The market has been rescued by Nvidia again. Although the strong financial results, Nvidia stock prices opened higher and lower, poor performance, leading technology stocks fell. If Nvidia misses expectations, expect the market to repeat last September's post-Jackson Hole performance.

But before the FOMC meeting on September 21, the market could face another free-for-all.

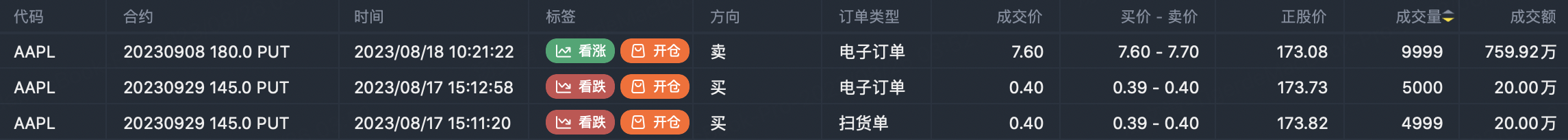

The agency is split on Apple. The market is hedging, with bullish institutions choosing to sell ITM put options $AAPL 20230908 180.0 PUT$ and bearish institutions being more aggressive and buying OTM options directly $AAPL 20230929 145.0 PUT$ .

The two options were traded on Friday (August 17, 18). Put expiration dates cover not only Jackson Hole but also beyond the FOMC. We have to guard against the turbulence that may be caused by the much-anticipated final rate hike.

As for what kind of turbulence is not certain, there are many possibilities.

But I'm pretty confident that the bottom will be right after the FOMC, in late September.

ARM will go public in mid-to-late September, thanks to a blockbuster IPO. There is no theory, an observed rule is that blockbuster ipos generally choose bull market or bottoming out time to go public. I guess it's a way for big banks to protect their clients and clients. For example, last year's $Mobileye Global Inc.(MBLY)$ listing was very cleverly timed.

We are currently in a very typical left side range, and stocks may continue to fall, but some people have started to buy on the left side. $Microsoft(MSFT)$ , for example, was bought a total of 4,946 lots at Friday's low$MSFT 20251219 445.0 CALL$

In general, options expiring in 2024 and 2025 are not a near-term reference and are very typical left side trades, and I observed a lot of 2024 and 2025 call options traded in Tesla in December, when the stock price continued to fall.

So buying a put option is more of a bet and an insurance position: something doesn't have to happen, but if it does, it's a big deal. For those who want to buy stocks at the bottom, choosing to sell put is a more certain return.

So whether to buy or sell put options depends on your trading style.

Recently, the range of options to sell put is very wide, take $Advanced Micro Devices(AMD)$ for example, there are countless strike prices to choose from: 100,98,75,90.

I think the first $AMD 20240216 100.0 PUT$ is actually a good choice.

Comments

Great ariticle, would you like to share it?

Great ariticle, would you like to share it?

Great ariticle, would you like to share it?

Great ariticle, would you like to share it?