Wednsday, FOMC will announce the June interest rate decision. Before that, the May CPI data, especially the core CPI, released on Tuesday (June 13th), will serve as the final important guidance. Apart from investors' focus on whether the Federal Reserve's monetary policy will "pivot," they will also pay attention to the dot plot of interest rates and the summary of economic projections. Of course, Powell's remarks at the post-meeting press conference are also essential.

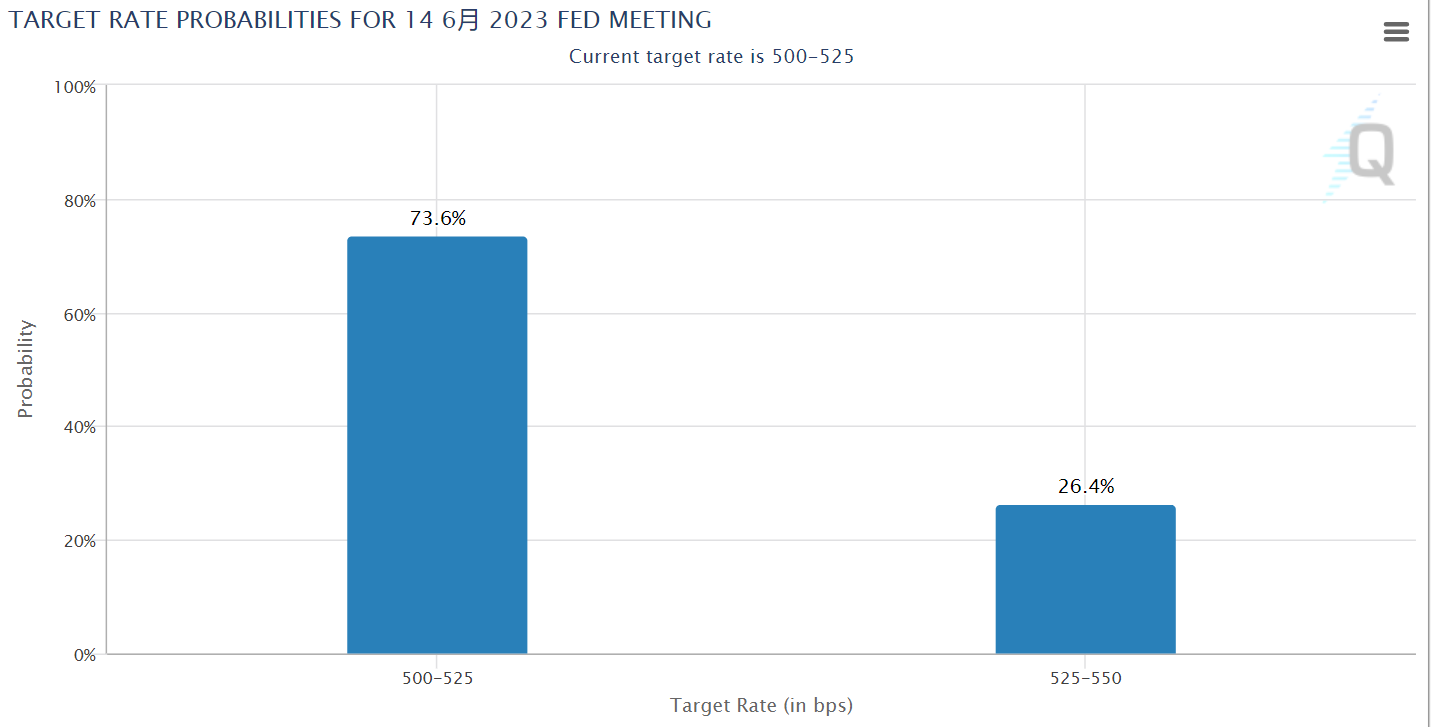

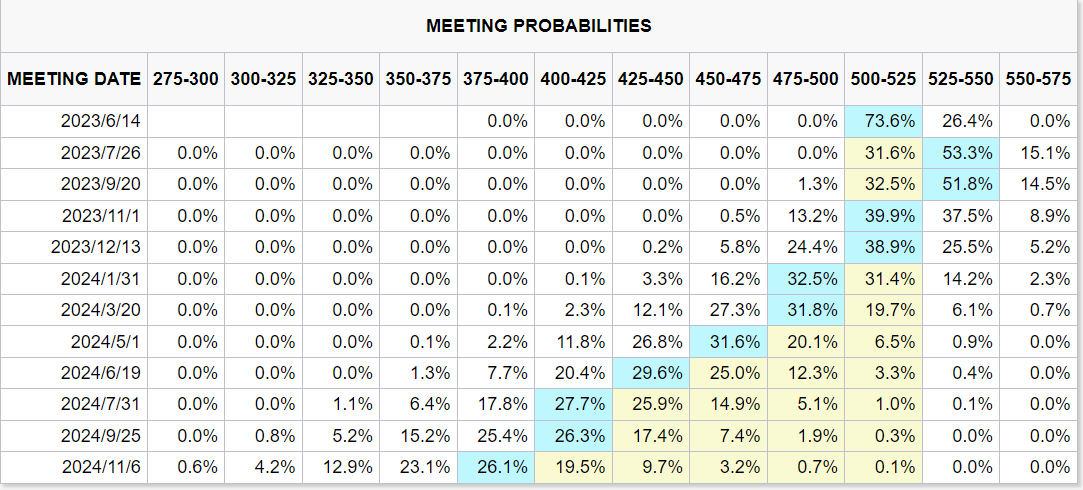

Currently, there is a relatively high consensus in the market regarding the expectations for the June FOMC meeting. The baseline scenario is that the Federal Reserve will "skip" the rate hike in June and maintain the status quo, but at the same time, it will emphasize that this round of rate hikes is not yet over, hinting at the possibility of further rate hikes, possibly in July or other times in the second half of the year. The Federal Reserve is also expected to raise the end-of-2023 target range for the federal funds rate to 5.25% to 5.50%.

However, the market is currently implying that after skipping the rate hike in June, there will be one rate hike in July and a reversal back in December. Pay attention to the remarks after the meeting. In fact, the market has already priced in a dovish outcome (skipping the rate hike) for this meeting, but Powell, out of cautious consideration, must convey hawkish information in his language. The most likely result is that interest rates will stay at high levels for a longer period.

