International credit rating agency Fitch downgraded the United States from its top rating, AAA, to AA+, dampening investor appetite for risky assets. Separately, prices for U.S. government debt fell after the ADP employment report showed far more jobs were created in July than expected.

The ADP employment report showed the U.S. private sector added a seasonally adjusted 324,000 jobs in July, well above economists' expectations of 190,000 but down from June's 497,000 gain.

However, due to the "small non-farm" data and the subsequent non-farm data "contradictory", so after the release of the data did not cause significant market fluctuations. Some media pointed out that the ADP data fundamentally can not be looked at together with non-agricultural; The two sets of data can only look at their own trends.

Fitch stripped America of its top-notch AAA credit rating, criticising its ballooning fiscal deficit and deteriorating governance relative to other countries. The downgrade poses an additional danger for investors already worried about the risk of a recession and the sustainability of this year's rally in U.S. stocks.

Qualcomm (QCOM-US) on Wednesday reported third-quarter earnings that beat Wall Street expectations, but missed both revenue and fourth-quarter guidance, sending its shares down more than 6 percent after hours.

* 9:30 ~ 10:30 every day, real-time sharing of exclusive screening options large order, welcome to click to subscribe.

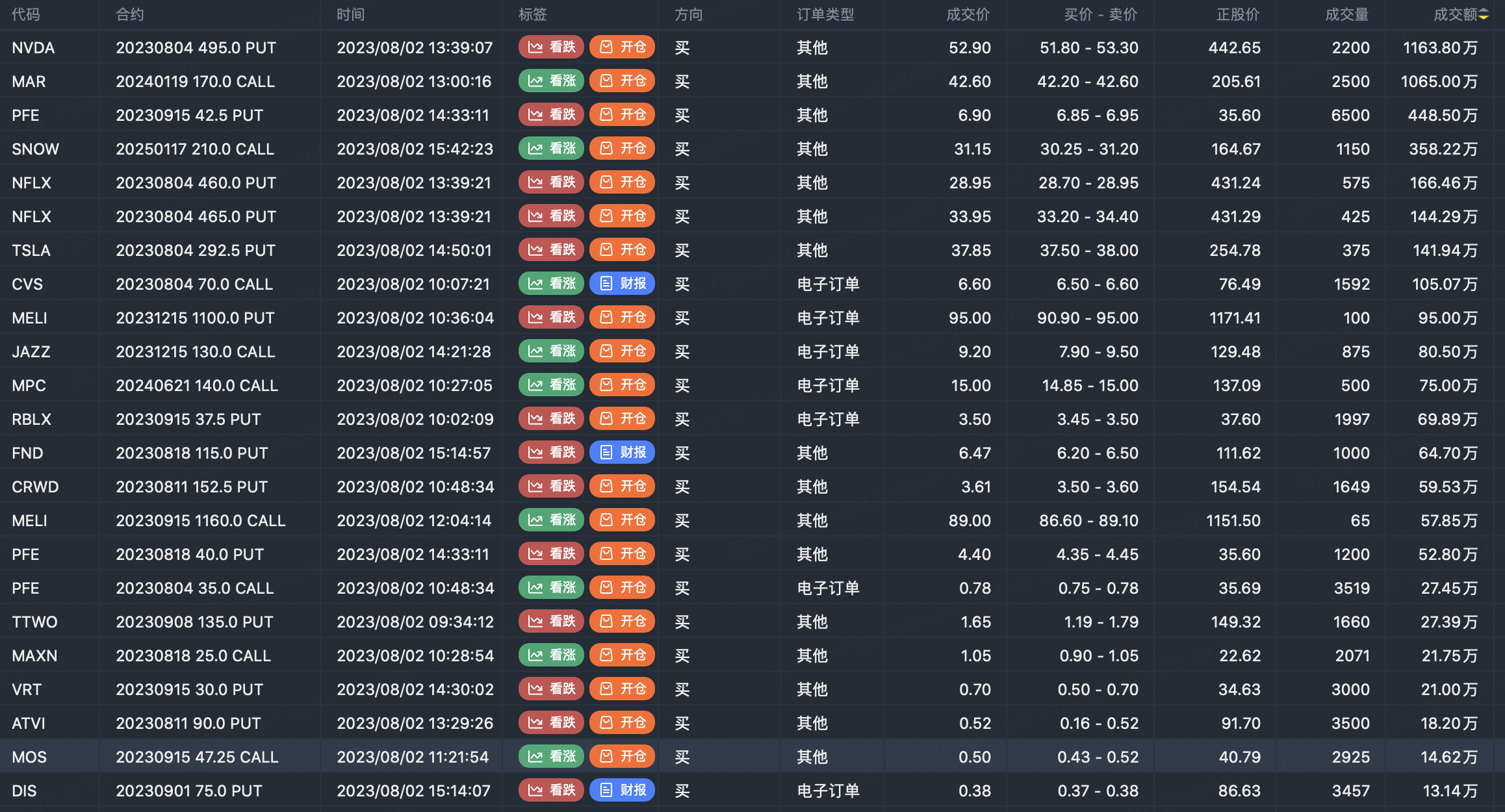

Option buyer open position (Single leg)

Highlight order:

Note: This image data is from Tiger PC. This screening is a significant buy open position for options contracts in the market. The purchase of a call option means that the trader believes that the underlying has upward momentum, and the purchase of a put option means that the trader believes that the underlying has downward momentum. These contract openings typically indicate significant activity in the underlying stock, including whether the trader is willing to accumulate a long or short option position.

