FG Trade

MercadoLibre (NASDAQ:MELI) has been a much talked about company in the markets since the covid-19 pandemic.

Today, I will be giving a brief introduction to the company and provide a review into its 2Q23 results.

What does MercadoLibre do?

MercadoLibre is the largest online commerce ecosystem in Latin America based on orders processed and unique visitors.

The company is currently present in 18 countries, but its three main ones are Brazil, Argentina and Mexico. About 50%, 20% and 20% of revenues come from Brazil, Argentina and Mexico respectively. These three geographies make up almost 90% of revenues as of 2Q23.

Breakdown of revenues (MercadoLibre)

The company classifies its revenue streams into two main segments: commerce revenue and fintech revenue. In the commerce revenue, this includes services revenue coming from Marketplace, including final value fees, shipping fees, classifieds fees, advertising fees and more. The commerce revenue also includes product sales revenue, which involves the selling of merchandise on a first party basis from its own inventory.

The company's fintech business has three main revenue streams. Firstly, Fintech Services include revenues from commissions for transactions off-platform that were derived from the use of the payment solution. Secondly, credit revenues, which include revenues from the interest earned from loans, advances and credit card transactions. Lastly, Fintech Product Sales, includes revenues from sales of mobile point of sales devices.

MercadoLibre offers an ecosystem of six integrated e-commerce and digital financial services, including the Mercado Libre Marketplace, the Mercado Pago Fintech platform, the Mercado Envios logistics service, the Mercado Ads solution, the Mercado Libre Classifieds service and the Mercado Shops online storefronts solution.

MercadoLibre ecosystem (MercadoLibre)

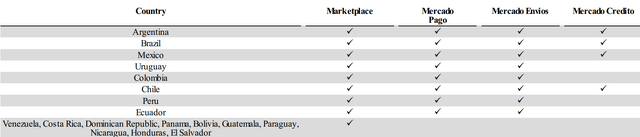

As can be seen below, in its three key geographical segments, Argentina, Brazil and Mexico, MercadoLibre provides all major services to these geographies.

Main services in each country (MercadoLibre)

Market opportunity and future growth

I expect that MercadoLibre will continue top-line growth CAGR of between 20% to 25% until 2027.

As a result, the scale of the business will grow materially in the next five years.

This will be driven by multiple segments and geographies.

For its commerce segment, its key e-commerce markets are growing between 14% and 32% CAGR respectively. For reference, Argentina's e-commerce market is expected to grow at 32% CAGR until 2025, while Brazil and Mexico's e-commerce market is expected to grow at 14% and 17% CAGR until 2027.

In addition, there are attractive fintech opportunities in Latin America today, Fintech venture capital investment grew from $4 billion in 2020 to almost $16 billion in 2021.

The main opportunities within the Latin American markets will be led by Brazil and Mexico. The fintech markets in these countries are expected to grow rapidly, at a revenue CAGR of 29% until 2030.

Accelerating profitability as a result of strong top line and operating leverage

Given that I expect that MercadoLibre will continue top-line growth CAGR of between 20% to 25% until 2027, the scale of the business will grow materially in the next five years, with huge operating leverage to be reaped.

Thus, I am of the view that we will see a strong inflection in margins as the business continues to scale up, and operating leverage improves.

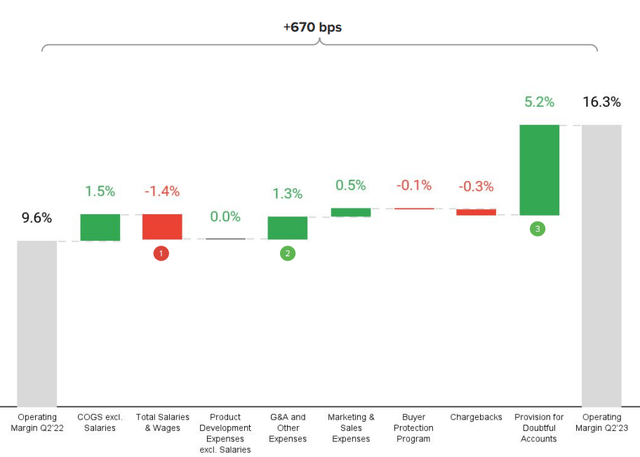

This was evident in the second quarter of 2023 as MercadoLibre's operating income came in at $558 million in the second quarter, up 123% from the prior year. This was 49% higher than the market consensus.

