The Fed's third in command, William Williams, forecast that interest rates are expected to be cut next year, and as the U.S. economy may be heading for a soft landing, the U.S. Treasury interest rate curve is getting steeper, and the main indexes of U.S. stocks closed higher on Monday (7).

Alphabet and Meta led gains in communications services, offsetting losses in Apple. Apple's market value continued to fall below $3 trillion as it reported slowing iPhone sales last quarter. Warren Buffett's Berkshire shares hit a record high after a stellar earnings report.

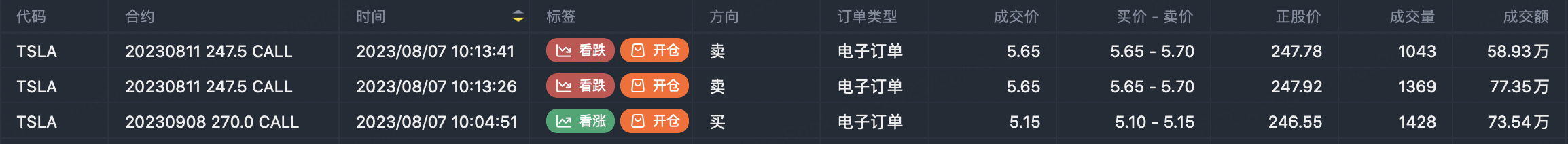

Tesla shares plunged as much as 4.4% after the surprise departure of the company's CFO. Large options orders indicate the stock price may be below 247.5 this week$TSLA 20230811 247.5 CALL$ , but there is optimism for future stock price performance, and call options indicate large buying orders $TSLA 20230908 270.0 CALL$ .

* 9:30 ~ 10:30 every day, real-time sharing of exclusive screening options large order, welcome to click to subscribe.

Option buyer open position (Single leg)

Highlight order:

Note: This image data is from Tiger PC. This screening is a significant buy open position for options contracts in the market. The purchase of a call option means that the trader believes that the underlying has upward momentum, and the purchase of a put option means that the trader believes that the underlying has downward momentum. These contract openings typically indicate significant activity in the underlying stock, including whether the trader is willing to accumulate a long or short option position.

