Nvidia surged more than 7 percent and technology stocks surged, leading U.S. stocks to break out of a two-week slump. However, Tesla cut prices and electric vehicles were generally weak. AMC shares plunged 35% after a preferred stock conversion plan was approved.

As earnings season comes to a close, the focus turns to retail earnings this week, including Home Depot on Tuesday, Target on Wednesday and Walmart on Thursday.

Minutes from the Federal Reserve meeting to be released on Wednesday will also be closely watched as investors look for more clues on the outlook for monetary policy and see whether most officials are sounding hawk or dove. Goldman expects the Fed to hold off on raising rates at its regular September meeting and then announce in November that inflation is slowing, meaning further rate hikes are "unnecessary."

A New York Fed survey released on Monday showed U.S. consumers' median one-year inflation expectations fell to 3.5 percent from 3.8 percent in June, the fourth straight monthly decline and the lowest since April 2021, while expectations for inflation over the next three and five years fell to 2.9 percent from 3 percent. The survey also found that American households are more optimistic about their financial situation and the job market.

Berkshire slashed its stake in Activision Blizzard by 70 percent in the second quarter, buying into three major U.S. real estate developers and adding $Capital One(COF)$ and $Occidental(OXY)$ . Options transaction feedback recently put options increased, but there are also large bullish orders:

* 9:30 ~ 10:30 every day, real-time sharing of exclusive screening options large order, welcome to click to subscribe.

Option buyer open position (Single leg)

Highlight order:

Buy TOP T/O: $META 20231117 260.0 CALL$ $INTC 20240315 30.0 PUT$

Buy TOP Vol: $INTC 20240315 30.0 PUT$ $VOD 20240119 10.0 CALL$

Note: This image data is from Tiger PC. This screening is a significant buy open position for options contracts in the market. The purchase of a call option means that the trader believes that the underlying has upward momentum, and the purchase of a put option means that the trader believes that the underlying has downward momentum. These contract openings typically indicate significant activity in the underlying stock, including whether the trader is willing to accumulate a long or short option position.

