Claudio Rampinini

Having been in the investment world for some time now, there are some areas within the investment space that are what I call alpha generators.

The companies that are pivotal in the move towards net zero and to achieve the ambitious targets set by governments and corporations will continue to generate alpha, in my view. This excess returns generated by this group of companies are a result of excess demand for their products and services in order meet these targets, incentives and grants provided by governments and agencies to lower their costs of operations and the urgency from individuals, corporations and governments to move to lower their carbon emissions and move towards net zero.

With that in mind, today's deep dive research goes into Origin Materials (NASDAQ:ORGN), which in my view, is the most promising player in the bioplastics space.

Brief introduction

Origin Materials has a platform technology meant to enable the world's transition to net zero by moving from petroleum-based materials to decarbonized materials in a wide variety of end markets and products. These include packaging for food and beverages, clothing, plastics, car parts, amongst others.

The company's platform technology converts sustainable feedstocks like wood residues, agricultural and wood waste or corrugated cardboard into products that are currently made using fossil feedstocks like petroleum and natural gas.

One thing to note, is that these feedstocks are not used for food production, like other sustainable materials companies that use vegetable oils or other types of sugars as feedstock. The abundance and renewable nature of wood supplies lead to more predictable and stable pricing compared to other platform technologies using other feedstocks.

In addition, another important point to note is that the products that are made using Origin Materials platform technology can directly compete against those made by petroleum based on price and performance.

In terms of differentiation and barriers to entry, Origin Materials is protected by a comprehensive intellectual property portfolio of 23 patent families and trade secrets that spans the company's critical manufacturing processes.

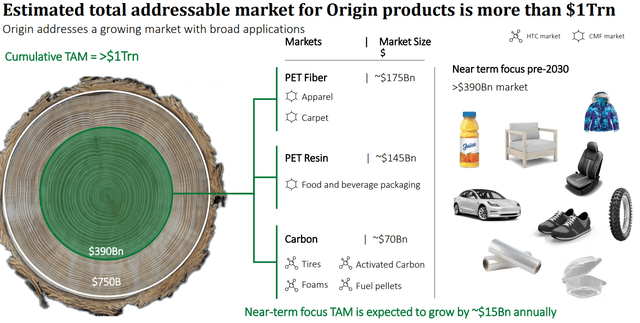

As a result of the ability of its platform technology to cover and tackle many different end products, the company is expected to have a $1 trillion market opportunity, which I will cover next.

Market opportunity

Origin Materials sizes its market opportunity according to what it deems as near-term and long-term opportunities.

In the near-term, the company sees more than $390 billion market opportunity in near term markets like "polyesters for textiles, resin for packaging, solid fuels, activated carbon and carbon black for tires and polymer fillers". This is the target markets for the upcoming Origin plants to be constructed over the next decade or so. This will be the focus for Origin 2 and Origin 3.

Origin Materials near-term market focus (Origin Materials)

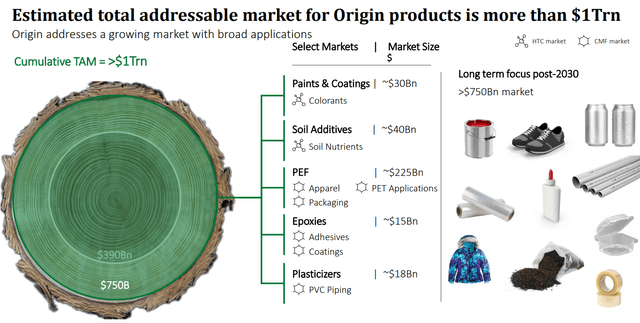

The company has a longer-term market focus, which amounts to a total long-term opportunity of more than $750 billion. These markets include "paints, coatings, soil additives, advanced polyesters, epoxies, plasticizers, polyurethanes, elastomers, emulsions and solvents".

