On the first trading day of July, three hours before closing, perhaps due to the rush to join in the festivities of the US Independence Day (July 4th), the bears seemed weak and lacking energy. The overall market saw a slight increase with the S&P 500 (+0.12%).

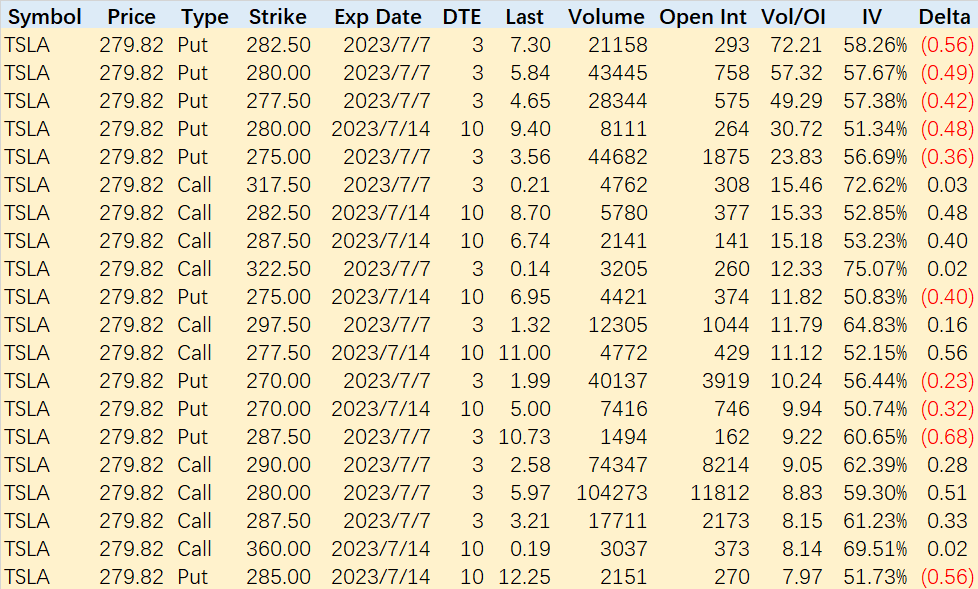

Leading the way were $Tesla Motors(TSLA)$ with better-than-expected vehicle deliveries (+6.89%), causing investors who previously thought Tesla's upward momentum had fizzled out to return. In terms of option activity, large trades once again appeared, as trading was very active around the $280 price level due to yesterday's opening. The number of large trades also increased, closing at $279.82. Currently, all PUT options with an exercise price at or above $280 are still in the money, but there is a relatively high number of Covered CALL options with exercise prices above $280, indicating a divergence of opinions at this level between bullish and bearish sentiments.

At present, Tesla is one of the top-performing companies in the S&P 500 in terms of year-to-date gains. If this upward surge continues, it is likely to make another push towards a trillion-dollar market capitalization. In addition, due to Bitcoin reaching new highs, cryptocurrency companies have seen significant gains recently, making it the top-performing sector this year. Among the large trades on July 3rd, there were many companies in this industry, including $Marathon Digital Holdings Inc(MARA)$ $Riot Blockchain, Inc.(RIOT)$ $Coinbase Global, Inc.(COIN)$

As for Chinese concept stocks, the covered price for the CALL options of the real estate company $KE Holdings Inc.(BEKE)$ is $15, the same as the current price. This indicates significant resistance to further price increases and reflects a negative outlook on the real estate sector.

The exercise price for $XPeng Inc.(XPEV)$ has risen to $20 (expiring in August), while the current price is $13.98. Investors remain relatively optimistic about Xpeng's new vehicles.

Lastly, the $100 CALL option for $Activision Blizzard(ATVI)$ is quite intriguing. I'm curious about what the buyers are thinking, considering the acquisition price is $95.

Comments

Put options above $280 are still in the money, but the bulls are calling in reinforcements with covered calls

At $279.82, it's like the market is playing a game of limbo - how low can it go

Big trades at $280? Looks like investors were partying hard yesterday and feeling bullish

Tesla's vehicle deliveries gave investors a shock of energy - they're back in the game

哇,那些熊一定是为了独立日去度假了