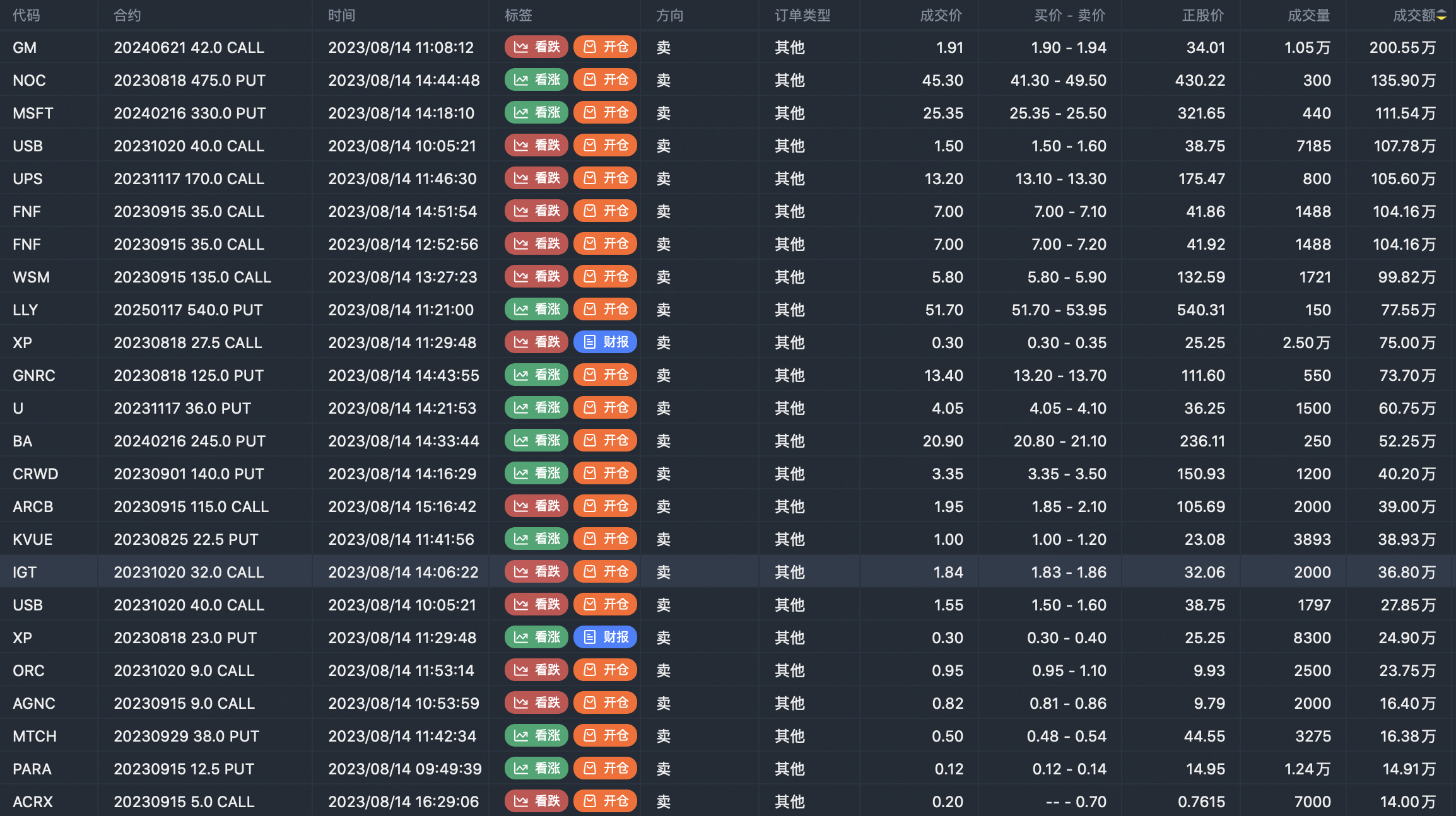

Option seller open position (Single leg)

Highlight order:

Sell TOP T/O: $GM 20240621 42.0 CALL$ $NOC 20230818 475.0 PUT$ $MSFT 20240216 330.0 PUT$

Sell TOP Vol: $XP 20230818 27.5 CALL$ $PARA 20230915 12.5 PUT$

Note: This image data is from Tiger PC. This screen is a significant sell open position for an option contract in the market. A sell of a call option means that the trader believes that the underlying trend has peaked, and a sell of a put option means that the trader believes that the underlying trend has bottomed. These contract openings typically indicate significant activity in the underlying stock, including whether the trader is willing to accumulate a long or short option position.

