A number of banks kicked off the earnings season with better-than-expected results, but investors had to contend with volatility amid rising geopolitical tensions. For the week, the Dow rose 0.8 percent, snapping a three-week losing streak, while the S&P gained 0.4 percent and the Nasdaq fell 0.2 percent.

International oil prices rose more than 6% on fears that a war between Israel and Hamas could exacerbate geopolitical tensions in the Middle East.

Mike Bailey, director of research at FBB Capital Partners, said after a strong second quarter, investors need to see at least the same level of results in the third quarter, and as the quarter's tech giants report, other market participants can be expected to follow the leaders. "The probability of a decline in tech earnings this quarter is pretty low."

Gary Bradshaw, portfolio manager at Hodges Capital Management, said it's important for large tech stocks to deliver results and boost confidence. Wall Street is expecting healthy earnings across the board for the tech giants. Large-cap tech stocks have the ability to lead the market in the final quarter of the year.

FANNG Option Intelligence: Someone bought Tesla PUT option $TSLA 20231020 155.0 PUT$ in advance, the strike price is 155, the intention is to bear the earnings share price.

* 9:30 ~ 10:30 every day, real-time sharing of exclusive screening options large order, welcome to click to subscribe.

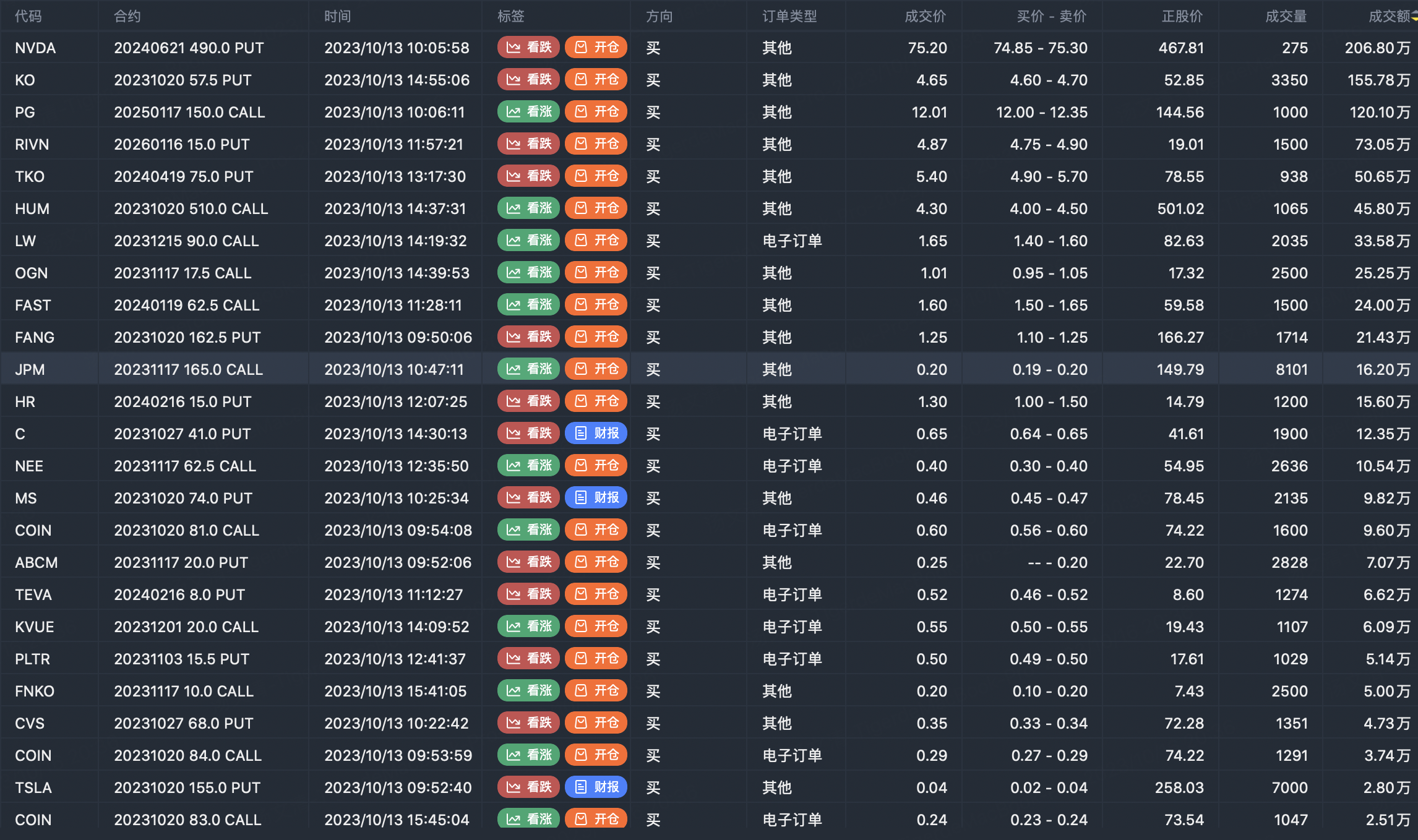

Option buyer open position (Single leg)

