August 24th, $MEITUAN-W(03690)$ released 2023 Q2 earnings, who demonstrated a comprehensive recovery in the first quarter, continued the trend of recovery in Q2 while facing stronger competition.

Currently, Meituan remains advantageous in the local lifestyle sector, competing with platforms like Douyin (TikTok). The revival of high-profit-margin businesses has also increased the overall profitability of the company, further solidifying its valuation foundation.

With the impact of Tencent's Special dividends on the stock price ending in the first half of the year, coupled with enhanced operational capabilities and rising profit levels, the company's valuation foundation continues to improve. The restoration of market confidence is the only missing piece for the stock price recovery.

We believe,

Meituan's core business, specifically its food delivery service, continues to exhibit growth with a stable base. This is due to seasonal factors as well as the lower base from the same period last year. Additionally, optimizing delivery costs further increases the gross profit margin.

A more significant aspect is the comprehensive recovery of the local in-store business. After several quarters of slower growth in advertising revenue compared to commission growth, this quarter's growth gap narrowed to 7%, with a year-on-year growth rate of over 40%, the highest in history. However, the complete recovery of offline activities has intensified industry competition, causing a potential decrease in profit margins for in-store businesses due to rising marketing fees.

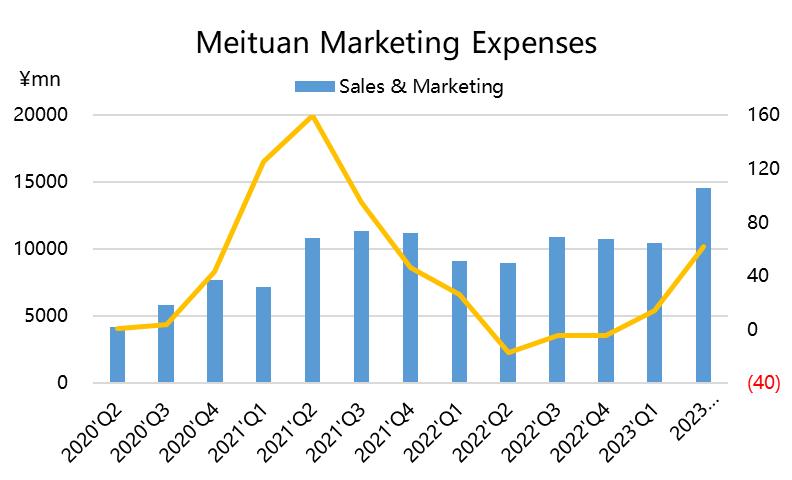

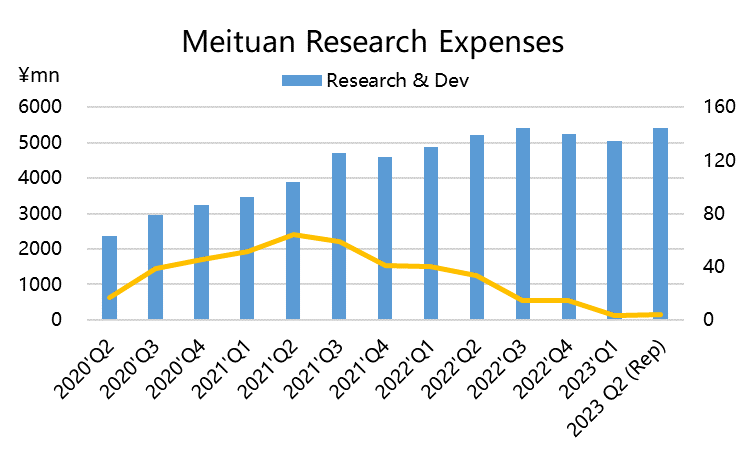

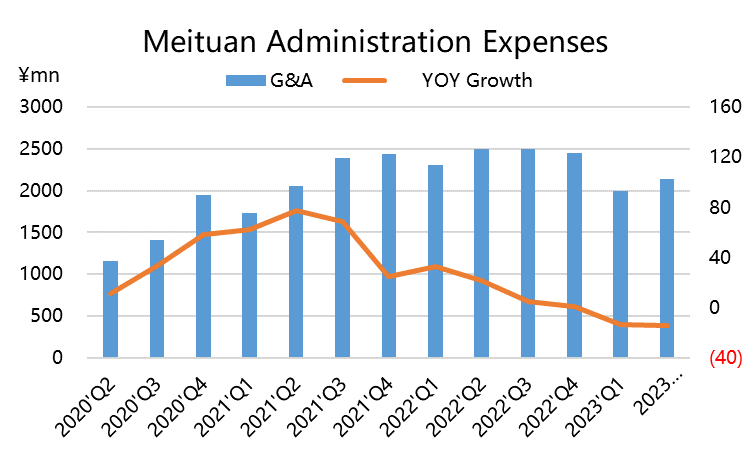

The recovery of high-profit-margin businesses in the travel and advertising sectors has also contributed to the company's overall profit margin. Nevertheless, the phase of cost reduction and efficiency enhancement is nearing completion. Administrative expenses and reduced research and development expenditures are approaching their limits, meaning long-term operational profits still depend on a balance between user-side subsidies and a higher proportion of high-profit-margin businesses.While Q2 performance is favorable, competitive pressures remain substantial.

Earnings Review

Revenue

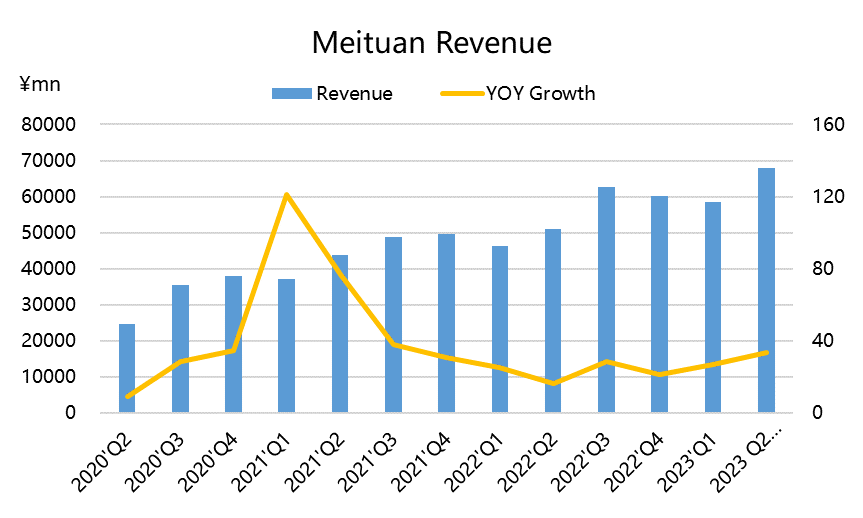

The overall revenue reached 68 billion yuan, surpassing the market's expectation of 67.2 billion yuan, with a year-on-year growth of 33%. This marks a resurgence to growth levels exceeding 30% since Q4 of 2021.

Among these figures, core local business revenue reached 51.2 billion yuan, showing a year-on-year increase of 39%, surpassing the market's expectation of 49.8 billion yuan. Innovative business revenue stood at 16.7 billion yuan, marking an 18% year-on-year growth.