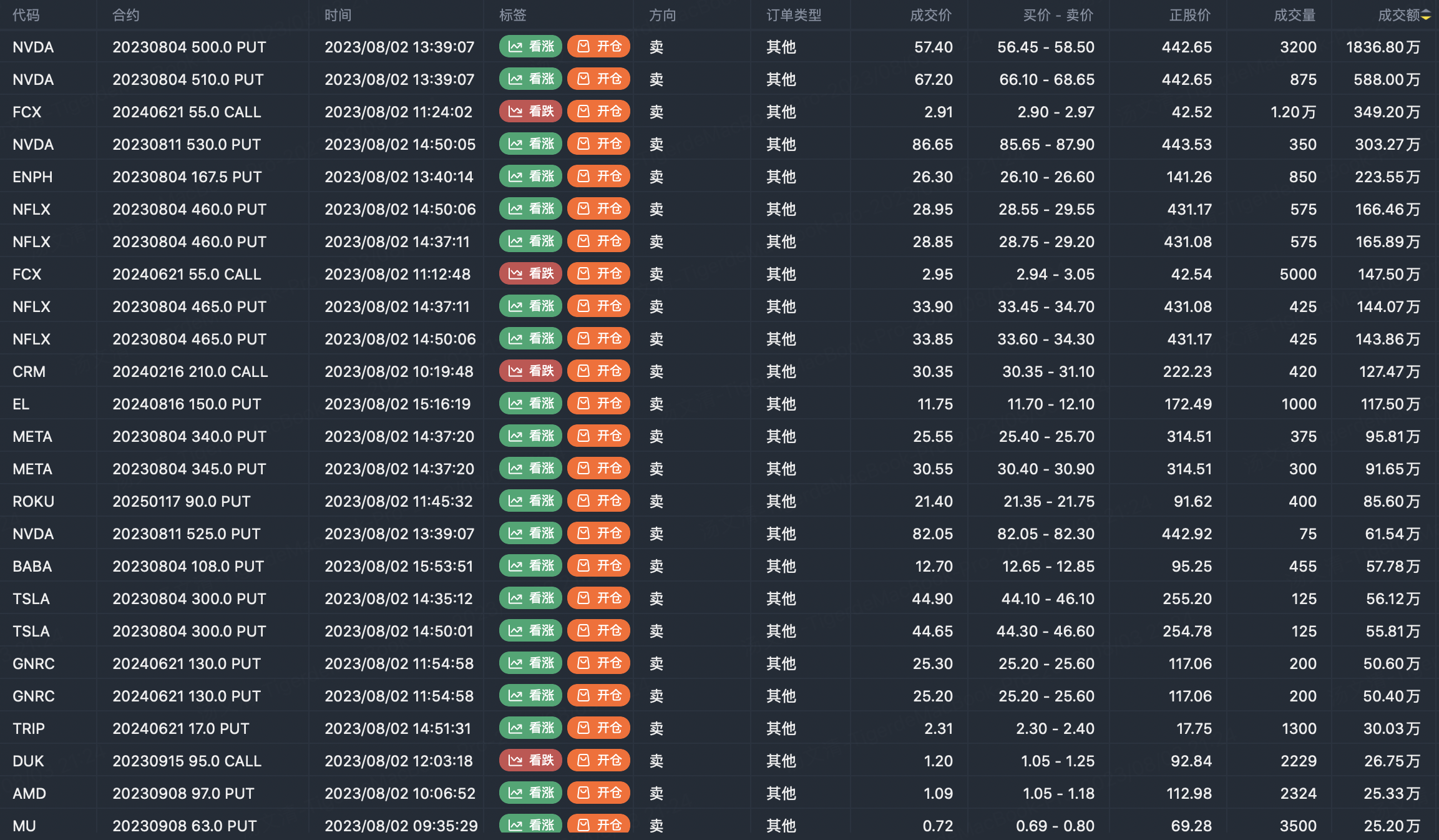

Option seller open position (Single leg)

Highlight order:

Note: This image data is from Tiger PC. This screen is a significant sell open position for an option contract in the market. A sell of a call option means that the trader believes that the underlying trend has peaked, and a sell of a put option means that the trader believes that the underlying trend has bottomed. These contract openings typically indicate significant activity in the underlying stock, including whether the trader is willing to accumulate a long or short option position.