Origin Materials long-term market focus (Origin Materials )

Strong industry tailwinds

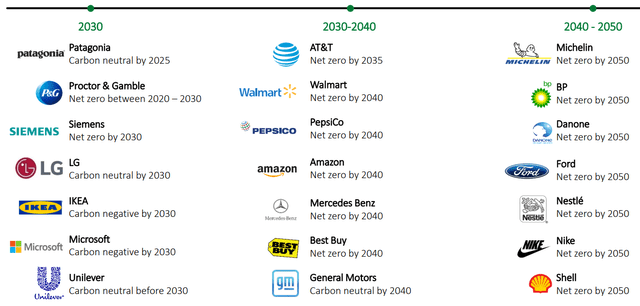

The increasing commitment towards decarbonization is causing a huge demand for the solutions that Origin Materials provide.

Governments around the world are gaining traction in shifting towards a decarbonized future. The 2015 UN Paris Agreement was joined by the EU and 194 countries, which includes the commitments to keep the global average temperature increase below 2°C compared to pre-industrial levels by 2100. For this to be achieved, it was estimated by the UN that 15 gigatons of carbon emissions must be lowered as of 2019 figures.

Even the largest corporations are shifting in the same direction, in line with the increasing consumer awareness about decarbonization and climate change. The largest companies in the world are pledging to be net zero by a certain date, with many of them starting in 2030.

Net zero ambitions (Origin Materials)

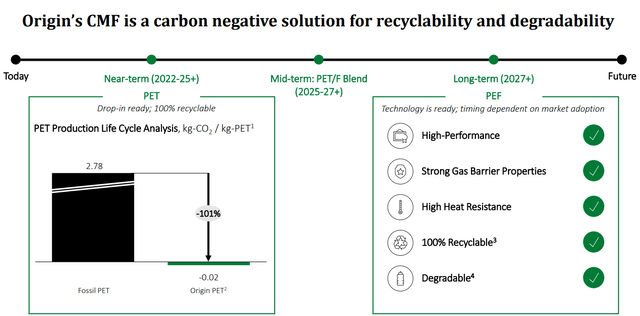

The chemical sector is currently the largest industrial consumer of oil and gas as most of the organic chemicals are traditionally and currently still derived from fossil fuels. In turn, these chemicals are then used to make many other materials like plastics, electronics, paints, amongst others. According to an estimate by Barclays, more than 10 million barrels of oil are used daily for the production of these materials and in the process, large amounts of carbon emissions are then released into the environment. Based on a report by The Association of Plastic Recyclers, each kg of fossil PET has a global warming potential of 2.78 kg of carbon emissions.

This is where Origin Materials platform technology comes in to lower carbon emissions and enable companies to meet their net zero targets.

Origin Materials platform technology

What does Origin Materials platform technology do?

It uses plant-based carbon derived from its sustainable feedstock to get versatile building block chemicals.

These building block chemicals include chloromethylfurfural (“CMF”) and hydrothermal carbon (“HTC”), and also other oils and extractives and co-products.

CMF is a very chemically flexible intermediate that can eventually be used for many different kinds of products. For example, CMF can be converted to furandicarboxylic acid ("FDCA") or purified terephthalic acid (“PTA”), which are then used to produce polyethylene terephthalate (“PET”) and polyethylene furanoate (“PEF”) respectively. Some of the use cases for CMF so far has been the development of applications for packaging for food and beverage, apparel and carpet fibers and in the pipeline for product development include other applications like adhesives, coatings and plasticizers. The focus for CMF is as a carbon negative solution that is degradable and recyclable.

Through Origin Materials patented process, CMF is produced from organic compound and can be easily converted to other products. Deloitte did an analysis and found that the patented process that Origin Materials use can product CMF with a negative 1.21kg carbon dioxide equivalent per kg of CMF when at full commercial scale.

CMF solutions (Origin Materials)

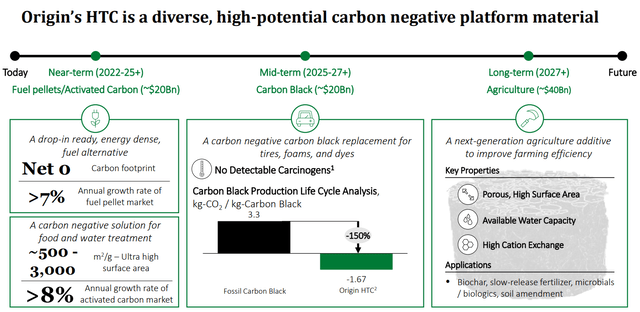

HTC is regarded as a carbon-negative material that is diverse and high-potential. Its current application includes a drop-in, energy dense solid fuel. In its HTC product development pipeline, it includes carbon black replacement for tires, foams and dyes, paint and coating applications, and agriculture and soil products. HTC is seen as a high potential and diverse carbon negative platform material because of what is shown below.

