On Thursday, the Federal Reserve raised interest rates by 25 basis points as expected, Chairman Bauer left the door open for future rate hikes, investors digested a fresh batch of earnings, and Microsoft led technology shares down amid a mix of bearish and bearish news.

A 14-day winning streak on Thursday would tie the longest winning streak since June 1897, set about a year after the Dow was founded in May 1896.

Social media leader Meta's second-quarter revenue rose 11 percent, beating market expectations. It also gave an encouraging third-quarter forecast and said its new short-form video feature Reels is successfully attracting advertisers, sending its shares up nearly 7 percent in premarket trading on Thursday.

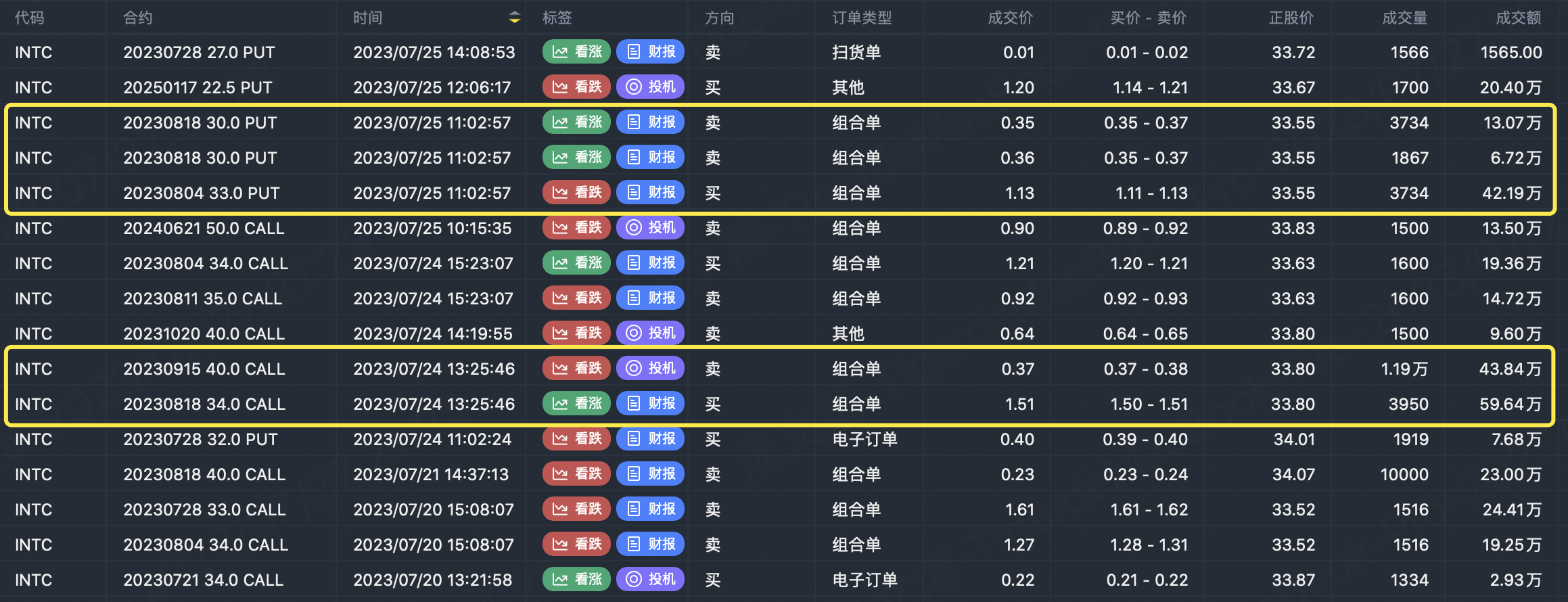

Intel will release its earnings report after the closing bell on Thursday, and the current bearish sentiment is anxious, with the main forecast direction, falling prices between 30 and 33 and rising prices between 34 and 40.

* 9:30 ~ 10:30 every day, real-time sharing of exclusive screening options large order, welcome to click to subscribe.

