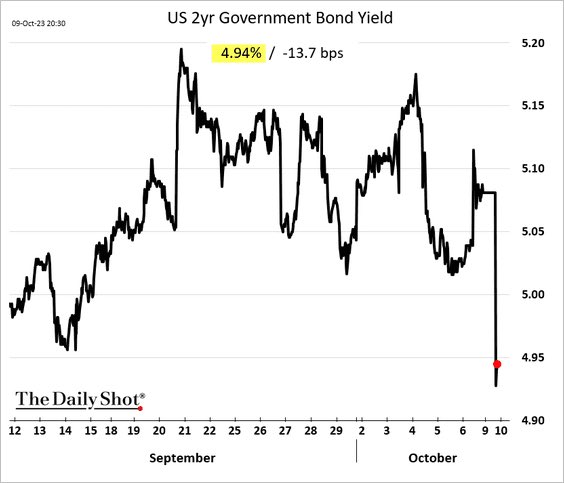

Treasury yields dropped sharply, with the 2-year rate dipping below 5%. Market is calling the Fed bluff.

Image

Image

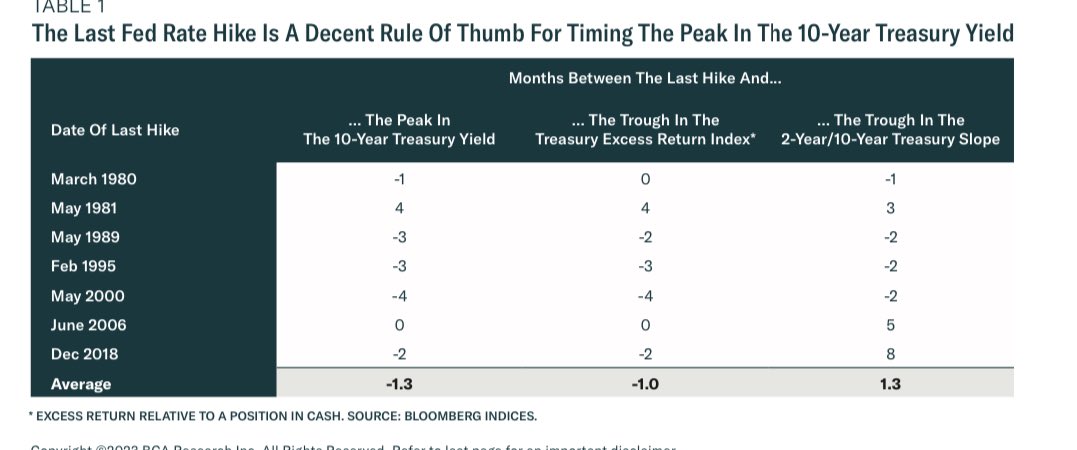

Bond yields tend to peak around the time of the last Fed rate hike. I don’t expect any more rate hikes, which is why I turned positive on bonds recently.

Image

Image

Corporate earnings are going down. CEOs will talk about new challenges during their Q3 calls.

I don’t see any reason for the Fed to hike rate again. If anything, rate cuts are coming for the U.S., Canada, Eurozone, and England…

Disclaimer: Investing carries risk. This is not financial advice. The above content should not be regarded as an offer, recommendation, or solicitation on acquiring or disposing of any financial products, any associated discussions, comments, or posts by author or other users should not be considered as such either. It is solely for general information purpose only, which does not consider your own investment objectives, financial situations or needs. TTM assumes no responsibility or warranty for the accuracy and completeness of the information, investors should do their own research and may seek professional advice before investing.

Image

Image

Comments

Great ariticle, would you like to share it?