The beat in operating income was due to the higher e-commerce revenues, which also beat by about 5% as a result of the higher GMV and take rates, higher efficiency as operating expenses was about 11% less than expected due to lower sales and marketing, G&A as well as product development expenses.

As a result, operating margin reached 16.3%, expanding massively from 9.6% from the prior year. Even when compared to 1Q23 when operating margin was 11.2%, 2Q23 operating margin was also strong.

Operating margin (MercadoLibre)

Despite negative effects from foreign exchange losses and taxes, net income for 2Q23 was still 16% higher than market consensus, coming in at $262 million.

The bottom line is this, as revenues continue to grow and management continues to focus on operational efficiency, operating margins have room to expand in the near term.

Continuing solid growth momentum in commerce

Let us dive into the commerce segment.

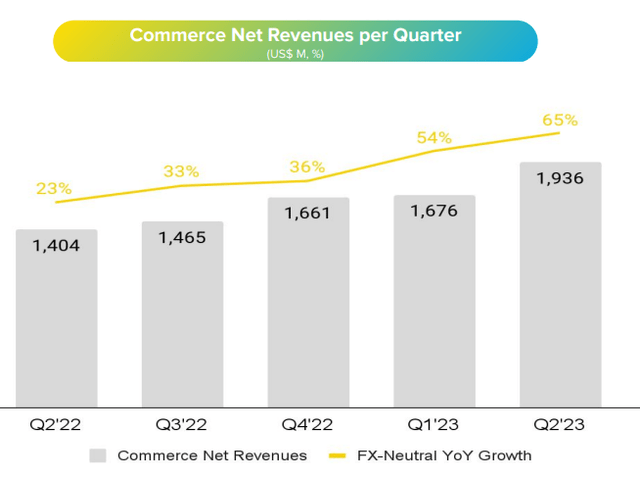

For the 2Q23 quarter, commerce revenues grew by 38% from the prior year to $1,936 million.

This was contributed by a 200 basis point take rate expansion from the prior year (more on that below), a faster 3P GMV growth, a higher share of 1P.

Commerce revenues (MercadoLibre)

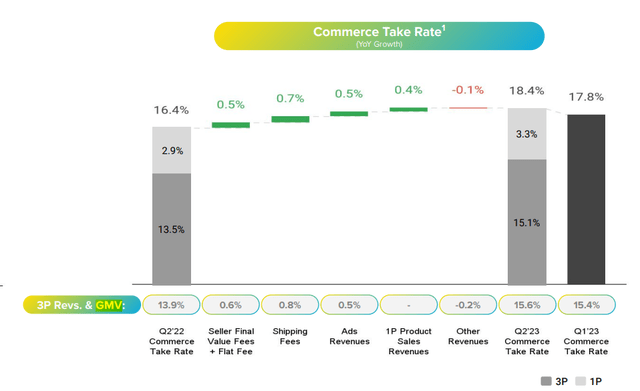

As can be seen below, when compared to one year ago, MercadoLibre's commerce take rate increased by 200 basis points in the quarter.

This comes as continued monetization efforts led to increase in commerce take rates, with shipping fees, ads revenues and seller final value fees adding to the commerce take rate.

Commerce take rate (MercadoLibre)

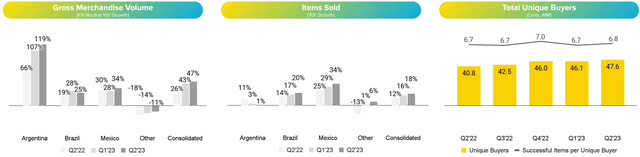

GMV growth on a consolidated basis accelerated to 47% year-on-year in 2Q23, up from the prior 43% year-on-year growth seen in 1Q23.

This improved GMV growth was largely contributed by the GMV growth in Argentina.

In 2Q23, GMV growth in Argentina was 119% year-on-year, up from the prior quarter's 107% year-on-year growth.

In particular, for Brazil and Mexico, items sold accelerated to 20% and 34% year-on-year growth respectively.