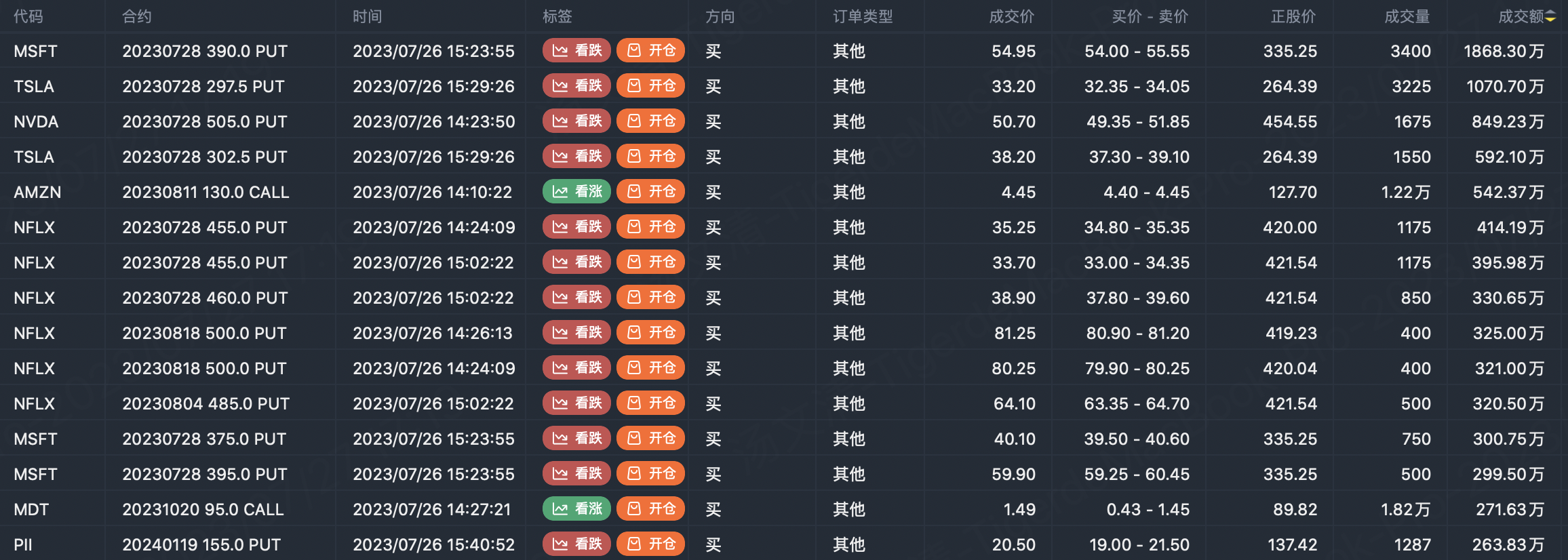

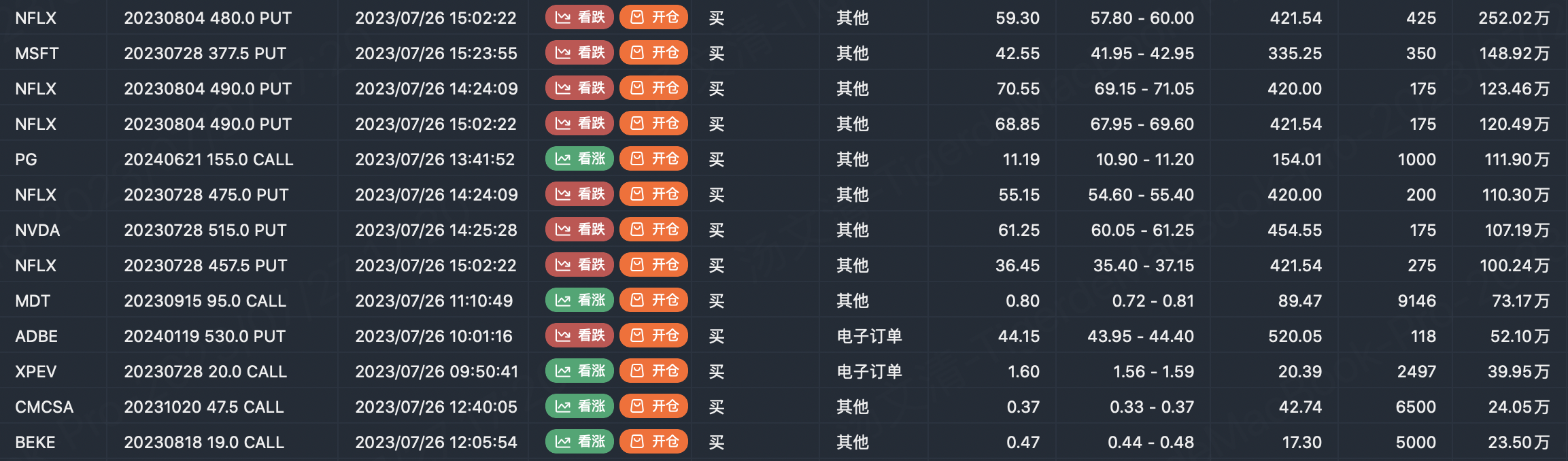

Option buyer open position (Single leg)

Highlight order:

Note: This image data is from Tiger PC. This screening is a significant buy open position for options contracts in the market. The purchase of a call option means that the trader believes that the underlying has upward momentum, and