Tesla and Netflix each fell 8% to become the trigger for this market correction. There is no hard damage in the earnings report, but the release time just before the index adjustment and FOMC, the market has a pullback demand. The FOMC meeting next Thursday, July 27, is likely to raise interest rates for the last time, and the dollar has rebounded after falling to a low point.

So what is the target of this pullback? Two orders caught my eye:

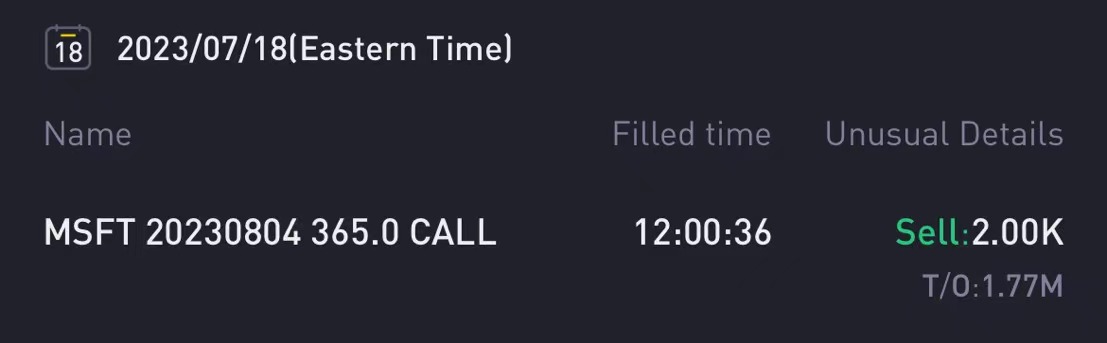

sell $MSFT 20230804 365.0 CALL$

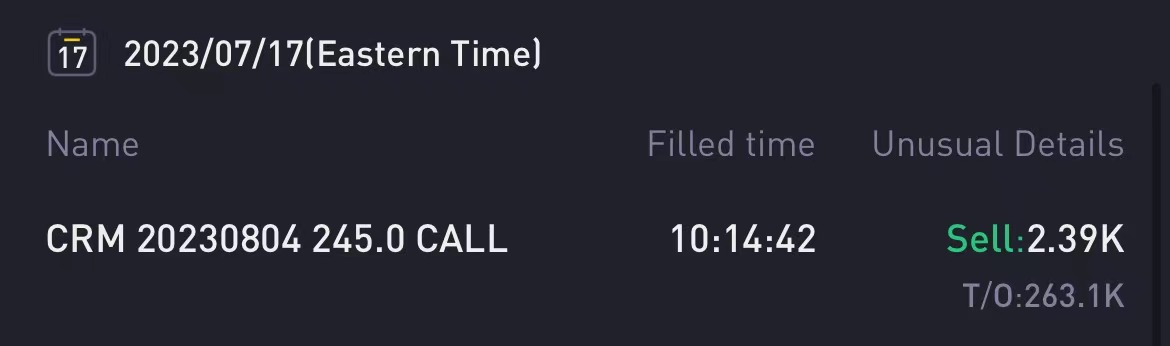

sell $CRM 20230804 245.0 CALL$

I think the seller weight is greater than the buyer weight in the big options order, because the margin pressure is so much. Although the total turnover is only tens of thousands, the margin may need hundreds of thousands or even millions.

In the case of Microsoft, the seller's 2,000 lots of options are equally converted into 200,000 MSFT shares. For Microsoft and bull stocks such as CRM, call option sellers will be more pressure. Because the risk of blowout is higher, it is not particularly confident in the trend, and the general institution will not do a single-leg sell call operation when the upper resistance is too strong.

CRM traders sell call options on Monday. Traders in MSFT were more cautious, selling at Tuesday's highs. These two AI stock leaders without exception chose to sell call at the peak of the stock price, and very tacit choice of August 4 as the expiration date. The expiration is only ten days, the time loss is fast, and the royalties are faster. This is also in line with the opening argument that the event resonates, rubbing up the thunder, and the market has a short-term correction.

Keep an eye on these two orders until the closing time or after the FOMC meeting.

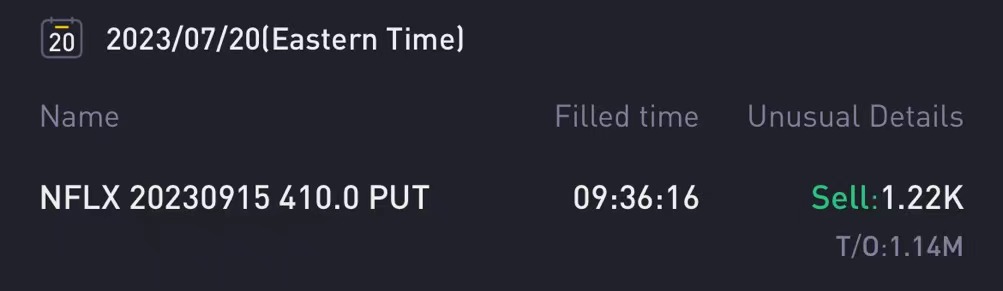

Specific callback points can refer to sell put large orders, such as this one from Netflix, almost around the end of June price range:

This is also a common situation that I have observed at present. Compared to the short, the market is still more inclined to sell put, even the at-the-money options sell put, even the growth stocks sell put:

sell $AAPL 20230915 170.0 PUT$

PLTR is special, there is a sell put, there is a sell call, and there is a buy put:

sell $PLTR 20231020 20.0 CALL$

In fact, don't worry too much about how to choose, Ai small-cap stocks still have to see the face of MSFT. From this point of view, the selling call option on October 20 has the risk of explosion, which is equivalent to betting that there is no progress in the AI industry from August to October, which is unlikely?

Finally, I laugh at others to close the position early, others laugh at me not to run. In the issue of when to close the position and run away from the purchase call, it is clear that the institution is more than one.

Comments

it's downright despicable how wall street and greedy traders are manipulating Microsoft when this stock is one of the safest investments just like apple. people are envious they didn't buy sooner so they deliberately make every effort possible to bring down the price. I wish the SEC would do their job in making trading fair and balanced. This would entail changing the rules for options trading

Baird analysts said they now have increased confidence in Netflix’s execution around new initiatives such as ad-supported plans and its crackdown on password sharing.

Reminder, MSFT’s earnings could be negatively impacted this coming Tuesday due to the upfront investment required to build out their infrastructure to support their future IA gains. I would focus more on the guidance from their after earnings call, than the quarterly results themselves.

Can we finally get some traction here. And, who will buy CISCO. It looks like a great company to come under the umbrella of another player. Boolean

With Netflix being amongst the most popular streaming services…if not THE most popular…I’m totally fine with gathering up some shares at these oversold prices.

Before you go all in on those overhyped stocks, just remember that goes up must come down