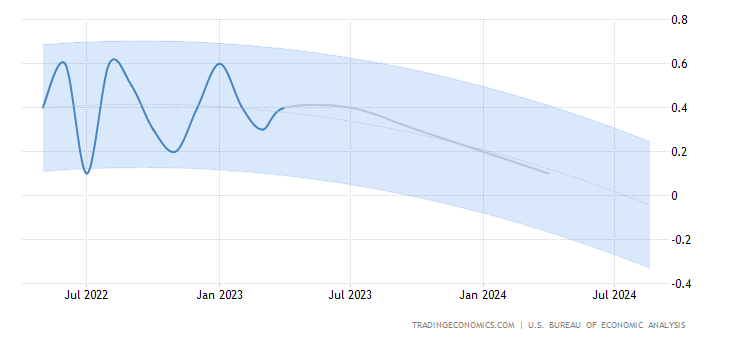

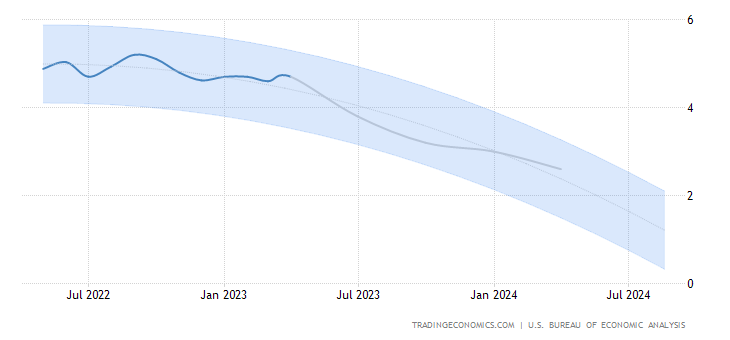

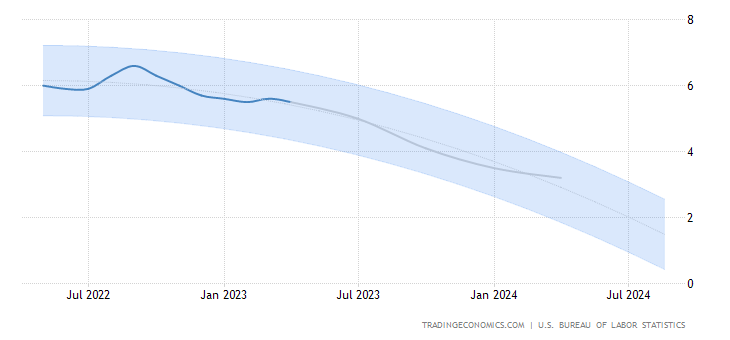

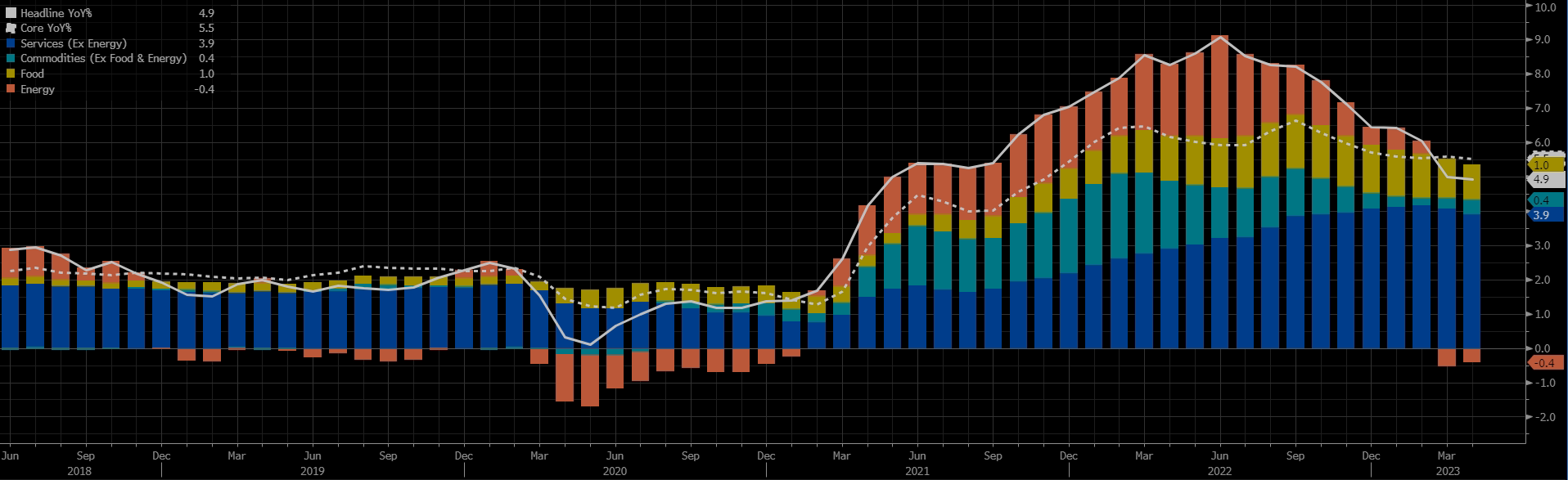

Pay attention to the inflation outlook. The Federal Reserve needs more time to observe the changes in inflation data while expressing concerns about economic recession and inflation stickiness. In particular, core PCE inflation is worth noting. Since the beginning of the year, the pace of decline in US PCE inflation has been slower than the Federal Reserve's expectations. The seasonally adjusted monthly average of the PCE price index from January to April is 0.34%. If this growth rate continues until the end of the year, it will reach an annualized growth rate of 4%, higher than the Federal Reserve's previous expectation of 3.3%. Therefore, if the subsequent decline in PCE inflation does not meet expectations, the Federal Reserve will adjust its annual projections promptly.

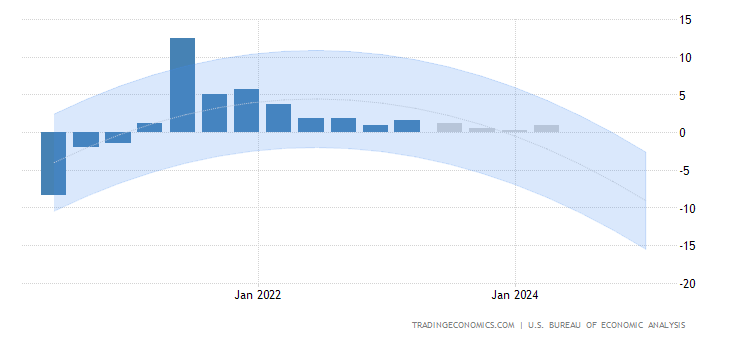

Pay attention to GDP changes. As expectations of a recession gradually diminish, the market also believes that the current economy is more resilient, and the Federal Reserve's expectations for the future economy will be more optimistic. According to the forecast of the Atlanta Fed's GDPNow model, the quarterly seasonally adjusted annualized growth rate of GDP in the second quarter is expected to be around 2.2%, indicating that the US economy is not currently entering a recession. The Federal Reserve may also raise its forecast for year-end GDP growth, which would be a more positive signal to the market.

Currently, the consensus in the market for May CPI is a year-on-year growth of 4.1%, with most analysts' expectations ranging from 4.0% to 4.1%. The consensus for core CPI is a year-on-year growth of 5.2%.

Comments

Will the Federal Reserve announce a rate hike in June or maintain the status quo?

What impact will the May CPI data have on FOMC's interest rate decision?

Is there anything we can do to control the rising CPI?

Why is the CPI expected to increase by 4.1% in May?