Many important things happened over the weekend, including the agreement in principle on US debt, the normal operation of the domestic large aircraft C919 COMAC, and the release of the Turkish election results.

Since the European and American financial markets are closed for holidays, the closure also means that the EIA related to crude oil fluctuations and the small non-agricultural ADP data related to gold fluctuations are released on Thursday instead of Wednesday,The highlight of Wednesday is the second step.

"Referring to the script of one, two and three steps, reaching a principled agreement on debt over the weekend is actually equivalent to realizing the first step. Of course, due to the closure of European and American financial markets, the real volatility has not been released. If the bill does not pass in Congress on Wednesday, it may enter the script of the second step.

Keep in mind that even if the bill is passed in Congress on Wednesday, it does not mean that US stocks will sit back and relax-

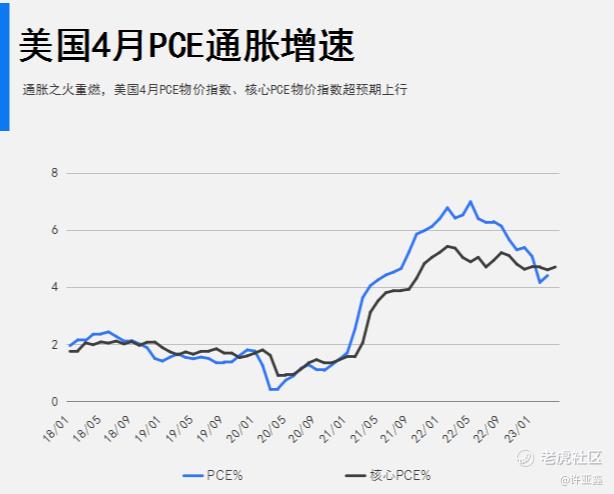

On the one hand,As the Fed's favorite inflation indicator, the core PCE, is still higher than expected, the market bets that the probability of continuing the rate hike by 25 basis points in June will rise to 66.5%, which will continue to put pressure on the stock market;

On the other hand,Even if the debt ceiling agreement is successfully passed to improve market sentiment, the issuance of new US bonds in the short term will still bring great pressure on liquidity in the market.

The data shows that the core PCE price index excluding food and energy increased by 4.7% year-on-year, exceeding expectations by 4.6%, and the previous value was 4.6%; It rose by 0.4% month-on-month, which was also 0.3% higher than the previous and expected values.The growth rate reached a new high since January 2023.

Therefore, Based on the huge cost of US dollar credit collapse caused by US debt default, the financial market as a whole believes in the "extreme game" between the two parties in the United States, but it can finally reach the expectation of debt agreement.

As mentioned, it will inevitably bring some "accidents", and even make the situation look out of control, which is also the huge fluctuation risk of financial market in the process of game.

Since the market has risks, it certainly means that the market has opportunities.Let's go back to the domestic market and have a look.

Taking the recent pessimistic point of October 2022 as an example, many investors chose to leave at the most pessimistic moment of the market in October 2022, and then many people chose to return in January and February 2023. The specific behavior is in January and February, the earnings forecast of a large number of individual stocks was raised.

As shown in the above figure, since May, investors' pessimism has achieved a comprehensive spread of multi-assets and multi-industries, and the expected degree of future profit forecast is very close to the upward degree in January and February.

Whether you agree with value investment or leveraged speculation, it doesn't matter. What matters is to find a way to make yourself have continuous cash flow.

Whether investing or speculating, it is essentially a game. If you play a game, you must not put in coins first. If you want to put in coins, can you not have coins first? !

-END-

$SP500 Index Main Connection 2306 (ESmain) $$Dow Jones Main Link 2306 (YMmain) $$NQ100 Index Main Connection 2306 (NQmain) $$Gold Main Connection 2306 (GCmain) $$WTI Crude Oil Main Link 2307 (CLmain) $

Comments

鑑於目前的市場形勢,跟隨人工智能的趨勢就行了

How long has this been dragging on? It's about time they reached a consensus.

no matter how fast or slow he is, achieving the goal is certain.

This is just a game, a dream.