Again, through Origin Materials patented process, HTC is produced from lignocellulose, or plant dry mass. HTC can then be converted into other products like carbon black, activated carbon black and agricultural products. Through the analysis of Deloitte, at full commercial scale, the company's process is expected to be able to have a carbon impact of negative 1.67kg of carbon dioxide equivalent per kg of HTC.

HTC potential (Origin Materials)

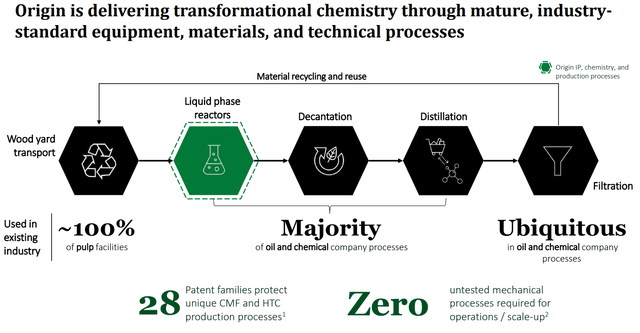

To produce CMF and HTC, Origin Materials manufacturing process includes front end feedstock handling, liquid phase reaction with its catalyst mixture and finally downstream separation processes to separate and purify CMF, HTC and its other co-products.

Manufacturing process (Origin Materials)

The co-products that emerge from the manufacturing process will be made full use of in Origin 2 and beyond. Management thinks these low carbon biofuels can be used for transportation, marine fuel, industrial applications and heat and power generation.

Customer demand

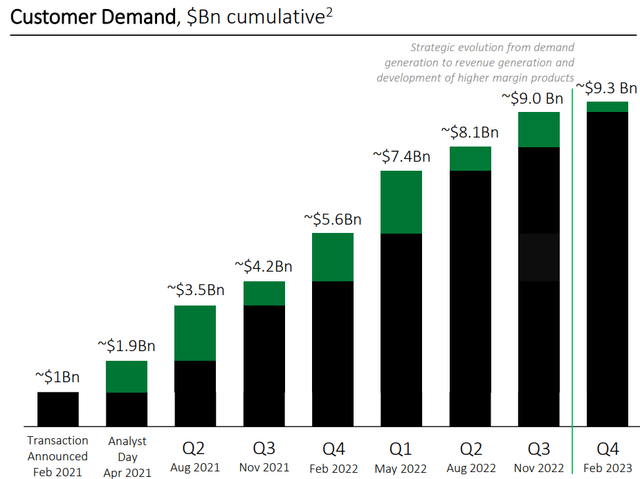

One of the most compelling reasons to buy Origin Materials is the huge customer demand it is seeing.

As of its latest quarter in February 2023, customer demand was at $9.3 billion. Just one year ago, it was at $5.6 billion, and two years ago, it was at $1 billion. Thus, the customer demand grew by 830% and 66% since two and one years ago respectively.

Customer demand (Origin Materials)

The quantity of this customer demand is great, but I also like to see the quality of the customer demand.

Customer base

The quality of the customer demand comes from Origin Materials customer base. As shown below, there are a large range of established and global companies in Origin Materials customer base. For example, it has a strategic partnership with LVMH to develop low carbon footprint packaging for the perfumes and cosmetics industry and as part of this partnership, LVMH signed a multi-year capacity reservation agreement with Origin Materials to buy carbon-negative PET for the packaging of perfumes and cosmetics.

Customer base (Origin Materials)

I think that it's a huge positive sign that the company has not only such a strong customer demand, but also from large, global and established customers, even when it has not even started mass production.

This goes to show how high the demand for carbon negative materials is especially for the companies looking to transition to their net zero ambitions in the near term.