Besides

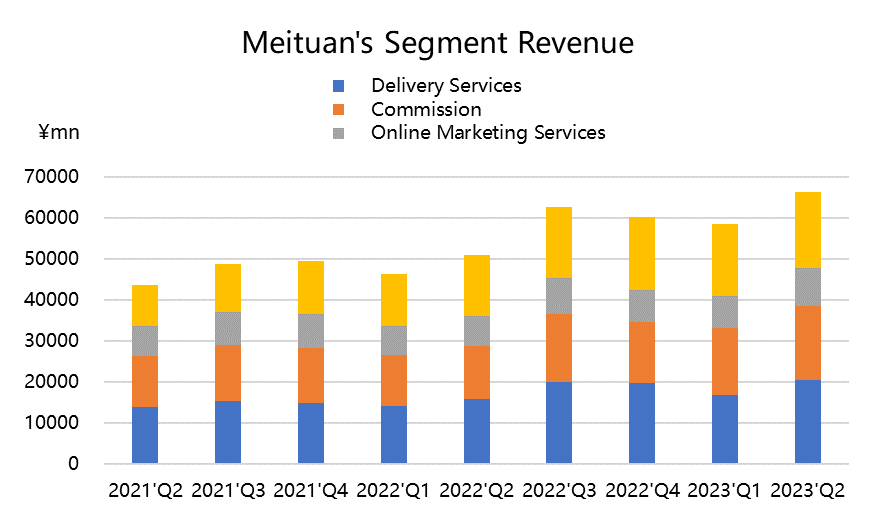

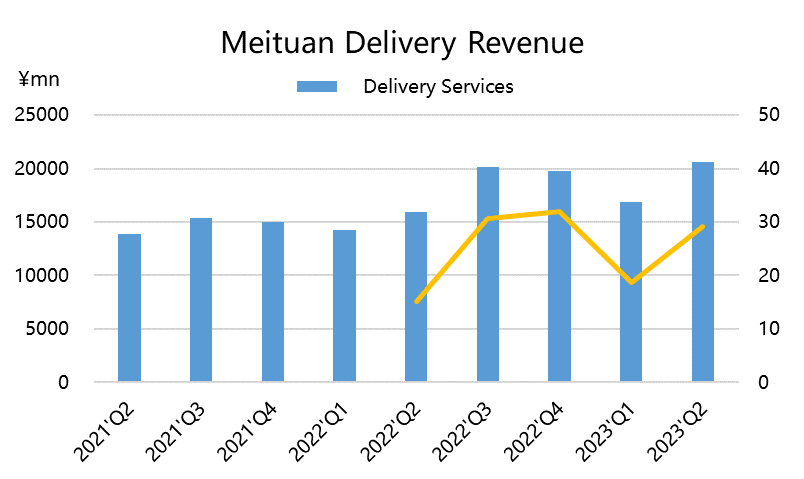

Food delivery revenue totaled 20.4 billion yuan, registering a year-on-year growth of 27.7%, closely in line with the market's expectation of 20.5 billion yuan.

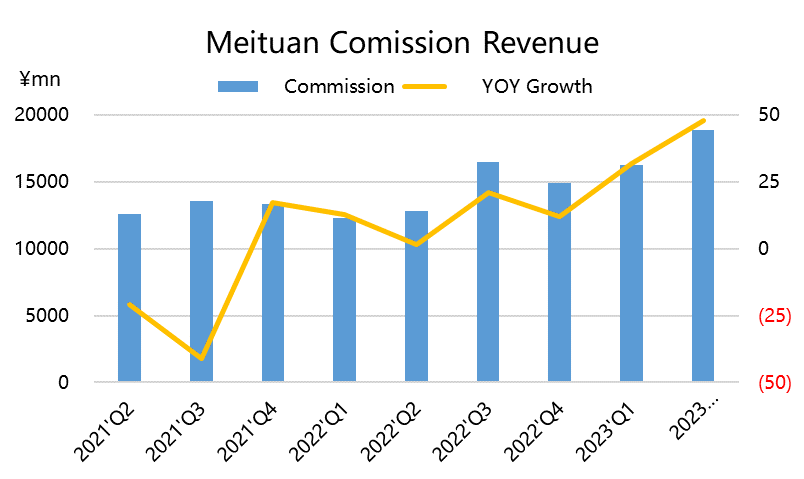

Commission income amounted to 18.4 billion yuan, showing a 47.8% year-on-year growth, surpassing the market's expected 17.9 billion yuan.

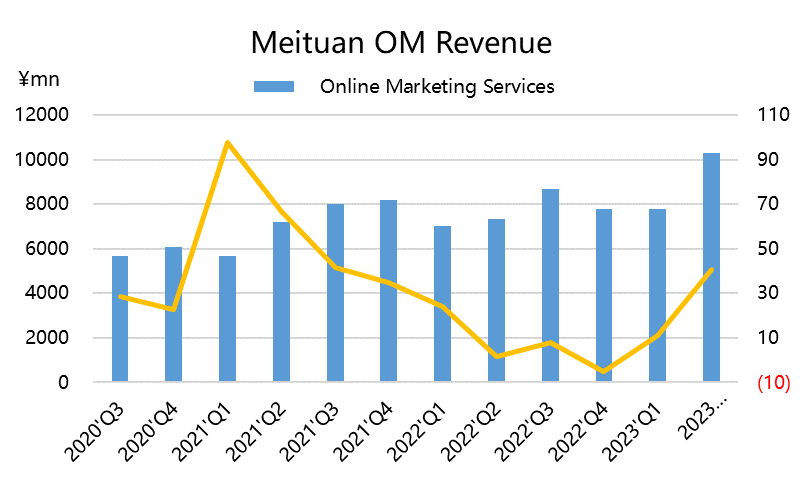

Online marketing service revenue reached 10.3 billion yuan, exhibiting a robust 40.9% year-on-year growth, significantly surpassing the market's forecast of 9.4 billion yuan.

