKU's problem is that the valuation is not low, and CTV is overdrawn because of its rapid growth.

To sum up, if you want to play streaming media, you should play something with stronger growth momentum.

Comments