With the release of May CPI and the June FOMC meeting, the U.S. stock market has experienced some brief fluctuations and adjustments. The big tech companies continue to reach new highs due to the influx of funds, while some previously oversold stocks in the consumer sector have also seen opportunities for a rebound (CP retracement). The overall U.S. stock market is currently at a relatively expensive level.

After stocks reach new highs, investors often consider hedging or taking profits to a certain extent. Therefore, covered calls have become one of the best choices.

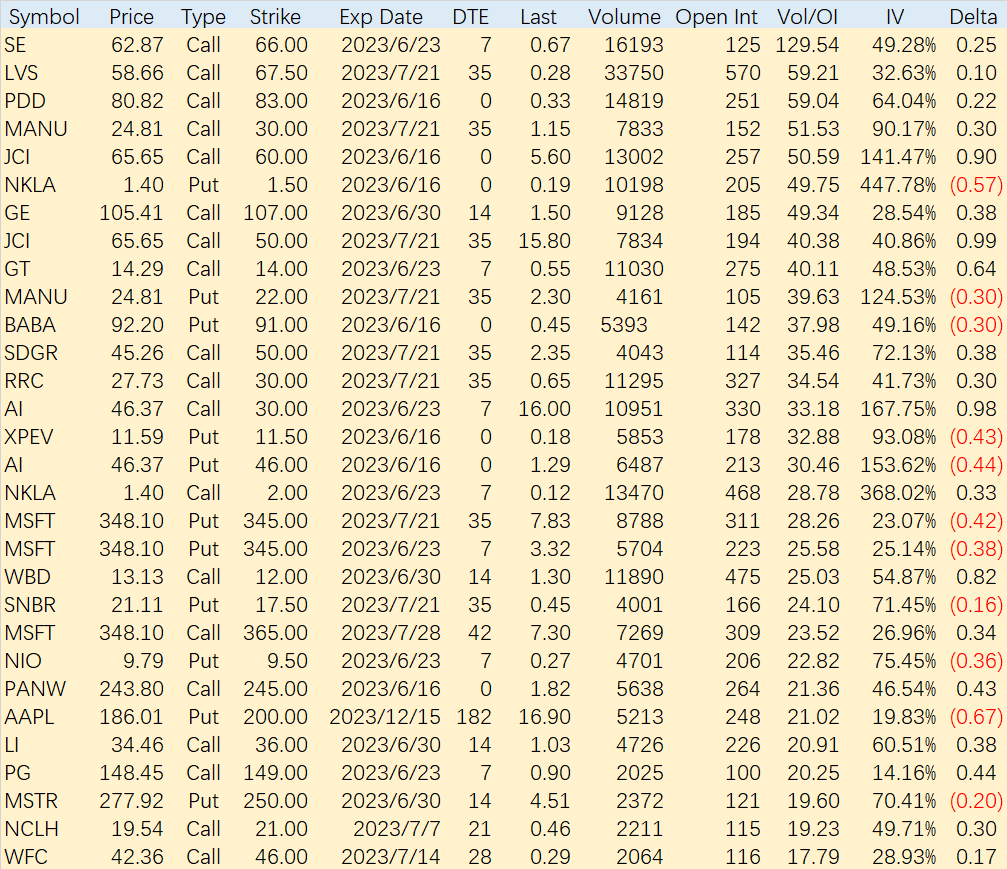

Looking at the significant transactions on June 15th, we can see that there were varying degrees of large call orders for $Sea Ltd(SE)$ $Pinduoduo Inc.(PDD)$ $Las Vegas Sands(LVS)$ $Manchester United PLC(MANU)$ $General Electric Co(GE)$ $Johnson Controls(JCI)$ Based on the timing and exercise prices, these orders were mostly for covered calls.

Interestingly, meme stock $C3.ai, Inc.(AI)$ which has experienced a surge due to its name recognition, also reached a new high for the year. However, investors have chosen a different approach to "covered calls" by directly selecting deep in-the-money calls (with a $30 strike price while the current price is $46). Of course, there were also significant orders for $40 puts.

Furthermore, there is still significant interest in end-of-day put options. Why do these investors favor selling end-of-day put options?

It's probably because recently there have been many bullish targets, and using end-of-day options offers higher probabilities and returns. For large investors, it's simply a way to utilize idle funds (since interest rates are currently high and funds should be kept working). Examples include Chinese concept stocks $Alibaba(BABA)$ $NIO Inc.(NIO)$ $XPeng Inc.(XPEV)$ . Of course, Chinese concept stocks are influenced by many factors, and currently, there is a greater emphasis on oversold rebounds.

Comments