Allow me to elaborate more on some of the key, large customers of Origin Materials.

Key customers

Origin Materials signed an offtake agreement with Nestlé (OTCPK:NSRGY) Waters in 2016, with the ability to buy a certain amount of product each year from the Origin 1 facility for a five-year period.

Origin Materials also signed another offtake agreement with Danone in 2016 and this agreement was amended in 2022 to allow Danone to have an option to make a one-time purchase from Origin 1 and another agreement to buy a certain amount of product annually from Origin 2 for up to ten years.

Then in 2018, Origin Materials signed an offtake agreement with PepsiCo (PEP) to buy a certain amount of product each year for a five-year period from Origin 1 and for the next five-year period, to buy a certain amount of product each year from Origin 2.

In 2020, Origin Materials signed an offtake agreement with Packaging Matters, with a 10-year term for the ability to buy certain amount of product each year from each of the company's first four plants from Origin 1 all the way to Origin 4.

Can these offtake agreements be cancelled?

These offtake agreements only under specific conditions, which includes bankruptcy, failure of Origin Materials to meet certain milestones or failing to meet the customer's product quantity or quality requirements.

While the company has been providing quarterly offtake agreement updates and capacity agreements, the company will only be providing such updates as appropriate in the future. As such, we did not plan to provide quarterly updates to our total sign-offtake agreements and capacity agreements going forward. But we'll provide updates as appropriate. The reason for this is that as of its recent quarter in February 2023, its strategy has transitioned from the generation of demand to the generation of revenues and higher margin product development.

Business strategy

As a result of this strong customer demand of $9.3 billion, this essentially means that Origin Materials future plants in Origin 1 through Origin 4 have contracted capacity that is sold out even before they are mechanically completed. This situation where the demand exceeds the company's supply results in a dynamic where they are able to prioritize higher margin products.

In addition, Origin Materials continues to develop next generation materials for next generation applications.

For example, while the near-term focus for CMF is on low or negative carbon PET, in the medium term, the company is focusing on improving PET polyester by integrating furan content (basically means CMF or HTC) to make "PETF" blended products, and in the long term, the company expects to be able to produce the next generation high performance polyesters that have a great heat resistance and fully recyclable.

In terms of HTC, the near-term focus is on drop-in energy dense solid fuels, while in the medium term, the focus is on carbon negative carbon black replacement for tires, while in the longer term, the focus will be on next generation agricultural products.

There's also scope to improve the revenue sources through licensing of its technologies. As Origin Materials has strong competitive advantages that are difficult to replicate, the technologies used to convert CMF and HTC into useful end products can be licensed to the manufacturers of these end products while Origin Materials can then supply the necessary CMF and HTC to this licensee.

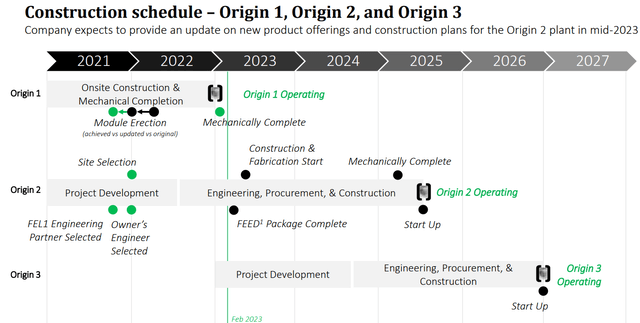

Commercial progress

The company has planned the construction schedule for Origin 1 to Origin 3, which can be seen below. Origin 1 is expected to be operational in the first half of 2023, Origin 2 is expected to be operational in 2025 and Origin 3 is expected to be operational in late 2026 or early 2027.

Construction schedule (Origin Materials)

Origin Materials is currently undertaking two initial capital projects: Origin 1 and Origin 2.

Origin 1 is already mechanically complete, with commissioning happening right now and the plant is expected to startup in the second quarter of 2023. This is in line with its initial timeline.

Origin 1 is meant as a commercial scale plant for customers to qualify higher value applications for its intermediates CMF and HTC. These higher value products will be produced and sold at scale at Origin 2 and beyond. Origin 1's operations will be optimized to fulfill customer demand for sampling and qualification.

