— Or just picking you up in reverse?

After reaching its peak with an opening stock price of $351 on June 16th, the stock price of the tech giant $Microsoft(MSFT)$ started to decline and by the close on June 26th, it had fallen back to the levels of late May. Other tech giants have also experienced varying degrees of retracement recently, and $NVIDIA Corp(NVDA)$ , the strongest chip stock due to increased demand for AI, has experienced its largest drop in a month. Is AI cooling down?

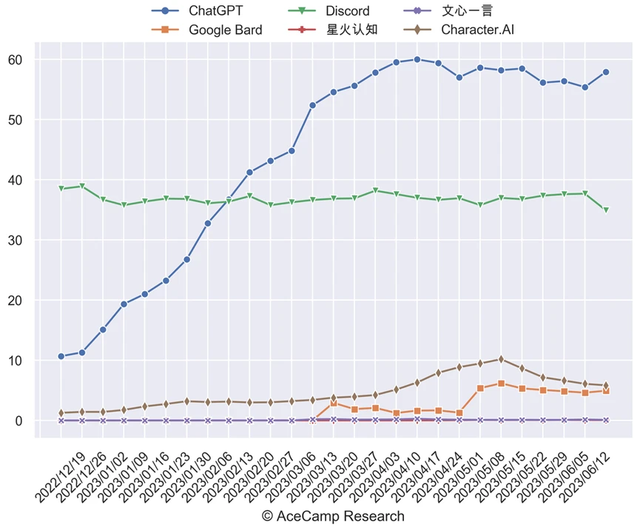

As for ChatGPT, according to SimilarWeb data, the growth in ChatGPT's traffic has noticeably slowed down recently, with a continuous decline in month-on-month comparison due to a larger base. Unless there are unexpected developments in June, the traffic is expected to decline compared to the previous month. Of course, this issue is not unique to ChatGPT; all AI bots are facing the same challenge. The chart below shows the growth in the number of users using AceCamp based solely on site access statistics (excluding API interfaces).

Whether it's a decrease in user novelty, a decline in popularity, or a temporary stagnation due to the company's subpar progress in content output optimization, the temporary slowdown does not indicate a lack of potential in the product itself. At the same time, since April, ChatGPT has also taken some measures to suspend certain accounts. On the one hand, this helps alleviate server pressure, and on the other hand, it eliminates the use of some negative accounts.

On the other hand, Google is using AlphaGo's technology to develop an artificial intelligence system called "Gemini," which can not only understand and generate text and code but also comprehend and generate images. However, this process will take several months. This also means that after experiencing the initial excitement and frenzy of tracking AI progress at the beginning of the year, users and investors are gradually slowing down the pace, which is a common phenomenon after any trendy affair.

Valuation and market performance

Except for the AI company $SoundHound AI Inc(SOUN)$ , which soared 10% against the trend due to its potential inclusion in the $iShares Russell 2000 ETF(IWM)$ other AI tech companies experienced a retreat during intraday trading on June 26th. NVIDIA (NVDA) fell by 3.74%, $Advanced Micro Devices(AMD)$ dropped by 2.27%, cloud infrastructure company $Snowflake(SNOW)$ declined by 4.72%, and even meme stock $C3.ai, Inc.(AI)$ decreased by 4.28%. This seems different from the continuous AI frenzy of the past month.

The market's concerns are focused on the following points: 1) The probability of a rate hike in the July Federal Reserve meeting increases, putting continued pressure on growth stocks. 2) The recent high increases in stock prices push up company valuations, to some extent increasing the risk of retracement.

We believe that since the banking crisis earlier this year, the stock market has been relatively optimistic about overall inflation and the Federal Reserve's interest rate decisions for the year. To some extent, it has overestimated the loose expectations. On the other hand, high inflation and high-interest rate environments have a greater impact on the consumer industry. Therefore, secondary market funds often seek assets with lower inflation correlation and higher growth potential. Furthermore, expectations of a recession have weakened after the Q1 earnings season and the release of recent macroeconomic data, leading to a gradual decline in previously anticipated recession expectations.