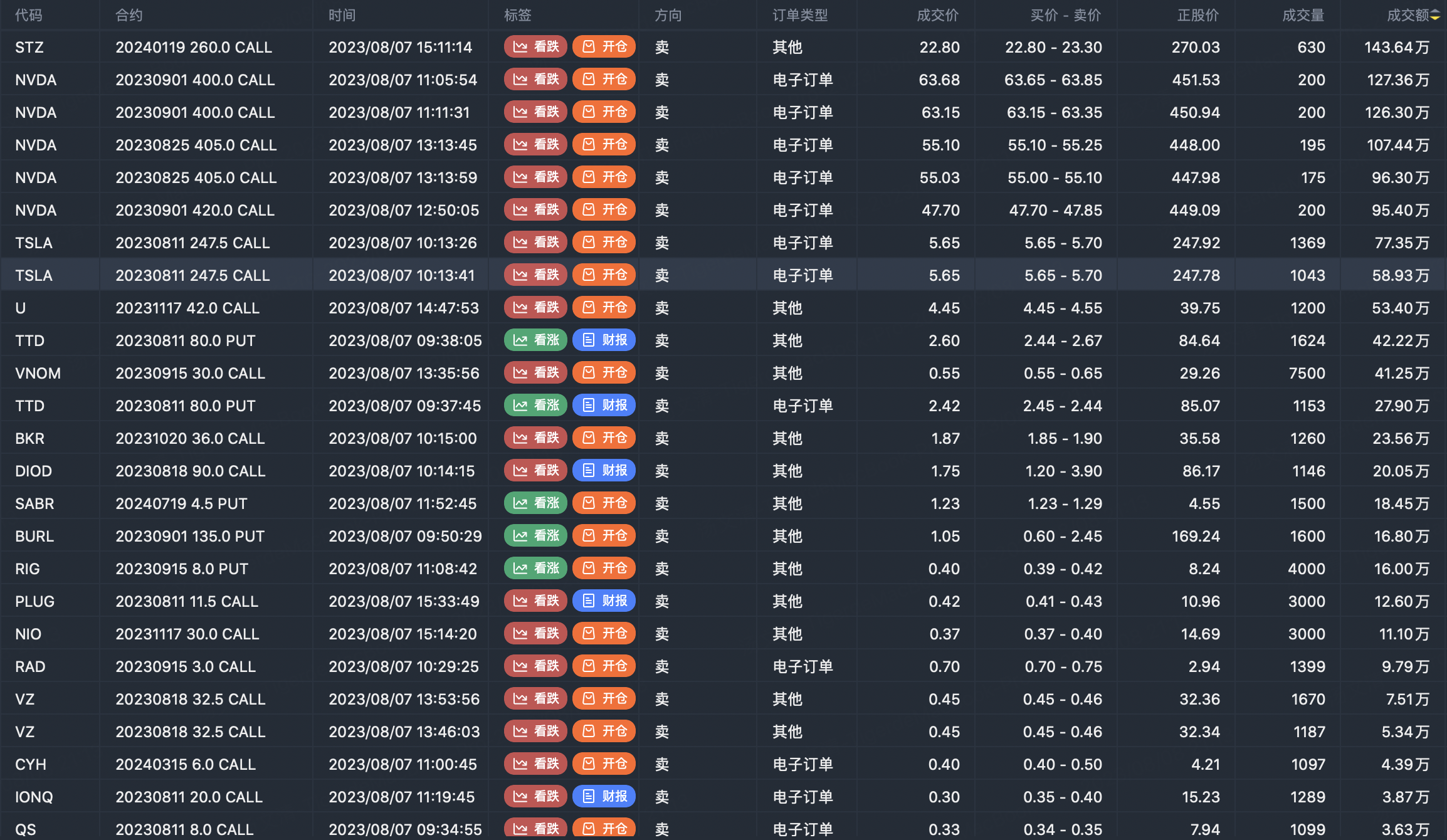

Option seller open position (Single leg)

Highlight order:

Note: This image data is from Tiger PC. This screen is a significant sell open position for an option contract in the market. A sell of a call option means that the trader believes that the underlying trend has peaked, and a sell of a put option means that the trader believes that the underlying trend has bottomed. These contract openings typically indicate significant activity in the underlying stock, including whether the trader is willing to accumulate a long or short option position.

