July 13th, the U.S. stock market continued to reach new highs in the past year and a half, with one of the important factors being the decline in inflation.

The PPI on Thursday was once again below expectations, creating anticipation in the market for a further decline in CPI. The U.S. dollar index also continued to fall, even breaking its lowest point in a year.

In terms of market performance, large technology stocks continue to support the upward trend. Among them, $Alphabet(GOOGL)$ had a relatively small increase previously, raising suspicions of a rebound this time. Furthermore, its advertising revenue is closely related to economic activities. $Amazon.com(AMZN)$ can be considered the large technology company with the closest relationship to CPI, and its sales during Prime Day exceeded expectations, restoring market confidence in the current consumption recovery.

Additionally, $NVIDIA Corp(NVDA)$ reached a new high again. The sentiment around AI-driven semiconductors is a key driving force for the current market surge, making it an especially important sentiment indicator.

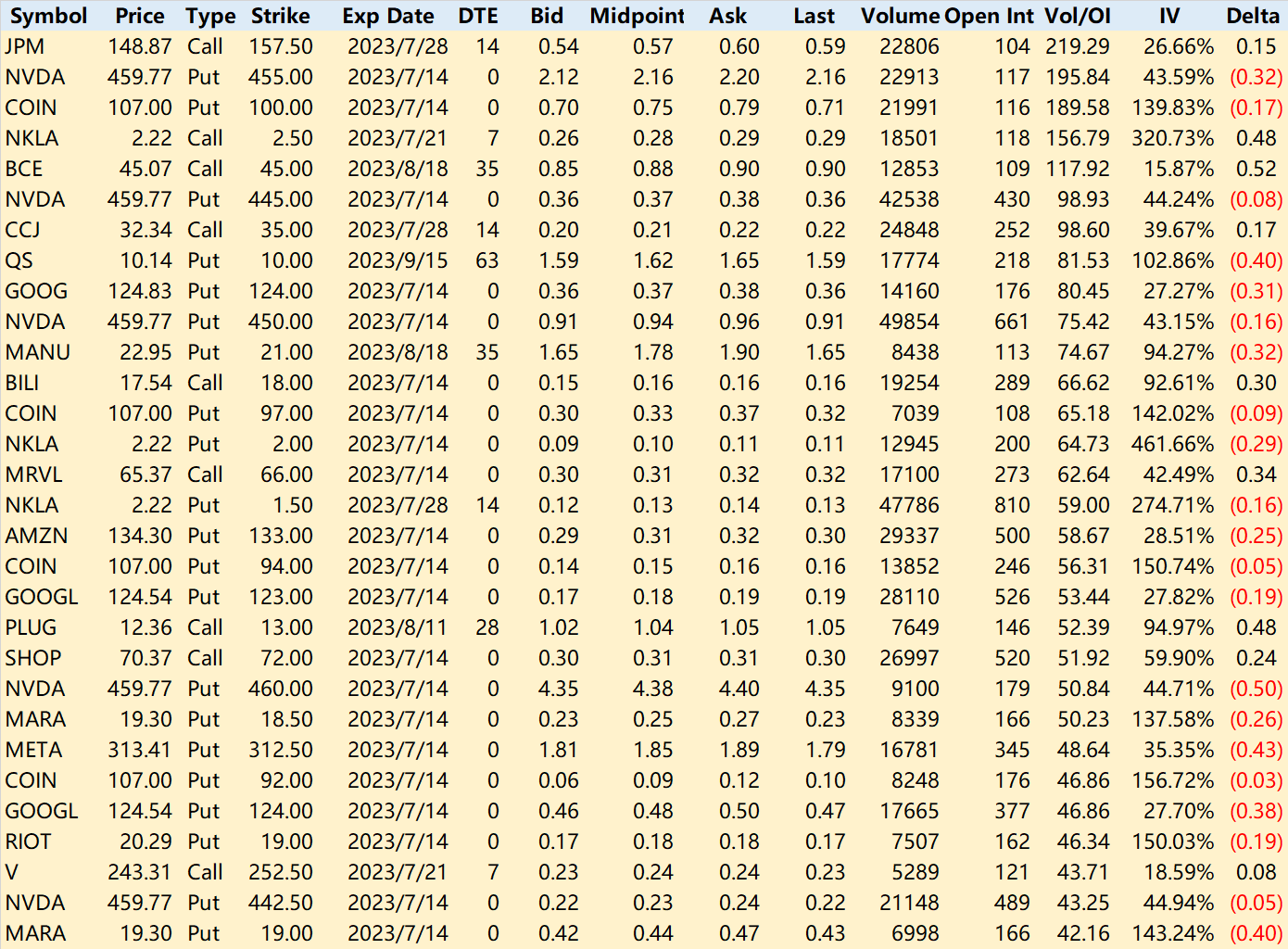

As for significant options activity, besides the increase in end-of-day PUT options (sell) for leading companies like Nvidia (NVDA), there are a few points worth paying attention to.

One is the upcoming banking industry financial reports. It is highly noteworthy to observe the performance of major banks after experiencing the industry turbulence in Q1. Additionally, major banks have absorbed a significant amount of assets and liabilities from smaller banks, and they will provide some follow-up explanations on their Q2 performance during the earnings conference call. $JPMorgan Chase(JPM)$ has seen a significant increase in CALL options with a price slightly below 10% higher than the current price. Normally, options at this price level are not the most active, so it appears that investors have certain expectations for its financial report.

Meme stocks continue to maintain a bullish sentiment, with previously high sentiment stocks like $Quantumscape Corp.(QS)$ Quantumscape Corp. (QS) reappearing on the scene.

However, the most significant momentum on July 13th was observed in cryptocurrency companies, as Bitcoin has been maintaining its high position and the sentiment around other cryptocurrencies is also very positive.

$Coinbase Global, Inc.(COIN)$ recorded a single-day increase of 27%, breaking through the $106 mark, and there was heavy activity in PUT options with strikes at 100, causing a slight squeeze.

Other stocks like $Marathon Digital Holdings Inc(MARA)$ and $Riot Blockchain, Inc.(RIOT)$ also showed very impressive performances.

Comments