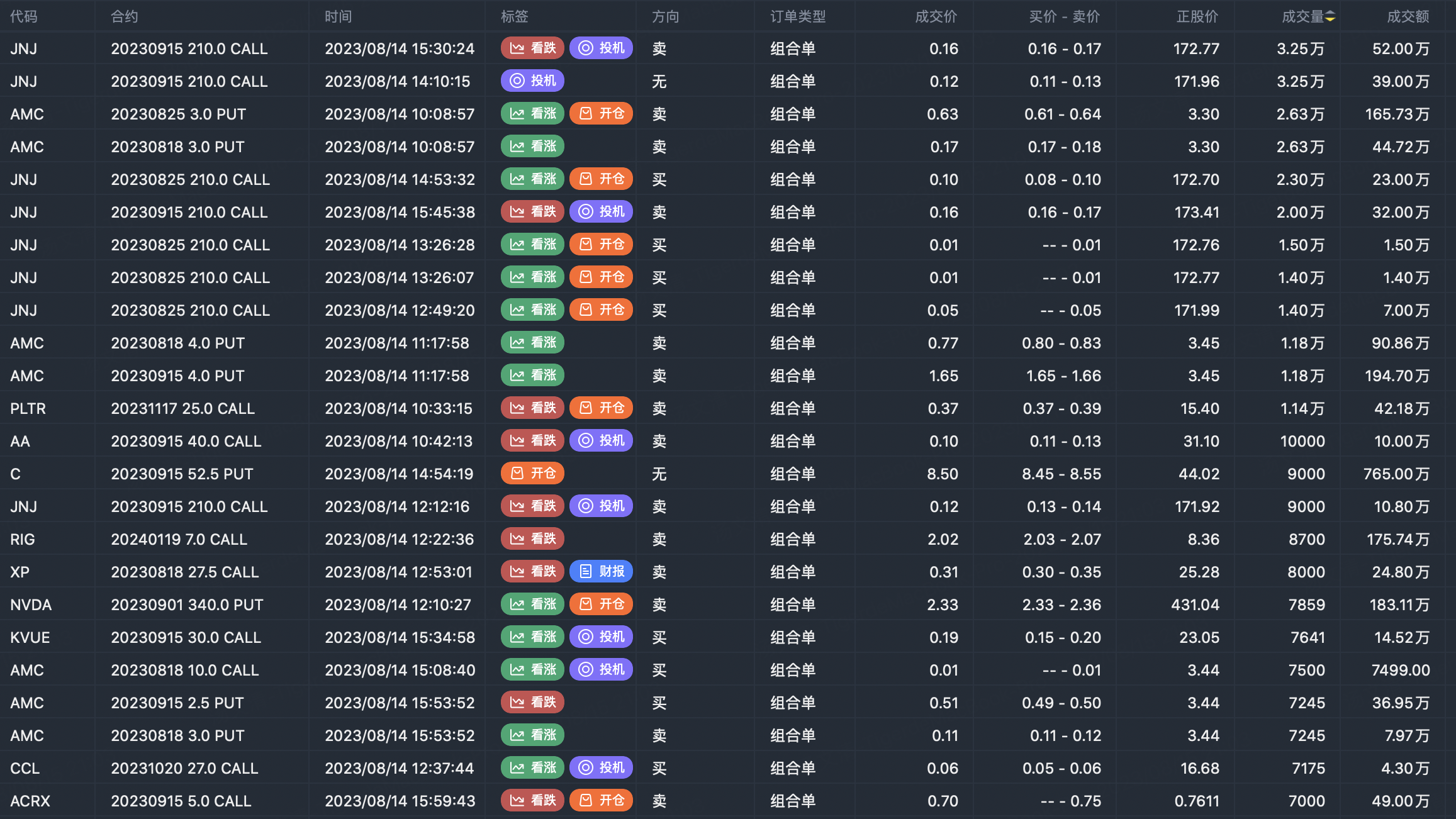

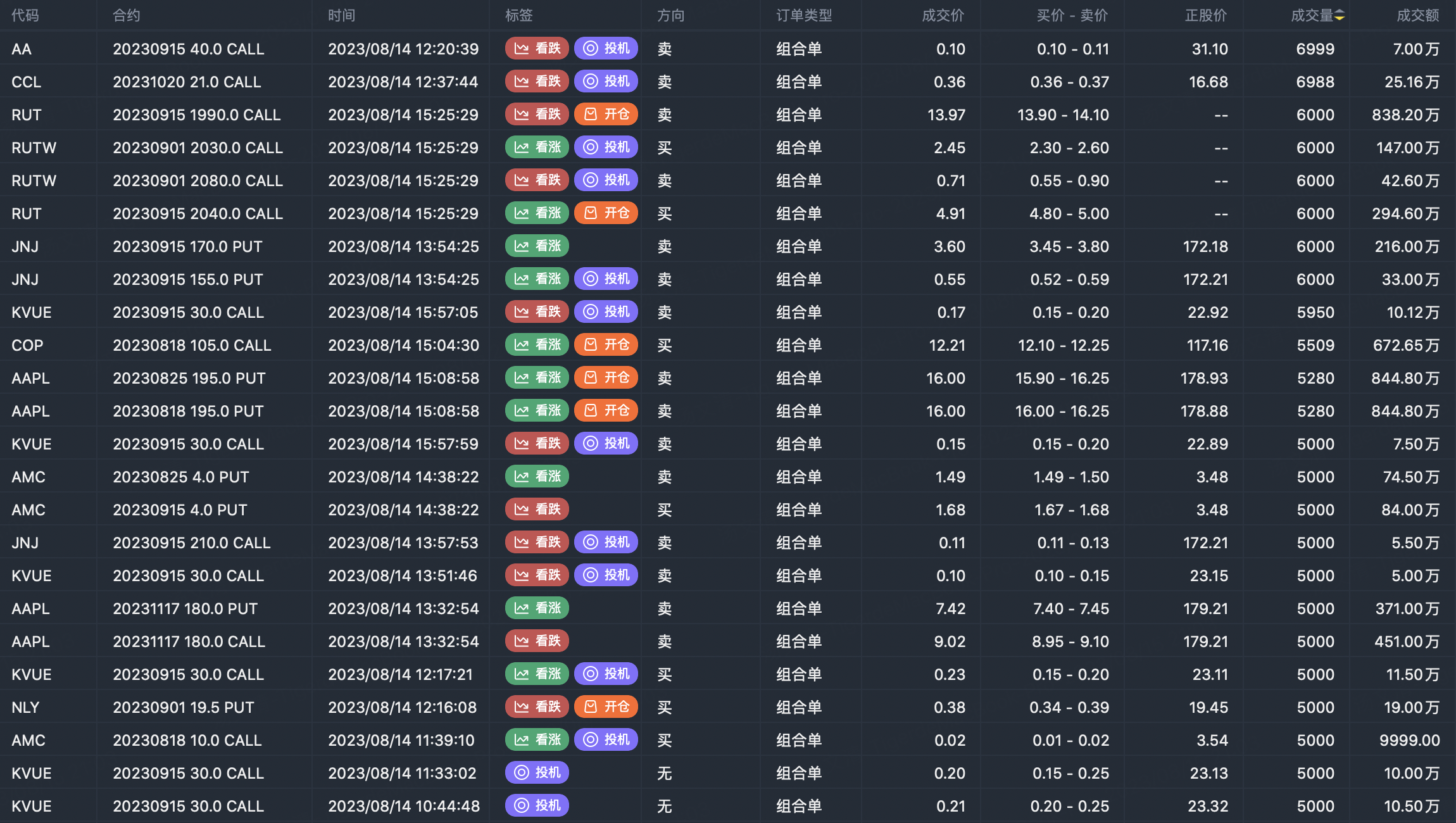

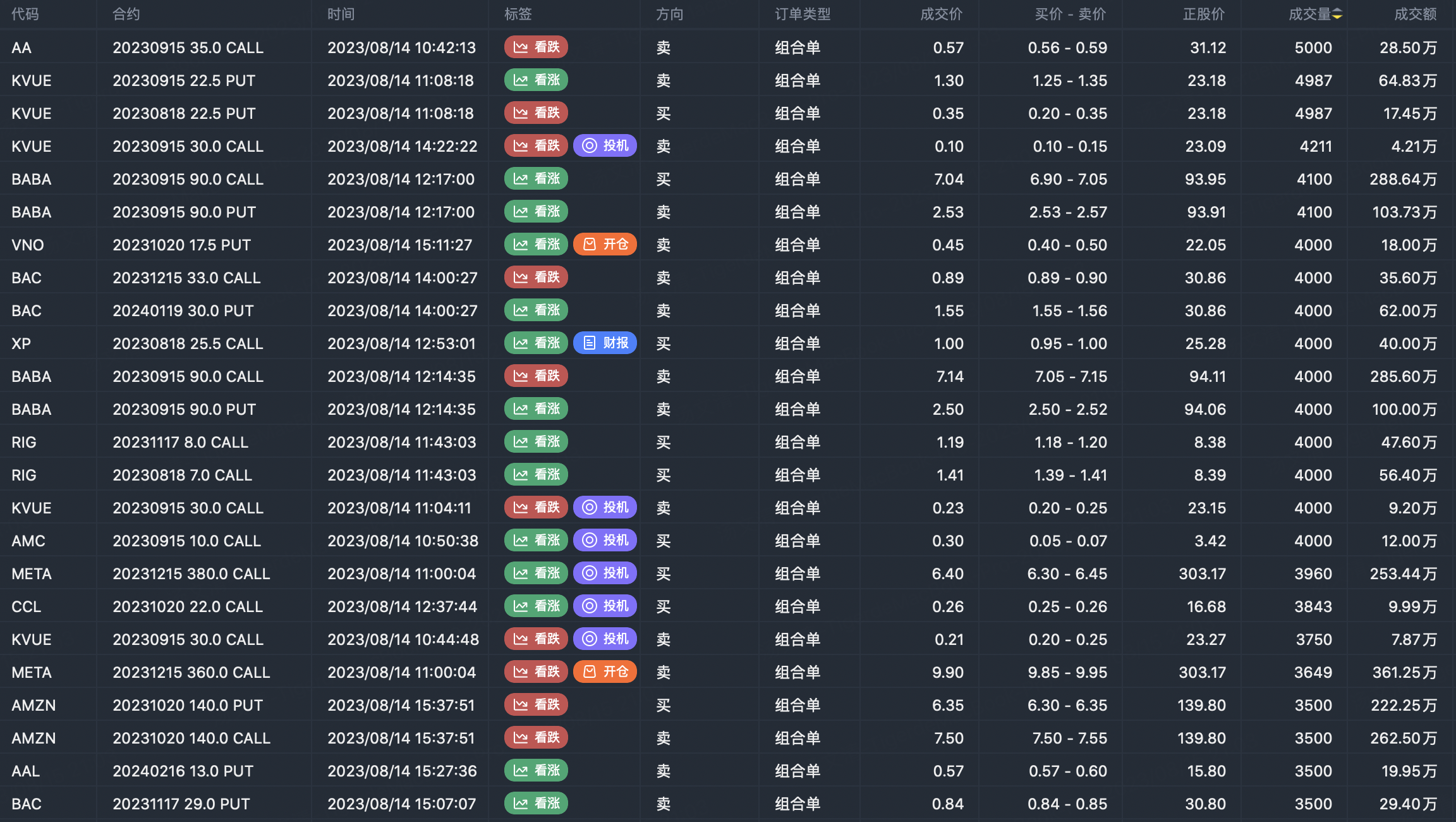

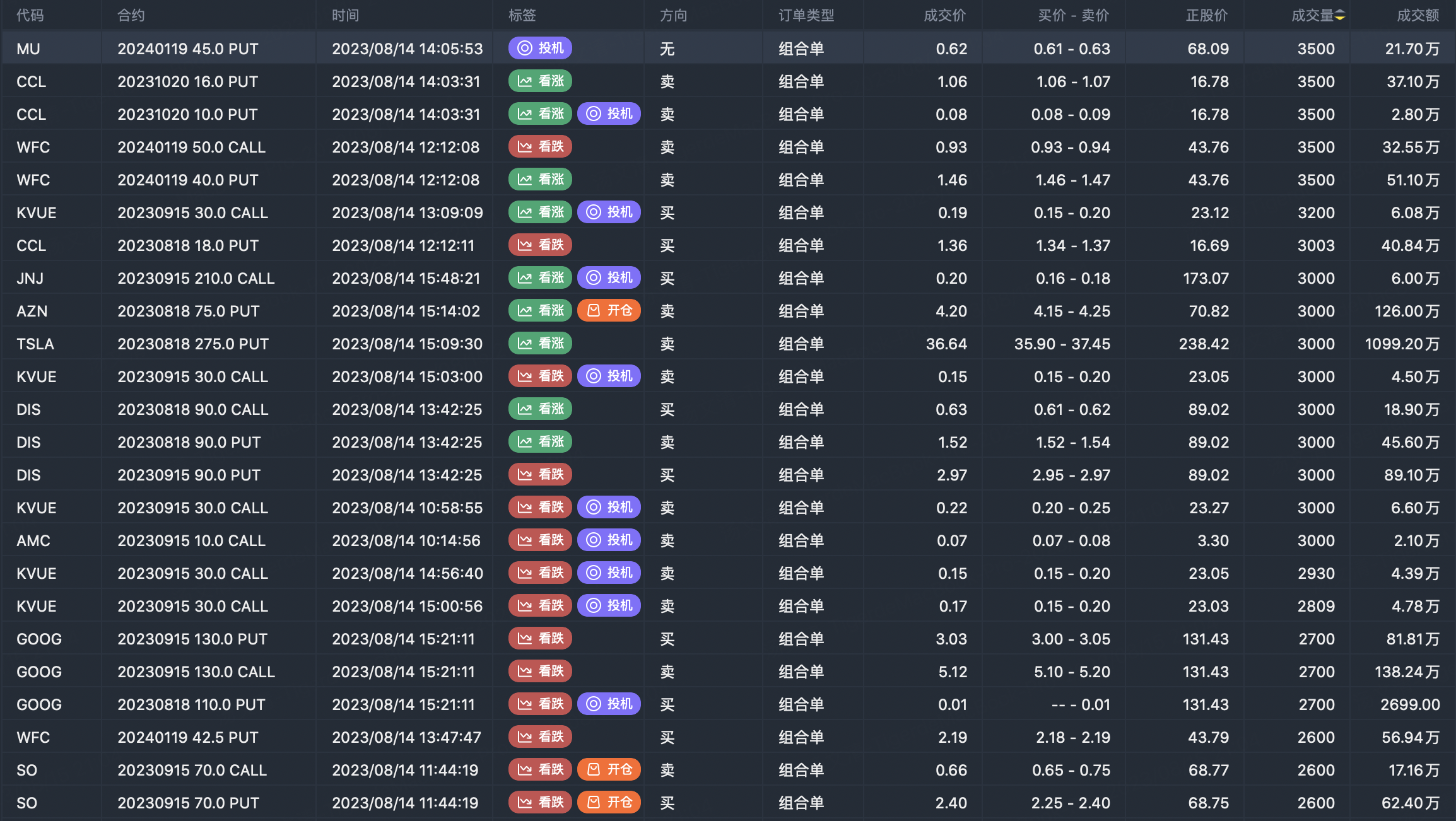

Options portfolio open position

Note: This image data is from Tiger PC. This screening is a significant portfolio of options contracts in the market. Portfolio opening includes a variety of underlying trends, requiring traders to further master the basic knowledge of options for analysis and judgment.

Comments

Great ariticle, would you like to share it?

[Thinking] Hmm....why Nvidia rose good to share

Great ariticle, would you like to share it?