Buy TOP T/O:

$NVDA 20240621 490.0 PUT$ $KO 20231020 57.5 PUT$

Buy TOP Vol:

$JPM 20231117 165.0 CALL$ $TSLA 20231020 155.0 PUT$

Note: This image data is from Tiger PC. This screening is a significant buy open position for options contracts in the market. The purchase of a call option means that the trader believes that the underlying has upward momentum, and the purchase of a put option means that the trader believes that the underlying has downward momentum. These contract openings typically indicate significant activity in the underlying stock, including whether the trader is willing to accumulate a long or short option position.

Option seller open position (Single leg)

Sell TOP T/O:

$PEP 20231020 175.0 PUT$ $MRK 20231020 115.0 PUT$

Sell TOP Vol:

$CHPT 20231020 3.5 PUT$ $NKLA 20231027 1.5 CALL$

other stock options:

$AMD 20231124 87.0 PUT$ $AAPL 20231124 200.0 CALL$

Note: This image data is from Tiger PC. This screen is a significant sell open position for an option contract in the market. A sell of a call option means that the trader believes that the underlying trend has peaked, and a sell of a put option means that the trader believes that the underlying trend has bottomed. These contract openings typically indicate significant activity in the underlying stock, including whether the trader is willing to accumulate a long or short option position.