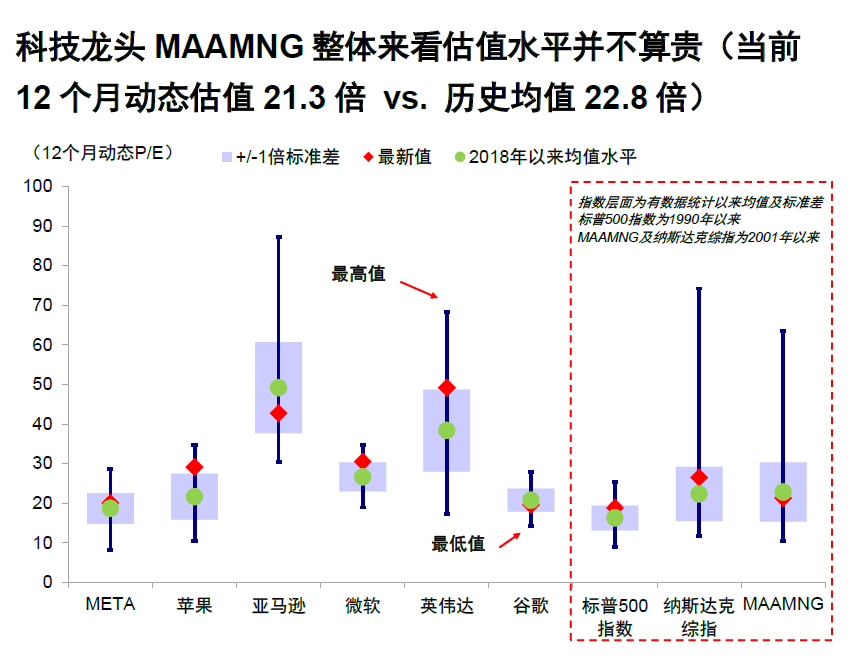

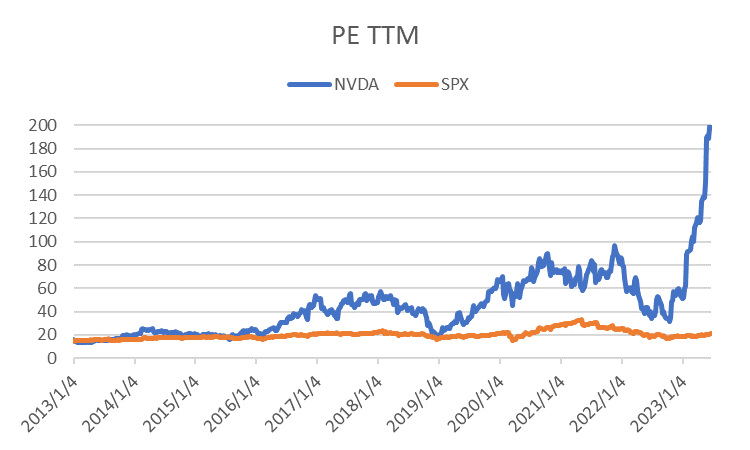

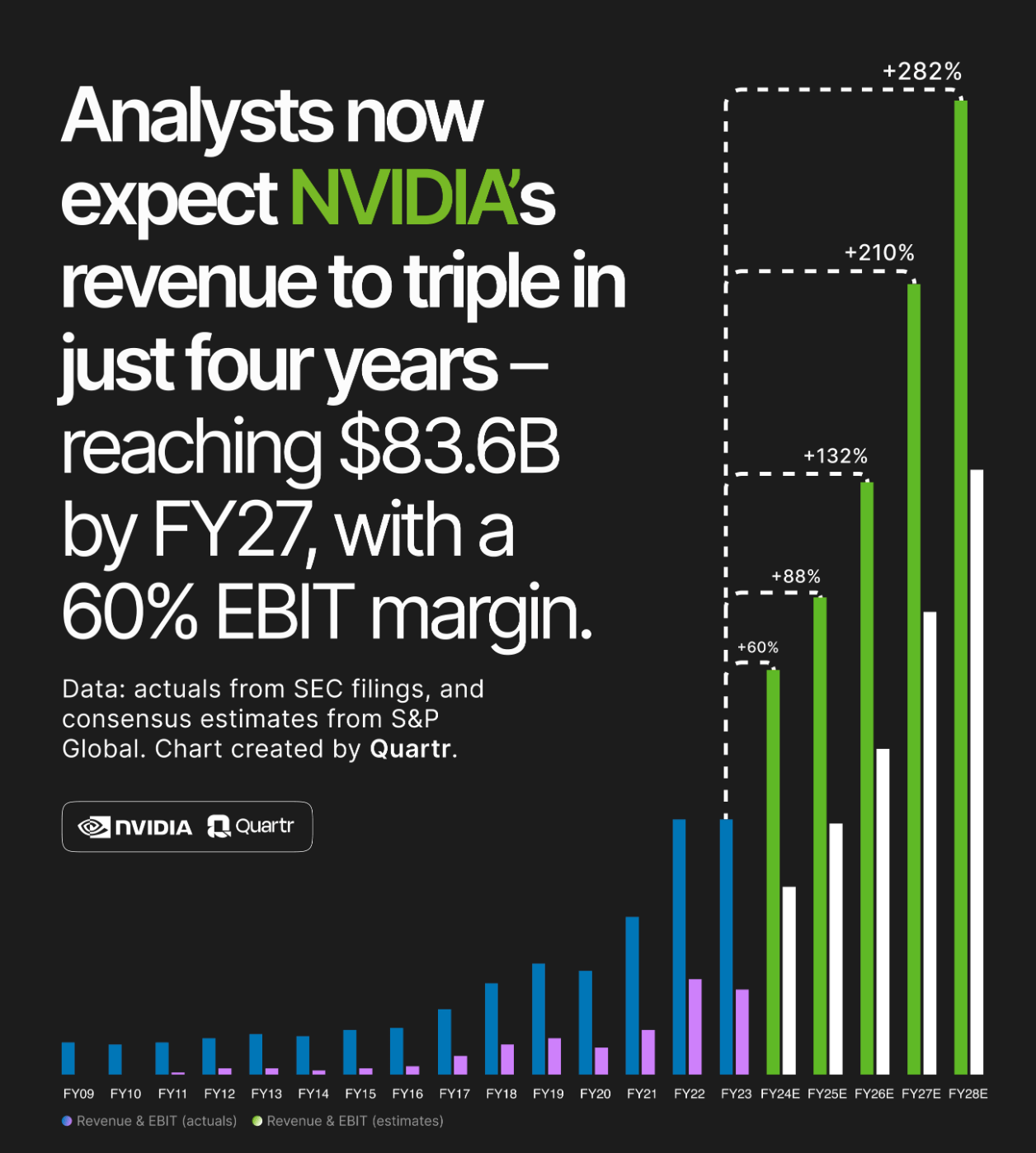

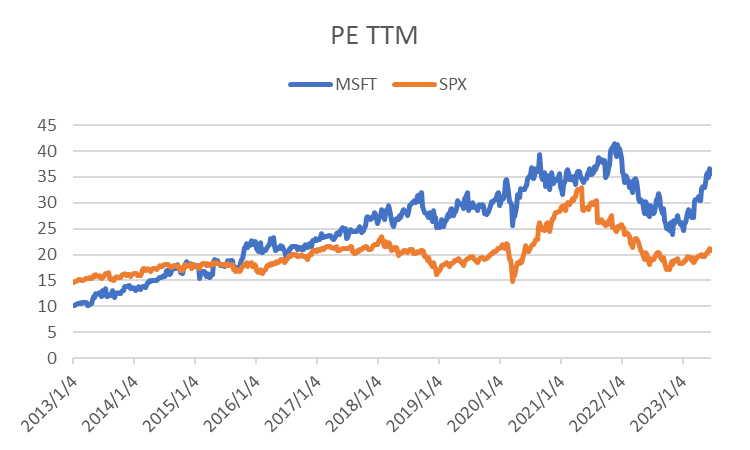

In terms of valuation, as we mentioned earlier, the overall index is still at high levels, but the valuations of major tech companies have not increased further (calculated within +/-1 standard deviation). Among them, NVIDIA (NVDA), Microsoft (MSFT), and Apple

Meanwhile, it is below the historical average level. NVIDIA's price-to-earnings ratio is 204 times, and the current market pricing implies that the company must achieve a compound annual growth rate of at least 50% until 2028, with an adjusted operating profit margin of at least 42.5%. This also means that the company will reach a market share of over 60%.

Of course, the market may have even higher expectations.

Microsoft's price-to-earnings ratio is 35.7 times.

Lastly, we cannot overlook $Apple(AAPL)$ , although it never promotes itself as an AI company, Apple is an indispensable player in the AI industry. The main difference between Apple's AI and other companies lies in their business model. Currently, Apple's price-to-earnings ratio stands at 31.7 times, which is above the historical average level.

Comments

The growth in ChatGPT's traffic is on a rollercoaster ride, but it seems to be heading for a downhill slope!

AI bots are facing a traffic jam? Looks like they need some traffic control emojis!

Microsoft's stock price took a dive faster than my heart rate during a horror movie!

Oh, you think the stocks are picking us up? More like dropping us off at the wrong stop!