the purchase of a put option means that the trader believes that the underlying has downward momentum. These contract openings typically indicate significant activity in the underlying stock, including whether the trader is willing to accumulate a long or short option position.

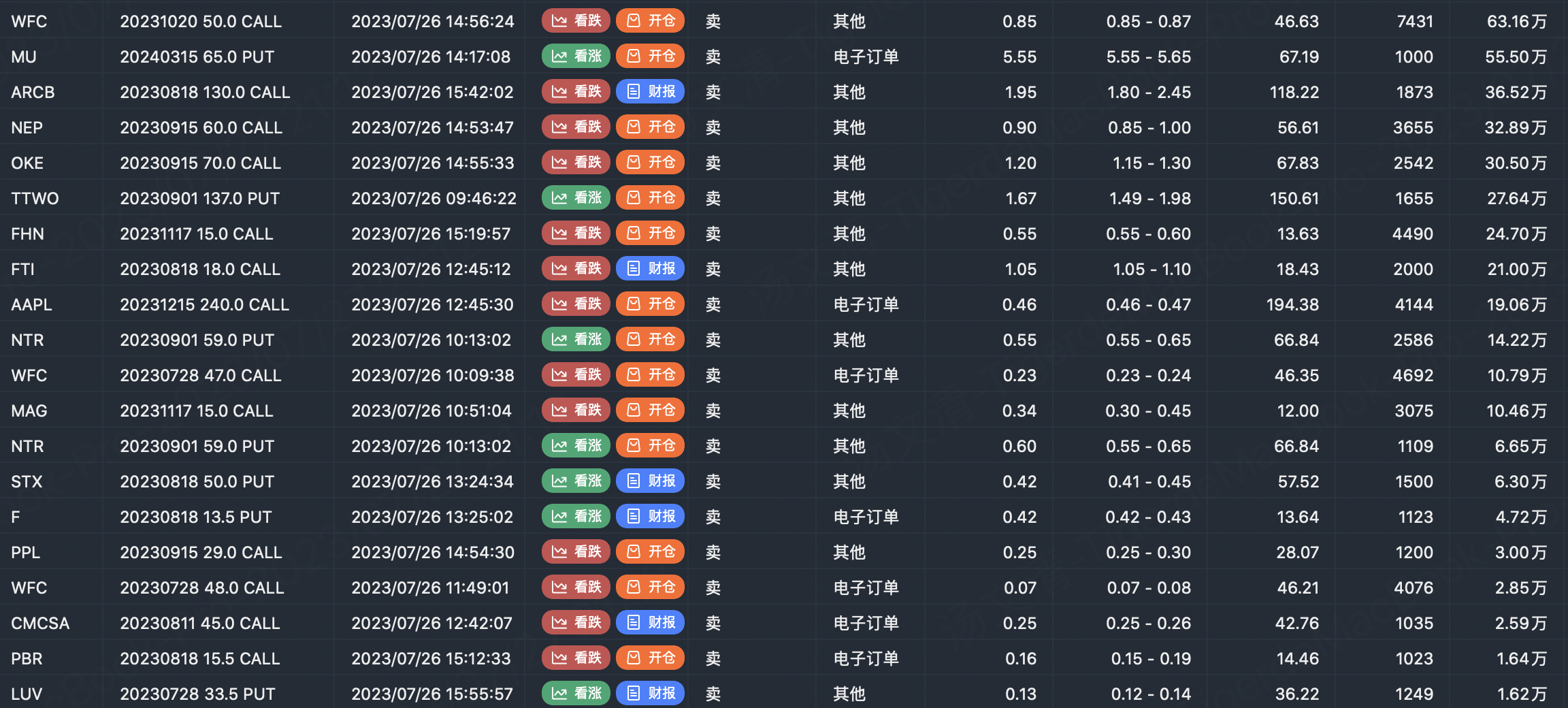

Option seller open position (Single leg)

