kokkai

`For a company that is at a relatively early stage in its growth, would you prefer it to focus fully on profitability or do you want it to invest in future growth areas?

I think this was the main reason for the pullback from the recent Q2 2023 earnings report of Sea Limited (NYSE:SE).

To me, this brings an excellent opportunity for long-term investors given that Sea Limited is investing in its long-term prospects and ensuring that it stays competitive in the long run.

Setting up for long-term success

Sea Limited achieved something I have not seen in the public markets for a long time. It managed to surpass expectations in its ability to reach profitability in just a matter of a few quarters.

This has demonstrated the strength of its business model and the management team's ability to not just talk but also execute very quickly and skillfully to the changing market environment.

The management team is of the view that the company now has achieved self-sufficiency and is on a firmer footing that enables it to be able to invest in its long-term growth prospects and expand its long-term addressable markets.

As a result, in the 2Q23 quarter, management announced that it has started and will continue to ramp up investments to grow its e-commerce business across its markets.

The negative impact of this is what the market is pricing into the share price today.

Given these investments need to be made for long-term growth, this will have an impact on the bottom line of Shopee as well as at the group level.

That said, management remains focused on its focus on self-sufficiency and continues to drive improvements in efficiencies in the business.

Lastly, management remains flexible in its strategy and continues to be watching the macro conditions and markets closely, and should there be a need to change its focus on pace of investment, it will be able to do so.

Reacceleration of investments

Management stated in the Q2 2023 earnings call that the consumption pattern in its core markets remains resilient today despite the global macro weakness.

Sea Limited has already demonstrated that it is more than capable of turning profitable when it needs and wants to with multiple levers to pull to do so.

As a result of its ability to turn profitable, along with its observation that there is a rising demand for short-form video and social live-streaming commerce, management intends to invest in this opportunity.

While I would argue that the competitive pressures from TikTok are still small at this point, I think that the fact that Sea Limited is moving quickly to innovate and adapt to market trends is indicative of a very high-quality company capable of adjusting to the times.

In my opinion, Sea Limited is actually preventing any potential loss of share from Shopee to TikTok even before it happens by ramping up its own live streaming and short-form video format.

Investments into future growth areas

There are three main investment areas.

Firstly, management is intending to invest more in live streaming features and incorporate this into its e-commerce platform.

In the 2Q23 quarter, Shopee's user engagement metrics improved as a result of its focus on its live streaming feature. The company saw the live-streaming feature drive significantly higher participation from buyers, sellers, and creators. The feedback for Shopee's live-streaming efforts has been positive so far and resulted in high satisfaction. For example, in its shopping campaign in Indonesia, one out of four Indonesian buyers watched live streams, and Shopee was already ranked as the leading live-streaming e-commerce platform in Indonesia by Populix.

Shopee has multiple reasons to focus on live streaming. Firstly, as an e-commerce platform, live streaming provides an efficient conversion mechanism to convert buyers into actual orders. Secondly, as a social commerce platform, Shopee is known for its ability to improve user engagement by gamifying e-commerce. As a result, by tapping on live streaming, this will enable Shopee to be a stronger social commerce platform.

And more importantly, we also see new opportunities for growth, in particularly relating to live streaming as well as e-commerce related to -- with video content.

Thirdly, given that at the Group level, Sea Limited is already profitable and at scale, it has the ability to invest to capture more market share in the space. Last, but not the least, there are huge opportunities for growth to incorporate live streaming into e-commerce as it brings a different angle to the e-commerce shopping experience.

The investments in this front include higher costs related to revenue sharing with influencers and affiliates, which might possibly affect effective take rates.

In my view, I think the investments in live streaming are actually crucial for its own survival. We all have heard of how Meta Platforms (META) social media platforms, Instagram and Facebook, were losing traction against TikTok. Shopee needs to continue to innovate and evolve to ensure its relevance in a fast-changing e-commerce world.

Secondly, management will be providing shipping subsidies. This will be offset revenues marginally and affect VAS revenues and effective take rates. Management intends to ramp up investments in free shipping to capture more of the growth opportunities it is seeing in the market.

Thirdly, management intends to invest to improve and strengthen Shopee's logistics capability so as to bring about a faster delivery experience and thus, a better user experience.

Some of the new initiatives include the improved digitalization of the scheduling as well as the tracking of orders, as well as more delivery options that have been launched to cater to different user preferences.

For example, in Singapore, Shopee has launched another 600 collection points across different locations, on top of the current 1,000 self-collection lockers it has today to bring about more options for delivery for its users.

Efforts like these have actually resulted in lower logistics costs for Shopee as these lower manpower costs, and it also helps to improve the overall delivery experience as well.