With a larger volume produced at Origin 1, this allows customers to sample and qualify materials faster. With this ongoing at a faster pace, the customers can then firm up orders soon after.

Origin 2 is Origin Materials large scale manufacturing facility, located in Geismar, Louisiana, which is expected to convert about 1 million dry metric tons of wood residues every year and is expected to cost about $1.1 billion.

For Origin 2, the company stated that progress is going well and there is expected to be an update provided in the second quarter of 2023 about the front-end design, construction planning and financing of Origin 2.

The company continues to expect that Origin 2 can be fully funded from the existing cash it has in its balance sheet and supplemented by traditional project financing as well as potential strategic partnerships.

Management team

John Bissell is one of the co-founders of Origin Materials, having served as its CEO since inception. John's expertise is in R&D, engineering and business development in the chemical industry. He was listed as Forbes 30 Under 30 in the Energy and Industry category in 2014.

To supplement John Bissell, Rich Riley was brought in as co-CEO in 2020. Rich was an advisor to and investor in Origin since 2010. He was CEO of Shazam, an industry advisor to KKR, and an executive at Yahoo. As a result, Rich has business and financial experience that complements John's expertise.

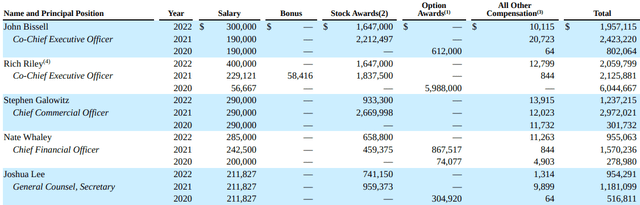

The executive compensation for Origin Materials is reflected below.

Executive compensation (Origin Materials)

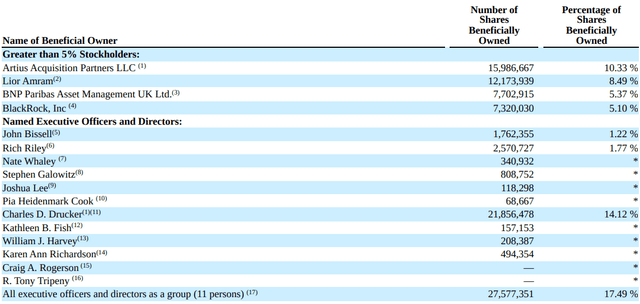

In addition, the executive team owns shares in Origin Materials. John Bissel currently has about 1.8 million in shares and Rich Riley has 2.6 million in shares, representing 1.2% and 1.7% of the company respectively.

Major shareholders (Author generated)

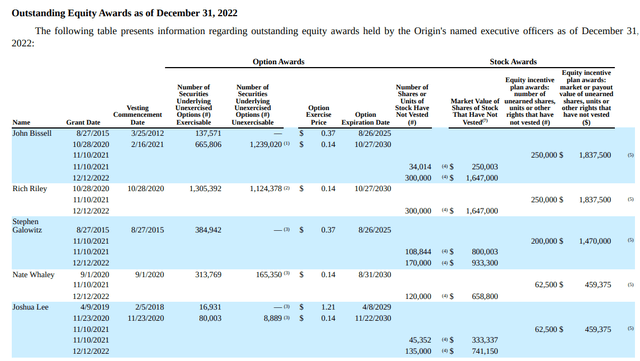

On top of shares owned, they also are aligned to shareholders in the form of option awards and stock awards that they earn as they reach certain milestones and targets.

Outstanding equity awards (Origin Materials)

I am not familiar with Rich Riley, but I had the opportunity to meet John Bissell once. All I can say is, you can tell he is one of the founders of the company. He is hugely excited about the opportunity that Origin Materials is tackling, he genuinely believes in its potential to make the world a better place and he is motivated to ensure it happens. He is heavily involved in the research and development and engineering efforts of the company, so he has had a huge impact on the innovation that emerged out of the company. I expect great things from this man leading Origin Materials.

