Central bank's monetary policy can have an impact on the U.S. stock market. By adjusting interest rates and printing money, the central bank can influence the money supply and economic activity, potentially affecting investors' decisions and thus impacting the stock market's performance.

We have observed recent actions by the central bank, providing guidance to investors.

The Federal Reserve

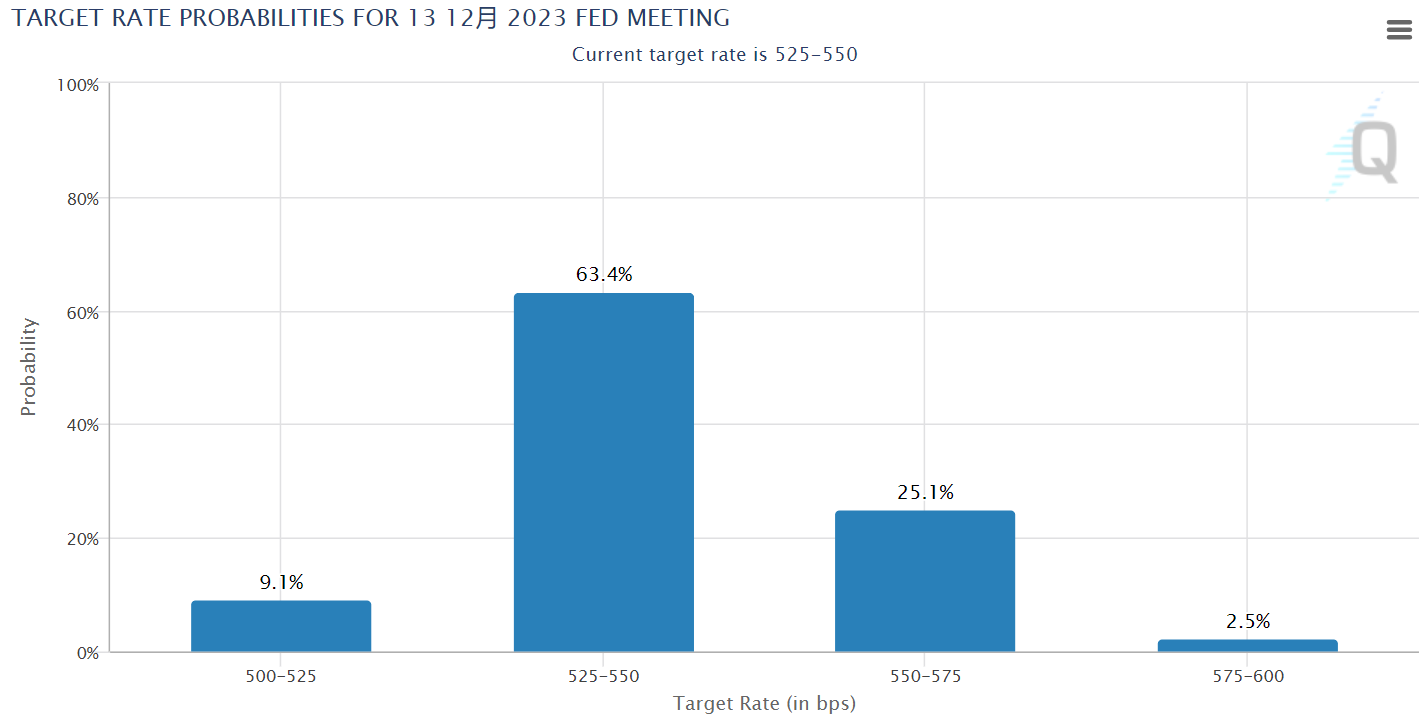

The July FOMC meeting of the Federal Reserve aligned with market expectations, raising interest rates by 25 basis points to 5.25-5.5%.

The June dot plot indicated two more rate hikes within the year, one of which was implemented in July. However, even Fed Chairman Powell remained ambiguous about the timing of the final rate hike, stating that it would depend on data and circumstances.

We believe that since the beginning of this inflation surge, the Fed's response has been slower than market expectations. Therefore, even when the Fed warned of possible future rate hikes, the market largely disregarded these warnings. Thus, the Fed is unlikely to announce an early "pivot" to avoid causing market overreactions or a in advance.

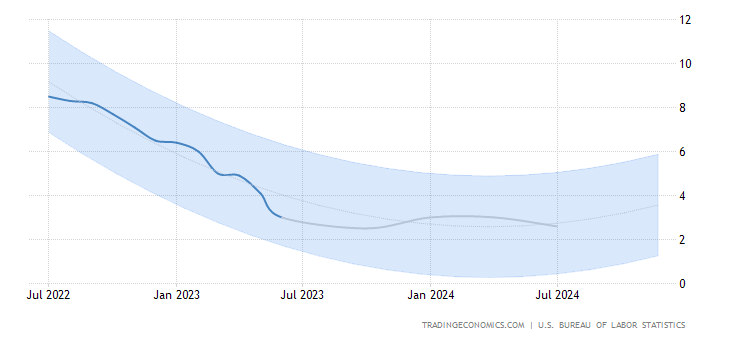

The Q3 CPI is of great importance, but after July, factors like a high base effect, credit contraction, and supply improvements may slow down the rate of CPI increase, even leading to a minor "tail-end rebound." This is why Powell expressed the need for the market to be patient.