Other service revenues reached 18.4 billion yuan, essentially meeting the market's expected 18.3 billion yuan.

Profit

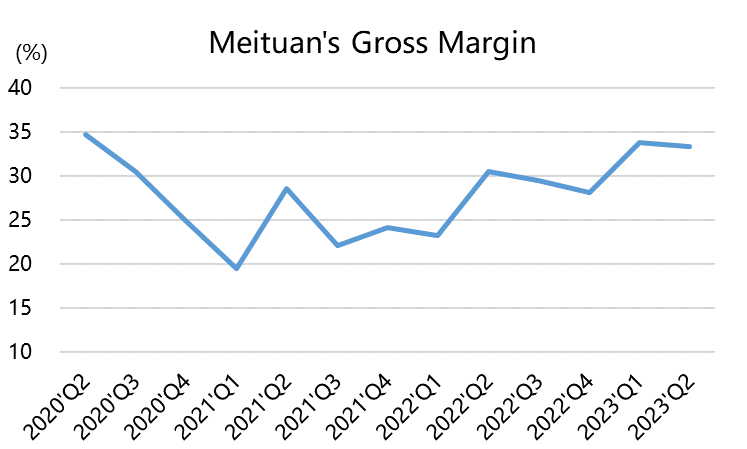

The gross profit margin reached 37.37%, exceeding the market's forecast of 35%.

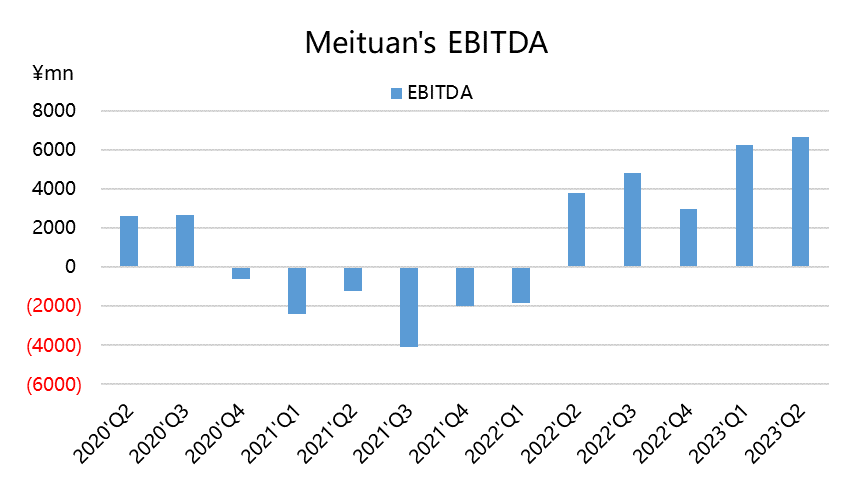

Profit before interest, taxes, depreciation, and amortization (EBITDA) reached 4.71 billion yuan, marking a tenfold year-on-year growth and surpassing the market's expected 2.21 billion yuan.

Adjusted EBITDA stood at 7.68 billion yuan, significantly surpassing the anticipated 2.75 billion yuan.

Investment Highlights

Steady Growth in Food Delivery Business, Expanding Gross Profit Trend

The combined order volume of instant delivery for both restaurant food delivery and flash purchases reached 5.4 billion orders, displaying a remarkable year-on-year growth of 31.6%. This growth rate significantly outpaces the previous quarter's 14.9% and serves as another testament to the recovery scenario. Notably, the peak daily order volume for flash purchases surpassed 1,100 orders.

The growth rate of the food delivery business had been averaging around 15% in the two years following the pandemic. However, this recovery has clearly broken that trend, with food delivery revenue increasing by nearly 28% year-on-year. Of course, this growth rate is influenced by the lower base from the previous year. Nonetheless, the average order values for both food delivery and flash purchases have decreased. This can be attributed to the overall consumption environment as well as the company's subsidy strategies.

What's important is that with the improvement in delivery efficiency, the gross profit margin of the food delivery business has also risen. The company emphasizes the increasing prevalence of "flexible employment," and whatever it may imply, it's a positive development for further reducing the costs of the food delivery business. The company's earlier goal of achieving a 1 yuan average profit per order should also continue to be exceeded in the coming quarters. As of now, the flash purchase business shows a higher degree of volatility compared to food delivery, but it's also expected to achieve a balance between profits and losses around 2024.