In my view, with continued investments into its logistics network and capabilities and improving the delivery experience, Shopee is building a strong competitive moat in e-commerce in its core markets similar to what Amazon (AMZN) is doing.

At the end of the day, I think this will enable a long-term sustainable leadership e-commerce position for Shopee in its core markets as a result of a strong delivery and logistics capability, lower overall costs, and lastly better user experience.

Overview of Q2 2023

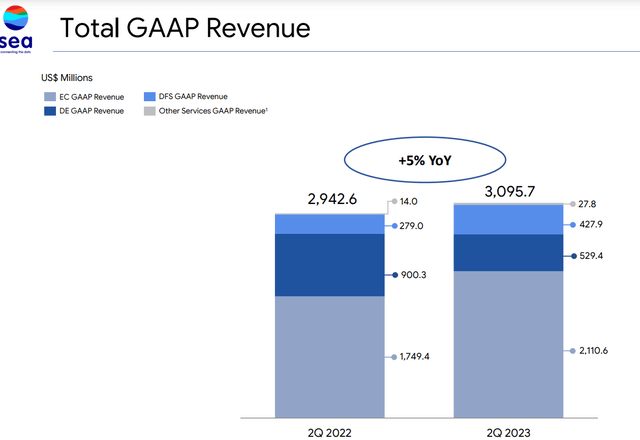

Revenue came in at $3.1 billion in 2Q23, up 5% from the prior year, missing consensus by just 3 percentage points.

The weakness in revenue was due to the digital entertainment segment revenue coming in at $529 million, down 41% from the prior year.

Digital financial services grew 53% from the prior year to $428 million, while e-commerce grew at a solid 21% from the prior year.

Revenue breakdown (Sea Limited)

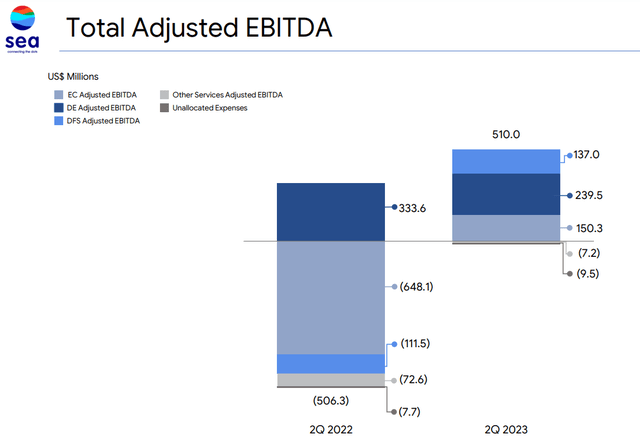

Adjusted EBITDA and net income bet expectations by 2 percentage points and 33 percentage points, respectively.

Both the e-commerce and digital financial services segment turn profitable in 2Q23 relative to the prior year, bringing in $240 million and $137 million in adjusted EBITDA in 2Q23, compared to the negative $648 million and negative $112 million adjusted EBITDA from the prior year.

Digital entertainment segment adjusted EBITDA decreased from $334 million in 2Q22 to $137 million in 2Q23.

Adjusted EBITDA breakdown (Sea Limited)

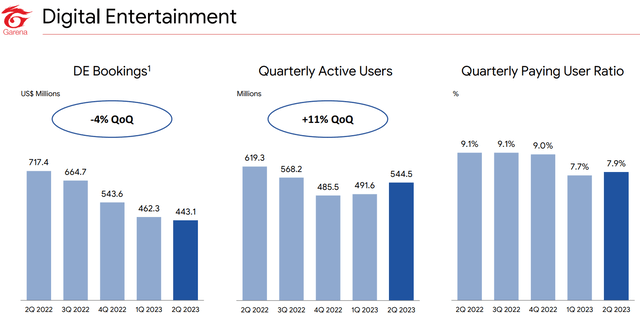

Digital entertainment business showing stabilization

Quarterly active users for 2Q23 were 545 million in 2Q23, increasing 11% sequentially, and as can be seen below, it's a second consecutive sequential increase for the quarterly active user metric. In the 2Q23 quarter, the quarterly paying user ratio metric also increased sequentially to 7.9% in 2Q23.

The improvement in user metrics was a result of Free Fire showing signs of sustained improvements in user retention and engagement as the bookings for the game actually grew quarter-on-quarter for the first time in seven quarters. This is definitely an encouraging sign for Free Fire's journey to stabilization.

Digital Entertainment operational metrics (Sea Limited)

The management team is happy with the positive trend that we are seeing for quarterly active users and quarterly paying users as well as Free Fire continuing to trend in the right direction in the quarter as bookings improved in the quarter.