If inflation remains around 3% in the long term, it could potentially make the Fed (at least in rhetoric) more inclined towards a hawkish stance.

The European Central Bank

ECB also announced a 25-basis-point interest rate hike, reaching the highest level for deposit rates since 2001 and a refinancing rate of 4.25%. However, the ECB abandoned its previous description of interest rates as "sufficiently restrictive" and replaced it with "maintaining sufficiently restrictive levels when necessary" to achieve the 2% inflation target.

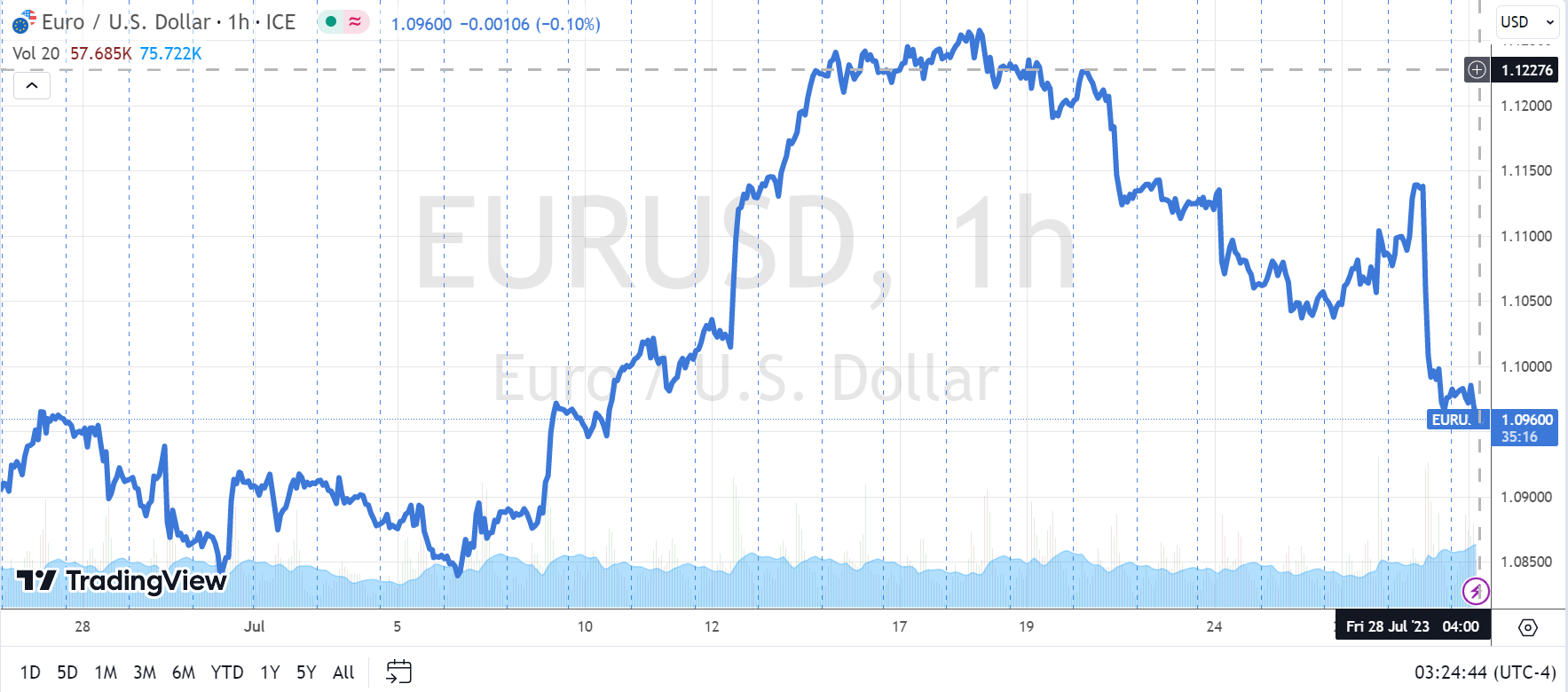

The stock market interpreted this shift as "dovish" immediately, resulting in significant gains in European stocks and a decline in the euro, almost wiping out the month's gains.

We believe that the ECB can be more aggressive than the Fed for several reasons.

First, inflation in Europe has been more severe and persistent than in the United States, making the ECB's hawkish stance more certain and expected to last longer.

Second, European countries have different fiscal policies, giving the ECB more independence in its monetary policy decisions.