The full recovery of in-store wine and travel, as well as local lifestyle competition, affects profitability.

A very positive signal is the quarter's advertising revenue (online impact), which has grown by more than 40%, contributing 10 billion yuan in revenue for the quarter and keeping up with commission growth (47%). It's evident that Q2 saw more active merchant activities, and services like travel also blossomed comprehensively after three years of dormancy.

Commission income was one of Meituan's first indicators of recovery, and Q2 has continued this advantage, with advertising revenue also increasing as a result. The establishment of more live streaming and special price group buying scenarios is expected to generate further increments in the subsequent quarters.

On the other hand, the competition in local lifestyle services with Douyin (TikTok) is a focus for many investors. The recovery this quarter might provide them with some relief. In our view:

Douyin focuses on brand promotion and cultivating interest, giving them an advantage in marketing.

Meituan's in-store services place more emphasis on dining experiences and vast user review data, giving them an advantage in transactions.

Therefore, one focuses on "recommendation," while the other focuses on "usage." Over the years, Meituan's services for merchants, including ordering and payment systems, have further provided value to users and merchants, increasing transaction frequency and stickiness.

Currently, the in-person service is still in a phase of substantial recovery, providing ample room for both companies to gain larger market shares simultaneously. In the short term, the emergence of more formidable competitors remains unlikely.

In the short run, the most significant impact could manifest in terms of profit margins.

Looking at the overall core commercial gross profit margin for Q2, it remained consistent with the previous quarter. The efficiency improvements in the delivery business have contributed to the rise in the gross profit margin. Additionally, sectors like hospitality and advertising inherently boast high-profit margins. Consequently, the overall in-person service sector has experienced a slight decline in profit margins.

Concurrently, we have observed a 62% increase in marketing expenses for this quarter. Apart from subsidies in innovative business segments, subsidies to on-site businesses have also been substantial, driven by the need to counter competition.

Initial businesses are still reducing losses.

Regarding the new businesses primarily centered around Meituan Grocery and Preferred Selection, Q2 revenues witnessed an 18% year-on-year growth, slightly below expectations. This is mainly attributed to the company's overall trend of cost reduction and efficiency enhancement, coupled with the rapid recovery of certain businesses like flash sales during the unique circumstances of the past year.

Losses in this segment have further narrowed to just over 5 billion, with the operational loss rate shrinking to around 30%.

Is there still room for an increase in profit margins?

With the recovery in the growth of high-margin advertising and travel businesses, steady efficiency improvement in the food delivery business, and continued reduction in losses from new ventures, it's not surprising that Meituan's profit margins are gradually reaching new highs.

The company's overall gross profit margin has risen to a historic 37%, far surpassing the expected 33.4%.

On the operational front, operating expenses have continued to contract by nearly 15%, while research and development expenses have increased by less than 4%. The potential for further expansion is set to be demonstrated by economies of scale.

Q2's other income also reached 1.5 billion yuan. Given the overall economic recovery and Meituan's strong cash flow, there is even greater incremental growth in financial income and fair value adjustments.

Valuation and Price

Although the profitability of Meituan's various businesses has fluctuated, the overall profits exhibit a linear growth trend. Since the past two years have marked the initial stable profitability, the growth rate of profits in the future is likely to be higher.

In Q1, we discussed that without considering new business (losses), the core business revenue in 2025 could reach 290 billion yuan. At a 15% profit margin, the profit would approach 43.5 billion yuan. Calculated at a price-to-earnings ratio of 25, the valuation would be 1.25 trillion Hong Kong dollars. Even using a higher weighted average cost of capital (WACC) of 22% (Bloomberg) as the discount rate, the value per share in 2023 would be 134.7 Hong Kong dollars. With a more typical discount rate of around 15%, and factoring in the contribution of new businesses, the valuation is far more than these figures.

However, at present, the upper limit of profit margins could potentially increase, indicating that the valuation center is not limited to these figures. With the current price of 140 Hong Kong dollars, it's evidently too conservative.

Starting from Q2, factors of business uncertainty have largely eased, and market pressure from certain shareholders that existed before has substantially diminished.

What's currently lacking is investor confidence.

Comments