Competitive advantages

First, the company is addressing one of the most pressing issues for many large, established companies, and that is to lower their carbon footprint and reach their net zero ambitions. Origin Materials is not just able to help these companies achieve their net zero ambitions by moving away from fossil-based materials to carbon negative materials made from sustainable plant-based feedstock. According to the company, for each million dry metric ton per year that goes into a commercial scale Origin plant, this eliminates 1.3 million tons of carbon emissions each year. All that is achieved while maintaining or even improving price and performance.

Second, Origin Materials has favorable unit economics and low-cost feedstock. As its platform technology utilizes timber and forest residues as feedstock. They are both abundant and low cost, and at the same time, its price is stable. Thus, this means that it is a very suitable feedstock for the platform and contributes to the favorable unit economics of the platform. On top of the low-cost renewable feedstock, its manufacturing process is simple, using only a single catalytic reaction, resulting in even better overall unit economics at scale.

Third, as highlighted earlier, the company has more than a decade of research and development experience and has amassed a robust patent portfolio and trade secrets. As a result, what this implies for Origin Materials is that its competitors are behind it and are unable to replicate the success that Origin Materials has in the quality, yield and efficiency of its process.

Last but not least, Origin Materials has a large addressable market because of its flexible platform technology. The flexible platform allows Origin Materials to have drop-in solutions. As a result, many of Origin Materials products are drop-in replacements for traditional products. This means that the customers are able to transition from petrochemical made products to products made by Origin Materials easily, while using their existing manufacturing processes. This is important so that the hurdle for customers to adopt Origin Materials platform technology stays low.

Competition

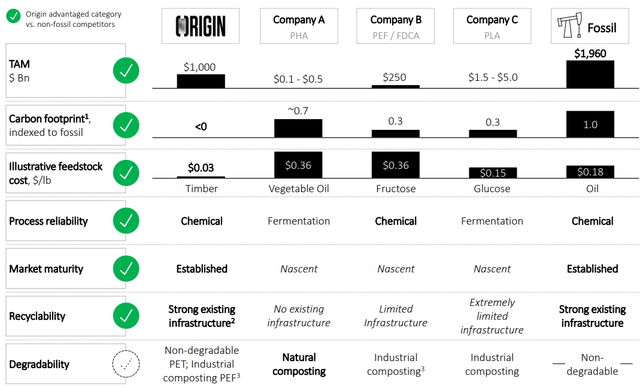

I have also covered other bioplastic companies, with Danimer Scientific (DNMR) focusing on polyhydroxyalkanoates ("PHA") using a fermentation process, for example.

Below, we can see how Origin Materials compete against these other bioplastic companies focusing on different technologies. The key advantages of the company include its larger total addressable market, lower carbon footprint, low cost of feedstock, and lower risks.

Origin Materials advantages over other bioplastic players (Origin Materials)

Valuation

My 1-year price target is based on the revenue multiple. The rationale for using the revenue multiple method to value the 1-year price target for Origin Materials is because the company is not profitable yet and valuing the company based on revenues makes the most sense.

I assume a 5x 2024 P/S multiple for the 1-year price target. This is more than justified, in my view, given the more than 100% revenue CAGR expected from the company in the next 5 years based on the strong customer demand we have seen, its leadership position in carbon-negative materials and a solid management team.

As such, my 1-year price target for Origin Materials is $3.45. This represents 146% upside potential.

Conclusion

It is clear that the strong tailwinds from the decarbonization efforts of governments and corporations are driving demand for the solutions that Origin Materials provide.

The market opportunity is another huge positive for the company as it has a $390 billion near-term market opportunity and $750 billion longer-term market opportunity. This results in a total market opportunity of more than $1 trillion.

In addition, its admirable to have the $9.3 billion strong customer demand from high quality and large customers even before mass production has started. This just shows how strong the value proposition of Origin Materials is to its customers.

Operationally, Origin Materials looks to be progressing according to schedule, with Origin 1 starting operations in 2Q23 and Origin 2 starting operations in 2025.

When looking at the competitive landscape, I think when it comes to fossil fuel based materials, those are likely to be substituted by materials that come from more sustainable materials in the future. Also, when it comes to other bioplastics players, Origin Materials has a better cost profile, large market opportunity, lower carbon footprint, and lower risks compared to peers.

Editor's Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.

Comments