The focus for the quarter has been on the game communities, as well as the generation of tailored content for communities and engagement with better user experience.

Garena will focus on the user base first before attempting to monetize further.

In addition, management continues to monitor and observe to see if the trend we are seeing is a sign of a start of a longer-term stabilization.

As a result of the increase in Free Fire bookings as well as other games in its portfolio, management expects that the segment's EBITDA margin to have a boost from its already significantly higher EBITDA margin relative to the industry.

The newly launched game, Garena Undawn, is an exciting one for Garena, Management will first focus on engaging with the user base and ensure a strong user base before monetization at an early stage of operations. The title seems to be outperforming management's expectations so far, which suggests a good start for the game.

E-commerce

In the 2Q23 quarter, Shopee GMV saw a sequential growth as well as a double-digit growth in the order number sequentially.

This bodes well for the start of the investments that the company is making in the quarter and ramping up in the quarters to come.

The main theme around the e-commerce segment is that management intends to ramp up investments in live streaming and e-commerce content for short videos to improve its strength as a social e-commerce player.

This is possible because of Shopee's large user base and strong profitability and with the recent progress and benefits that Shopee has seen from the start of these investments, the management team is even more convinced that this is the right path forward.

While such investments will have a near-term impact to profitability at the Shopee and the group level, Sea Limited has shown that it is able to pivot back to profitability if and when it needs should market conditions change and that the company will remain self-sufficient with an unshifted focus on profitability.

Digital financial services

It is just amazing how the digital financial services segment is generating a positive $137 million in the 2Q23 quarter and the management event mentioned that the fintech business continued to generate strong cash flows with strong year-on-year revenue growth at a stable risk profile. Given an early development stage for the business, management will focus on maximizing efficiency of the business.

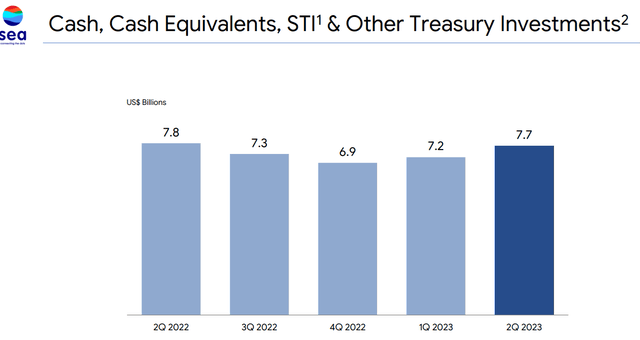

Cash

One of the most important points to note in the 2Q23 quarter was that the cash on Sea Limited's balance sheet expanded by $500 million in the quarter.

The company generated $1.2 billion in cash from operating activities while free cash flows came in at about $1 billion for the 6 months period from January to June 2023.

Cash levels (Sea Limited)

At the $20 billion market capitalization that the company is trading at today, this implies a free cash flow yield of about 10%.

Valuation

Sea Limited trades at just 15x 2024 P/E today.

I can't imagine a better bargain in the market right now if you think that Sea Limited's leadership in e-commerce, fintech, and gaming will continue. The runway remains long, and the company is in the process of building and upgrading its competitive moat.

At the end of the day, the company is playing defense by playing attack. By ensuring that it is innovating and being ahead of the curve, it can defend successfully its e-commerce market share from new entrants like TikTok.

I am reiterating 1-year price target for Sea Limited of $94.50.

This is based on a 35x 2024F P/E assumption, which is justified given Sea Limited's leadership position and long runway for growth.

The 1-year price target may be challenged by the near-term uncertainties about how long the near-term investments will be, but I think that we will see this pay off in the form of longer-term profitability.

That said, I do expect that on a full-year basis, given management's continued focus on self-sufficiency and efficiency, I continue to expect positive profitability in the future.

Conclusion

I think that what we are seeing today brings an excellent opportunity for investors with a longer-term horizon.

Management is clearly executing well with a proactive approach to dealing with competition, while at the same time being adaptable and flexible to the changing environment and managing profitability.

As management has shown that they are able to pivot to profitability when they need to and that the company is in a stronger position cash flow and profitability wise compared to one year ago, the company's investments for its long-term business opportunity is crucial, in my view to ensure Sea Limited remains relevant for a long time.

While this may result in near-term bottom-line impact to Shopee and Sea Limited, I think that this is the right strategy to ensure the long-term sustainability and growth of the company.

I will end off with this: Amazon did not end up being a market leader overnight and I think what Sea Limited is doing today is not unlike what Amazon did in its early days when it had to invest for the long term and not be short-sighted.

I remain impressed by Sea Limited and the management team.

Comments