Third, the European economy has not recovered as strongly as the U.S. since COVID-19, and the major economies in Europe, such as Germany and France, face challenges that differ from those in the U.S.

Therefore, Europe did not have such strong capabilities to "maintain higher interest rate levels." Previously, the strength of the euro was largely based on continuous tightening. However, once the European Central Bank's monetary policy begins to loosen, it will deal a severe blow to the euro and also drive up the bond yields of various European countries, which will not benefit the economy.

Furthermore, the euro's loosening will also make the tightening policy of the Federal Reserve more pronounced. This can be seen from the rise in US bond rates on July 27. More funds are flowing back from the euro area into the US bond and currency markets. The mixed performance during the US stock earnings season has also led more investors to consider taking profits in advance.

Bank of Japan

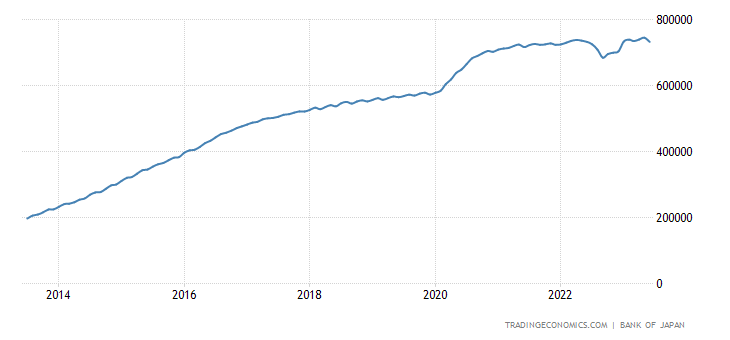

BOJ there were rumors in the North American trading session on the 27th that the BOJ might adjust its yield curve control (YCC) policy on the 28th. As a result, the yen immediately surged more than 1%.

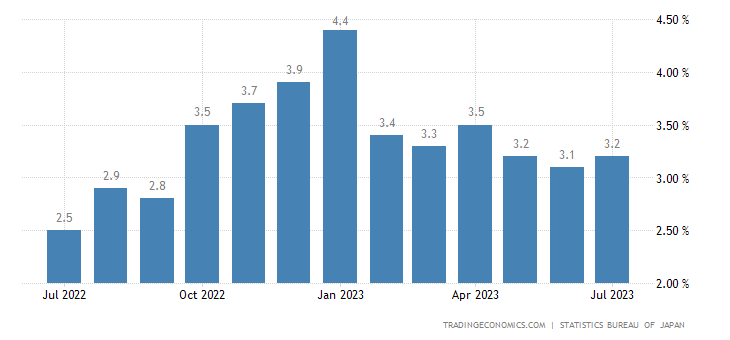

On the 28th, BOJ Governor Haruhiko Kuroda announced an unexpected decision, though he used many dovish and accommodating terms like "will not hesitate to add further easing if necessary" and "will expand the scope of long-term government bond purchases." The market's focus was on the phrase "will conduct controls more flexibly."

We believe that the new upper limit is likely to be raised to 1%.

This move could be seen as a reduction in bond purchases and a sign of starting to exit quantitative easing (QE).

First, the new BOJ governor is unlikely to abruptly overturn the previous policy in just a few months. This would create the impression of "purging the predecessor," and Kuroda wouldn't choose a successor with conflicting ideologies. Second, the shift in monetary policy depends on the actual situation, and with Japan's inflation gradually rising, especially the unexpectedly positive Tokyo area CPI announced on the 28th, it presents the need for the central bank to consider the timing for QE.

The phrase "conduct controls more flexibly" does not necessarily mean a hawkish stance. The market can interpret it as slightly hawkish or even no action at all, showing that the BOJ retains control over its decisions, unlike the Fed, which seems to be led by the market.

A significant interest rate hike in Japan is unlikely due to the large size of Japanese bonds held by the central bank. Raising interest rates would increase the burden on the government (and the central bank). Thus, Japan can only flexibly adjust its current QE policy to control liquidity.

Since China's complete opening earlier this year, international exchanges with Japan have become more active, leading to the inevitability of rising inflation within Japan. More Japanese businesses need to seize opportunities from this economic recovery to make up for losses during the pandemic.

Additionally, due to geopolitical risks in other regions like Europe, Japanese assets (including those bought by Buffett) have become attractive safe-haven assets that appreciate in value. As a result, more international funds flow into Japan, providing further opportunities for inflation and a stronger yen.

Related: How to participate in Japan Market?

Comments

Concerning about Japan stock market, i have immense questions which you have clearly explained it, tks

even if such little pivot lag after actual market in reality, it is very meaningful to deep into this

听起来日本市场有更多的机会,任何股票推荐。

it is very true that Europe have bigger inflation which must be forceful to adjust by this means

Kuroda was previous Governor!! Now is Ueda