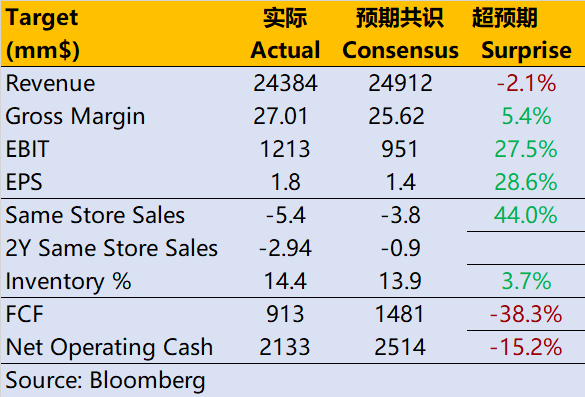

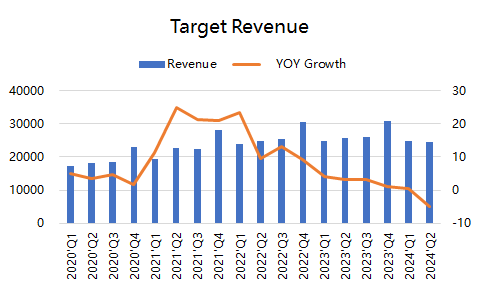

After several turbulent earnings seasons, $Target(TGT)$ showed a reversal trend in its Q2 financial report released yesterday. Despite falling short of revenue expectations, the operational improvements led to profits exceeding the market's forecast.

Amid macro-level changes, Q2 witnessed sluggish sales of non-essential items. However, the company's stock price maintained an upward trajectory after the earnings announcement. This can be attributed to the significant sell-off previously triggered by declining profit margins. Q2 revealed a robust operational performance, and the provided guidance surpassed expectations.

Total revenue decreased by 4.9% to $24.8 billion, falling below the market's projected $25.3 billion. Comparable store sales dropped by 5.4%, far from the anticipated -1.7%. Essential goods, beauty, food, and beverages exhibited continuous growth, offsetting a decline in discretionary categories. Immediate services, including a nearly 7% growth in Drive-Up, increased by approximately 4% during Q2.

The company's operating profit margin stood at 4.8%, a substantial improvement from the previous year's 1.2%. Gross margin, accounting for 27.0% of sales, demonstrated an increase compared to the previous year's 21.5%. This reflects reduced markdowns and other inventory-related costs, lower shipping expenses, retail price hikes, and improved supply chain and digital fulfillment costs.

EPSreached $1.80, exceeding expectations of $1.42. Post-adjustment EBITDA amounted to $1.9 billion, surpassing the consensus estimate of $1.58 billion.

Inventory decreased by 17% compared to the previous year, driven by a 25% reduction in stock within non-essential categories. This partly offset investments made to support frequency-based categories and strategic investments for long-term market share opportunities.

During the earnings conference call, company executives pointed out that

consumer spending had shifted towards travel and entertainment choices, affecting other non-essential goods. Although the year's product line faced negative responses, improved traffic and comparable sales in July and August suggest a potentially stronger start to Q3 than some investors expected.

Concurrently, the company lowered its full-year sales and profit expectations. Comparable store sales for the remaining two quarters are projected to decline by a single-digit percentage range. The revised expectation for full-year GAAP net income and adjusted EPS is $7.00 to $8.00, compared to the previous range of $7.75 to $8.75. However, this adjustment still presents a slightly better outlook than market predictions.

Investment Highlights

Despite lackluster revenue performance among retailers, the gross profit margin has outperformed expectations, contributing to an unexpectedly robust earnings per share.

Compared to a year ago, the improvement in gross profit margin is primarily attributed to reductions in discounts and other inventory costs, lower shipping expenses, retail price enhancements, and supply chain refinements. These positive factors have only partially offset higher inventory losses this quarter compared to a year ago.

The company faces challenging comparisons, potentially higher non-essential product penetration rates in traditional e-commerce sales, and intensified competition from other retailers, including $Wal-Mart(WMT)$ , who are enhancing their omnichannel sales and operational prowess.

The company's full-year pre-tax profit margin appears to be on track to reach a modest 4%, not far from the current market consensus of 4.7%, indicating that the performance decline is mainly sales-driven. The question is not whether Target Corporation will rebound, but when.

Furthermore, no stocks were repurchased this quarter. With approximately $9.7 billion in repurchase authorization remaining from the board-approved buyback plan, the company still retains significant repurchase capacity.

Comments

Interesting Walmart sales crushed it last quarter. Maybe all the people left Target (like many I know) and are now buying at Walmart gonna be a long cold winter for 🎯

WMT stalling, investors thought the boycott from TGT to WMT would be bigger, it failed. So TGT rewarded, WMT flat on a pretty good report. It is all about expectations people!!!

Don't forget, TGT also owns Shipt. Not sure how much revenue Shipt brings in for them, though.

After careful consideration, and guidance from James. I am buying. Good luck all.

Target will never recover. Broken corporation.