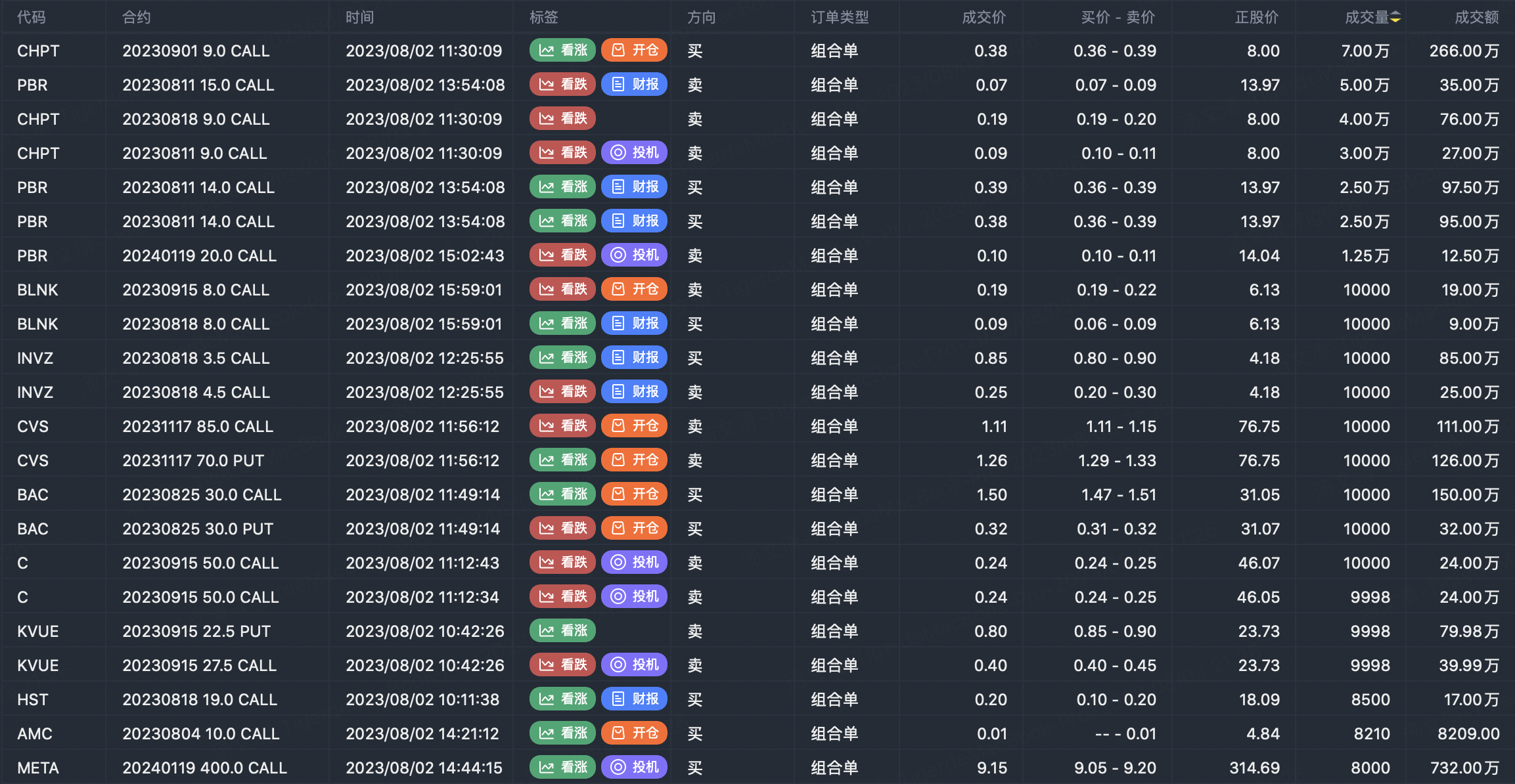

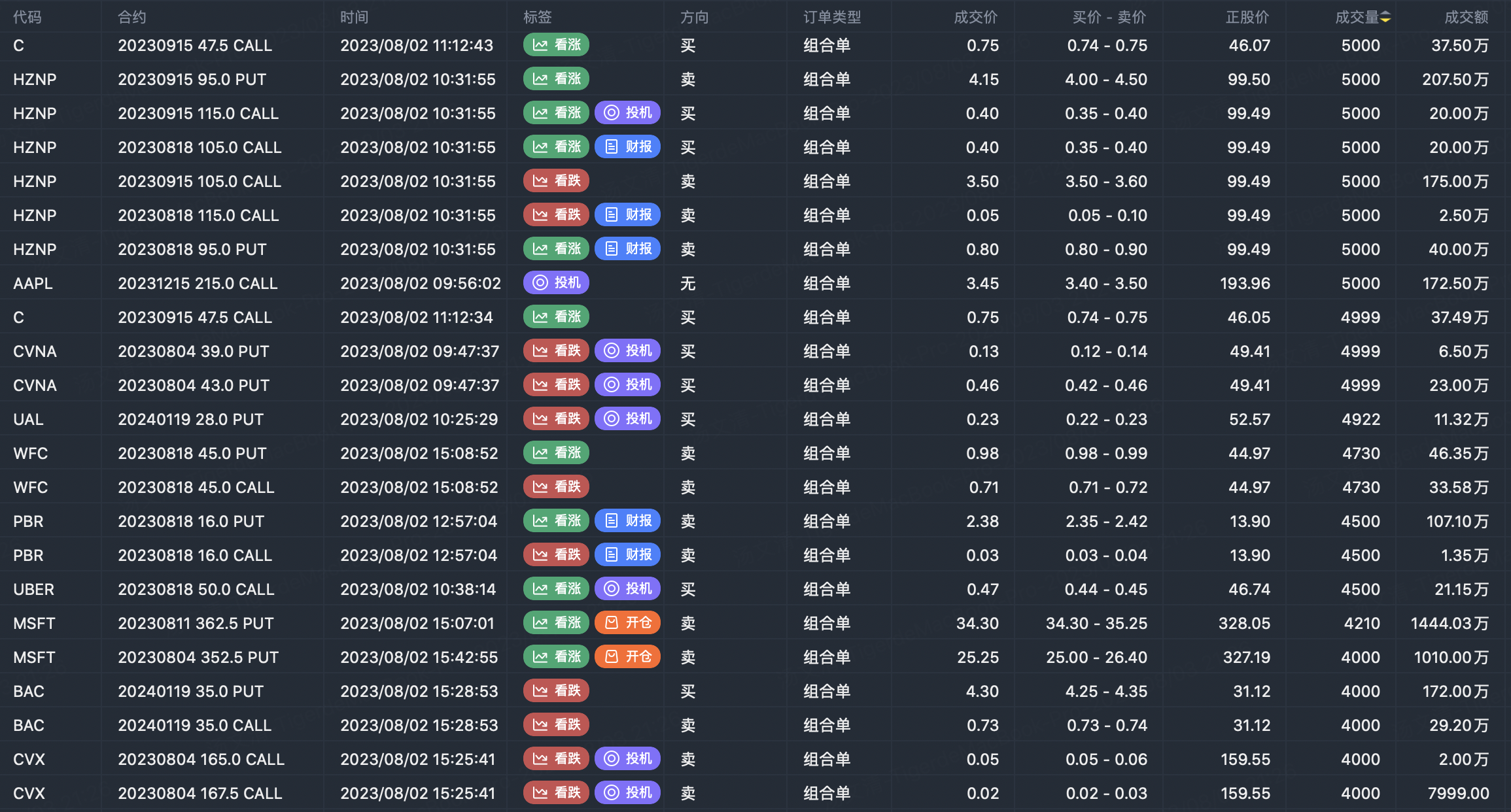

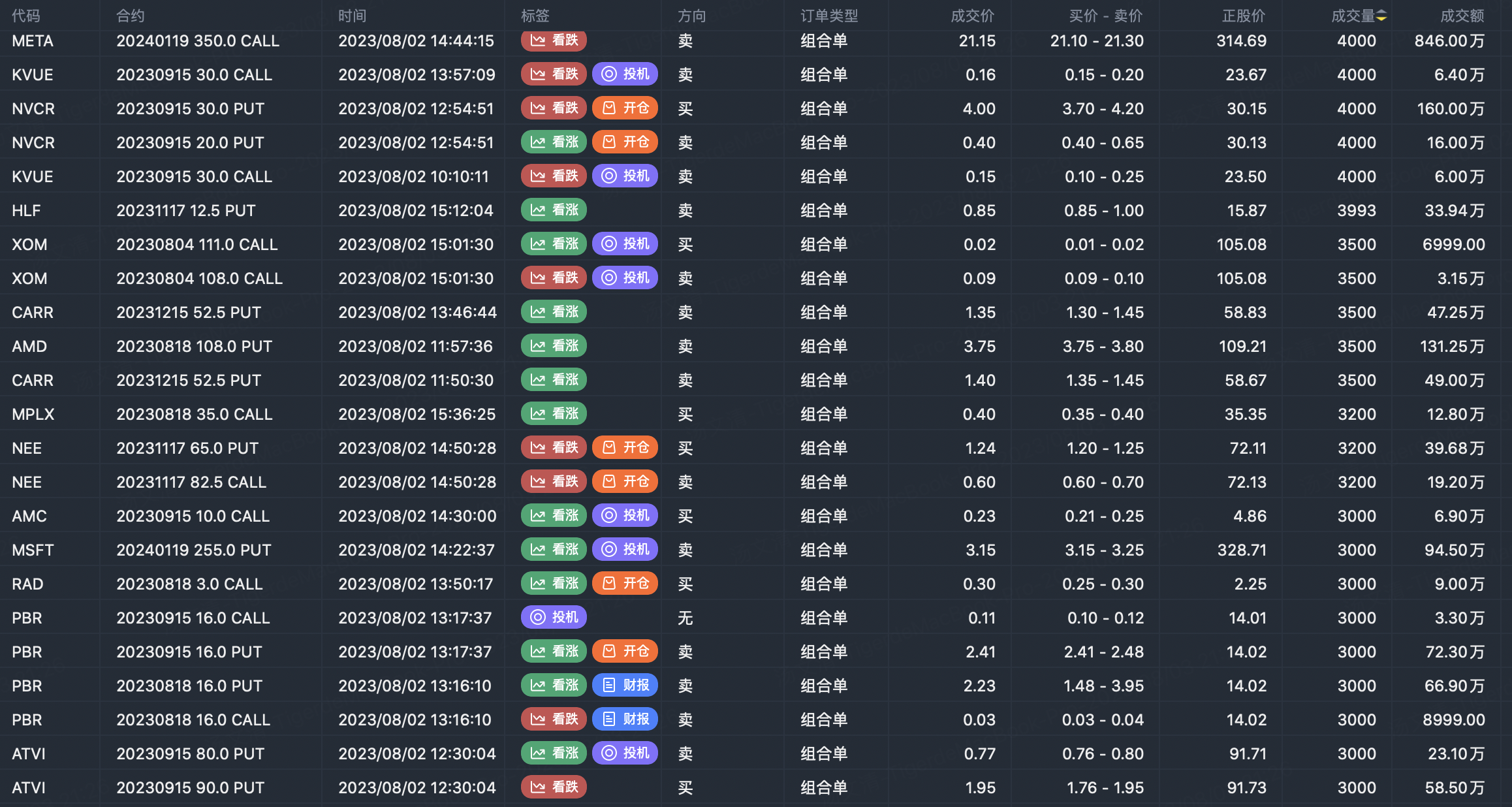

Options portfolio open position

Note: This image data is from Tiger PC. This screening is a significant portfolio of options contracts in the market. Portfolio opening includes a variety of underlying trends, requiring traders to further master the basic knowledge of options for analysis and judgment.

Comments