before the interest rate meeting here, there were four combinations of the Federal Reserve's interest rate meeting in June:

First, rate hike 25 basis points + doves press conference;

Second, rate hike 25 basis points + hawkish press conference;

Third, stay put + doves press conference;

Fourth, stay put + hawkish press conference.

Obviously, if the Fed chooses 3, then precious metals will soar, and if it chooses 2, then precious metals will plummet. Both of them are actually small probabilities, and the final cash should be 1 and 4, while I firmly believes that it is 4,That is, before the interest rate meeting, bulls have an advantage, but the press conference is likely to be hawkish and market will dive.

It's a pity that the volatility of gold price is limited in the end, and it didn't reach around 1980. Otherwise, this empty order would be quite perfect if it was put into the market, right? !

Some people think that the Fed's interest rate meeting and Blinken's visit to China have nothing to do with each other. Why did I have to involve the two?

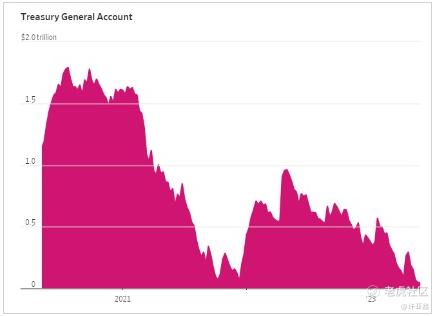

On the surface, it is true, but in fact there is a dark line linking them.That is US debt.For the Fed, the most urgent thing in June is not to go to rate hike to fight inflation, but how to quickly replenish the TGA account when the debt ceiling crisis eases. Is it a priority? !

According to the latest report, supplemented by QT of the global central bank and TGA account of the US Treasury Department,The global liquidity will be reduced by more than 1 trillion US dollars in the next 3-4 months, which may be close to 1.5 trillion US dollars.

Therefore, unless the Federal Reserve is the enemy of the US Treasury, suspending rate hike will be the best choice at this juncture. Do you still need to guess one of the main purposes of blinken's visit to China?

However, I believe that after the "severe beating" of the market in recent years, everyone should not have high expectations for this time. Instead of paying attention to him, it is better to pay attention to this news:

Microsoft founder Bill Gates tweeted on June 14th that he had arrived in Beijing and visited China for the first time in more than three years.

So far this year, most familiar CEOs of American multinational companies have visited the dock, including Tesla, JP Morgan Chase, Apple, Citigroup, Pfizer, Starbucks, Qualcomm and so on. Will these business leaders have poor vision? We must still see that the Chinese market is very important to the United States and the key role of business in Sino-US relations.

When we go back to the Fed, the Fed ended up holding the benchmark rate at 5.00-5.25% overnight, but the bitmap sends a more hawkish signal.Hint that there are still two rate hike this year (bad for precious metals).

First, the interest rate level.Stay still at 5%-5.25% and keep interest rates unchanged will be able to evaluate more data and continue to sell Treasury Bond and MBS plans.

Second, the prospect of interest rates.The median bitmap is expected to rise by 50BP to 5.6%, suggesting that rate hike will cut interest rates four or five times by the end of next year. Powell said that the suspension in June should not be called "skipping rate hike", and decisions will be made at successive meetings according to the data. It is inappropriate to cut interest rates this year, and it has been discussed to cut interest rates in the next few years.

Third, the inflation outlook.Inflation has eased, but it is still at a high level. There is still a long way to go to reach the target of 2%. Only "early signs" of falling inflation in service industry have been seen, and there has not been much progress in core PCE. I hope to see this data drop significantly.

Fourth, the economic prospects.The expected median unemployment rate at the end of 2023 is lowered to 4.1%, and the expected median GDP growth rate in the United States at the end of 2023 is raised to 1.0%. The tightening of household and corporate credit conditions may put pressure on economic activities, recruitment and inflation, but the degree of impact is unknown. The gradual cooling of the labor market may help the economy achieve a soft landing.

CICC Research Report pointed out that the Federal Reserve intends to slow down the rate hike. Powell mentioned in his speech that the Fed's monetary tightening is divided into three dimensions-The speed and height of rate hike and the length of time that interest rates stay at high levels.

As rate hike's role appears in interest rate sensitive sectors such as real estate and banking, the Fed no longer needs to make great strides in rate hike as quickly as last year. The purpose of "skipping" rate hike at this June meeting is to slow down the speed of rate hike, which is also conducive to reducing financial risks. However, Powell also stressed at the meeting that rate hike's speed and height are two different things. Slowing down rate hike does not mean that rate hike will no longer be there, but to see more clearly and make more accurate decisions.

Look at the picture, at present, the market has not fully digested the expectation of rate hike twice and accumulating 50 basis points in the future. So,Next, the support below is facing a test, which is a matter of high probability. It is best to be able to break down, and then......

-END-

NQ100 Index Main Connection 2206 (NQmain) $$Gold Main 2206 (GCmain) $$Dow Jones Main Link 2203 (YMmain) $$2205 (NGmain) $$WTI Crude Oil Main Line 2206 (CLmain) $

Comments