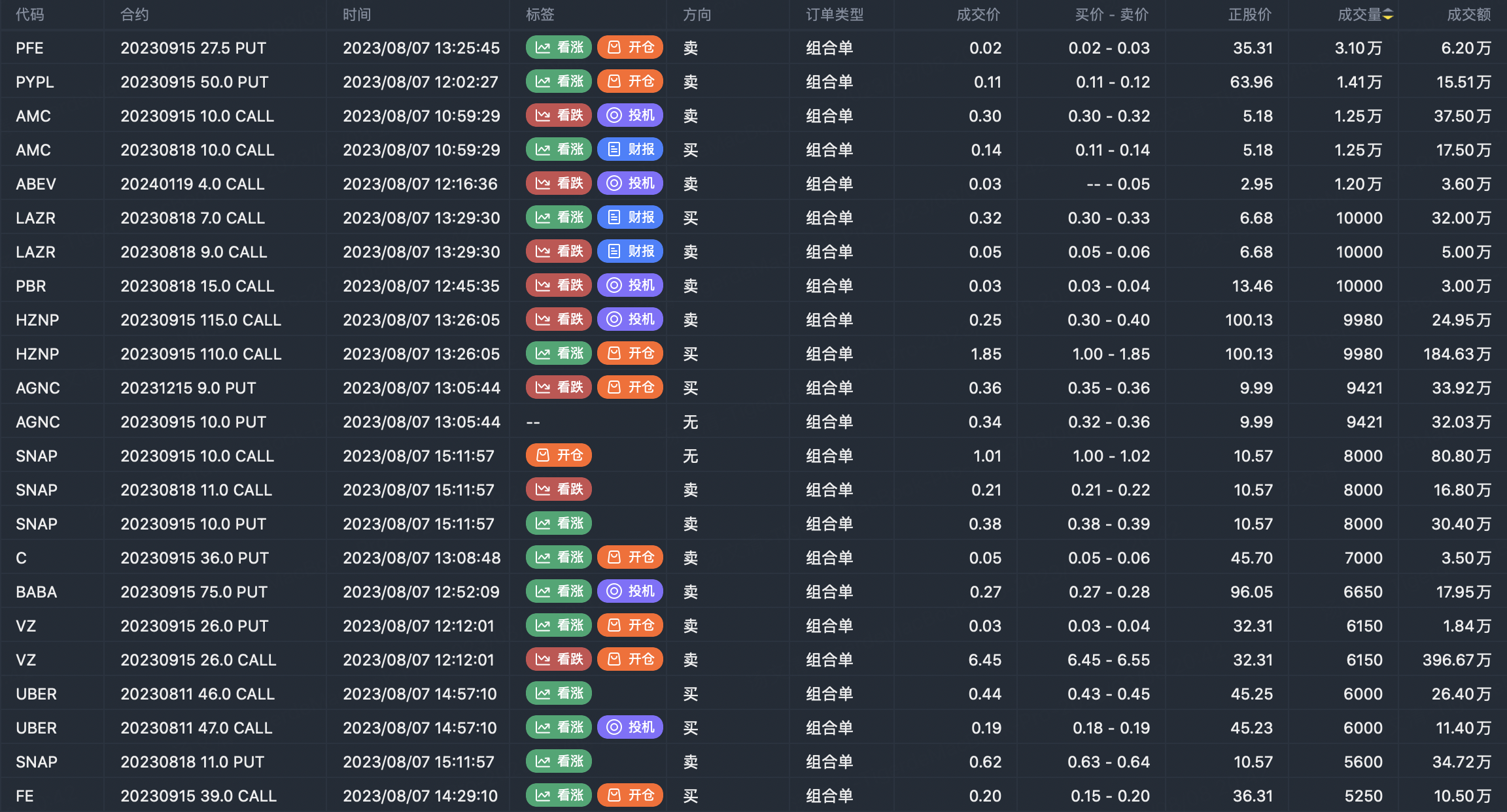

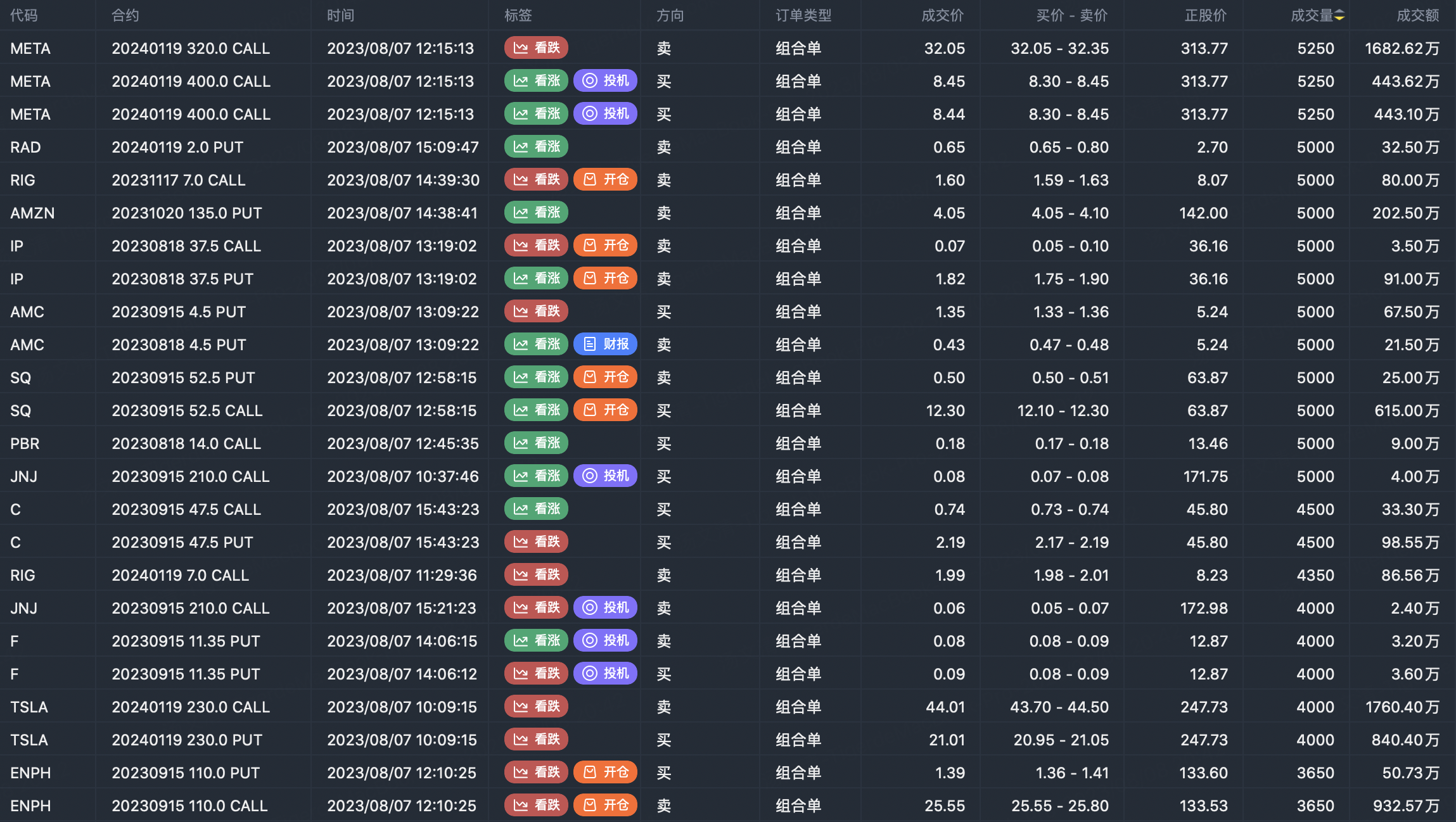

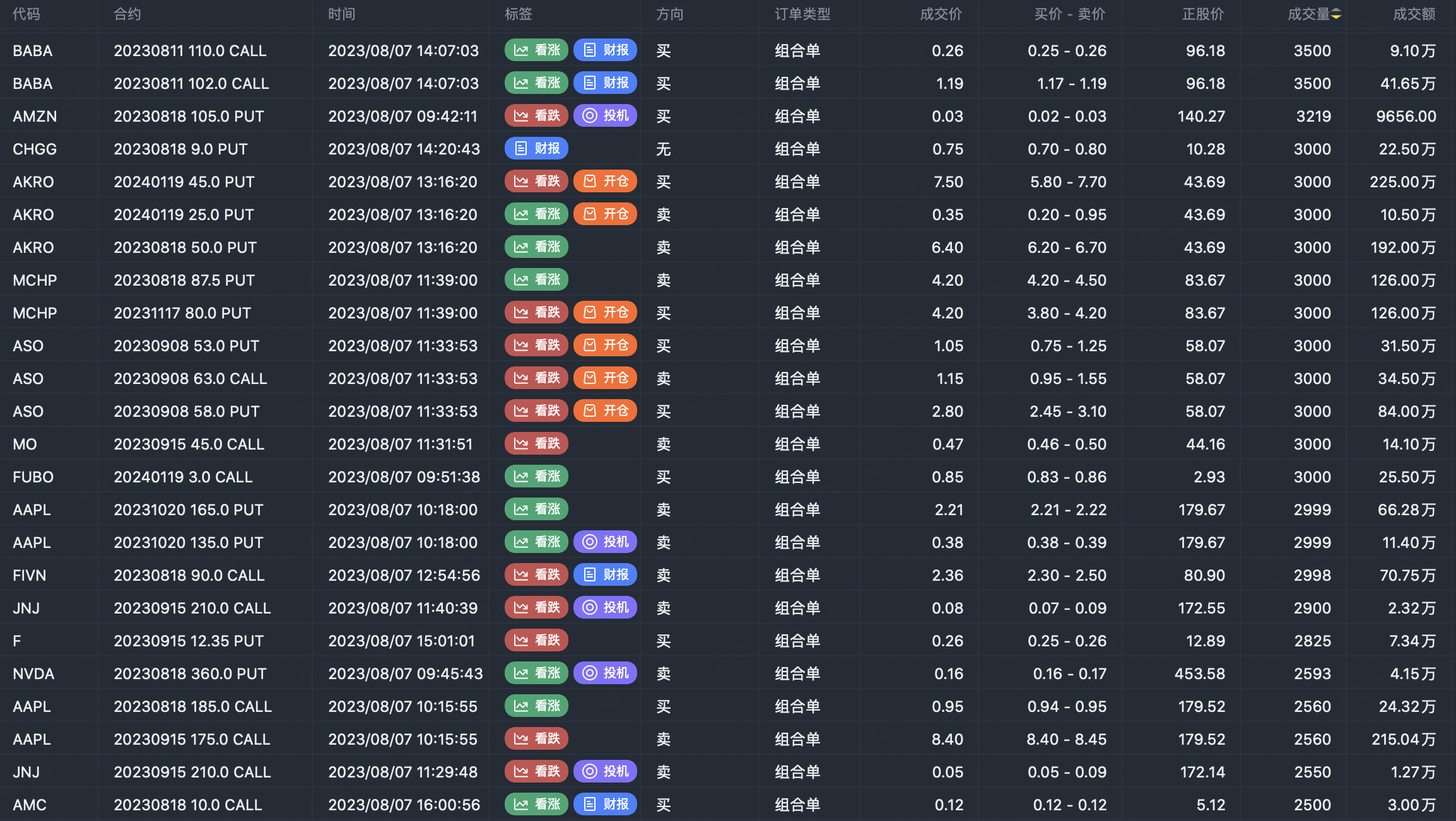

Options portfolio open position

Note: This image data is from Tiger PC. This screening is a significant portfolio of options contracts in the market. Portfolio opening includes a variety of underlying trends, requiring traders to further master the basic knowledge of options for analysis and judgment.

Comments

Great ariticle, would you like to share it?

Great ariticle, would you like to share it?