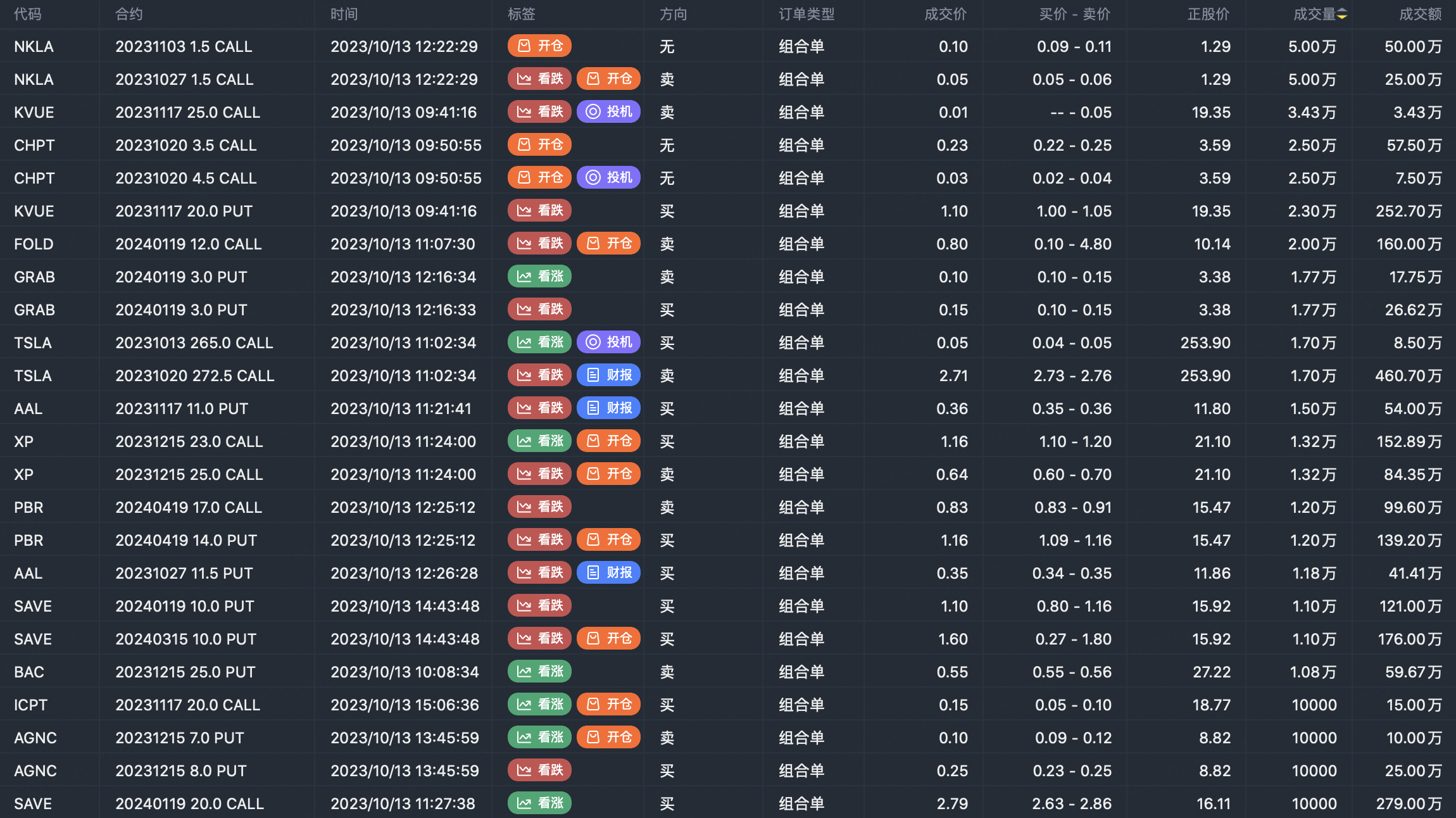

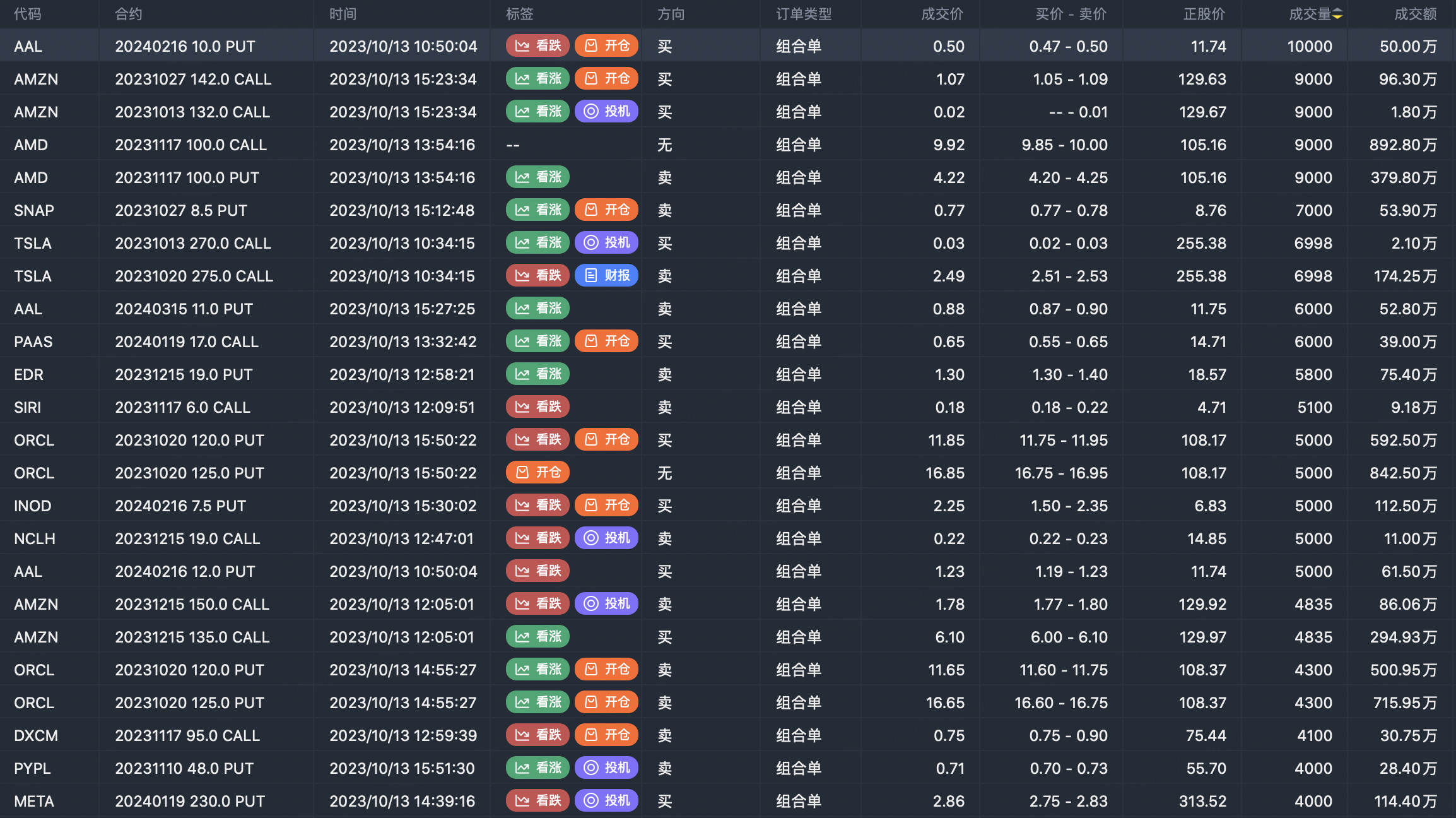

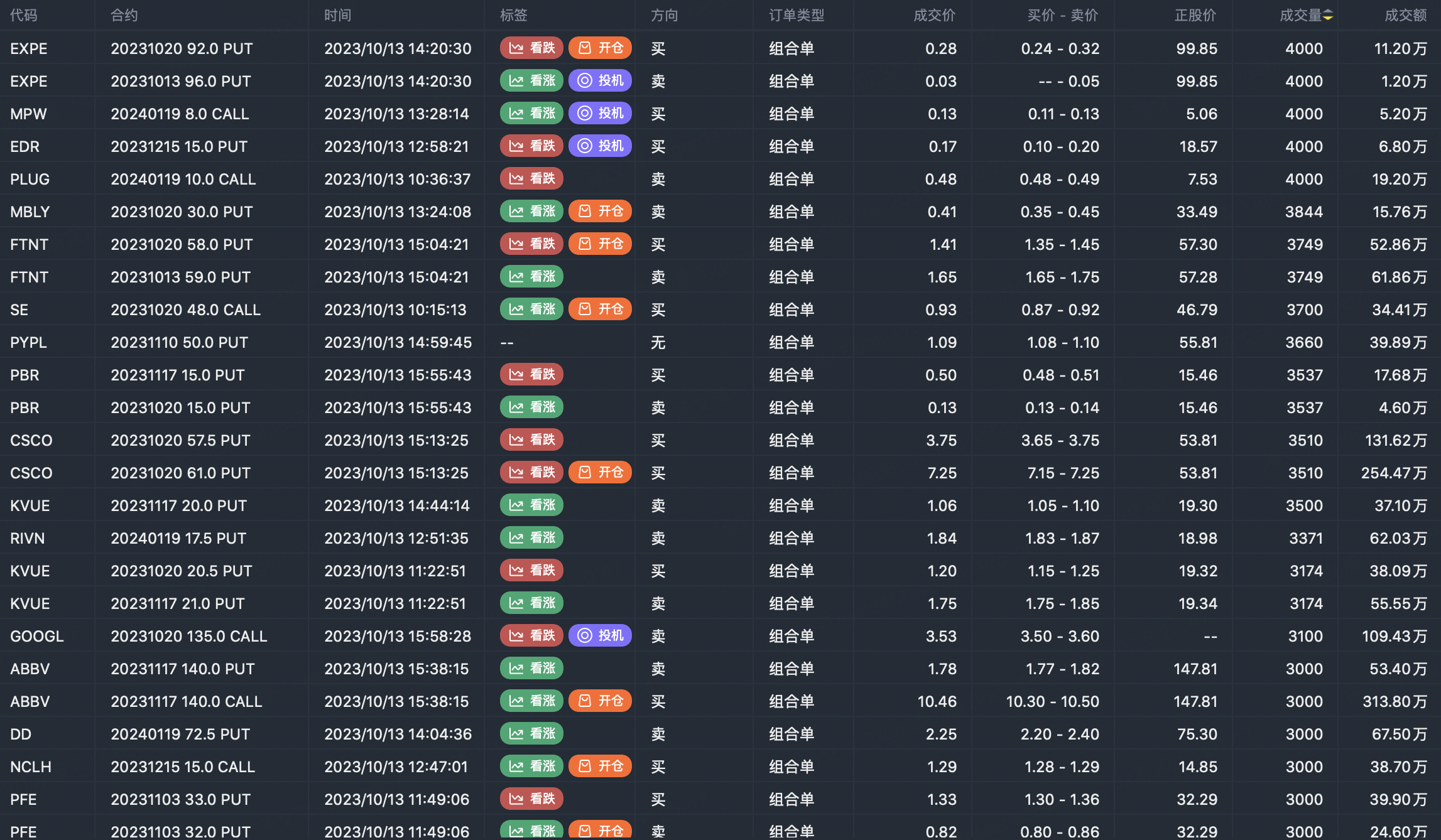

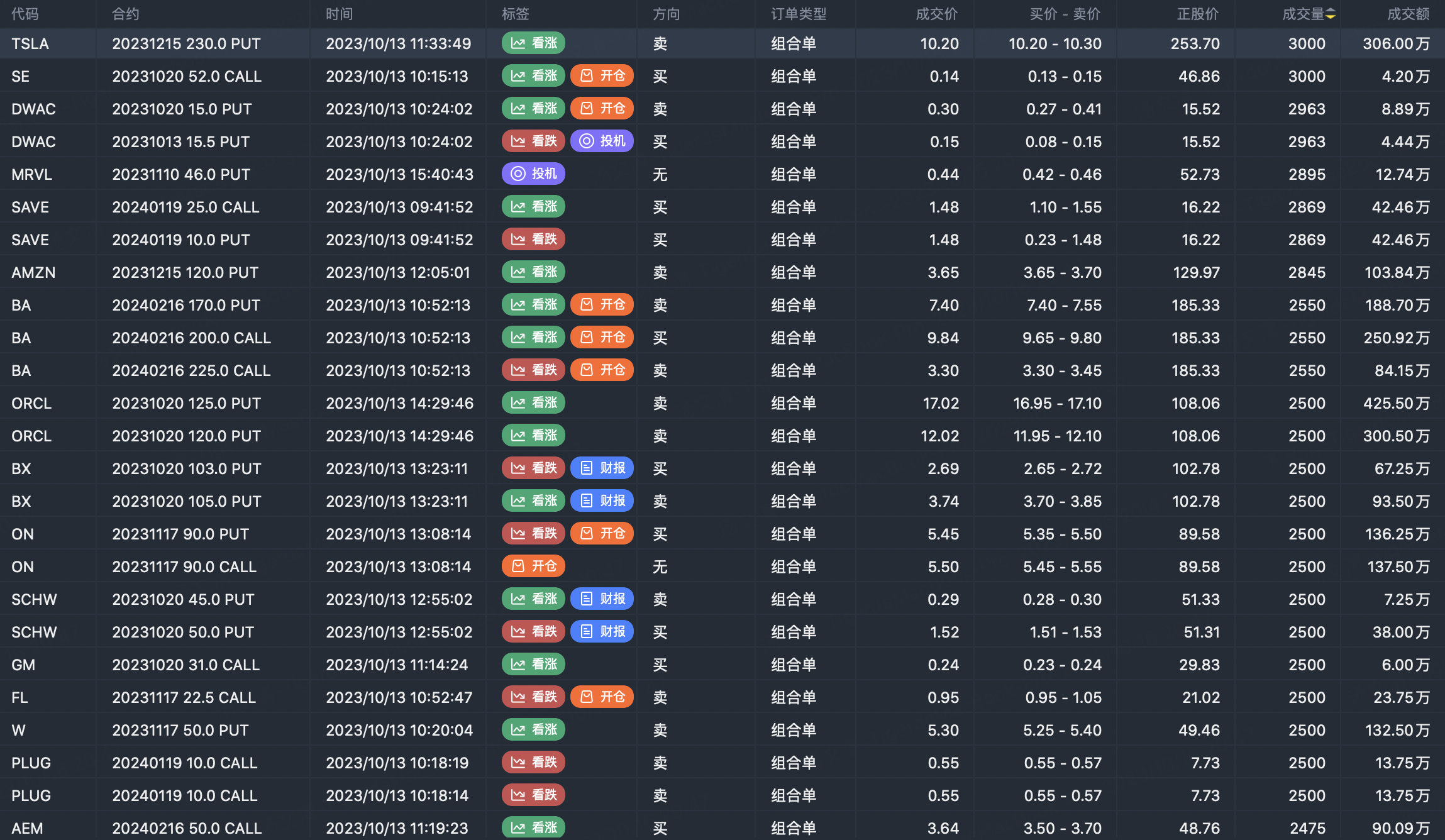

Options portfolio open position

Note: This image data is from Tiger PC. This screening is a significant portfolio of options contracts in the market. Portfolio opening includes a variety of underlying trends, requiring traders to further master the basic knowledge of options for analysis and judgment.

Comments

Great ariticle, would you like to share it?

Great ariticle, would you like to share it?

Great ariticle, would you like to share it?