Highlight order:

Note: This image data is from Tiger PC. This screen is a significant sell open position for an option contract in the market. A sell of a call option means that the trader believes that the underlying trend has peaked, and a sell of a put option means that the trader believes that the underlying trend has bottomed. These contract openings typically indicate significant activity in the underlying stock, including whether the trader is willing to accumulate a long or short option position.

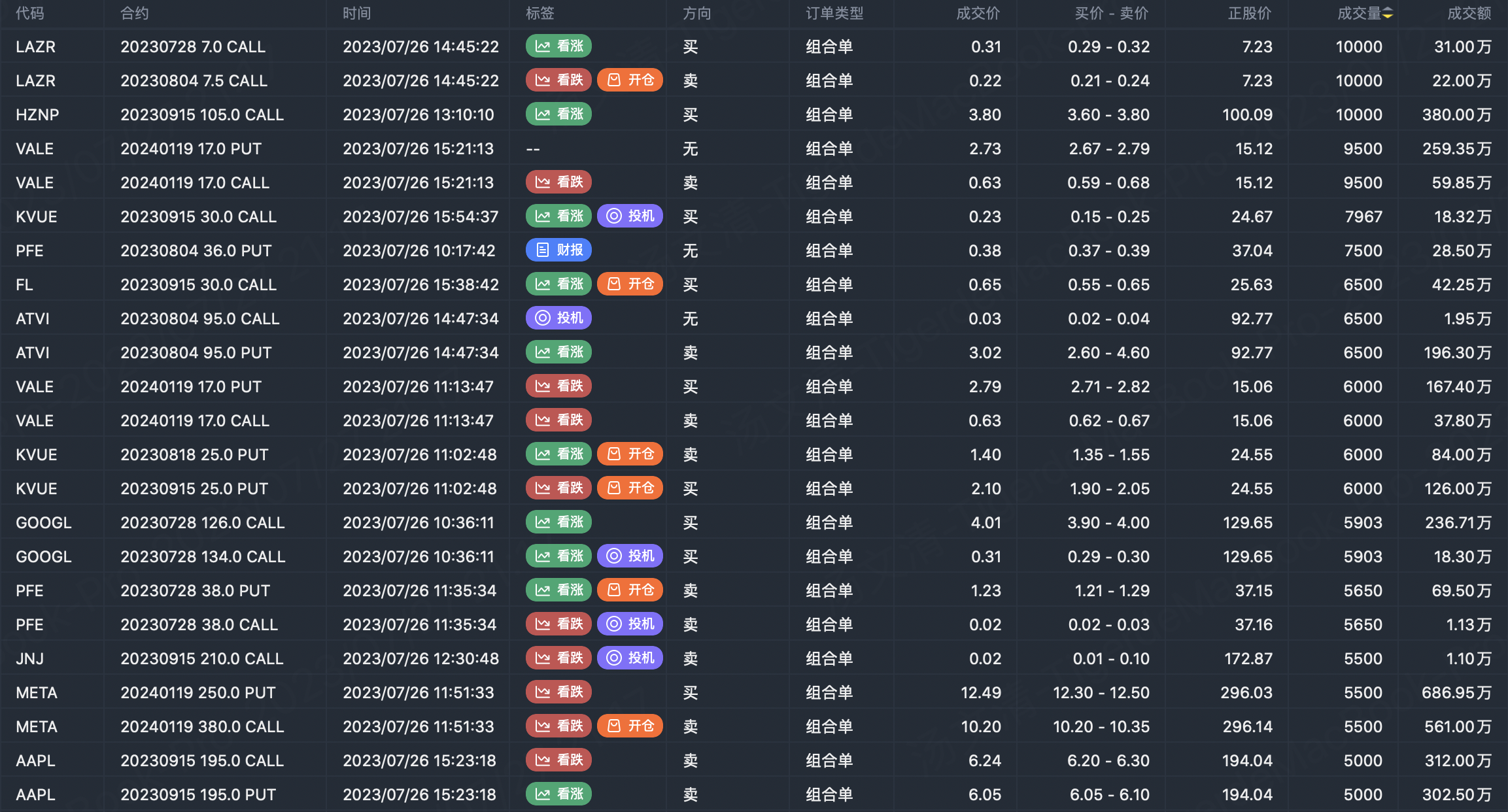

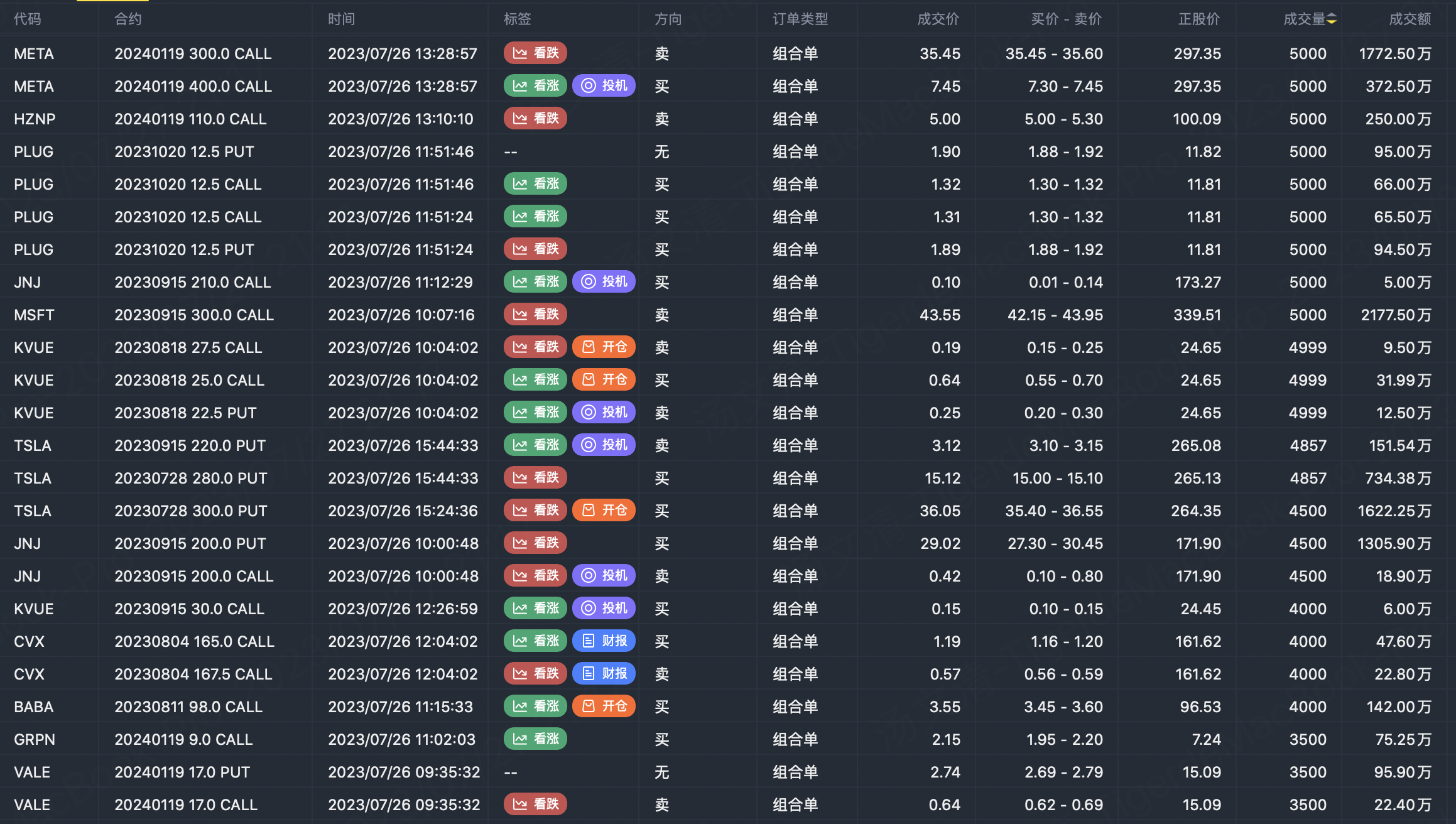

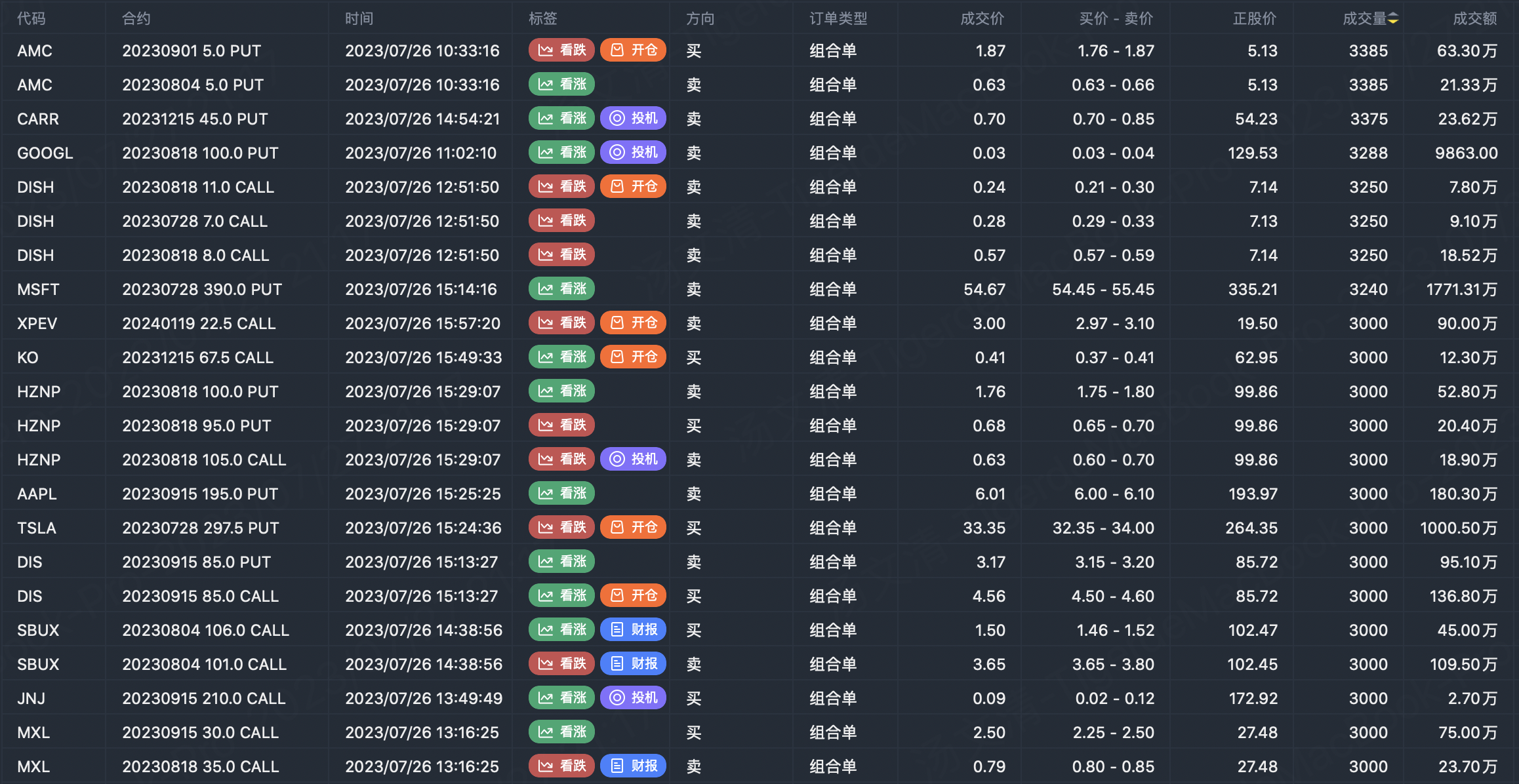

Options portfolio open position

Note: This image data is from Tiger PC. This screening is a significant portfolio of options contracts in the market. Portfolio opening includes a variety of underlying trends, requiring traders to further master the basic knowledge of options for analysis and judgment.

Comments

很棒的文章,愿意分享一下吗?

Great ariticle, would you like to share it?

Nice