Marketplace highlights (MercadoLibre)

In the 2Q23 quarter, MercadoLibre achieved a record in the total managed network penetration reaching 93.9%.

In addition, fulfilment by MercadoLibre also reached an all-time high with more than 46% penetration.

This was contributed by all markets with fulfillment operations, as all markets grew in terms of penetration from the prior year, but Brazil was the one that showed the most improvement.

The company continues to improve its managed network in most geographic regions, so I expect this managed network penetration to continue to improve over time.

In addition, MercadoLibre achieved more than 110 million same-day and next-day deliveries in the second quarter.

This made up 56% of MercadoLibre's total deliveries, which was also a record for the company.

Logistics highlights (MercadoLibre)

In my view, these achievements in the logistics side of things are a result of the investment the company has made in logistics in the region. In the longer term, this will serve as a strong moat for the company as it continues to improve on logistics and provide customers with a better experience.

Where will the commerce business head in the future?

With continued market share gains in the quarter, especially in Brazil and Mexico, I think that MercadoLibre is heading in the right direction.

The reason for this is simple: The company continues to aggressively invest in its business for long-term value creation and to improve on its value proposition.

This includes improvements to its logistics network to increase the proportion of same-day and next-day deliveries to customers. The company has been investing aggressively to improve its user experience, amongst others, to drive growth.

I think this commentary by management in the 2Q23 quarter is very relevant:

In the short run, not every quarter will look like this, there are still multiple growth vectors for us to invest behind, but it certainly points to the long term margin and cash upside we believe we can deliver.

While 2Q23 reflects a strong margin and thus, free cash flow profile, the company continues to have many areas in which it is investing in.

As it continues to invest in its business, this may affect the short-term margin profile of the business but in the long-term, this drives long-term sustainable and superior margins and growth.

Robust fintech growth

I have briefly mentioned the three revenue streams for the fintech business above.

Total payment volume ("TPV") grew strongly at 39% from the prior year. The rapid growth in Digital Account TPV of 182% year-on-year growth was due to Mexico and Argentina's strong growth. Acquiring TPV also grew solidly at 74% year-on-year growth, contributed by all geographies and products. In particular, Argentina and Mexico TPV growth accelerated in the quarter.

TPV growth (MercadoLibre)

Net Interest Margin After Losses ("NIMAL"), which is basically the credit revenues less bad debt and funding costs reached 36.8% in 2Q23 expanding from the prior year and the prior quarter.

This increase in the NIMAL spread was a result of a decrease in bad debt as originations and portfolio growth shifted from Brazil towards lower risk Mexican consumer book, as well as improved credit card asset quality. In addition to that, revenue growth contributed to the increase in NIMAL spread as there were accelerated originations in the Mexican consumer book.

Credit highlights (MercadoLibre)

MercadoLibre's <90-day NPL went up marginally sequentially to 9.9% in 2Q23 as a result of the merchants book and was partially offset by improvements in credit card book.

The >90-day NPL was down sequentially to 25.1% in 2Q23 downwards for the second quarter.

The total portfolio exposure is still skewed towards the lower risk cohorts.

Credit highlights (MercadoLibre)

Valuation

My 1-year price target for MercadoLibre is based on a 50x 2024F P/E.

I think for MercadoLibre, 50x 2024F P/E is a justifiable premium multiple that the company is able to achieve due to its strong competitive position, continued investments for growth and generation of strong margins and free cash flows.

My 1-year price target is thus $1,400.

Conclusion

MercadoLibre is poised to be a leader in online commerce ecosystem with its strong competition position in commerce and fintech.

The company continues to invest aggressively in growth areas within its business and this will result in improved customer experiences, differentiated offerings and lower costs, resulting in a drastically improved business in the long term.

In addition, the Latin American e-commerce and fintech market is still growing rapidly, and I expect MercadoLibre to grow faster than the industry as a result of its strong competitive position and continued innovation.

With solid free cash flow generation while the company is still scaling up revenues, I expect that in the long run, the business will be able to generate strong margins and thus free cash flows.

These excess cash flows can then be returned to shareholders, re-invested or used to acquire new businesses to supplement its growth engine.

Comments